Another Common Term For Stockholders' Equity Is:

For those navigating the world of finance, understanding the various terms used to describe fundamental concepts is crucial. While stockholders' equity is a widely recognized phrase, another term often surfaces in financial statements and discussions: net worth.

The terms are generally interchangeable, though subtleties exist depending on the context.

What is Stockholders' Equity/Net Worth?

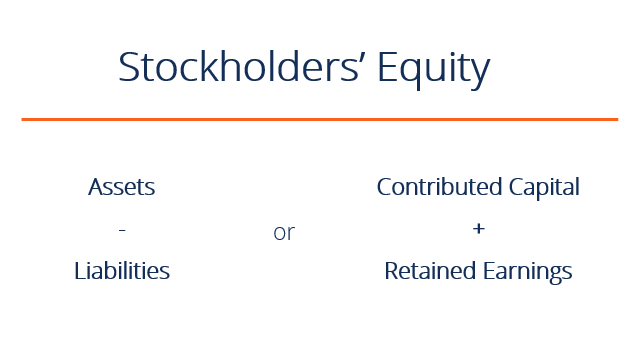

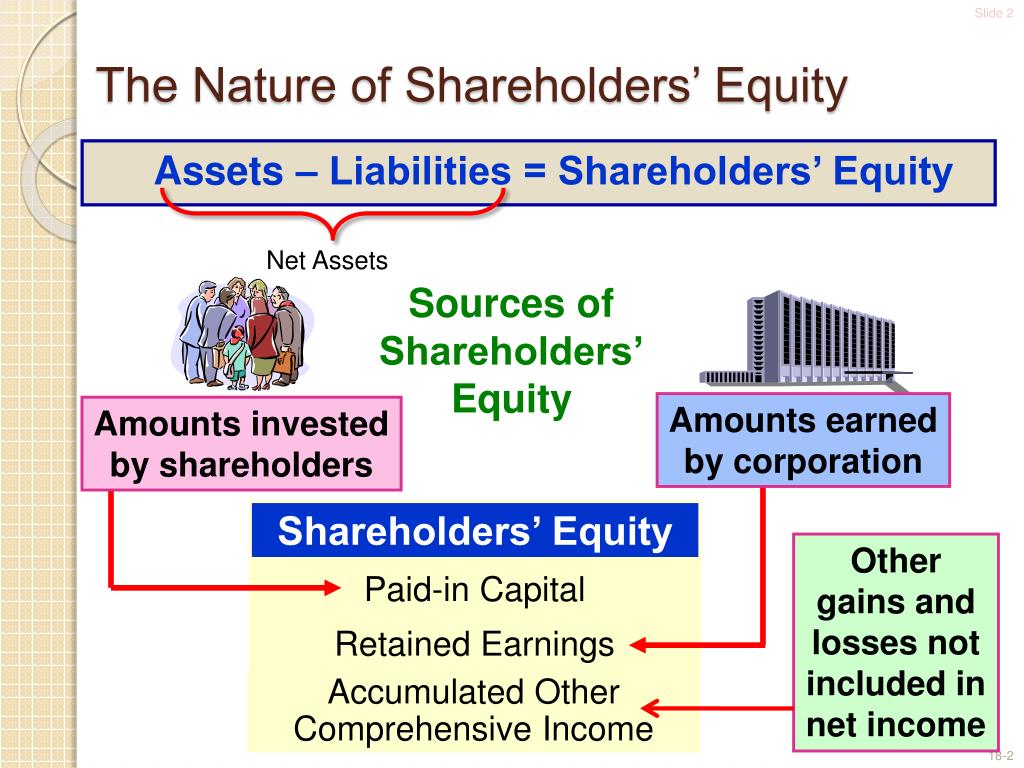

At its core, stockholders' equity, or net worth, represents the residual value of a company's assets after deducting its liabilities. Essentially, it's what would theoretically be left for the shareholders if all assets were sold and all debts were paid off.

This figure is a key indicator of a company's financial health.

