All Of The Following Are Internal Control Procedures Except

In a world increasingly defined by financial complexity and corporate scrutiny, the robustness of internal controls stands as a crucial pillar of organizational stability and trust. The subtle nuances of these controls, however, often lead to confusion and misinterpretations, impacting their effective implementation. Recent discussions among accounting professionals and regulatory bodies highlight a persistent gap in understanding what constitutes a legitimate internal control procedure.

At the heart of the debate lies the frequent misidentification of activities that, while beneficial for overall management, do not qualify as formal internal controls. This misunderstanding poses a significant risk: organizations might overestimate their security posture, leaving them vulnerable to fraud, errors, and inefficiencies. Understanding the critical differences between supportive management practices and dedicated control procedures is paramount for safeguarding assets and ensuring reliable financial reporting.

Defining Internal Control: A Closer Look

Internal control, as defined by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), is a process, effected by an entity's board of directors, management, and other personnel, designed to provide reasonable assurance regarding the achievement of objectives relating to operations, reporting, and compliance. This definition underscores the active and integrated nature of internal controls within an organization's structure.

Key elements of internal control, according to COSO, include: control environment, risk assessment, control activities, information and communication, and monitoring activities. Each element plays a crucial role in ensuring effective control. Failing to properly implement just one of these elements can significantly weaken the entire internal control system.

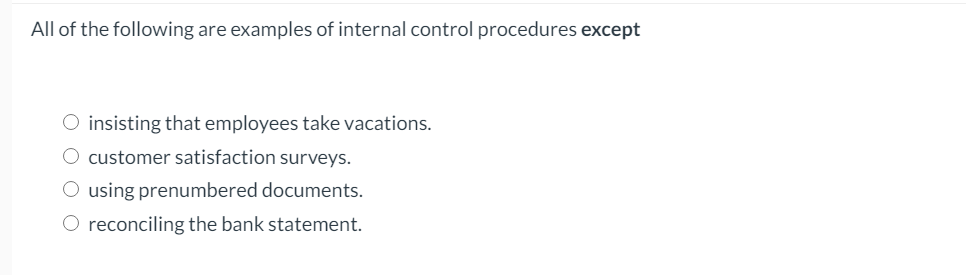

Crucially, not all management activities automatically qualify as internal controls. An internal control activity is specifically designed to mitigate a risk or achieve a specific objective. Differentiating between general management practices and targeted internal control procedures is essential.

What Doesn't Qualify? Common Misconceptions

One prevalent misconception involves considering broad managerial oversight as an internal control. For instance, regular management meetings, while valuable for coordination and information sharing, typically do not represent a specific control activity designed to mitigate a particular risk. They lack the direct, demonstrable link to preventing errors or fraud that characterizes a true control.

Similarly, general employee training programs, although important for enhancing competence and awareness, are not inherently internal controls. Unless the training specifically addresses how to identify and prevent specific types of errors or fraudulent activities, it's simply a management practice, not an internal control. Generic awareness programs should not be confused with targeted anti-fraud or compliance training.

Furthermore, promoting a positive ethical culture, while undoubtedly beneficial, does not, on its own, constitute an internal control. While a strong ethical tone can influence behavior and reduce the likelihood of misconduct, it requires concrete control activities to enforce ethical standards and detect violations. A code of conduct requires supporting enforcement mechanisms.

