As The Interest Rate Increases The Present Value

Economic shockwaves are rippling through markets as the Federal Reserve continues its aggressive interest rate hikes. These increases are directly impacting the present value of future assets, investments, and even long-term financial plans, forcing immediate reassessments across the board.

The escalating interest rates, intended to combat inflation, are drastically reducing the present value of future cash flows, affecting everything from bond yields to real estate valuations. This article breaks down the immediate implications and what individuals and businesses need to know to navigate this volatile financial landscape.

The Immediate Impact: Declining Present Value

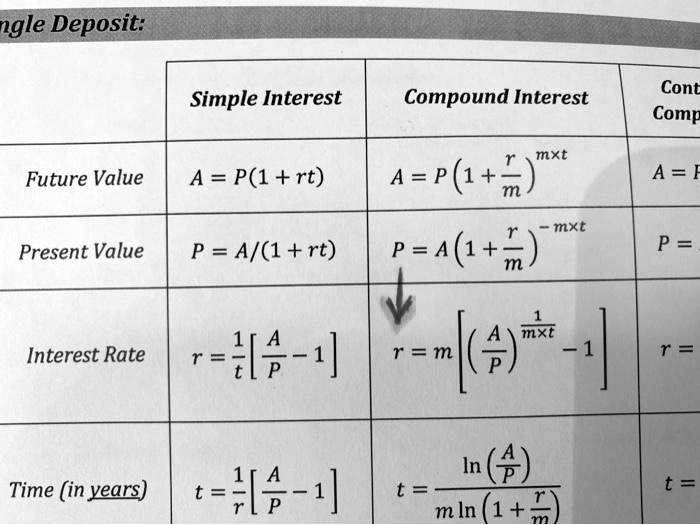

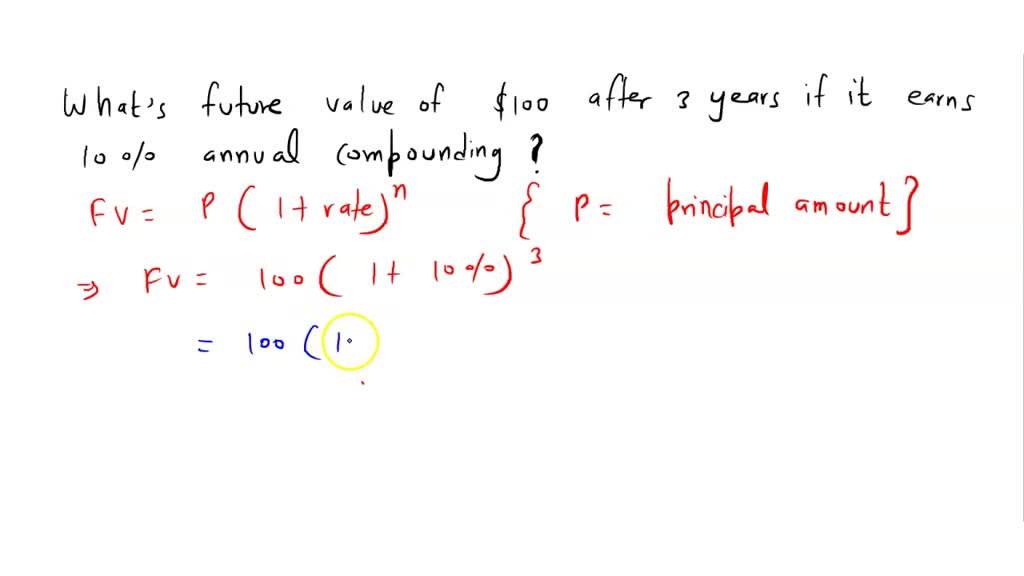

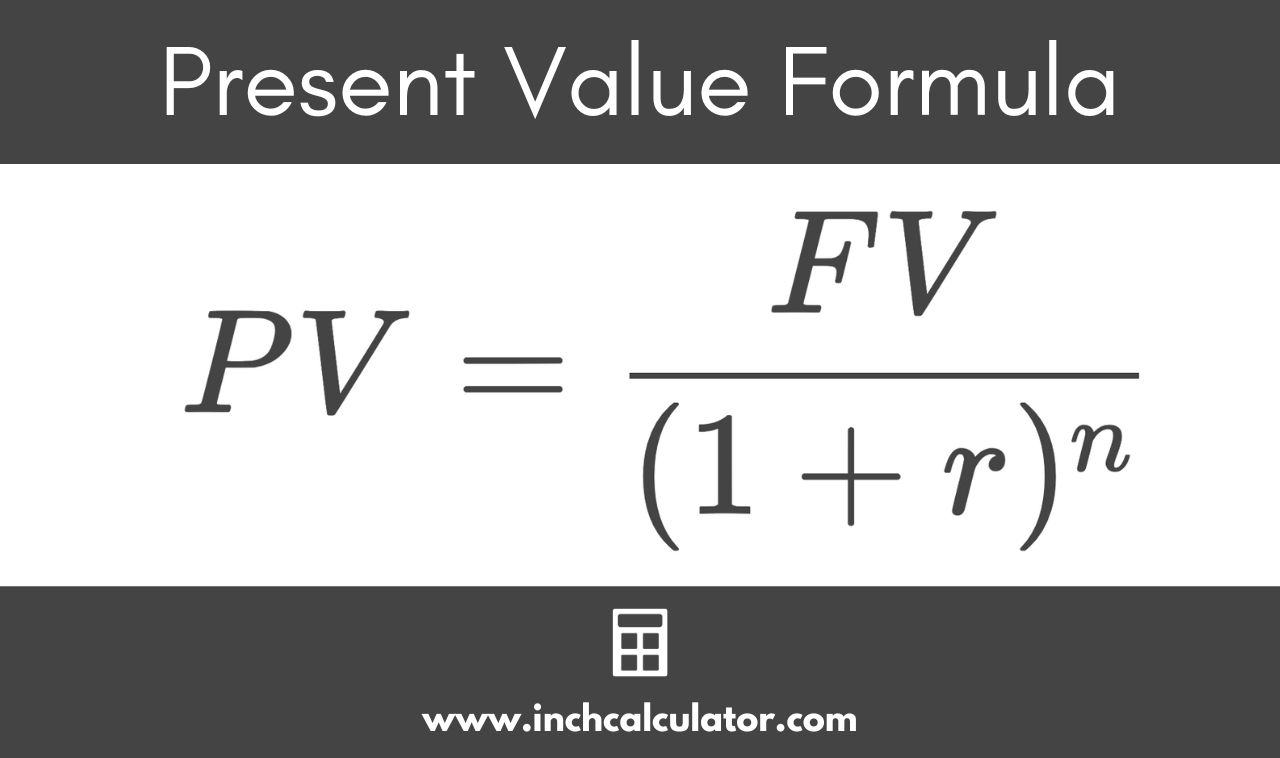

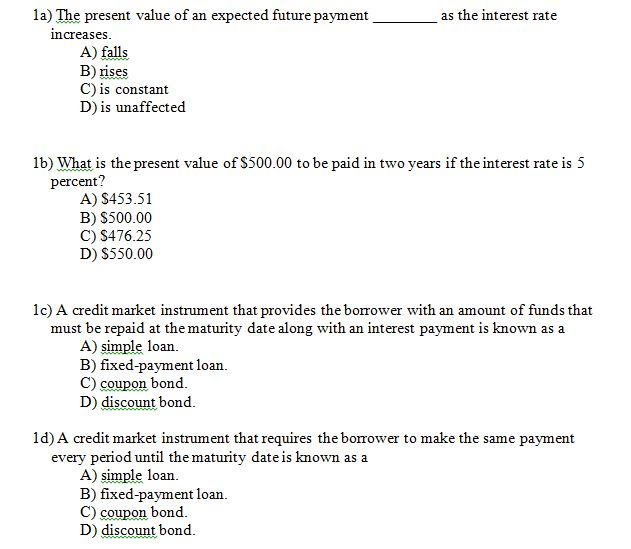

The core principle is simple: higher interest rates mean future money is worth less today. The present value (PV) calculation discounts future cash flows back to their current worth, using the interest rate as a discount factor.

As the discount rate (interest rate) increases, the resulting present value decreases. This has a cascading effect on asset valuations, investment decisions, and borrowing costs.

Bond Market Turmoil

Bond yields are inversely related to bond prices. As interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive.

According to Bloomberg data, the Bloomberg US Aggregate Bond Index, a broad measure of the investment-grade U.S. bond market, has experienced significant losses this year as interest rates have climbed, reflecting the decline in present value of fixed income streams.

This forces investors to sell existing bonds at a discount, driving prices down further and highlighting the immediate impact of rising rates on present value.

Real Estate Market Correction

The real estate market is acutely sensitive to interest rate changes. Higher mortgage rates directly reduce affordability, dampening demand and putting downward pressure on prices.

Data from the National Association of Realtors (NAR) reveals a sharp decline in existing home sales in recent months, coinciding with the surge in mortgage rates, which currently stand above 7% according to Freddie Mac.

