Best Credit Card For 540 Credit Score

Imagine yourself standing at the checkout, a basket brimming with groceries, only to feel a familiar wave of anxiety wash over you. The plastic card in your hand, a symbol of convenience for some, feels like a burden. You worry whether it will be accepted, burdened by the knowledge that your credit score isn’t where you’d like it to be.

If you're among the many Americans navigating the world with a credit score around 540, finding the right credit card can feel like an uphill battle. This article cuts through the noise to spotlight cards that can help you rebuild your credit and regain financial confidence.

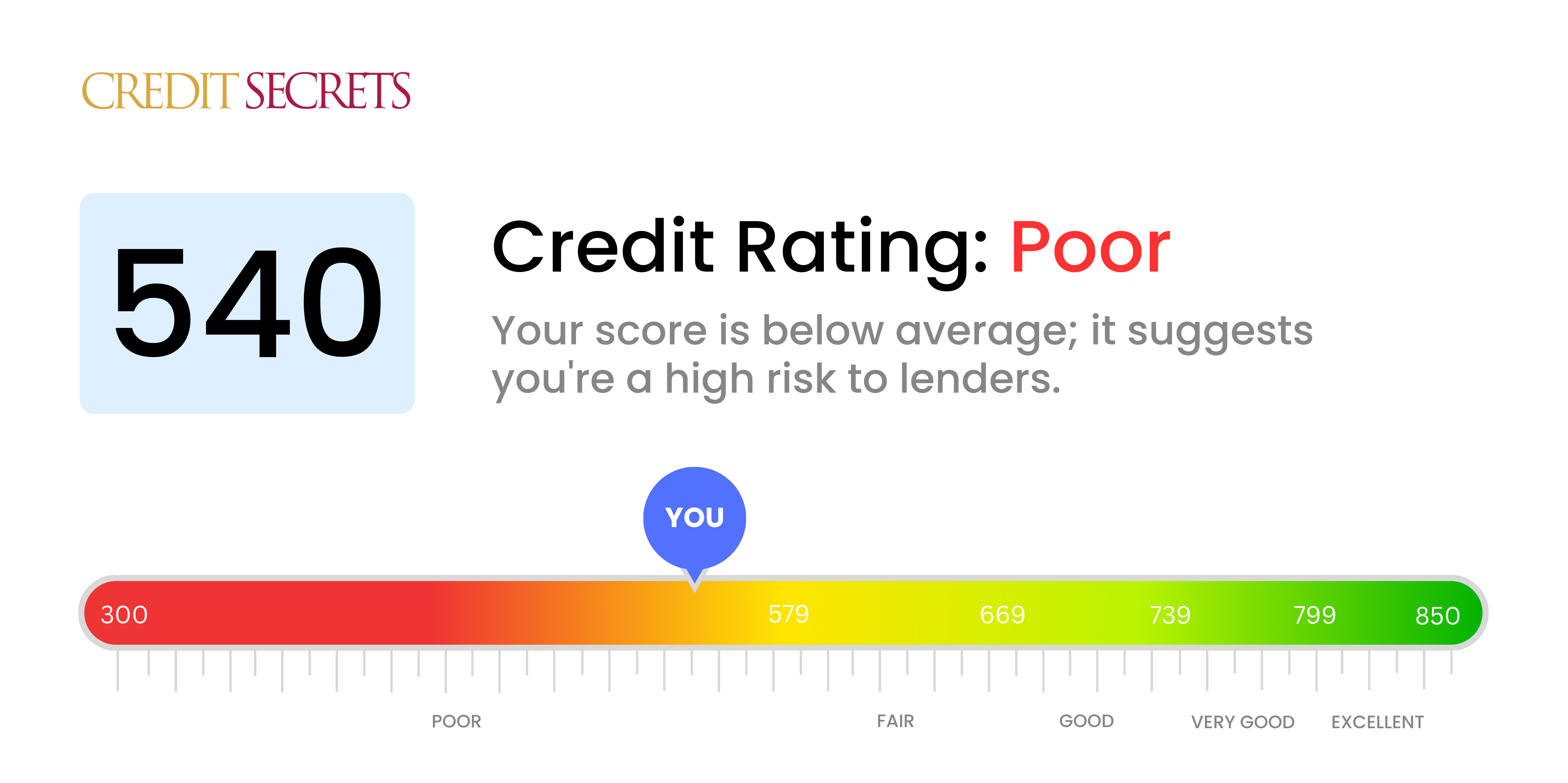

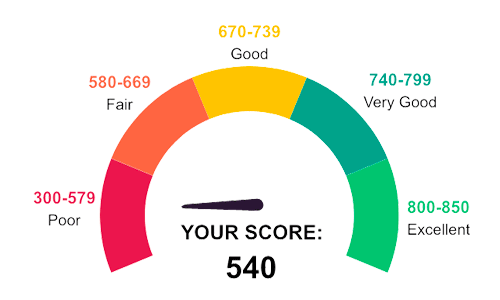

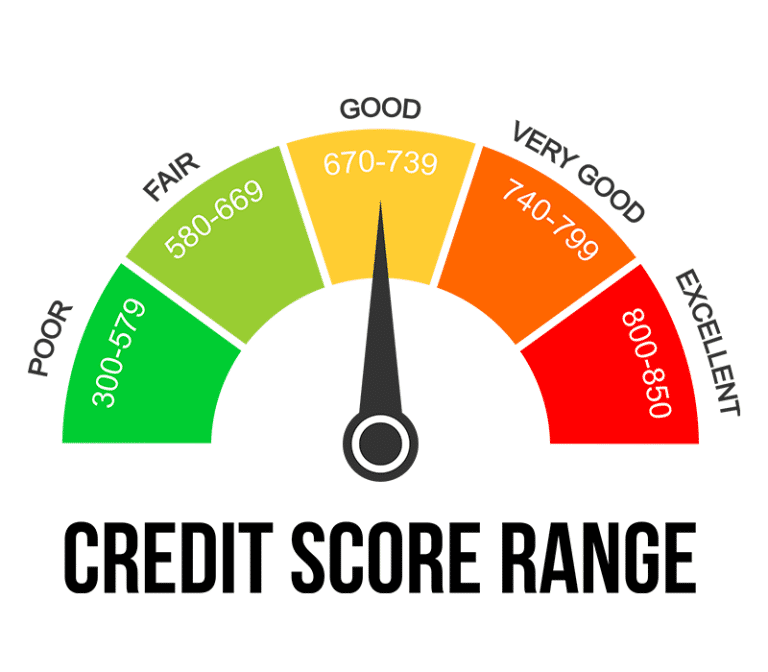

Understanding the Credit Score Landscape

A 540 credit score falls within the "poor" or "very poor" range, according to most credit scoring models like FICO and VantageScore. This means you've likely experienced credit challenges in the past, such as missed payments, high credit utilization, or even bankruptcy. These scores can impact your ability to secure loans, rent an apartment, or even get favorable insurance rates.

However, it's crucial to remember that a low credit score isn't a life sentence. It’s a temporary hurdle, and with the right strategies and tools, it can be improved.

Secured Credit Cards: A Stepping Stone

Secured credit cards are often the most accessible option for individuals with credit scores around 540. These cards require a security deposit, which typically acts as your credit limit. This deposit protects the issuer, making them more willing to extend credit to someone with a less-than-ideal credit history.

Consider the Discover it® Secured Credit Card. Not only does it offer rewards on purchases, which is rare for secured cards, but it also automatically reviews your account for graduation to an unsecured card. According to Discover's official website, responsible use can lead to the return of your deposit and access to a traditional credit line.

Another popular choice is the Capital One Platinum Secured Credit Card. It's a solid option for those looking to rebuild credit without unnecessary fees. Remember to always check the fine print for the latest offers and terms.

Unsecured Credit Cards for Bad Credit: A Ray of Hope

While more difficult to obtain, some unsecured credit cards cater specifically to individuals with poor credit. These cards typically come with higher interest rates and fees, so it's vital to weigh the costs carefully against the potential benefits.

