Audit Risk Is Typically Considered And Assessed

The meticulous assessment of audit risk stands as a cornerstone of financial accountability, influencing everything from investor confidence to the stability of capital markets.

Audit risk, the possibility that an auditor expresses an inappropriate audit opinion when the financial statements are materially misstated, is not merely a technical term confined to accounting textbooks. It is a pervasive concern that shapes the audit process, guiding auditors in their efforts to provide reasonable assurance about the fairness of financial statements.

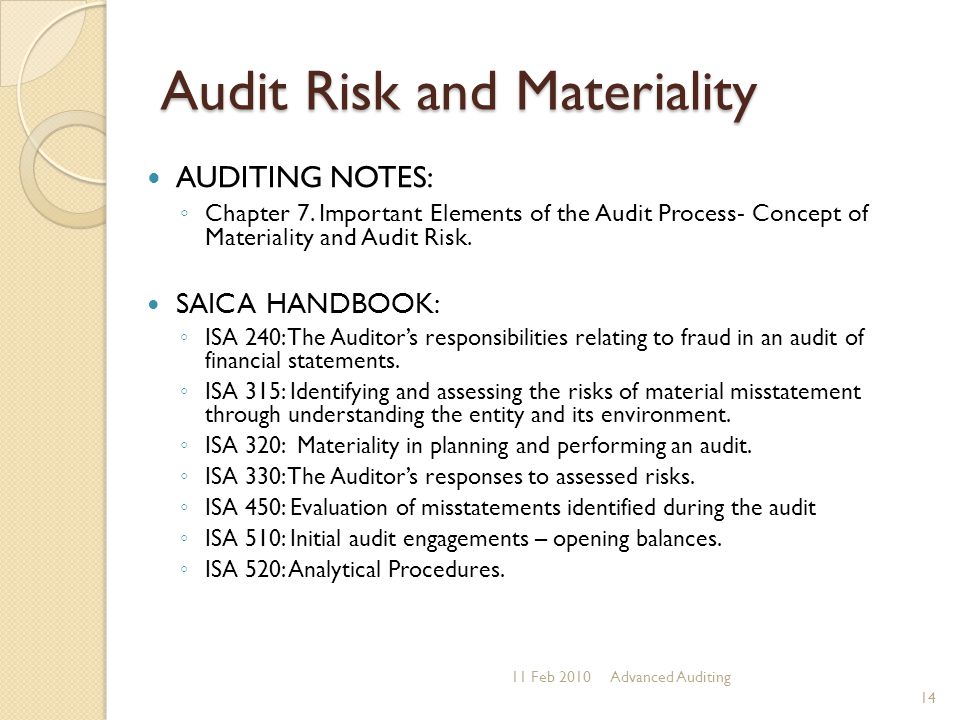

Understanding Audit Risk

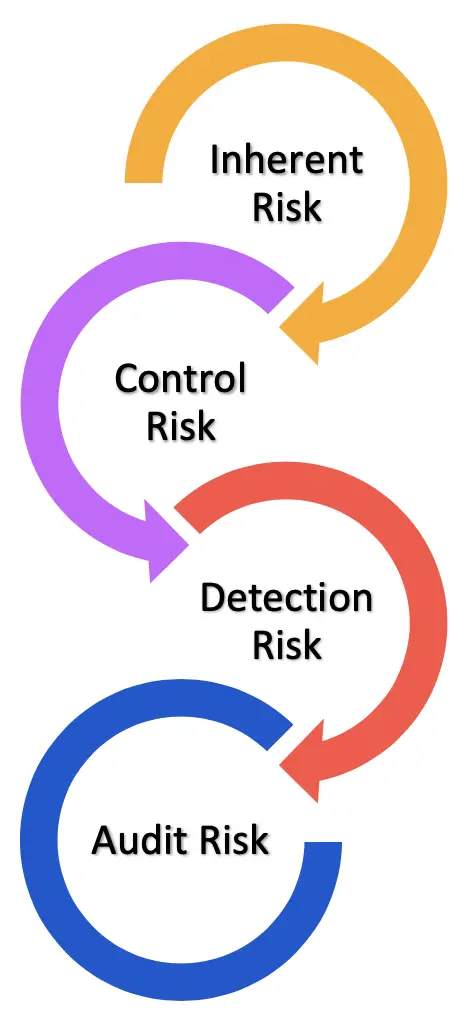

At its core, audit risk comprises three key components: inherent risk, control risk, and detection risk. These components interact to determine the overall level of risk an auditor faces during an engagement.

