Berkshire Hathaway Stock Class A Dividend

:max_bytes(150000):strip_icc()/Berkshire-Hathaways-Class-A-and-Class-B-323a79bb687f4403b18204c78605fa68.jpg)

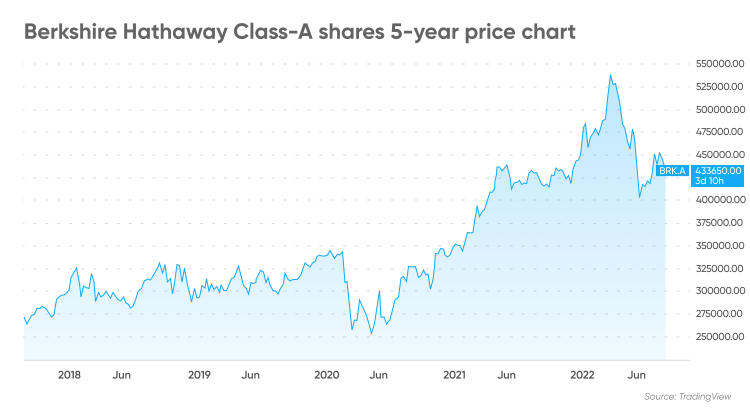

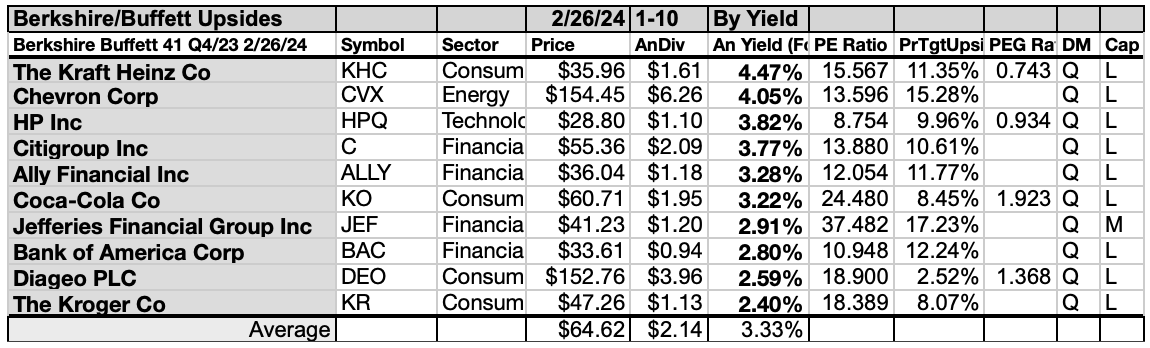

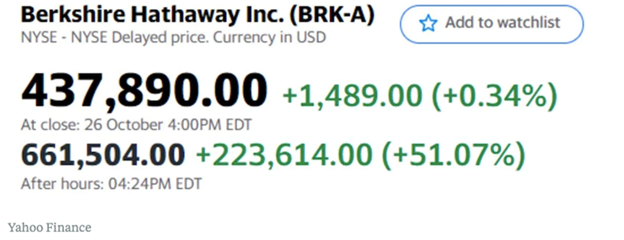

The financial world buzzed with unprecedented speculation this week as rumors swirled regarding a potential dividend payout for Berkshire Hathaway's Class A shares (BRK.A). This is a historic event, given Warren Buffett's long-held aversion to dividends. The mere suggestion has sent ripples through investment circles, forcing analysts to re-evaluate the conglomerate's future strategy.

The intense speculation focuses on the possibility, however slim, that Berkshire Hathaway could, for the first time ever, initiate a dividend payment on its Class A shares. This analysis probes into the confluence of factors fueling these rumors, the potential motivations behind such a dramatic shift, and the likely repercussions for shareholders and the broader market. Considering the company's massive cash reserves and evolving investment landscape, a dividend, however unlikely, isn't entirely outside the realm of possibility.

