Basic Accounting Software For Small Business

For many small business owners, the thought of managing finances conjures images of complex spreadsheets, late nights, and potential accounting errors. However, navigating the financial landscape is crucial for survival and growth. Investing in the right basic accounting software can transform this daunting task into a manageable and even insightful process.

The core purpose of this article is to explore the landscape of basic accounting software designed for small businesses. It will delve into the functionalities, benefits, and considerations that business owners should keep in mind when selecting a platform. The aim is to provide a comprehensive overview that empowers entrepreneurs to make informed decisions about their financial management tools.

The Essentials of Basic Accounting Software

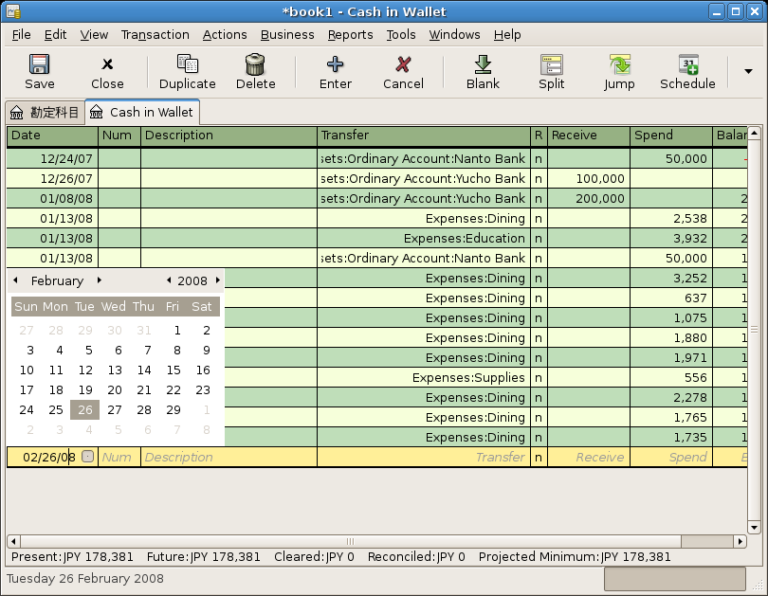

At its core, basic accounting software automates and streamlines fundamental financial tasks. According to a 2023 report by the Small Business Administration (SBA), efficient financial management is a key determinant of small business success. The key functionalities typically include invoicing, expense tracking, bank reconciliation, and basic financial reporting.

Invoicing features allows businesses to create and send professional invoices to clients. Expense tracking helps to categorize and monitor business expenditures. Bank reconciliation ensures that bank statements match internal records. Financial reporting capabilities offer insights into a company's financial health.

Benefits for Small Businesses

The advantages of using basic accounting software extend beyond mere convenience. Firstly, it significantly reduces manual errors that are common with traditional bookkeeping methods. Automation minimizes the risk of data entry mistakes and calculation errors.

Secondly, it offers real-time insights into a company's financial position. Business owners can access up-to-date information on cash flow, profitability, and expenses. This timely data allows for more informed decision-making. Lastly, basic accounting software saves time and resources that can be better allocated to other business operations.

