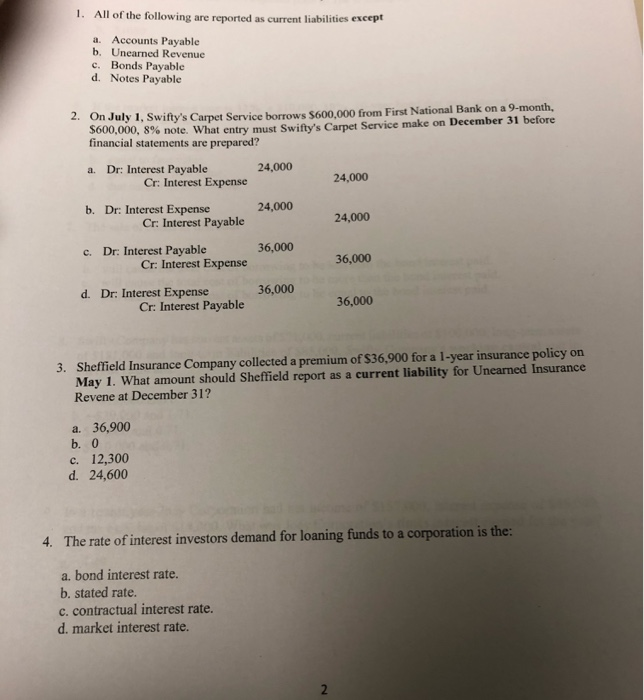

All Of The Following Are Reported As Current Liabilities Except

Imagine yourself poring over a company's financial statements, the late afternoon sun casting long shadows across your desk. Numbers dance before your eyes – assets, liabilities, equity – each piece a vital clue in understanding the financial health of the organization. Then, you encounter a question: "All of the following are reported as current liabilities EXCEPT..."

This simple question, often encountered in accounting exams or financial analysis, highlights the importance of accurately classifying liabilities. Understanding the nuances of current liabilities – those obligations due within one year or the operating cycle – is crucial for assessing a company's short-term liquidity and solvency. Let's delve into the world of current liabilities and explore what items typically don't belong in this category.