Factors Fueling the Speculation

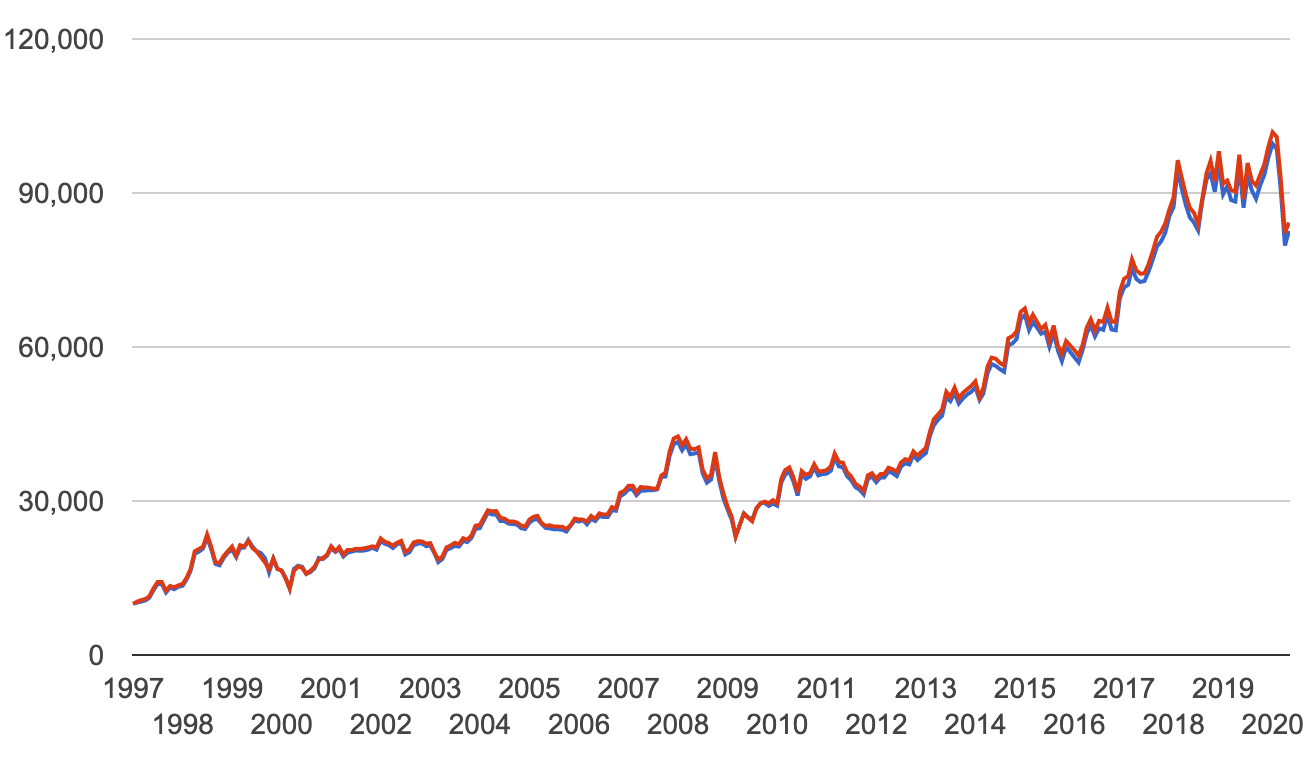

Several factors contribute to the heightened speculation surrounding a Berkshire Hathaway dividend. First, the company is sitting on a massive cash pile, exceeding $167 billion in the last quarter, according to its most recent financial statements. Finding adequate investment opportunities to deploy this capital effectively is an ongoing challenge.

Second, the investment landscape has changed significantly. Historically, Berkshire Hathaway thrived on identifying undervalued companies and deploying capital for outsized returns. However, the market's increased efficiency and rising valuations make it tougher to find such opportunities today.

Third, Warren Buffett's advancing age and the eventual transition of leadership are prominent. While Greg Abel is widely expected to succeed Buffett as CEO, the long-term capital allocation strategy remains uncertain, potentially favoring dividends.