Popular Software Options

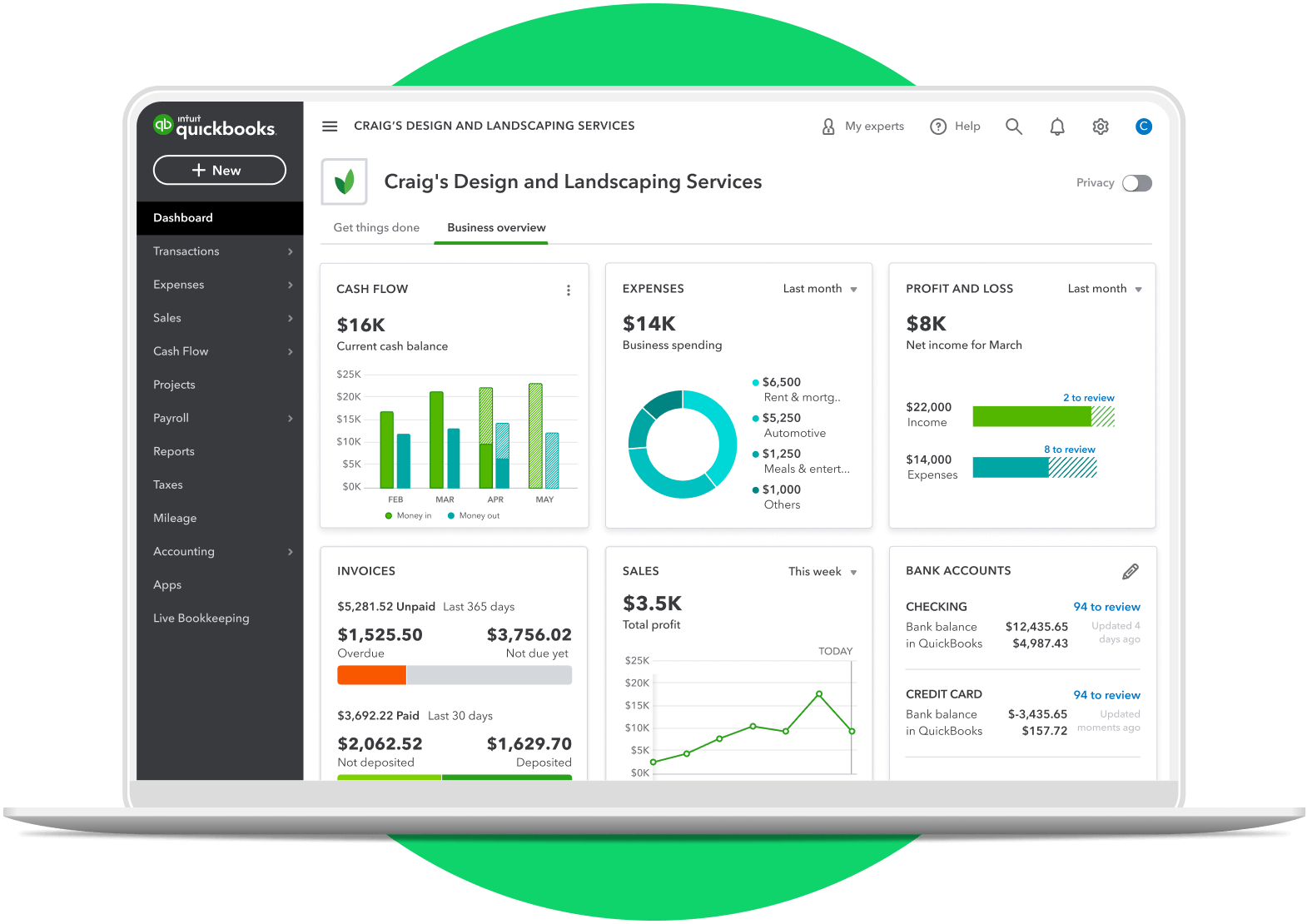

Several software options cater to the needs of small businesses. QuickBooks Online is a popular choice, offering a range of features and scalability. Xero is another leading platform known for its user-friendly interface and integration capabilities.

Zoho Books provides a comprehensive solution with competitive pricing, appealing to budget-conscious businesses. Furthermore, FreshBooks is specifically designed for service-based businesses, focusing on invoicing and time tracking. It's vital to compare features and pricing to find the best fit.

Considerations When Choosing Software

Selecting the right software requires careful consideration of several factors. The first and most important is compatibility, it needs to integrate seamlessly with your existing business systems. The second is ease of use, a user-friendly interface minimizes the learning curve and maximizes efficiency. Finally, the cost of the software, which including subscription fees, training expenses, and potential add-ons, should align with the budget.

According to a 2022 survey by Gartner, businesses often underestimate the time required for implementation and training. Training and support are essential to ensure that employees can effectively use the software. Consider the level of support offered by the vendor and the availability of training resources.

Security and Data Privacy

Data security and privacy are paramount when handling financial information. Cloud-based accounting software should employ robust security measures to protect sensitive data from cyber threats. Be sure to choose a provider with strong security protocols.

Ensure the software complies with relevant data privacy regulations. The General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are examples of such regulations.

The Future of Basic Accounting Software

The future of basic accounting software is likely to involve increased automation and integration with other business tools. Artificial intelligence (AI) and machine learning (ML) technologies are expected to play a larger role in automating tasks such as data entry and reconciliation.

"Expect to see accounting software becoming more intuitive and predictive,"noted David Smith, a financial technology consultant.

Furthermore, seamless integration with e-commerce platforms, customer relationship management (CRM) systems, and other business applications will become increasingly important. This integration will provide a holistic view of business operations.

Conclusion

In conclusion, basic accounting software is an indispensable tool for small businesses seeking to streamline their financial operations. By automating essential tasks, offering real-time insights, and reducing errors, these solutions empower businesses to make informed decisions and achieve sustainable growth. As technology continues to evolve, we can expect even more sophisticated and integrated accounting solutions to emerge, further transforming the financial management landscape for small businesses.