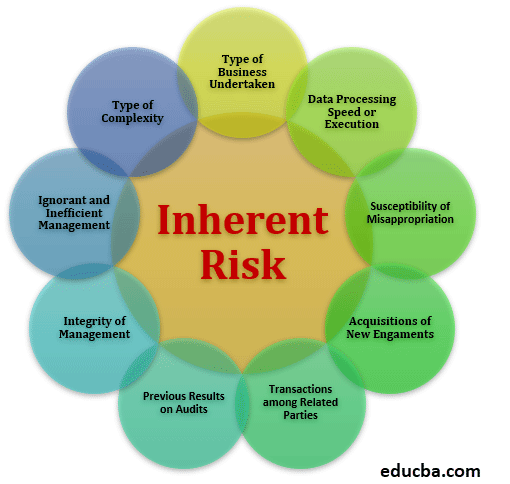

Inherent risk refers to the susceptibility of an account balance or class of transactions to material misstatement, assuming there are no related controls. High inherent risk might be associated with complex calculations, volatile industries, or areas prone to management bias.

Control risk is the risk that a material misstatement that could occur in an account balance or class of transactions will not be prevented or detected on a timely basis by the entity's internal controls. A weak internal control environment elevates control risk.

Detection risk is the risk that the procedures performed by the auditor to reduce audit risk to an acceptably low level will not detect a misstatement that exists and that could be material, either individually or when aggregated with other misstatements. Auditors can influence detection risk through the nature, timing, and extent of their audit procedures.

The Audit Risk Model

The audit risk model provides a framework for auditors to conceptualize and manage these components.

This model is often expressed as: Audit Risk = Inherent Risk × Control Risk × Detection Risk. By assessing inherent and control risks, auditors determine the level of detection risk they can accept, thereby guiding the scope and rigor of their audit procedures.