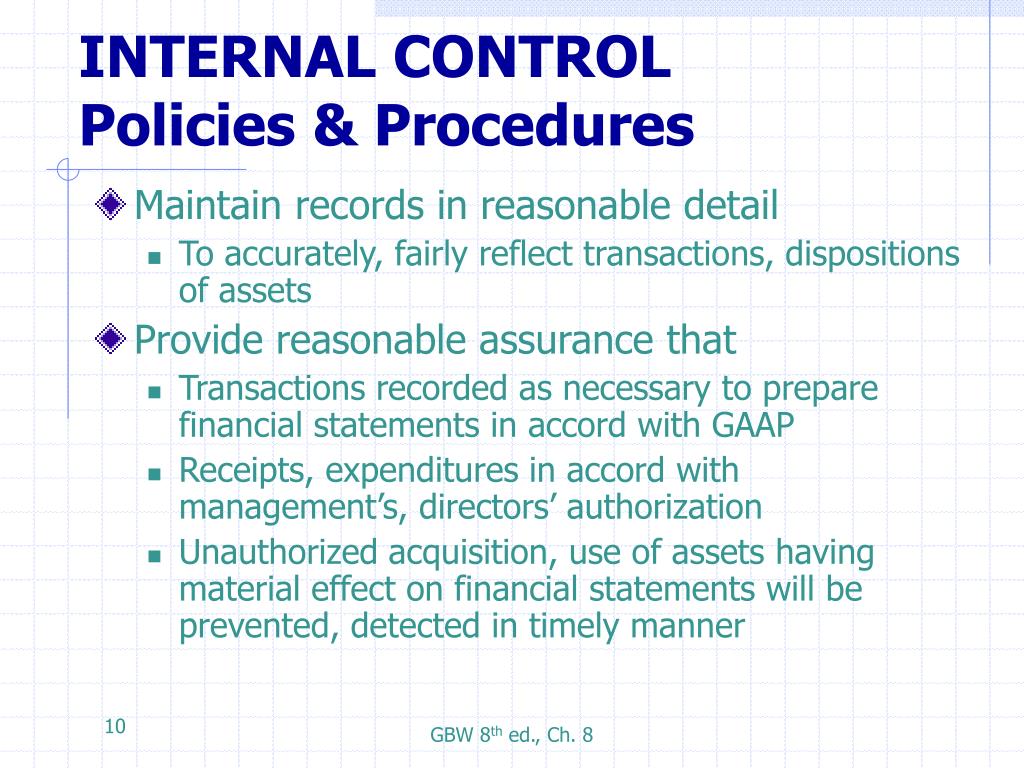

Examples of Legitimate Internal Controls

To illustrate the distinction, consider the following examples of valid internal controls. These directly address risk mitigation.

Segregation of duties, for instance, separates the authorization, custody, and recording functions related to a transaction, thereby reducing the risk of fraud or error. Requiring dual signatures on checks is another example of a robust control, ensuring that no single individual can unilaterally disburse funds.

Regular reconciliations of bank statements to accounting records provide a critical check on the accuracy and completeness of financial data. Similarly, physical inventories conducted periodically to verify the existence and condition of assets are concrete control activities. These verify the accuracy of financial statements.

The Implications of Misidentification

The misidentification of internal control procedures can have far-reaching consequences. Organizations may falsely believe they have adequate safeguards in place, leaving themselves vulnerable to financial misstatements, asset misappropriation, and regulatory penalties. This can erode investor confidence and damage the reputation of the company.

This overestimation of control effectiveness can also lead to inadequate resource allocation. If management believes existing practices are sufficient, they may not invest in necessary control improvements or monitoring activities. This can be a costly mistake.

Moreover, auditors rely on management's assessment of internal control effectiveness. If these assessments are inaccurate, auditors may fail to identify material weaknesses, leading to unqualified audit opinions that are ultimately misleading. Reliance on flawed internal controls weakens the entire audit process.

Moving Forward: Strengthening Internal Control Frameworks

Addressing the misunderstanding surrounding internal control requires a multi-pronged approach. Organizations must invest in training and education to ensure that all relevant personnel understand the definition and characteristics of effective internal controls. Emphasis should be placed on the distinction between general management practices and targeted control activities.

Regular assessments of existing control frameworks are also crucial. Organizations should engage qualified professionals to evaluate the design and operating effectiveness of their controls, identifying any gaps or weaknesses. Independent reviews provide a fresh perspective on control effectiveness.

Furthermore, organizations should prioritize the implementation of a strong control environment, fostering a culture of integrity and accountability. This includes clearly defining roles and responsibilities, establishing reporting mechanisms for suspected wrongdoing, and enforcing ethical standards consistently. A strong control environment is the foundation for effective internal controls.

In conclusion, the effective implementation and maintenance of internal controls are vital for organizational success and integrity. By understanding what truly constitutes an internal control procedure and avoiding common misidentifications, organizations can strengthen their safeguards and protect themselves from a wide range of risks. This requires a concerted effort from all levels of management and a commitment to continuous improvement.