Best Way To Invest In Copper

Copper, often dubbed "Dr. Copper" for its purported ability to predict economic health, is a crucial industrial metal with diverse applications. Demand is surging, fueled by the green energy transition and infrastructure development, prompting investors to seek the best ways to capitalize on its upward trajectory. But navigating the copper investment landscape requires careful consideration of various options, each with its own risks and rewards.

The surge in demand is primarily driven by the transition to renewable energy sources and the expansion of electric vehicle (EV) infrastructure. This increase has prompted individuals and institutions alike to seek opportunities to participate in the copper market. Understanding the intricacies of the available investment vehicles is paramount for making informed decisions.

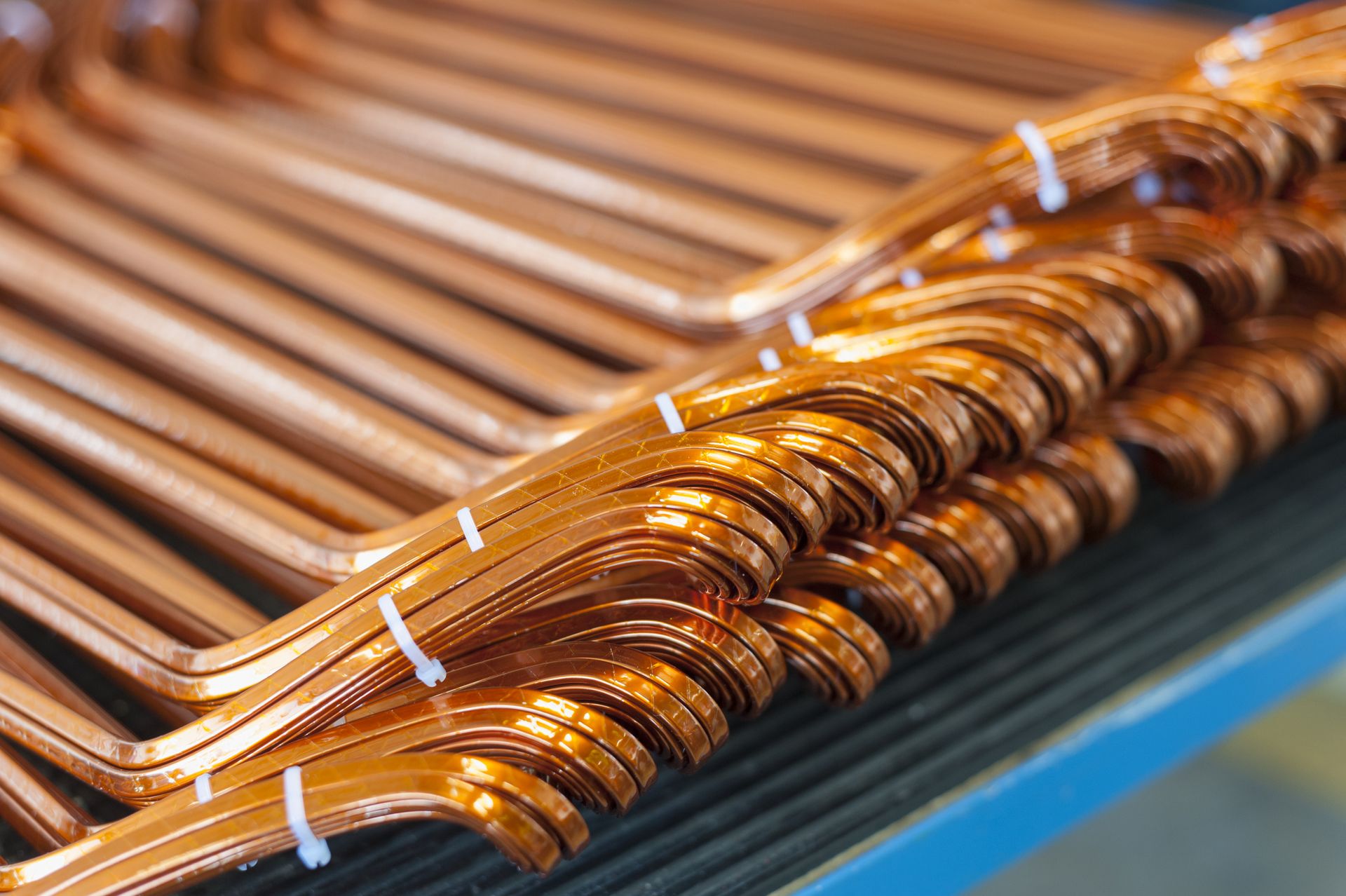

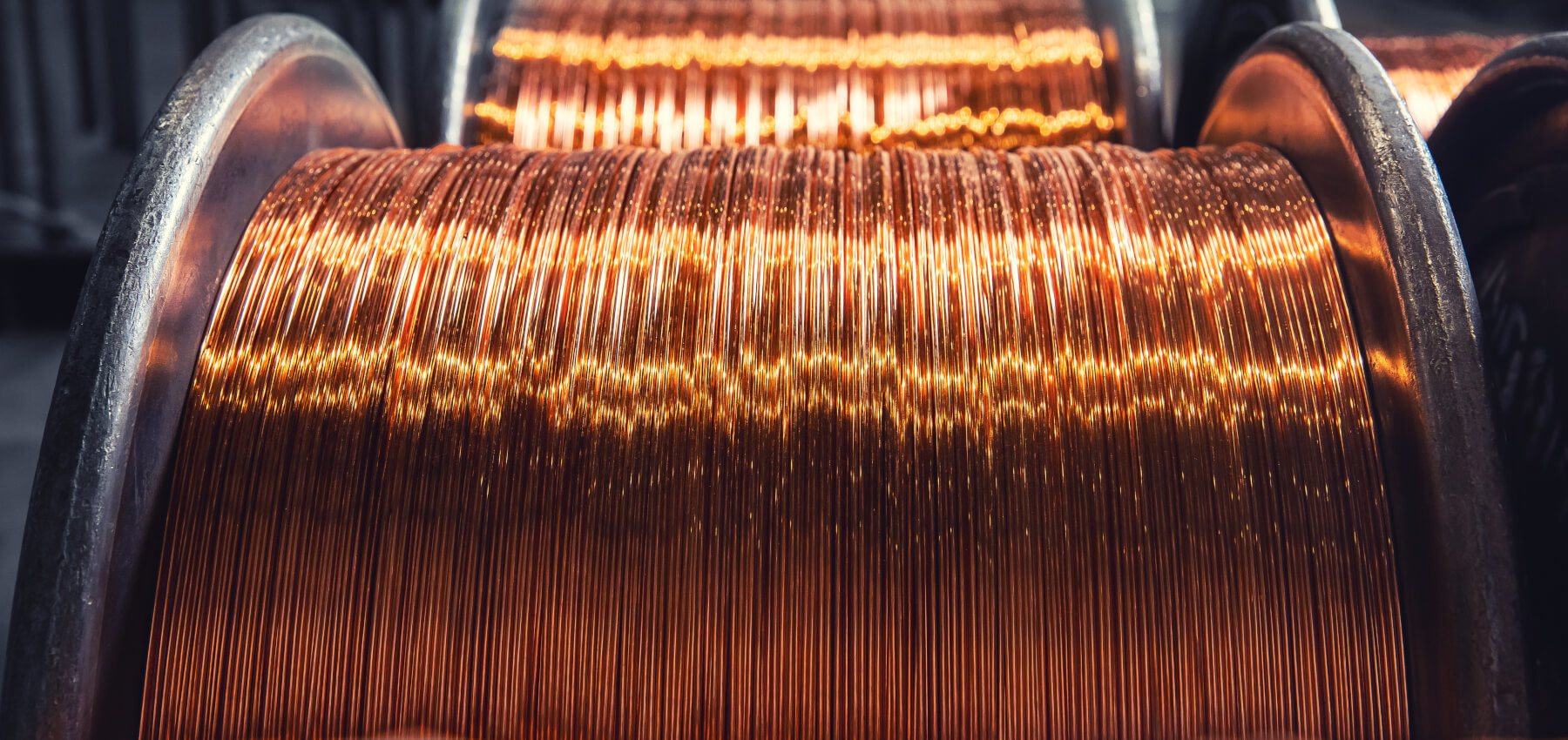

Direct Investment in Copper

One of the most direct ways to invest in copper is by purchasing physical copper. This can take the form of copper bars, wires, or coins.

While appealing to some, storing and insuring physical copper can be cumbersome and expensive. Moreover, the spread between the buying and selling price of physical copper can erode potential profits.

Copper Mining Stocks

Investing in the stocks of copper mining companies represents a more accessible and liquid option. Companies like Freeport-McMoRan (FCX), BHP Group (BHP), and Rio Tinto (RIO) are major players in the copper mining industry. Analyzing the financial health, production capacity, and geopolitical risks associated with each company is essential before investing.

