An Insured's Inability To Perform Two Or More

Across the nation, individuals holding long-term disability insurance policies are increasingly finding themselves in a precarious position: deemed unable to perform two or more essential job duties, yet denied benefits by their insurance providers. This conflict highlights a growing tension between policyholders, who rely on these benefits for financial security during times of incapacitation, and insurance companies, who are tasked with managing risk and controlling costs.

The core issue revolves around the interpretation of policy language regarding the inability to perform job duties. While a claimant might present medical evidence supporting their limitations, the insurer may argue that the evidence is insufficient or that the claimant's limitations do not prevent them from performing the material and substantial duties of their occupation.

Defining "Inability" and "Essential Job Duties"

At the heart of these disputes lies the ambiguity in defining "inability" and "essential job duties." Policies often stipulate that benefits are payable if the insured is unable to perform the material and substantial duties of their own occupation. However, what constitutes a "material and substantial duty" can be open to interpretation.

This ambiguity leaves room for insurers to argue that a claimant, despite their limitations, can still perform the core functions of their job. Claimants often face pushback when documenting the frequency or the number of tasks impacted.

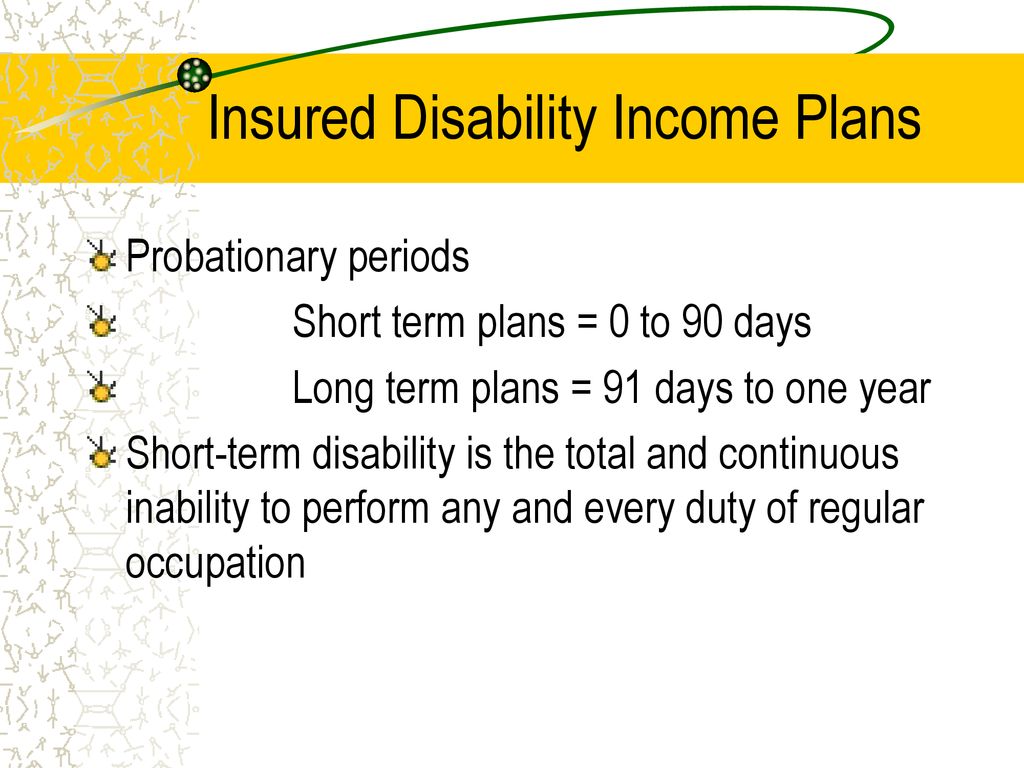

Varying Policy Definitions

The specific definitions within a disability insurance policy are crucial. Some policies have a more lenient definition of disability, covering individuals who cannot perform the duties of their "own occupation." Others have a stricter definition, requiring the inability to perform the duties of "any occupation" for which the claimant is reasonably suited by education, training, and experience.

This shift in definition, often occurring after a period of benefits based on the "own occupation" standard, can significantly impact a claimant's eligibility.

The Role of Medical Evidence

Medical evidence plays a pivotal role in disability claims. Insurers typically require detailed medical records, including diagnoses, treatment plans, and functional capacity evaluations, to assess a claimant's limitations.

However, even with supporting medical documentation, insurers may challenge the credibility or objectivity of the medical evidence. They may request independent medical examinations (IMEs) or peer reviews, which can sometimes contradict the findings of the claimant's treating physicians.

These external reviews can provide the basis to deny claims or to terminate ongoing benefits.

Case Examples and Human Impact

Consider the case of Sarah Miller, a former software engineer suffering from severe chronic pain and fatigue. Despite medical documentation from her physician outlining her inability to concentrate for extended periods or sit for more than an hour, her insurance company denied her claim.

The insurer argued that, while she might experience discomfort, she could still perform the essential functions of her job by taking frequent breaks and modifying her work environment. Sarah is now appealing this decision and facing financial hardship because of the denial.

Another example is Robert Jones, a construction worker who sustained a back injury. His policy covered him if he could not perform the essential duties of his job. His claim was denied, despite his doctor saying that he cannot lift heavy objects.

Legal and Regulatory Landscape

Disputes over disability insurance claims often lead to litigation. Claimants may file lawsuits against their insurers, alleging breach of contract or bad faith. ERISA (Employee Retirement Income Security Act) governs many employer-sponsored disability plans, creating a complex legal framework for these disputes.

State laws also vary regarding insurance regulations and consumer protection. Some states have stricter regulations regarding claim denials and require insurers to act in good faith.

Understanding the legal framework is critical for claimants navigating the appeals process.

Potential Societal Impact

The increasing difficulty in obtaining disability benefits has broader societal implications. Individuals denied benefits may be forced to rely on public assistance programs, placing a strain on social safety nets.

Furthermore, the stress and anxiety associated with navigating complex insurance claims can exacerbate existing health conditions. It creates an environment of distrust towards insurance companies.

There is a growing need for greater transparency and clarity in disability insurance policies, as well as improved dispute resolution mechanisms.

Moving Forward: Recommendations for Claimants and Insurers

For claimants, it is crucial to thoroughly understand their policy language and gather comprehensive medical evidence. Seeking legal counsel early in the process can also be beneficial.

For insurers, a more empathetic and transparent approach to claim evaluations is needed. Improving communication and focusing on vocational rehabilitation efforts may mitigate disputes.

Ultimately, a collaborative approach between claimants, insurers, and medical professionals is essential to ensure that disability insurance serves its intended purpose: providing financial security to those who are genuinely unable to work.

.jpg)

.jpg)

.jpg)