Aortic And Vascular Graft Devices Pipeline Product Market

The market for aortic and vascular graft devices is poised for considerable growth, driven by an aging population, increasing prevalence of vascular diseases, and advancements in medical technology. These devices, crucial for treating aneurysms, occlusive diseases, and traumatic injuries, are seeing a surge in demand globally.

This article delves into the current state of the aortic and vascular graft devices pipeline product market, examining key players, emerging technologies, and the factors shaping its future trajectory. The analysis draws upon recent industry reports, company announcements, and expert insights to provide a comprehensive overview.

Market Drivers and Trends

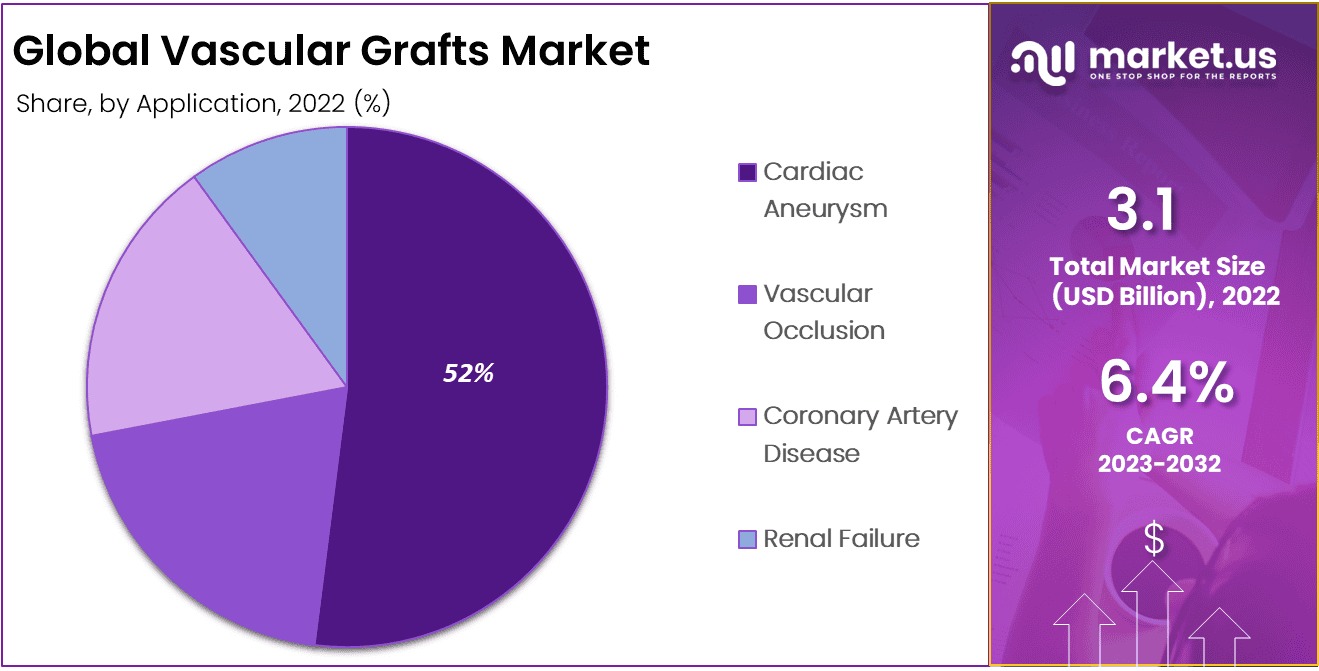

Several factors are fueling the expansion of the aortic and vascular graft market. The rising incidence of cardiovascular diseases, including aortic aneurysms and peripheral artery disease (PAD), is a primary driver.

An aging global population, coupled with lifestyle factors like smoking and obesity, contributes significantly to the increasing prevalence of these conditions. Consequently, the demand for effective treatment options, including vascular grafts, is escalating.

Technological advancements are also playing a pivotal role. Innovations in graft materials, such as ePTFE (expanded polytetrafluoroethylene) and polyester, are enhancing biocompatibility and durability. Endovascular techniques, which involve minimally invasive graft placement, are gaining popularity due to reduced patient recovery times and complications.

