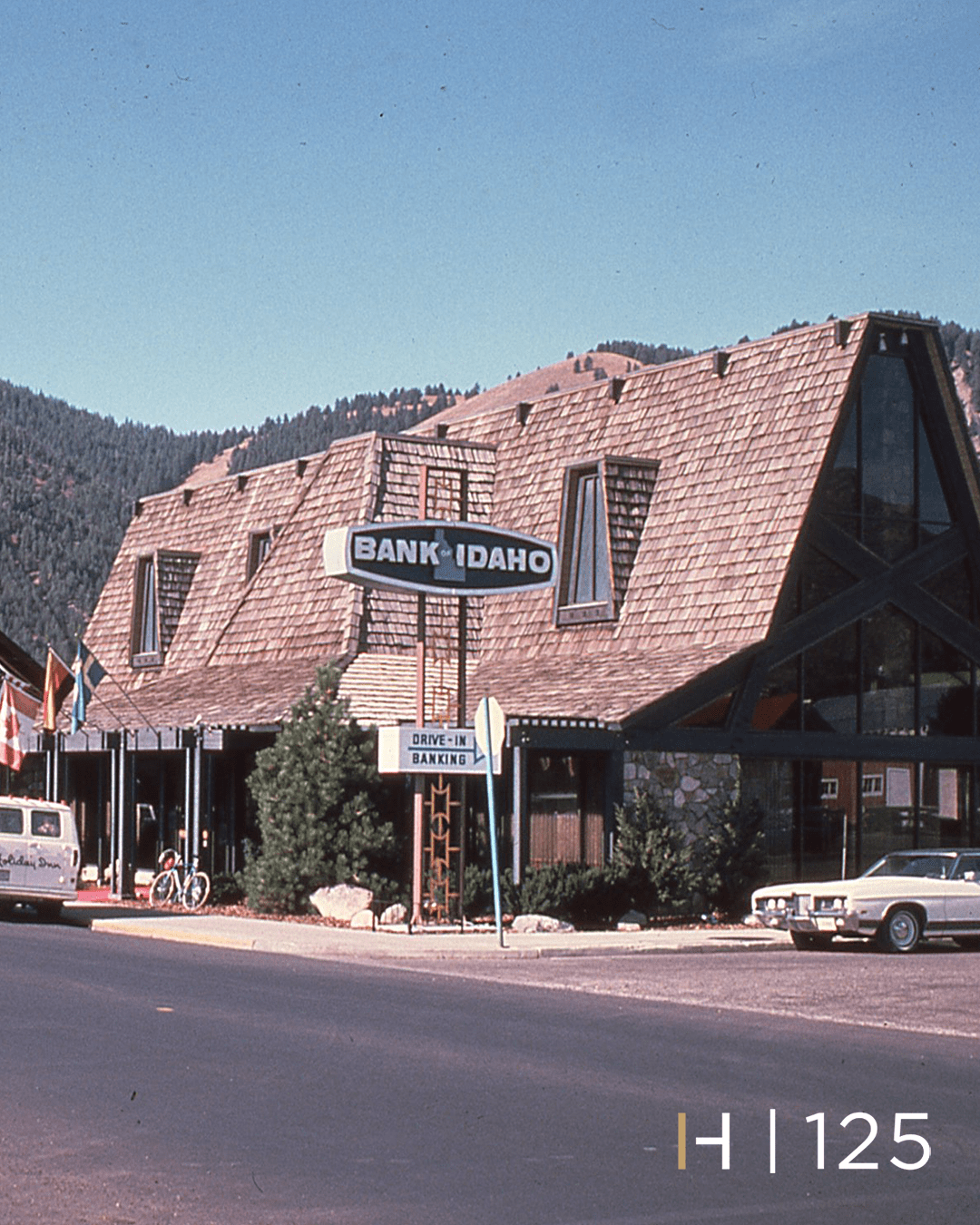

Bank Of Idaho Idaho Falls Idaho

Bank of Idaho, a community bank headquartered in Idaho Falls, is experiencing significant growth and expansion across the state, reflecting a broader trend of regional banks thriving in specific niches. This growth, coupled with community-focused initiatives, positions the bank as a notable player in Idaho's financial landscape.

This article examines Bank of Idaho's recent performance, expansion strategies, and community involvement, analyzing its impact on the local economy and its customers.

Growth and Expansion

Bank of Idaho has demonstrated consistent growth over the past several years. This growth is fueled by a combination of organic expansion and strategic acquisitions, allowing the bank to reach a wider customer base across the state.

In recent years, Bank of Idaho has focused on expanding its physical footprint by opening new branches in key markets. These new branches are strategically located to serve both retail and commercial customers.