Defining Current Liabilities

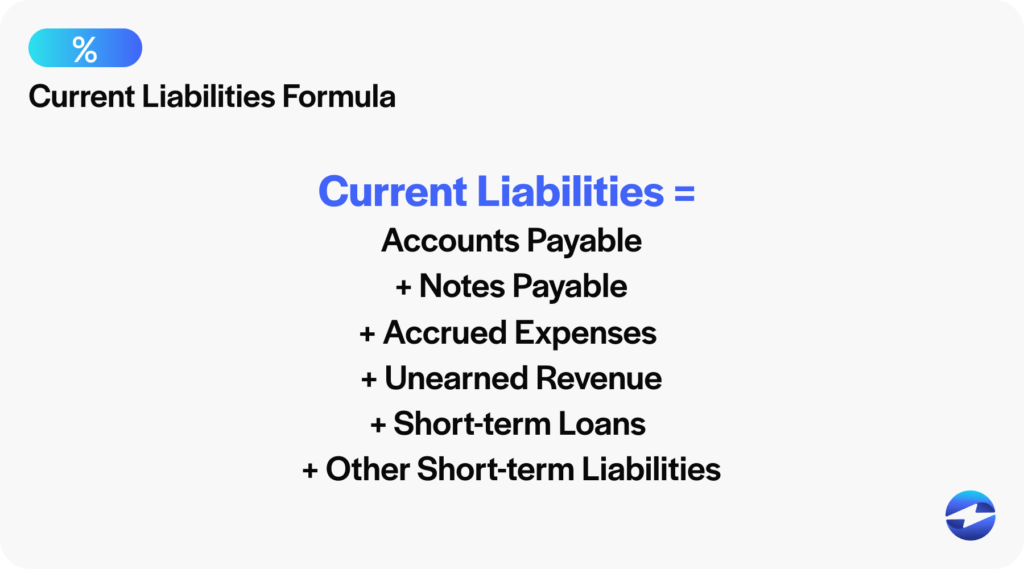

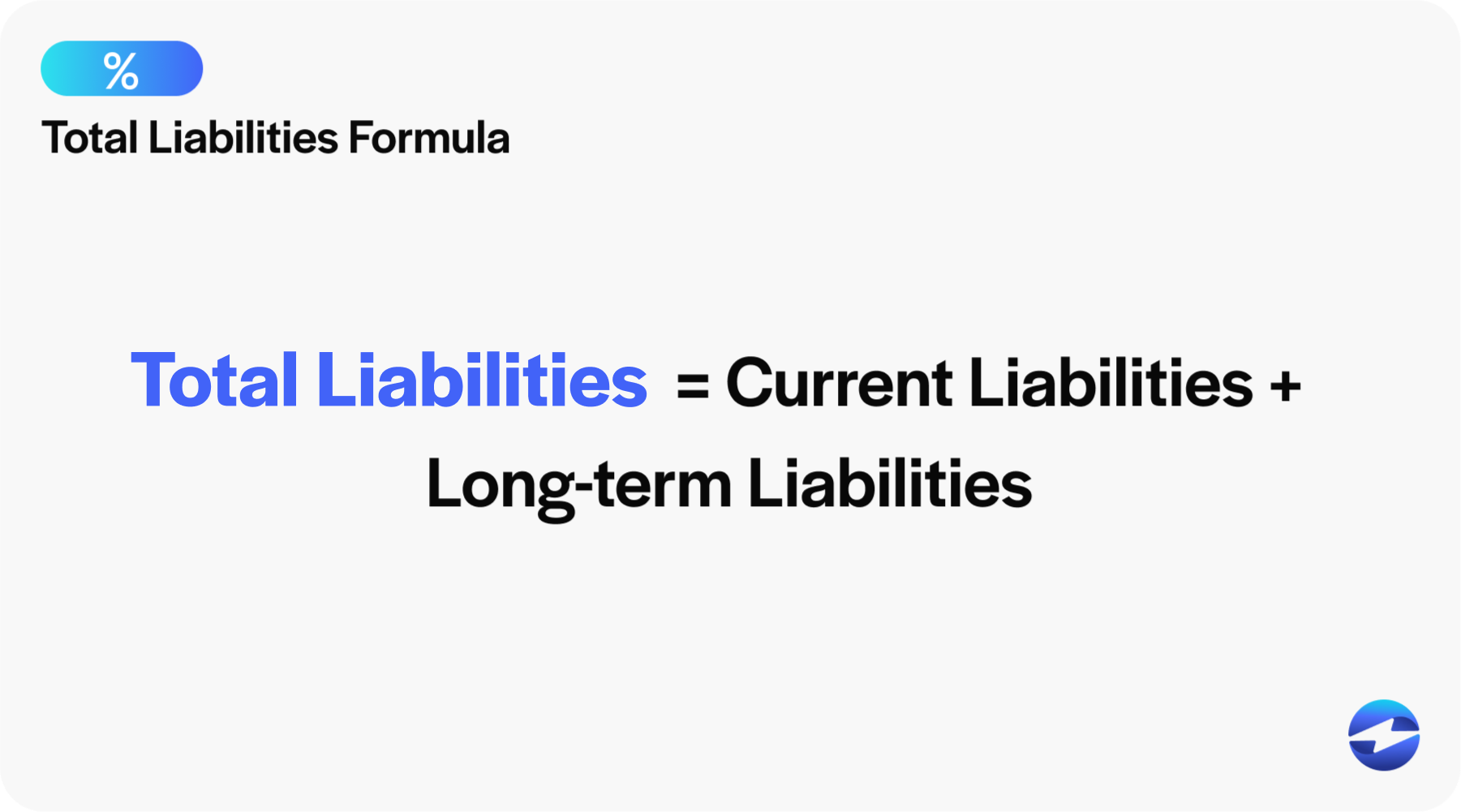

A current liability represents a company's obligations that are expected to be settled within a year or within the company's normal operating cycle, whichever is longer. This timeframe is essential for differentiating them from long-term liabilities, which extend beyond this period. Properly classifying liabilities is crucial for stakeholders to understand a company’s immediate financial obligations.