Warren Buffett's Stance on Dividends

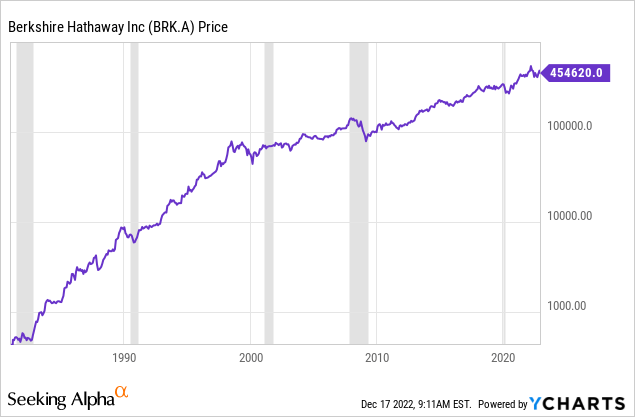

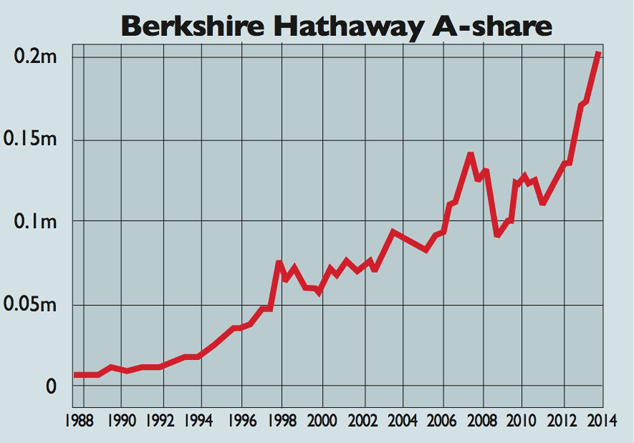

Warren Buffett has always maintained a strong preference for reinvesting Berkshire Hathaway's earnings. He believed that he and his team could generate higher returns by reinvesting profits than shareholders could achieve on their own. This strategy has been instrumental in Berkshire Hathaway's phenomenal growth over the decades.

Buffett's argument centers around the tax inefficiency of dividends. Dividends are taxed at the shareholder level, while reinvested earnings benefit from compounding growth within the company, deferring and potentially minimizing tax liabilities.

Despite Buffett's general aversion, the company already pays dividends on some of the companies it owns. These include Coca-Cola and Apple. This demonstrates a willingness to accept dividends from its subsidiaries when appropriate.

Potential Motivations for a Dividend

Despite the historical resistance, a strategic shift toward a dividend isn't entirely unthinkable. One key motivation would be to address the challenge of effectively deploying the massive cash reserves. A regular dividend could be a way to return capital to shareholders when investment opportunities are scarce.

Another motivation could stem from investor relations. Younger investors, who are now more involved in the stock market, often value the regular income stream that dividends provide. A dividend might attract a new generation of investors to Berkshire Hathaway.

Lastly, a dividend could be seen as a way to provide long-term shareholders with a more tangible return, particularly as Warren Buffett's succession plan progresses. It could give the incoming CEO the flexibility to focus on operational improvements and long-term growth, while assuring consistent returns for shareholders.

Potential Repercussions and Market Impact

The introduction of a Berkshire Hathaway dividend would have far-reaching consequences. The immediate impact would likely be a surge in the company's stock price. Investors seeking a stable income stream would flock to the stock, especially given the company's reputation and financial strength.

The move could also influence other companies with large cash reserves to consider initiating or increasing dividends. It might set a precedent for more mature, cash-rich businesses to prioritize returning capital to shareholders.

On a broader scale, the financial market could see increased demand for dividend-paying stocks. Investors might shift their focus toward companies that generate consistent income, potentially leading to a re-evaluation of growth stocks versus value stocks.

Expert Opinions and Analysis

Analysts are divided on the likelihood of a Berkshire Hathaway dividend. Some believe that Warren Buffett's long-standing philosophy makes it highly improbable, citing his unwavering commitment to reinvestment and value creation. They emphasize that finding exceptional investment opportunities is still the primary goal.

Others argue that the changing economic and investment landscape warrants a re-evaluation of the dividend policy. They point to the company's massive cash reserves and the difficulty of finding suitable investments. They see a dividend as a potentially efficient way to return capital to shareholders.

"While a dividend remains unlikely under Buffett's leadership, the sheer size of Berkshire's cash pile makes it a topic worth considering," said Cathy Seifert, an analyst at CFRA Research. "The eventual leadership transition could bring about a shift in capital allocation strategy."

Looking Ahead

Whether or not Berkshire Hathaway initiates a dividend remains to be seen. The company's upcoming annual shareholder meeting will likely shed more light on the issue, with analysts and investors keenly watching for any hints from Warren Buffett regarding the future capital allocation strategy.

The decision will ultimately depend on the company's ability to find attractive investment opportunities and its evolving view of shareholder value. If Berkshire Hathaway concludes that a dividend is the best way to deploy its capital and reward its shareholders, it could mark a new chapter in the company's history.

Regardless of the outcome, the speculation surrounding a dividend highlights the enduring significance of Berkshire Hathaway in the financial world. Warren Buffett's decisions continue to shape the investment landscape, making any potential shift in strategy a subject of intense scrutiny and debate.

:max_bytes(150000):strip_icc()/berkshire_hathaway_stock-5bfc2ef2c9e77c00519b4274.jpg)

:max_bytes(150000):strip_icc()/shutterstock_173796827-5bfc3bac46e0fb0051801c6b.jpg)