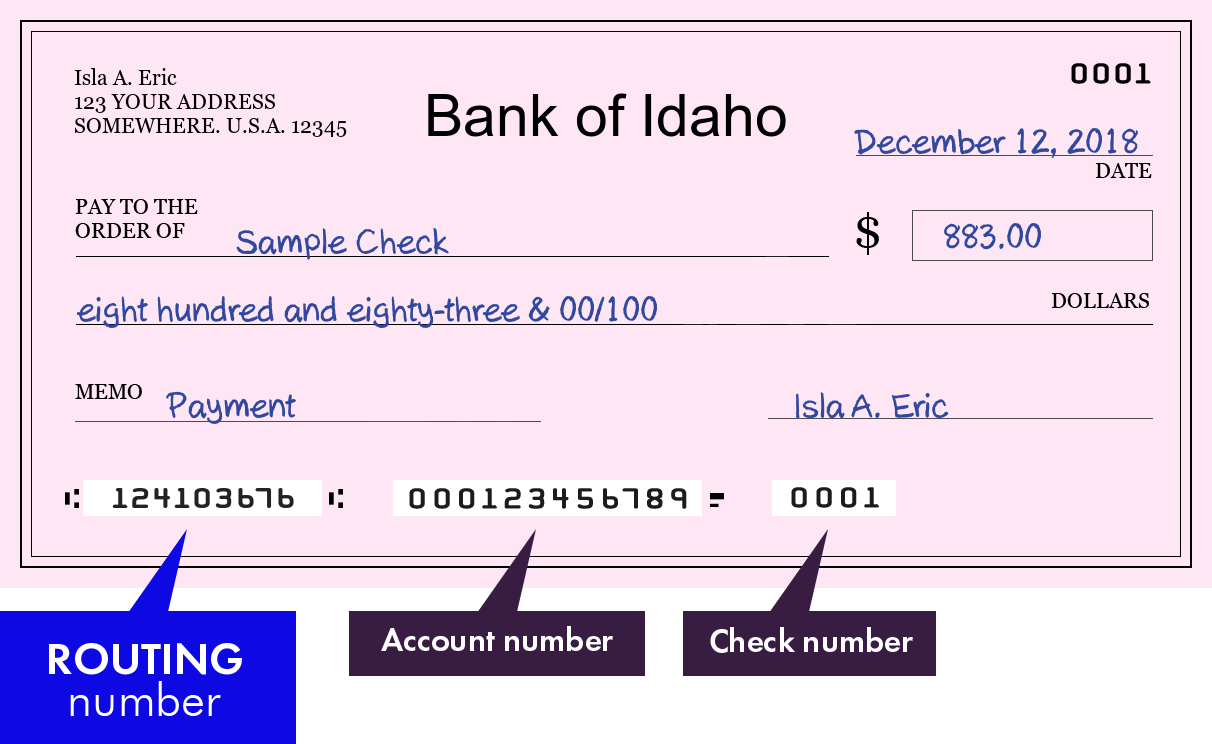

The bank’s expansion strategy also includes enhancing its digital banking capabilities to cater to the evolving needs of modern customers. This includes mobile banking, online account management, and other digital services.

Community Involvement

A key differentiator for Bank of Idaho is its deep commitment to the communities it serves. This commitment is demonstrated through various initiatives, including sponsorships, charitable donations, and volunteer programs.

Bank of Idaho actively supports local non-profit organizations and community events. These sponsorships range from youth sports teams to arts and cultural festivals, enhancing the quality of life in the areas it serves.

The bank also encourages its employees to participate in volunteer activities, fostering a culture of community service within the organization. This hands-on approach reinforces the bank's dedication to making a positive impact.

Financial Performance

Bank of Idaho's financial performance reflects its successful growth and expansion strategies. Its financial statements show steady increases in assets, deposits, and loans, indicating a healthy and stable financial institution.

The bank has maintained strong capital ratios, ensuring its ability to withstand economic fluctuations and continue serving its customers. This financial stability provides confidence to both depositors and investors.

"We are committed to providing our customers with the best possible banking experience, while also supporting the communities we serve," said Jeff Newgard, President of Bank of Idaho, in a recent statement.

Impact on the Local Economy

Bank of Idaho's presence has a positive impact on the local economy. By providing loans and financial services to businesses and individuals, the bank helps stimulate economic growth and create jobs.

The bank's support for local businesses is particularly important, as it enables entrepreneurs to start and expand their operations. This contributes to a more vibrant and diversified economy.

Furthermore, Bank of Idaho's community involvement strengthens social bonds and enhances the overall quality of life in the areas it serves. This fosters a sense of community pride and belonging.

Challenges and Opportunities

Despite its success, Bank of Idaho faces challenges common to the banking industry. These challenges include increasing competition from larger national banks and the need to adapt to evolving regulatory requirements.

However, the bank also has significant opportunities to further expand its market share and enhance its brand reputation. These opportunities include leveraging technology to improve customer service and expanding into new markets.

Bank of Idaho's focus on community banking and personalized service provides a competitive advantage in an increasingly impersonal financial landscape.

A Human-Interest Angle

One notable example of Bank of Idaho's commitment to its customers is its personalized approach to lending. Unlike larger banks that rely heavily on automated credit scoring, Bank of Idaho takes the time to understand each customer's unique circumstances.

This personal touch has helped many local businesses and individuals obtain the financing they need to achieve their goals. This demonstrates the bank's dedication to empowering its customers and helping them succeed.

"Bank of Idaho is more than just a bank; it's a partner in our community's success,"said a local business owner who received a loan from the bank to expand their business.

Conclusion

Bank of Idaho's growth and community involvement make it a significant player in Idaho's financial landscape. Its commitment to personalized service, local businesses, and community development sets it apart from larger national banks.

As Bank of Idaho continues to expand and evolve, it is well-positioned to play an important role in supporting the economic growth and prosperity of Idaho.

The bank's future success will depend on its ability to adapt to changing market conditions and continue providing value to its customers and communities. Its strong foundation and commitment to its values suggest a bright future for Bank of Idaho.