Reduced demand coupled with higher borrowing costs translates to a lower present value of future rental income and potential capital appreciation, leading to a market correction in many areas.

Business Investment Scrutiny

Businesses are reassessing capital investment projects in light of the increased cost of capital. Any project with future returns must now clear a higher hurdle rate to justify the investment.

Companies are now employing more stringent discounted cash flow (DCF) analysis, recognizing that higher interest rates shrink the present value of future earnings, making marginal projects less appealing.

This is leading to project postponements, budget cuts, and increased scrutiny of long-term investments, potentially slowing economic growth.

Consumer Spending Slowdown

Consumers are feeling the pinch as borrowing costs rise across the board. Credit card rates, auto loan rates, and personal loan rates are all climbing, reducing disposable income.

This impacts spending on discretionary items and increases financial strain on households, affecting the present value of future consumption and overall economic activity.

Data from the Federal Reserve indicates a deceleration in consumer spending growth, suggesting that higher interest rates are beginning to curb demand.

Navigating the New Landscape: Immediate Actions

Individuals and businesses must take immediate steps to adapt to the new interest rate environment. Re-evaluating investment portfolios, adjusting financial plans, and controlling debt are critical.

Consider strategies such as shortening bond durations, exploring alternative investments, and prioritizing debt reduction to mitigate the negative impact of rising rates on present value. Seek advice from qualified financial professionals.

The Federal Reserve's next policy meeting is scheduled for [Insert Date - e.g., December 13-14, 2023], where further rate hikes are widely anticipated. Stay informed and prepared for continued volatility in the financial markets. Monitor updates from credible financial news outlets like the Wall Street Journal and the Financial Times.

+Bond+Contract+in+which+a+borrower+agrees+to+pay+the+bondholder+(the+lender)+a+stream+of+money..jpg)

.jpg)