Ally Financial Announces Third Quarter 2024 Financial Results.

Detroit-based Ally Financial Inc. (NYSE: ALLY) released its third-quarter 2024 financial results today, revealing a mixed performance amidst a challenging economic environment. The company's earnings reflect both strategic successes in key areas and pressures from rising interest rates and evolving consumer behavior.

At a time when the financial sector is under increased scrutiny due to fluctuating market conditions, Ally's Q3 results offer valuable insights into the resilience and adaptability of a major player in the automotive finance and digital banking space. Investors, customers, and industry analysts are closely watching to understand how Ally is navigating these complex dynamics and what the results signal for the broader economy.

Key Financial Highlights

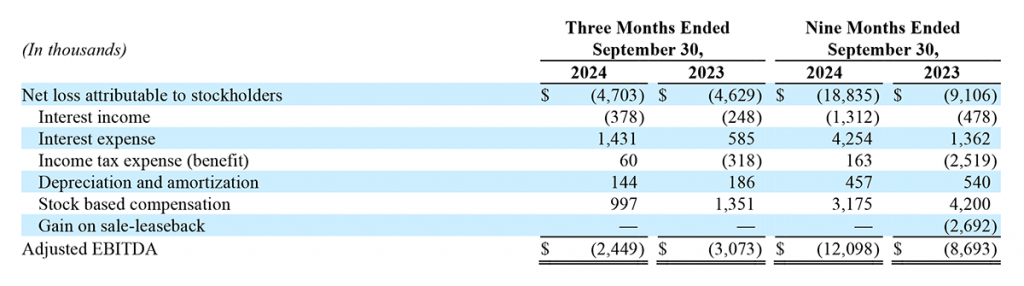

Ally reported net income of $323 million, or $1.02 per share, for the third quarter of 2024. This compares to a net income of $481 million, or $1.41 per share, for the same period last year. The decline in net income primarily reflects increased funding costs and lower net interest margins, partially offset by strong performance in certain business segments.

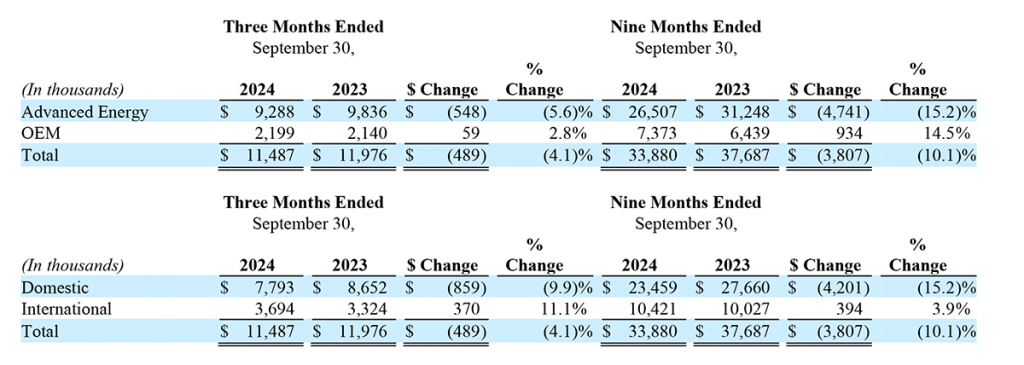

Net revenue for the quarter totaled $1.95 billion, down from $2.07 billion in Q3 2023. The decrease is attributed to the impact of higher interest rates on deposit costs and a slight decline in auto finance originations.

