Basic Small Business Accounting Software

Small business owners are facing a critical need for affordable and effective accounting solutions. Many are struggling to manage their finances efficiently, leading to potential errors and missed opportunities.

This article details the essential features and benefits of basic accounting software tailored for small businesses, highlighting options available and how they can streamline financial operations. We will be focusing on basic software, which typically caters to businesses that don't have advanced needs, and the importance of implementing such software.

The Core Problem: Financial Management Challenges

Many startups and small businesses operate on tight budgets. Manual accounting methods are often time-consuming and prone to error, leading to inaccurate financial reporting.

These inefficiencies can hinder growth, impact decision-making, and potentially lead to compliance issues with tax authorities.

What Basic Accounting Software Offers

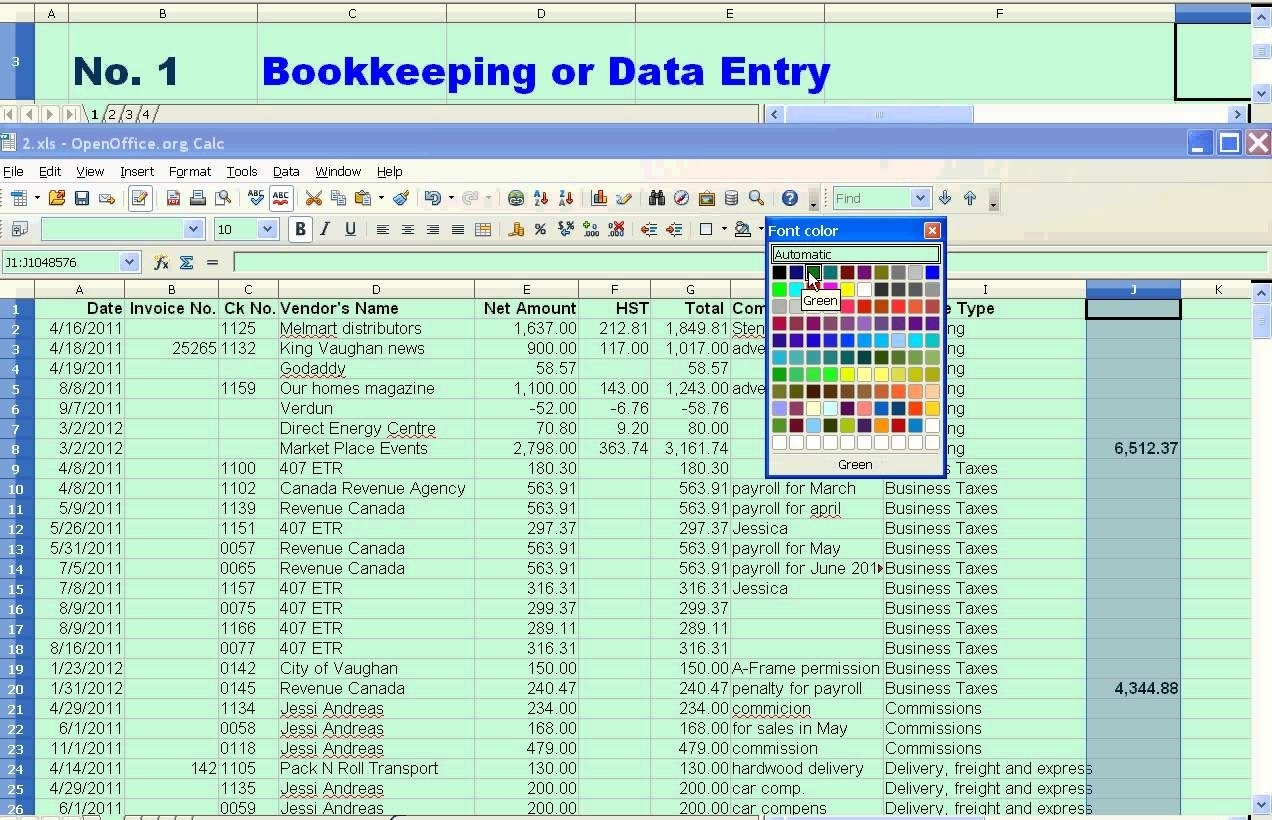

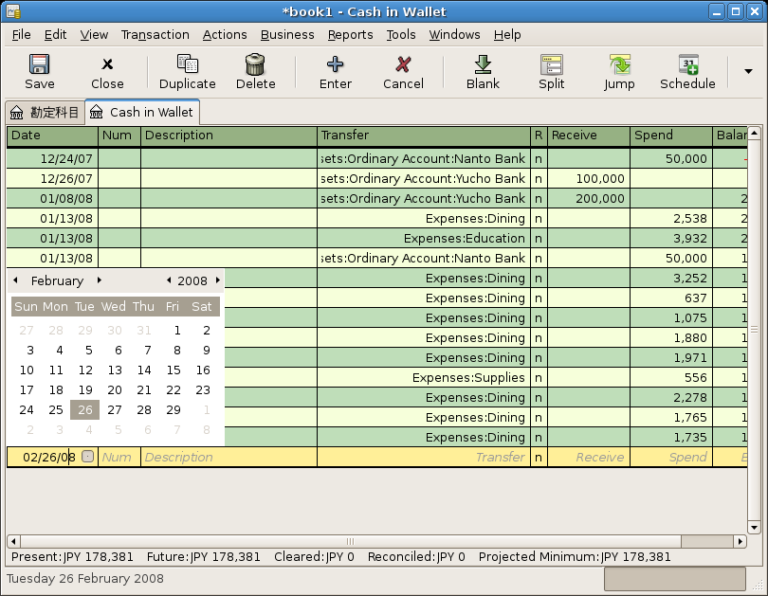

Basic accounting software provides a user-friendly interface for managing key financial tasks. This includes tracking income and expenses, creating invoices, and managing accounts payable and receivable.

