Barclays Global Consumer Staples Conference 2024

The hum of anticipation filled the air at the Barclays Global Consumer Staples Conference 2024. Executives in sharp suits mingled with analysts clutching notepads, the low murmur punctuated by the clinking of coffee cups and the soft glow of presentation screens. Outside, the cityscape bustled, but inside, the focus was laser-sharp: understanding the shifting sands of consumer behavior and navigating the future of the consumer staples industry.

The Barclays Global Consumer Staples Conference serves as a crucial annual meeting point. It brings together industry leaders, investors, and analysts to dissect trends, strategies, and challenges facing companies that produce the everyday essentials we all rely on. The 2024 conference, held recently, offered a deep dive into topics ranging from inflation and supply chain resilience to innovation in product development and the growing importance of sustainability.

A Deep Dive into the Consumer Staples Landscape

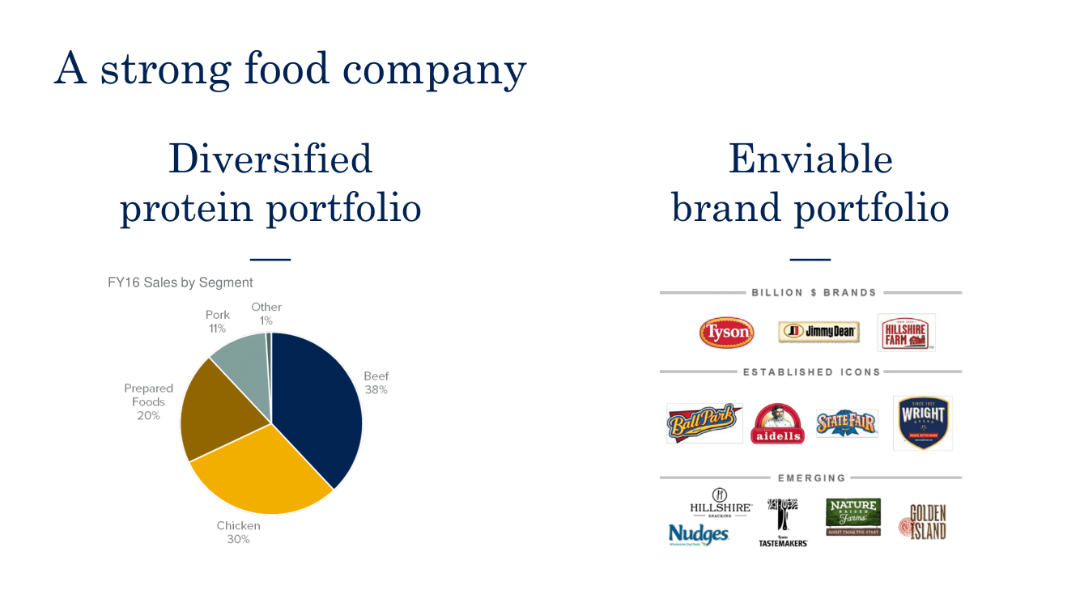

Consumer staples, unlike discretionary goods, are products people purchase regardless of economic conditions. Think food, beverages, household products, and personal care items. Their resilience makes them a bellwether for the broader economy, offering valuable insights into consumer sentiment and spending habits.

This year’s conference took place against a backdrop of persistent inflation and evolving consumer preferences. Inflation, while moderating in some areas, continues to exert pressure on household budgets, forcing consumers to become more discerning about their purchases.

According to a recent report by the Bureau of Labor Statistics, food prices remain elevated compared to pre-pandemic levels. This reality has fueled a surge in private label brands and a renewed focus on value among shoppers.

Key Themes and Discussions

Several key themes dominated the discussions at the Barclays conference.

1. Navigating Inflation and Pricing Strategies: Companies grappled with the challenge of maintaining profitability while remaining competitive in an increasingly price-sensitive market.

Many highlighted the importance of strategic pricing, promotional optimization, and innovation to justify price increases and retain customer loyalty. Some opted for "shrinkflation," reducing product size while maintaining prices, a tactic that garnered mixed reactions.

2. The Rise of Private Label and Value Brands: The growing popularity of store brands was a recurring topic. Retailers like Costco and Aldi have successfully cultivated strong private label offerings, attracting budget-conscious consumers without sacrificing quality.

Analysts noted that the perception of private label goods has shifted from being a "cheap" alternative to a smart choice. They now present a significant challenge to established brands.

3. Sustainability and ESG Considerations: Environmental, Social, and Governance (ESG) factors continued to gain prominence. Investors are increasingly scrutinizing companies' sustainability efforts, and consumers are demanding more eco-friendly products and packaging.

Many companies showcased their initiatives to reduce carbon emissions, improve water usage, and promote ethical sourcing practices. However, some expressed concerns about the costs associated with sustainable transitions, particularly in the face of inflationary pressures.

4. Innovation and Product Development: In a mature market like consumer staples, innovation is crucial for driving growth. Companies are investing in new product categories, exploring emerging technologies, and tailoring products to meet the diverse needs of consumers.

Plant-based alternatives, functional foods, and personalized nutrition were among the areas receiving significant attention. Companies emphasized the need to stay ahead of evolving consumer trends and adapt quickly to changing preferences.

5. Supply Chain Resilience: The disruptions caused by the pandemic highlighted the vulnerability of global supply chains. Companies are now focused on building more resilient supply networks, diversifying sourcing options, and investing in technology to improve visibility and efficiency.