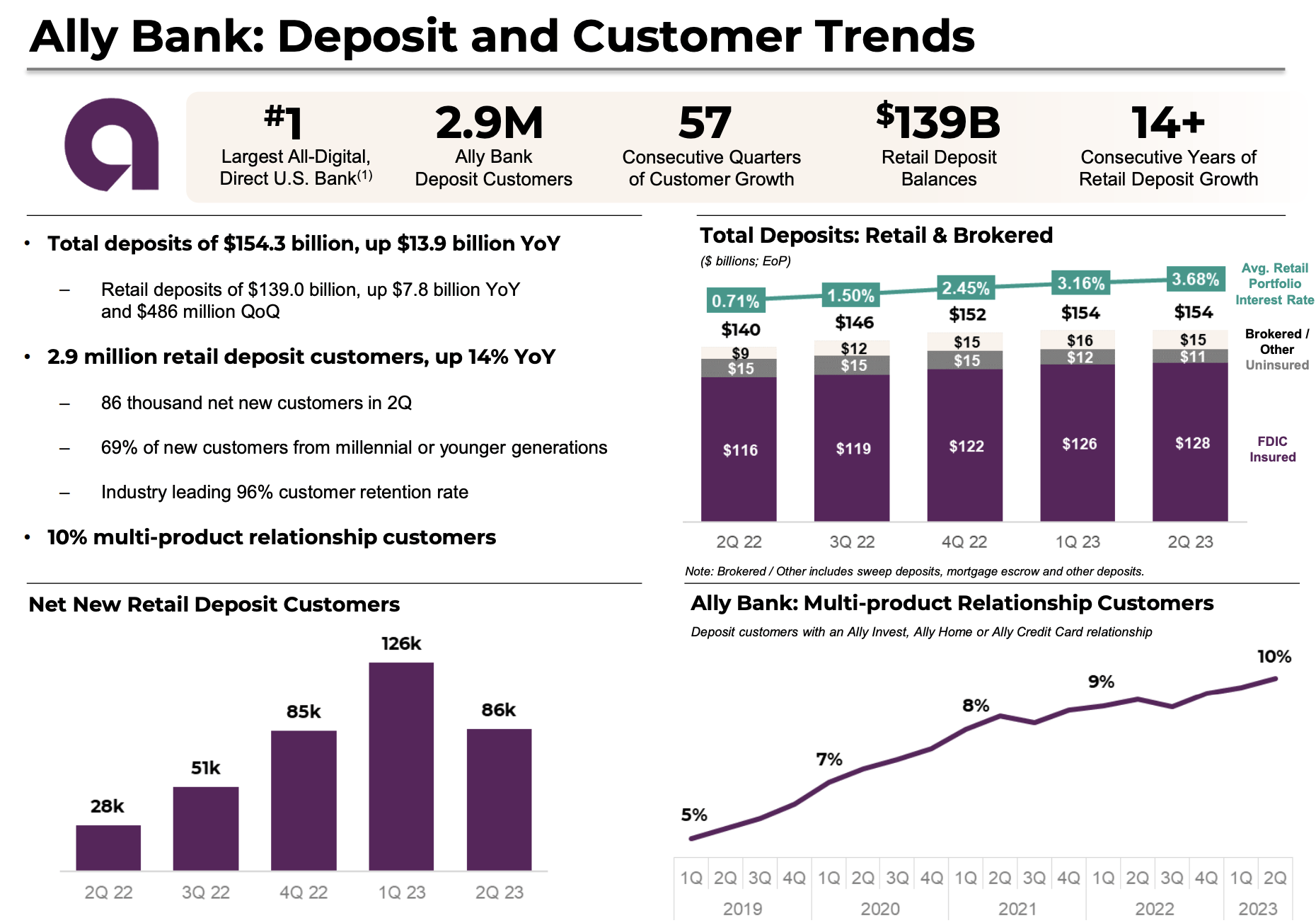

Ally's retail deposit base continued to grow, reaching $144.1 billion, a 9% increase year-over-year. This growth demonstrates the ongoing appeal of Ally's direct banking platform and competitive interest rates.

Auto Finance Performance

Ally remains a leading player in the auto finance market. During the third quarter, the company originated $9.4 billion in auto loans. This figure represents a slight decrease compared to the $9.8 billion originated in the same period last year, reflecting industry-wide trends of moderating auto sales and rising interest rates.

The net interest margin (NIM) in the auto finance segment contracted to 2.84%, compared to 3.32% in Q3 2023. The compression is primarily driven by higher funding costs as the company actively manages its deposit rates to remain competitive.

Credit performance in the auto loan portfolio remains within the company's expectations, with net charge-offs at 1.33%, a slight increase from 1.05% in the prior year quarter. Ally continues to monitor credit trends closely and adjust its underwriting standards as needed.

Digital Banking Growth

Ally's direct banking platform continues to be a strong driver of growth. The company added approximately 40,000 new retail deposit customers during the quarter. This growth showcases the company's ability to attract and retain customers through its user-friendly platform and competitive product offerings.

Beyond deposit growth, Ally is expanding its digital banking offerings to include investment services and personal loans. These initiatives are designed to provide customers with a more comprehensive suite of financial products and services.

The expansion of Ally's product offerings is aimed at deepening customer relationships and diversifying revenue streams.

Strategic Initiatives and Future Outlook

Ally is actively pursuing several strategic initiatives to enhance its long-term growth prospects. These initiatives include investing in technology to improve the customer experience and expanding its presence in the point-of-sale financing market.

The company is also focused on optimizing its capital structure and returning capital to shareholders. During the third quarter, Ally repurchased $150 million of its common stock.

According to Ally's management, the company is well-positioned to navigate the current economic environment. They expect to see continued growth in the digital banking business and stable performance in the auto finance segment.

"We remain confident in our ability to generate sustainable long-term value for our shareholders,"said Jeffrey J. Brown, Ally's Chief Executive Officer, in a statement accompanying the earnings release.

Impact and Analysis

Ally's Q3 2024 results reflect the broader challenges facing the financial services industry. Rising interest rates are putting pressure on net interest margins, while economic uncertainty is impacting consumer behavior.

However, Ally's strong deposit growth and continued leadership in auto finance demonstrate its resilience and adaptability. The company's investments in technology and strategic initiatives are also expected to drive long-term growth.

For consumers, Ally's competitive interest rates on deposits provide an attractive option for saving money. The company's commitment to providing a user-friendly digital banking experience also benefits customers by making it easier to manage their finances.

For investors, Ally's Q3 results highlight the importance of carefully evaluating the company's financial performance and strategic initiatives. The company's ability to navigate the current economic environment and generate sustainable long-term value will be key to its future success.

The full details of Ally's third-quarter 2024 financial results, including supplementary information and investor materials, can be found on the company's website at www.ally.com.