Key Details

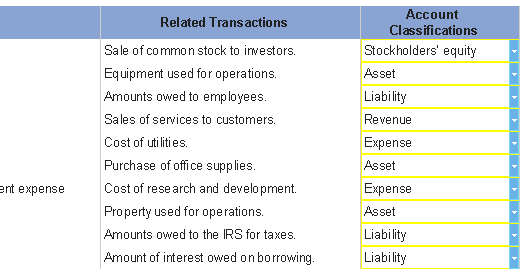

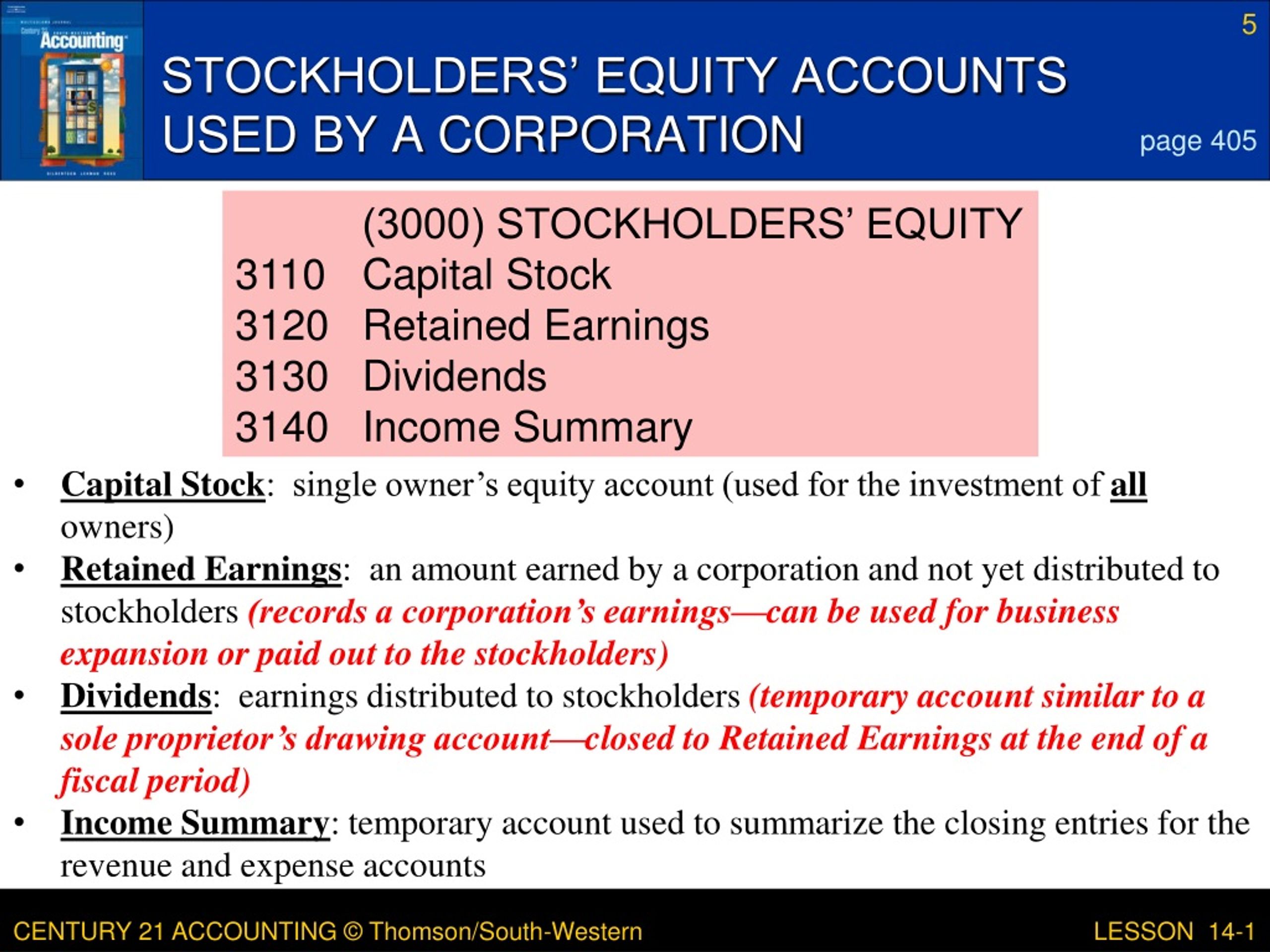

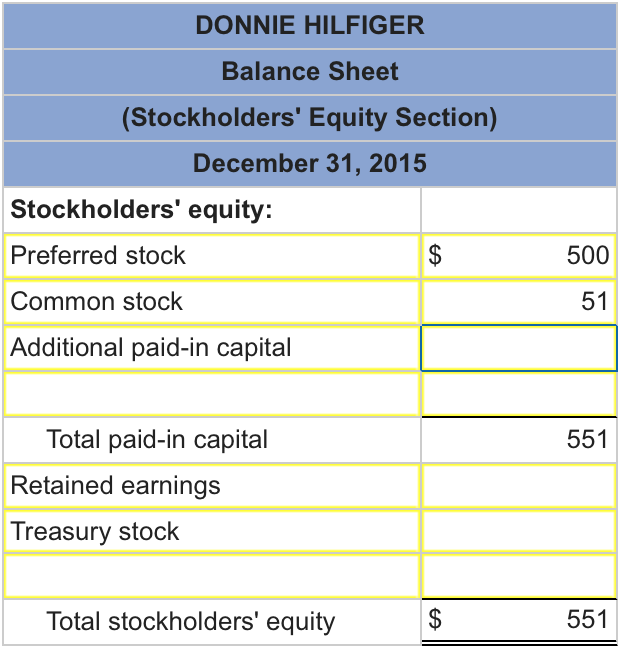

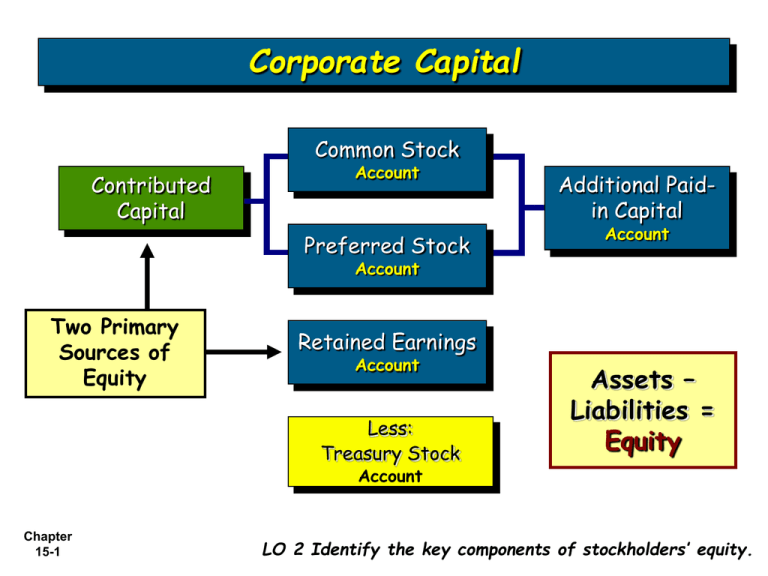

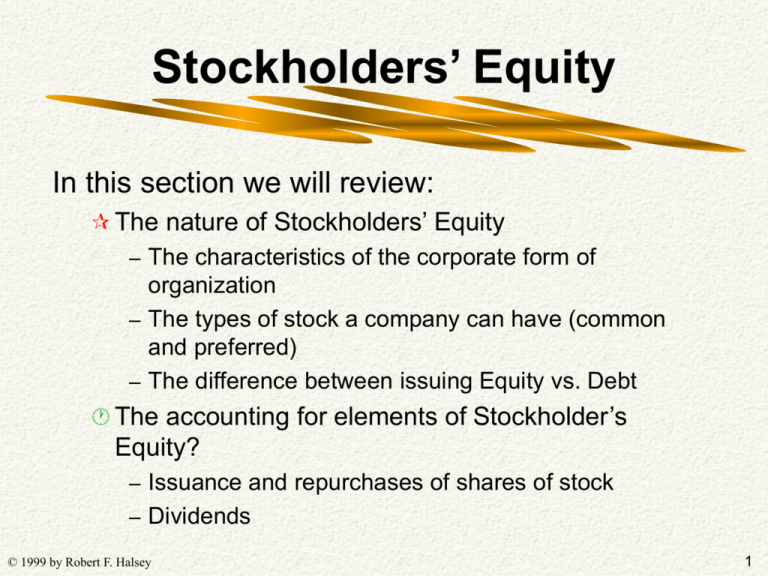

Both terms, stockholders' equity and net worth, appear on the balance sheet, one of the core financial statements used to analyze a company. The basic accounting equation dictates the relationship: Assets = Liabilities + Stockholders' Equity.

Therefore, stockholders' equity can be derived by subtracting total liabilities from total assets.

Stockholders’ equity is the owners’ stake in the corporation.

Who Uses These Terms?

These terms are used broadly by investors, analysts, creditors, and company management. Investors use it to assess a company's value and financial stability.

Creditors use it to evaluate a company's ability to repay its debts.

Company management uses it to make strategic decisions and monitor financial performance.

Significance and Impact

The significance of understanding stockholders' equity or net worth lies in its ability to provide a snapshot of a company's financial strength. A high stockholders' equity usually indicates a financially healthy company with fewer liabilities relative to its assets.

Conversely, a low or negative stockholders' equity might signal financial distress. It’s essential to compare a company's stockholders' equity over time and against its peers to get a complete picture.

This analysis informs investment decisions, lending practices, and overall economic forecasting.

Human-Interest Angle

Consider the story of Sarah Miller, a small business owner. She relied on her business's net worth, which includes stockholders’ equity, to secure a loan for expansion.

The bank reviewed her balance sheet, focusing on the difference between her assets and liabilities. Because Sarah's net worth demonstrated financial stability, she secured the loan, expanded her business, and created more jobs in her community.

Variations and Context

While often interchangeable, subtle differences can exist in certain contexts. For individuals, net worth generally refers to the value of all personal assets minus liabilities. For corporations, stockholders' equity is the preferred term.

However, the underlying concept remains the same.

Potential Pitfalls

It's essential to remember that stockholders' equity, or net worth, is a book value, not necessarily the market value of a company. Market fluctuations and intangible assets not reflected on the balance sheet can significantly impact a company's actual worth.

Additionally, accounting methods can influence the reported stockholders' equity.

Conclusion

Understanding that stockholders' equity is another common term for net worth provides a crucial stepping stone to financial literacy. By grasping this fundamental concept, investors, business owners, and everyday citizens can better understand financial statements, evaluate financial health, and make informed decisions.

This knowledge empowers them to navigate the complexities of the financial world with greater confidence.