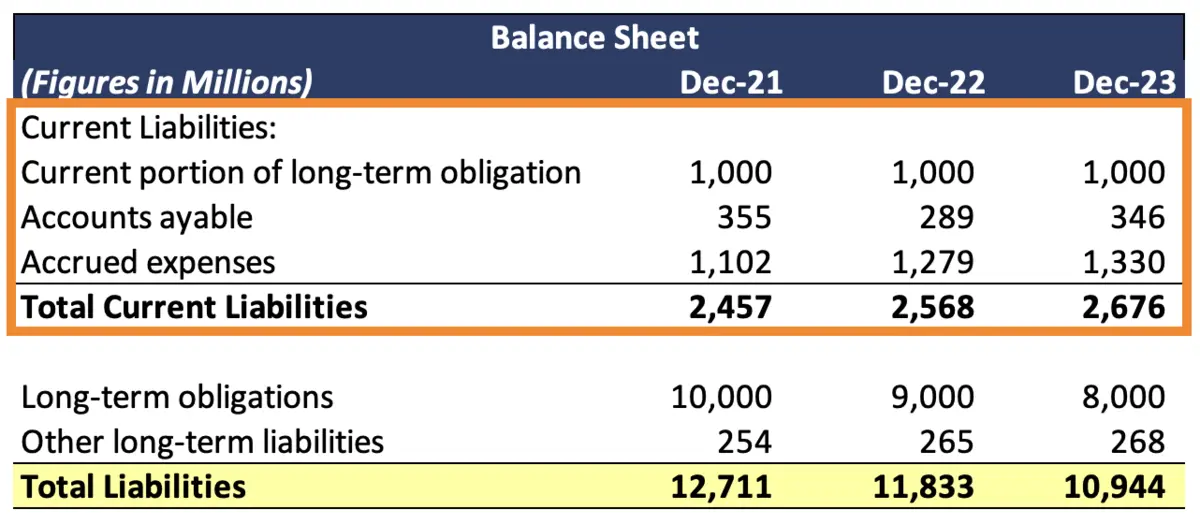

Classifying liabilities accurately helps investors, creditors, and managers assess a company's ability to meet its short-term obligations. It impacts key financial ratios like the current ratio (current assets divided by current liabilities) and working capital (current assets minus current liabilities). These metrics offer insights into a company's liquidity position.

Common Examples of Current Liabilities

Several types of obligations routinely fall under the umbrella of current liabilities. These include accounts payable, which represent short-term debts owed to suppliers for goods or services purchased on credit. Think of it as the bills a company needs to pay soon.

Salaries and wages payable are another significant current liability. These reflect the amount of compensation owed to employees for work already performed, but not yet paid. Unearned revenue, also known as deferred revenue, is the payment a company receives for services or goods that have not yet been delivered or performed.

Short-term notes payable and the current portion of long-term debt also qualify as current liabilities. Short-term notes payable are essentially loans due within a year. The current portion of long-term debt represents the principal amount of a long-term loan that is due within the upcoming year.

What Doesn't Belong: Long-Term Liabilities

The key distinction lies in the repayment timeframe. Obligations due beyond one year or the operating cycle are generally classified as long-term liabilities. These can have a significant impact on a company's financial structure and debt profile.

Bonds payable, if the maturity date is more than one year away, are typically considered long-term liabilities. Mortgages payable on property, plant, and equipment also belong in this category, unless a portion is due within the next year, making that portion a current liability. Long-term lease obligations, particularly those under capital leases, are another example.

Deferred tax liabilities, arising from temporary differences between taxable income and accounting income, can be classified as either current or non-current depending on when these differences are expected to reverse. However, they often lean towards the non-current category if the reversal timeline extends beyond the immediate year.

Context Matters: Contingent Liabilities

Contingent liabilities present a slightly different scenario. These are potential liabilities that depend on the outcome of a future event. They can be tricky to classify.

If the likelihood of the future event occurring is probable and the amount can be reasonably estimated, the contingent liability is recorded as a liability on the balance sheet. Warranties on products are a common example. If, however, the likelihood is only possible or remote, or if the amount cannot be reasonably estimated, it is disclosed in the footnotes to the financial statements. It is *not* recorded as a liability on the balance sheet.

The Importance of Proper Classification

Accurate classification of liabilities is not merely an accounting exercise. It directly impacts financial statement analysis and decision-making. Misclassifying a long-term liability as current can paint a distorted picture of a company's short-term financial health.

For example, if a significant long-term debt installment is incorrectly categorized as a current liability, it can artificially inflate the current liabilities figure. This could make the company appear less liquid than it actually is. This error would negatively impact the current ratio and potentially deter investors or creditors.

Consequences of Misclassification

The consequences extend beyond inaccurate financial ratios. Misclassification can lead to poor business decisions based on flawed information. It could also result in violations of loan covenants, which are agreements between a borrower and lender that set certain financial performance targets.

A company that appears to have insufficient liquidity might hesitate to invest in growth opportunities. Conversely, a company that overestimates its liquidity might take on excessive debt, increasing its financial risk. Accurate accounting is therefore essential for sound financial management.

Real-World Implications

Consider a hypothetical manufacturing company. If the company misclassifies a portion of its long-term bond payable as a current liability, its balance sheet will show a higher level of current liabilities. This could cause its bankers to worry, potentially leading to stricter loan terms or even a denial of credit.

On the other hand, if the company properly classifies its liabilities, potential investors will have a clear picture of the company's ability to meet its short-term obligations. This will make them more confident in their investment decision. The integrity of financial reporting hinges on accurate categorization.

Therefore, when faced with the question, "All of the following are reported as current liabilities EXCEPT...", remember to consider the due date of the obligation. If the repayment period extends beyond one year or the operating cycle, it likely belongs in the long-term liability section of the balance sheet.

Looking Ahead

As the business landscape continues to evolve, so too will the complexities of financial accounting. New types of financial instruments and business models will continue to emerge, posing new challenges for liability classification. Staying abreast of current accounting standards and best practices will remain crucial.

The distinction between current and long-term liabilities provides essential information about a company’s liquidity and solvency. It offers insight into its ability to meet immediate financial obligations and to manage its long-term debt.

So, the next time you encounter that question about current liabilities, remember the core principle: the repayment timeline. It is the guiding star that leads you to the correct classification and a clearer understanding of a company's financial standing. This, in turn, empowers informed decision-making and responsible financial stewardship.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)