Nearshoring and reshoring initiatives were discussed as potential strategies to reduce reliance on overseas suppliers and mitigate risks associated with geopolitical instability.

Perspectives from Industry Leaders

Throughout the conference, executives from leading consumer staples companies shared their perspectives on the current market environment and their strategies for future growth. Unilever's CEO, for example, emphasized the company's commitment to sustainability and its focus on building brands with purpose.

Similarly, Procter & Gamble highlighted its innovation pipeline and its efforts to leverage data and analytics to better understand consumer behavior. Nestlé executives discussed the company's expansion into emerging markets and its investments in plant-based alternatives.

"The consumer staples industry is undergoing a period of significant transformation," said one analyst from Morgan Stanley. "Companies that can adapt quickly to changing consumer preferences, embrace sustainability, and build resilient supply chains will be best positioned for success."

The conference also featured presentations from smaller, emerging companies that are disrupting the industry with innovative products and business models. These companies offered a glimpse into the future of consumer staples, showcasing the potential for growth and innovation in niche markets.

Looking Ahead: Challenges and Opportunities

The Barclays Global Consumer Staples Conference 2024 painted a complex picture of the industry. While the demand for essential goods remains relatively stable, companies face a multitude of challenges, including inflation, changing consumer preferences, and increased competition.

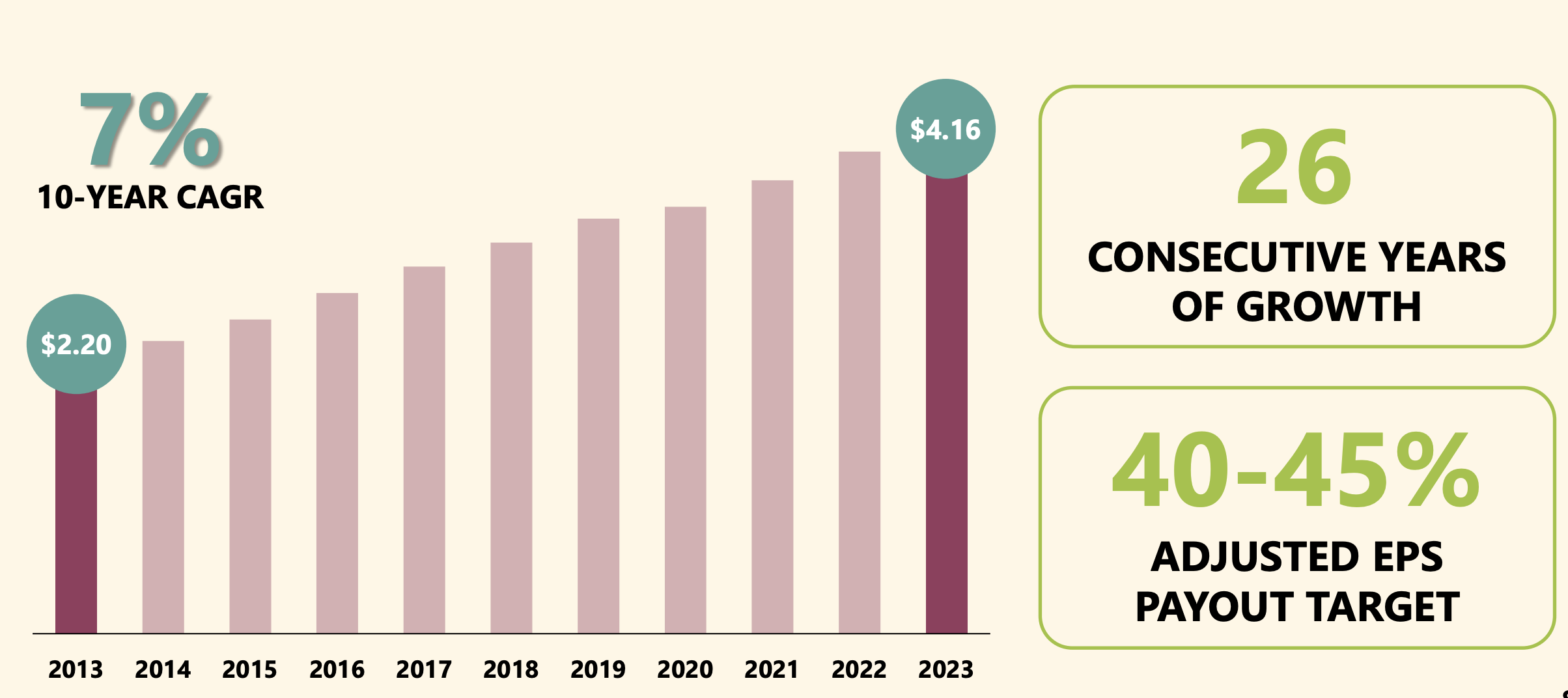

However, these challenges also present opportunities for companies to innovate, improve efficiency, and build stronger relationships with consumers. By embracing sustainability, investing in new technologies, and adapting to evolving market dynamics, consumer staples companies can position themselves for long-term success.

The conference underscored the importance of agility, adaptability, and a deep understanding of consumer needs. Companies that can successfully navigate these challenges will not only survive but thrive in the ever-changing landscape of the consumer staples industry.

As attendees dispersed, the echoes of insightful discussions and strategic forecasts lingered. The Barclays Global Consumer Staples Conference 2024 served as a timely reminder of the resilience and adaptability of an industry that touches the lives of everyone, every day.