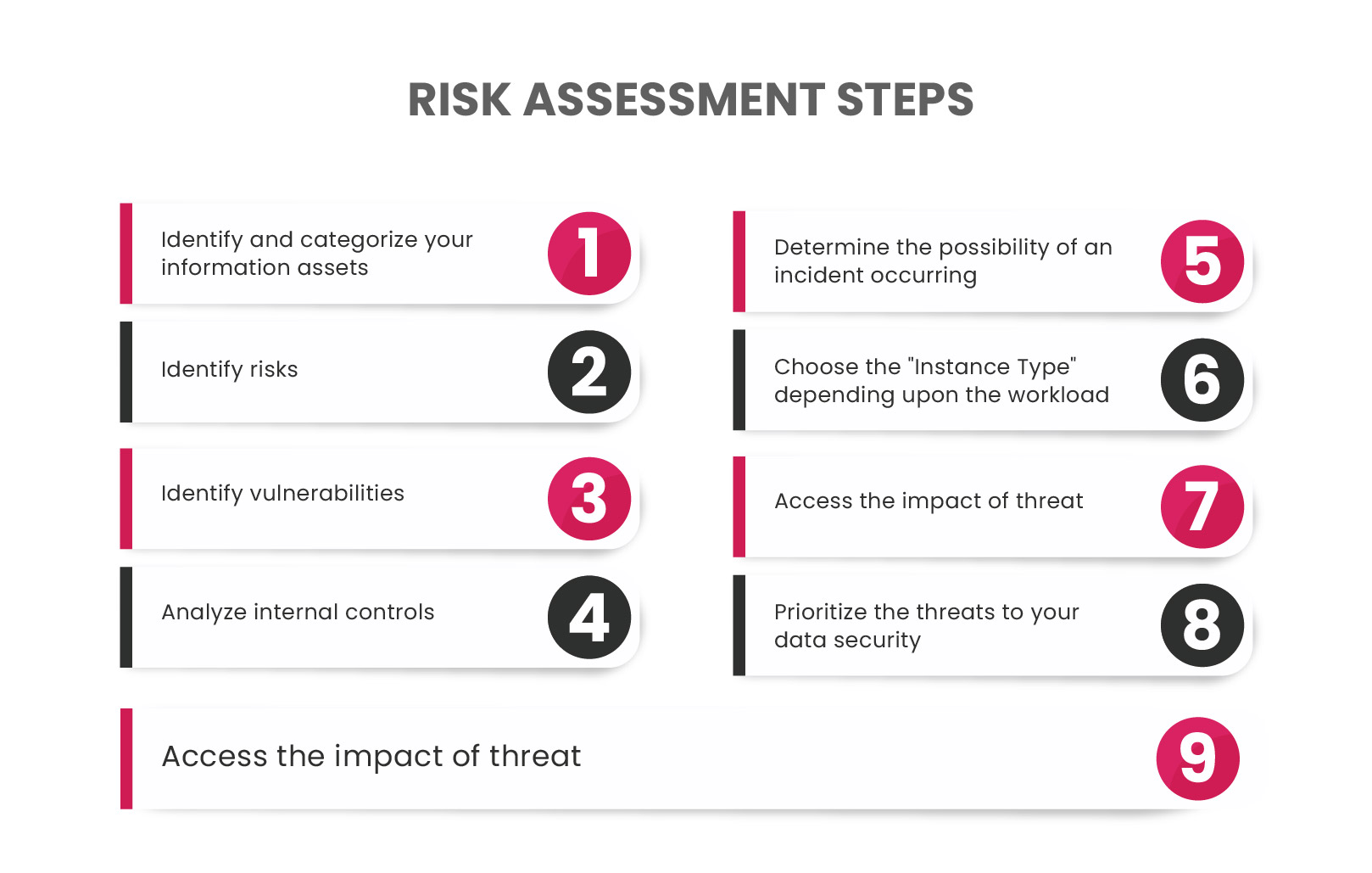

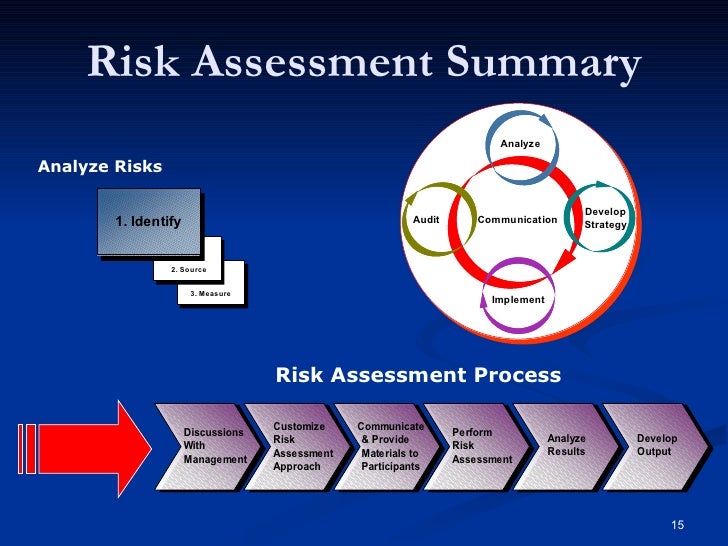

Assessment Process

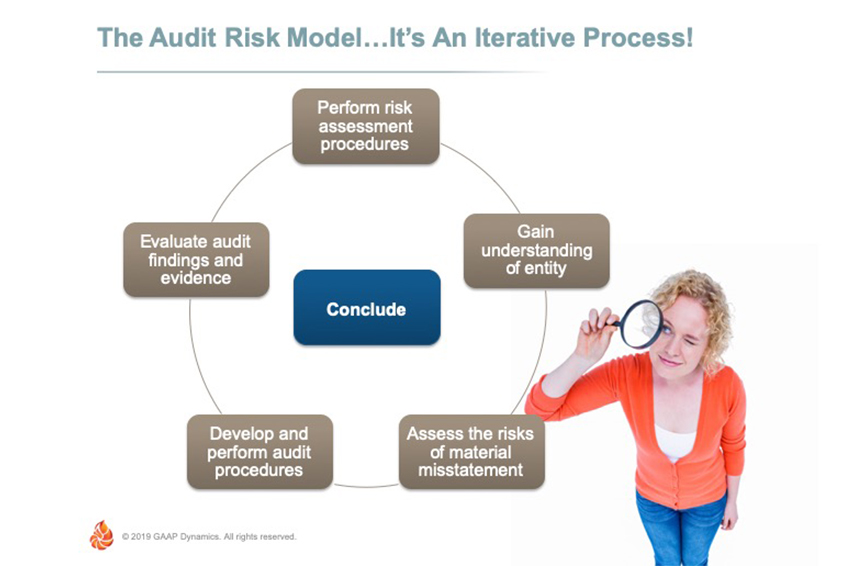

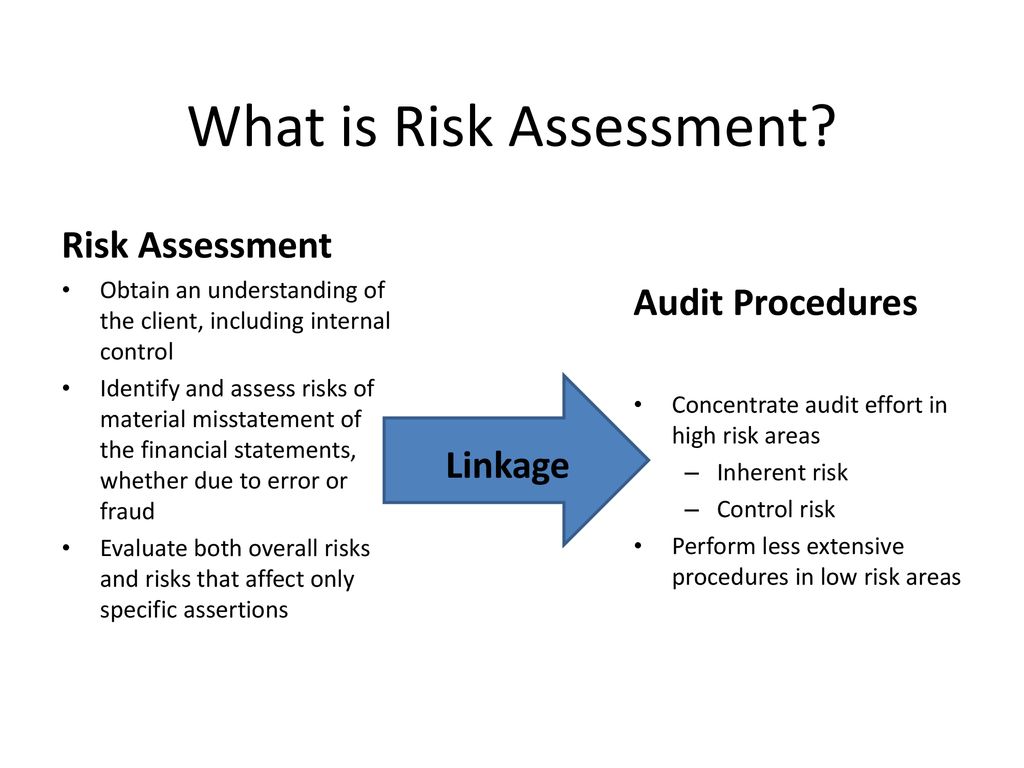

The assessment of audit risk is not a one-time event but an ongoing process throughout the audit. It begins during the planning phase, where auditors gain an understanding of the entity and its environment, including its internal controls.

Auditors use various techniques to assess inherent risk, such as reviewing industry trends, analyzing financial ratios, and interviewing management. They evaluate the design and effectiveness of internal controls through walkthroughs, testing, and observation to assess control risk.

Based on these assessments, auditors design their audit procedures to achieve the desired level of detection risk. This may involve increasing sample sizes, performing more substantive procedures, or using specialized audit techniques.

Significance and Impact

The proper consideration and assessment of audit risk are crucial for several reasons. First, it helps auditors focus their efforts on the areas where misstatements are most likely to occur, improving audit efficiency and effectiveness.

Second, it enhances the quality of the audit by ensuring that auditors gather sufficient appropriate audit evidence to support their opinion. Ultimately, it strengthens the credibility of financial statements, which is essential for informed decision-making by investors, creditors, and other stakeholders.

Failure to adequately assess audit risk can have serious consequences. It may lead to undetected material misstatements, which can erode investor confidence, trigger regulatory scrutiny, and result in significant financial losses for companies and investors.

