Best Credit Card For Someone Trying To Build Credit

Imagine this: you're standing in line at a cozy coffee shop, the aroma of roasted beans filling the air. You reach for your wallet, ready to pay with your new credit card, a symbol of your newfound financial independence. The cashier smiles, swipes the card, and… approved! That little beep signifies more than just a caffeine fix; it's a step forward in building a solid credit history.

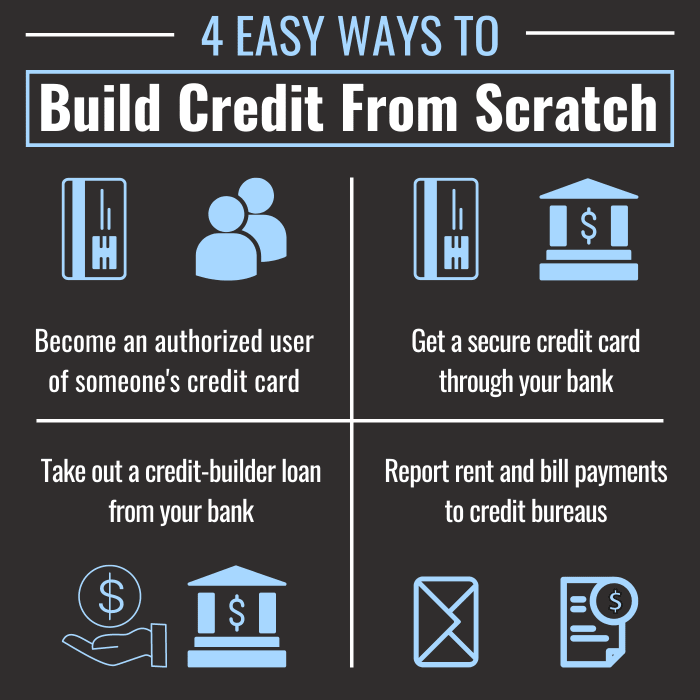

For many young adults, students, or those rebuilding their credit, the quest for the right credit card can feel daunting. But fear not! This article explores the top contender for the best credit card to kickstart your credit journey: the secured credit card. It's not about lavish rewards or high spending limits, but about responsible credit building and setting yourself up for future financial success.

The Secured Credit Card: A Foundation for Financial Growth

A secured credit card is a type of credit card that requires a cash deposit as collateral. This deposit typically becomes your credit limit, offering a safety net for both you and the lender. It's a fantastic option for those with limited or no credit history because it minimizes the risk for the credit card issuer.

Why Choose a Secured Card?

Unlike some other credit-building options, such as store cards or unsecured cards with high fees, secured cards offer a more transparent and potentially rewarding experience. Responsible use—making on-time payments and keeping your balance low—is reported to the major credit bureaus: Equifax, Experian, and TransUnion. This consistent reporting is crucial for building a positive credit history.

According to a 2023 report by Experian, individuals who consistently make on-time payments with their secured credit cards see an average credit score increase of 30-50 points within six months. This improvement can be the key to unlocking better interest rates on future loans, like car loans or mortgages.

Key Features to Look For

When choosing a secured credit card, consider factors like annual fees, interest rates (APR), and whether the card reports to all three major credit bureaus. Some secured cards even offer rewards programs, though these are less common.

Capital One, for example, offers the Capital One Secured Mastercard, which is widely recognized for its accessibility and potential for credit limit increases without requiring an additional deposit. This is a significant advantage, as it allows you to gradually increase your credit line as you demonstrate responsible credit behavior.

The Discover it Secured Credit Card is another excellent option, often praised for its cashback rewards program and no annual fee. These perks can make building credit a bit more rewarding, offering tangible benefits as you work towards your financial goals.

Beyond the Card: Building Good Credit Habits

Remember, a credit card is just a tool. The real magic lies in how you use it. Pay your bills on time, every time. Even setting up automatic payments can be a lifesaver.

Keep your credit utilization low. Experts recommend keeping your balance below 30% of your credit limit. For example, if your credit limit is $500, try to keep your balance below $150.

Regularly check your credit report. You can access free credit reports from each of the three major credit bureaus annually through AnnualCreditReport.com. This allows you to monitor your progress and identify any errors that may be affecting your score.

A Brighter Financial Future

Building credit takes time and dedication, but the rewards are well worth the effort. A good credit score opens doors to opportunities, providing access to lower interest rates, better loan terms, and even more affordable insurance premiums. It empowers you to take control of your financial future and achieve your dreams.

So, as you sip that coffee, remember that every responsible transaction with your secured credit card is a step towards a brighter financial future. It's an investment in yourself, your stability, and your long-term goals. Embrace the journey, learn from your experiences, and celebrate every milestone along the way.