Key Players and Competitive Landscape

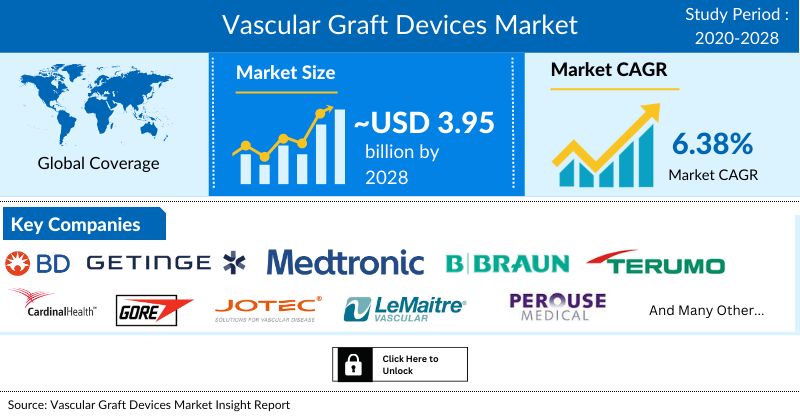

The aortic and vascular graft market is characterized by a mix of established multinational corporations and specialized smaller companies. Medtronic, W.L. Gore & Associates, Cook Medical, and Terumo are among the leading players.

These companies invest heavily in research and development to introduce innovative graft designs and technologies. Competition is intense, with companies vying for market share through product differentiation, strategic partnerships, and acquisitions.

Smaller players often focus on niche markets or specific types of grafts, fostering innovation and providing specialized solutions. The competitive landscape is constantly evolving, with new entrants and emerging technologies reshaping the market dynamics.

Pipeline Products and Emerging Technologies

The pipeline for aortic and vascular graft devices is robust, featuring a range of promising new products and technologies. These include next-generation grafts with enhanced biocompatibility, improved drug-eluting capabilities, and advanced delivery systems.

One key area of innovation is the development of bioactive grafts that promote tissue regeneration and reduce the risk of thrombosis. Researchers are exploring the use of cellular therapies and growth factors to enhance graft integration and long-term patency.

Endovascular graft technologies are also advancing rapidly. New stent graft designs are being developed to improve conformability and reduce the risk of endoleaks, which are a common complication following endovascular aneurysm repair (EVAR).

Furthermore, the integration of imaging technologies, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), is enhancing the precision and safety of graft placement procedures. These technologies provide real-time visualization of the vessel anatomy and graft deployment, allowing for more accurate and effective treatment.

Regional Market Analysis

The aortic and vascular graft market exhibits regional variations in terms of growth rates and market dynamics. North America currently holds the largest market share, driven by a well-established healthcare infrastructure and a high prevalence of vascular diseases.

Europe is another significant market, with increasing adoption of endovascular techniques and a growing aging population. Asia-Pacific is expected to be the fastest-growing region, fueled by rising healthcare expenditure, increasing awareness of vascular diseases, and improving access to medical technologies.

Emerging markets in Latin America and the Middle East are also presenting growth opportunities, albeit from a smaller base. These regions are witnessing increasing adoption of advanced medical technologies and expanding healthcare infrastructure.

Regulatory Landscape and Reimbursement

The aortic and vascular graft market is subject to stringent regulatory requirements, with devices requiring approval from regulatory agencies such as the FDA in the United States and the EMA in Europe.

These agencies evaluate the safety and efficacy of graft devices through rigorous clinical trials and pre-market approval processes. Compliance with these regulations is crucial for manufacturers to gain market access.

Reimbursement policies also play a significant role in shaping market dynamics. Favorable reimbursement rates for graft procedures can encourage adoption and drive market growth. However, cost containment pressures and evolving reimbursement models can pose challenges to market access.

Challenges and Opportunities

Despite the promising growth prospects, the aortic and vascular graft market faces several challenges. These include the high cost of advanced graft technologies, the risk of complications such as thrombosis and infection, and the need for long-term follow-up.

However, these challenges also present opportunities for innovation. Developing more cost-effective grafts, improving biocompatibility, and enhancing long-term outcomes are key areas of focus for manufacturers and researchers.

Furthermore, the increasing adoption of endovascular techniques and the development of personalized graft solutions are creating new opportunities for growth. As the population ages and the prevalence of vascular diseases continues to rise, the demand for effective and innovative graft devices will only increase.

Conclusion

The aortic and vascular graft devices market is a dynamic and evolving landscape, driven by technological advancements, demographic trends, and increasing healthcare expenditure. The pipeline for new products is robust, with a focus on improving biocompatibility, enhancing long-term outcomes, and expanding the use of minimally invasive techniques.

While challenges remain, the market presents significant opportunities for growth, particularly in emerging markets and with the development of personalized graft solutions. Key players are investing heavily in research and development to meet the growing demand for effective and innovative graft devices.

Ultimately, the continued advancement of aortic and vascular graft technology will play a crucial role in improving the lives of patients suffering from vascular diseases worldwide.