An Assessment Of Whether Financial Statements Follow Gaap

Imagine stepping into a bustling marketplace, a vibrant tapestry of vendors each hawking their wares. Now, picture that each vendor uses a different measuring stick – some inches shorter, some pounds lighter. Chaos, right? That's what the financial world would resemble without a common language, a set of rules to ensure everyone plays fair. Those rules, in the world of accounting, are generally accepted accounting principles, or GAAP.

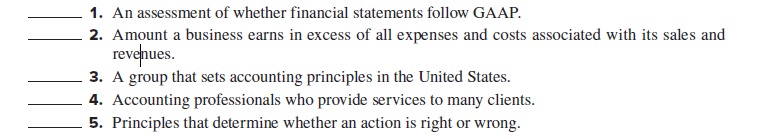

This article delves into the crucial process of assessing whether a company's financial statements faithfully adhere to GAAP. This assessment is paramount to maintaining trust in the financial system and ensuring that investors, creditors, and other stakeholders can make informed decisions based on reliable information.

The Foundation: What is GAAP?

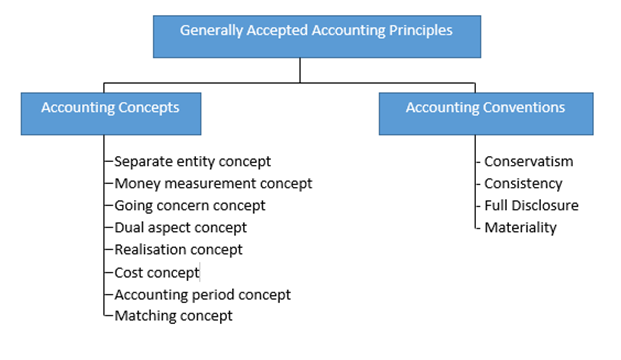

GAAP is not a static set of laws, but rather a dynamic collection of accounting standards, conventions, and rules developed over time. It's designed to provide a consistent framework for preparing and presenting financial statements.

Think of it as a recipe book for financial reporting, ensuring that everyone is using the same ingredients and following similar instructions.

The Significance of GAAP Compliance

Adherence to GAAP is more than just a technicality; it's the bedrock of financial transparency and comparability. It fosters trust in the financial markets and enables investors to compare the performance of different companies.

Without GAAP, comparing financial statements would be like comparing apples to oranges – a futile and potentially misleading exercise. GAAP compliance ensures accuracy.

According to the Securities and Exchange Commission (SEC), publicly traded companies in the United States are required to file financial statements prepared in accordance with GAAP. This requirement underscores the importance of GAAP in maintaining market integrity.

Who Checks for GAAP Compliance?

Several players are involved in the process of ensuring GAAP compliance. Management, internal auditors, and external auditors all play critical roles.

Management bears the primary responsibility for preparing financial statements that accurately reflect the company's financial position and performance. They must establish and maintain internal controls to ensure GAAP compliance.

The Role of Auditors

External auditors, independent accounting firms, are the gatekeepers of GAAP compliance. They perform audits of a company's financial statements to provide an independent opinion on whether those statements are presented fairly in all material respects, in conformity with GAAP.

An auditor's opinion is a critical assurance for investors and other stakeholders, providing confidence that the financial statements can be relied upon. It is a high level of assurance.

The Public Company Accounting Oversight Board (PCAOB) oversees the audits of public companies to protect investors and further the public interest by promoting informative, accurate, and independent audit reports.

The Assessment Process: A Closer Look

Assessing GAAP compliance is a multi-faceted process involving a detailed review of a company's accounting policies, procedures, and financial statement presentation.

Auditors examine underlying documentation, test internal controls, and perform analytical procedures to verify the accuracy and completeness of the financial statements.