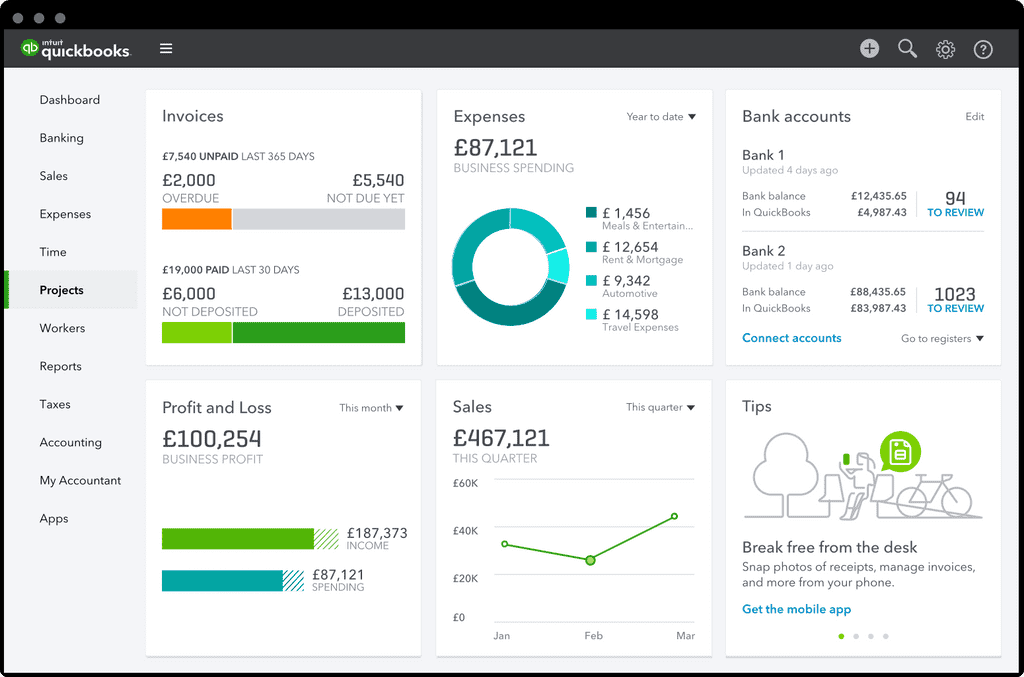

Software, like Zoho Books, QuickBooks Simple Start and Xero, also automate bank reconciliation, generate financial reports, and provide a clear overview of a business's financial health. This means less time on repetitive tasks and more focus on growing your business.

Key Features to Look For

Essential features include invoice generation, expense tracking, bank reconciliation, and basic reporting capabilities. Integration with other business tools, such as payment processors and e-commerce platforms, is also highly beneficial.

Cloud-based solutions offer the advantage of accessibility from anywhere, anytime. They also eliminate the need for costly hardware and IT maintenance.

Benefits for Small Businesses

Implementing basic accounting software significantly reduces the risk of errors. It also improves the accuracy of financial data, which is crucial for making informed business decisions.

Software streamlines financial processes, saving time and resources. These can be redirected towards core business activities.

According to a recent study by Gartner, businesses that implement accounting software see an average of a 25% reduction in accounting errors.

Affordable Options Available

Several software packages are specifically designed for small businesses with budget constraints. Zoho Books offers plans starting from around $15 per month.

QuickBooks Simple Start and Xero offer similar entry-level packages with comparable features and pricing structures.

These affordable options provide a strong return on investment by improving efficiency and accuracy in financial management.

Where to Find These Solutions

Accounting software is available directly from the software providers' websites. Many online retailers such as Amazon and Staples are also partners with software providers.

Most providers offer free trials, allowing businesses to test the software before committing to a purchase.

When to Implement

The best time to implement accounting software is now. Don't wait until financial management becomes overwhelming.

The sooner you automate your accounting processes, the sooner you will experience the benefits of improved efficiency and accuracy.

How to Get Started

Start by identifying your specific needs and budget. Research different software options and read user reviews.

Take advantage of free trials to test the software and ensure it meets your requirements. Consider consulting with a bookkeeper or accountant to help with the implementation process.

Next Steps and Ongoing Developments

Small business owners need to prioritize the move from manual to automated accounting practices. Staying informed about updates to the software you choose is vital.

Ongoing developments in AI and machine learning are further enhancing accounting software capabilities, providing even greater efficiency and insights.

Look for new product features coming from Intuit later this year.