This approach allows investors to gain exposure to copper prices while also participating in the potential upside of the mining company's operations. However, the performance of mining stocks can be affected by factors beyond copper prices, such as operational challenges, political instability in mining regions, and management decisions.

Copper ETFs and ETNs

Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs) offer a diversified and relatively liquid way to invest in copper. Copper ETFs, like the Global X Copper Miners ETF (COPX), track an index of copper mining companies.

These funds provide exposure to a basket of copper-related companies, mitigating the risk associated with investing in a single mining stock. On the other hand, Copper ETNs, like the iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC), track the performance of copper futures contracts.

Investors should be aware of the potential risks associated with ETNs, including credit risk, as they are debt instruments backed by the issuer. The choice between ETFs and ETNs depends on an investor's risk tolerance and investment objectives.

Copper Futures Contracts

For sophisticated investors, copper futures contracts offer a leveraged way to speculate on the price of copper. These contracts obligate the holder to buy or sell a specific quantity of copper at a predetermined price and date.

The high leverage associated with futures contracts can magnify both gains and losses. This makes them unsuitable for novice investors. Participants should be knowledgeable about futures trading, risk management, and the factors influencing copper prices.

The COMEX division of the New York Mercantile Exchange (NYMEX) is the primary exchange for copper futures trading. Understanding margin requirements, contract specifications, and potential for margin calls are crucial for successful futures trading.

Factors Influencing Copper Prices