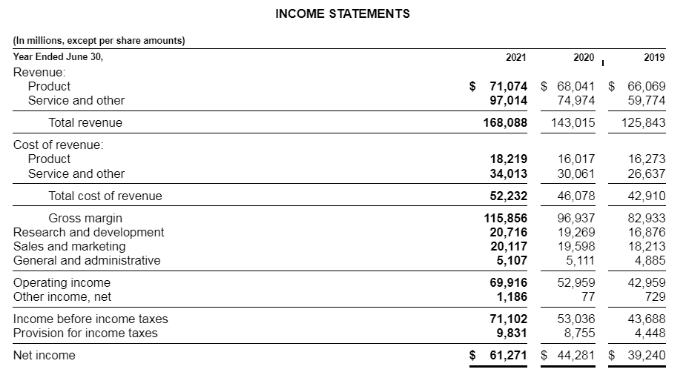

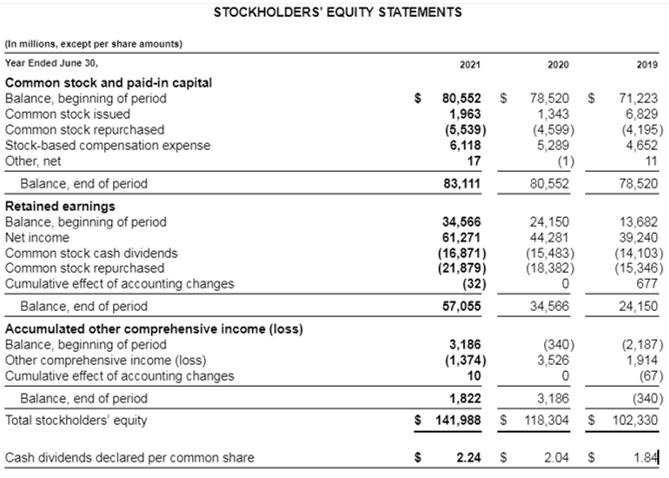

The assessment covers areas such as revenue recognition, expense recognition, asset valuation, and liability measurement, ensuring that each area is handled according to GAAP requirements.

Common GAAP Violations

While the goal is always full compliance, violations of GAAP can occur for various reasons, ranging from unintentional errors to deliberate attempts to manipulate financial results.

One common violation involves improper revenue recognition, where companies may prematurely recognize revenue before it has been earned. Another violation can be over or understating expenses.

Another area prone to violations is asset valuation, where companies may inflate the value of their assets to improve their financial position. The SEC regularly investigates companies for GAAP violations and imposes penalties, highlighting the seriousness of these breaches.

The Consequences of Non-Compliance

The consequences of non-compliance with GAAP can be severe, ranging from reputational damage to legal and regulatory sanctions.

Companies found to have materially misstated their financial statements may face lawsuits from investors who relied on the inaccurate information. The SEC can impose fines and other penalties on companies and individuals who violate securities laws.

Beyond the legal and financial ramifications, non-compliance can erode trust in the company and its management, making it difficult to attract investors and maintain positive relationships with stakeholders.

The Evolving Landscape of GAAP

GAAP is not static; it evolves over time to reflect changes in the business environment and address emerging accounting issues. The Financial Accounting Standards Board (FASB) is responsible for setting accounting standards in the United States.

FASB regularly issues new accounting standards and interpretations to provide guidance on specific accounting issues. Keeping up with these changes is crucial for companies and auditors alike.

International Financial Reporting Standards (IFRS) are used in many parts of the world. The potential for greater convergence between GAAP and IFRS remains an ongoing topic of discussion.

Looking Ahead: The Future of GAAP Compliance

As the business world becomes increasingly complex and globalized, the importance of GAAP compliance will only continue to grow. Technology is playing an increasing role in the assessment process, with data analytics and artificial intelligence being used to identify potential GAAP violations.

Continuous education and training are essential for accounting professionals to stay abreast of the latest developments in accounting standards and best practices. The increasing use of technology to audit financial information will ensure companies are following the rules.

The goal is to create a more transparent and reliable financial reporting environment that fosters trust and confidence among all stakeholders.

Assessing whether financial statements follow GAAP is not merely a compliance exercise, but a fundamental pillar of financial integrity. It's a process that demands rigor, expertise, and a commitment to transparency. As we navigate the ever-changing landscape of finance, the principles of GAAP provide a compass, guiding us toward a more reliable and trustworthy financial future.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)