The Credit One Bank® Platinum Visa® for Rebuilding Credit is frequently mentioned in discussions about cards for lower credit scores. It's readily available to those with limited or poor credit history. However, be aware of the associated annual fee and interest rates, and always prioritize paying your balance on time to avoid further damaging your credit.

"Choosing the right credit card when you have a lower credit score isn't just about getting approved; it's about setting yourself up for long-term financial success," - Financial Wellness Expert.

Responsible Use: The Key to Credit Improvement

Regardless of which card you choose, responsible use is paramount. Pay your bills on time, every time. Late payments can significantly damage your credit score and erase any progress you've made.

Keep your credit utilization low. Aim to use less than 30% of your available credit limit. For example, if your credit limit is $300, try to keep your balance below $90.

Monitor your credit report regularly. You can obtain free credit reports from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually through AnnualCreditReport.com.

By actively monitoring, you can identify and dispute any errors that may be negatively impacting your score.

The Bigger Picture: Beyond the Card

While a credit card can be a valuable tool for rebuilding credit, it's important to address the underlying factors that led to your low score in the first place. Consider creating a budget, paying down existing debts, and seeking advice from a financial advisor.

Improving your credit score is a marathon, not a sprint. It takes time, patience, and consistent effort.

Remember, you're not defined by your credit score. It's simply a number that reflects your past financial behavior. With the right choices and a commitment to responsible credit management, you can write a new chapter in your financial story.

![Best Credit Card For 540 Credit Score 11 Best Credit Cards for Good & Excellent Credit Scores [2022]](https://upgradedpoints.com/wp-content/uploads/2018/03/Credit-Score-e1520045235903-732x444.jpg)

![Best Credit Card For 540 Credit Score 11 Best Credit Cards for Good & Excellent Credit Scores [2025]](https://upgradedpoints.com/wp-content/uploads/2019/01/Venture-X-Amex-Gold-Sapphire-Reserve-and-Amex-Platinum-Yellow-Wallet-Upgraded-Points-LLC.jpg)

![Best Credit Card For 540 Credit Score Best Premium and Luxury Credit Cards [June 2025]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Credit-Cards-and-Chase-Credit-Cards-Upgraded-Points-LLC-Large.jpg)