Several factors influence copper prices, including global economic growth, supply disruptions, and government policies. Demand from emerging markets, particularly China, is a significant driver of copper prices.

Supply disruptions, such as strikes at copper mines or geopolitical instability in major producing regions like Chile and Peru, can lead to price spikes. Government policies, such as infrastructure spending plans and environmental regulations, can also affect copper demand and supply.

Risk Management and Due Diligence

Regardless of the chosen investment vehicle, risk management is paramount when investing in copper. Diversifying investments across different asset classes and geographic regions can help mitigate risk.

Conducting thorough due diligence on individual companies or investment products is also essential. This involves analyzing financial statements, reading industry reports, and understanding the risks associated with each investment.

Consulting with a qualified financial advisor can provide personalized guidance and help investors make informed decisions based on their individual circumstances and risk tolerance. Remember that past performance is not indicative of future results, and all investments carry inherent risks.

Conclusion

Investing in copper presents opportunities for investors seeking to capitalize on the growing demand for this essential industrial metal. However, the best approach depends on individual circumstances, risk tolerance, and investment objectives. By understanding the various investment options, factors influencing copper prices, and the importance of risk management, investors can make informed decisions and potentially benefit from the copper market's upward trajectory.

Careful consideration of each option is vital to determine the best way to participate in the market. Ultimately, the decision should align with one's financial goals and comfort level with risk.