Recent Developments and Regulatory Focus

Regulators like the Public Company Accounting Oversight Board (PCAOB) have increasingly emphasized the importance of audit risk assessment. They have issued guidance and inspection reports highlighting areas where audit firms need to improve their risk assessment procedures.

These include enhancing the understanding of the entity's business and industry, properly identifying and assessing risks of material misstatement, and designing audit procedures that are responsive to those risks. The PCAOB regularly issues updates and releases related to audit deficiencies, frequently citing inadequate risk assessment as a contributing factor.

Furthermore, technological advancements are influencing how auditors assess audit risk. Data analytics and artificial intelligence tools are enabling auditors to analyze large volumes of data, identify anomalies, and gain deeper insights into an entity's operations and financial performance.

These technologies have the potential to enhance the accuracy and efficiency of audit risk assessments, but they also require auditors to develop new skills and competencies to effectively utilize these tools.

Conclusion

In conclusion, the assessment of audit risk is not merely a compliance exercise but a fundamental aspect of a high-quality audit. By carefully considering inherent risk, control risk, and detection risk, auditors can design and perform audit procedures that provide reasonable assurance about the fairness of financial statements.

The ongoing emphasis from regulators and the advent of new technologies underscore the importance of continuous improvement in audit risk assessment. Ensuring effective audits safeguards the integrity of financial reporting and fosters trust in the capital markets.