Big Buck Loans No Credit Check

In an increasingly complex financial landscape, the allure of quick and easy loans, especially those marketed as "no credit check," has become a siren song for individuals facing immediate financial pressures. Among these lenders, Big Buck Loans has recently garnered attention, prompting both interest and scrutiny regarding its practices and potential implications for borrowers.

This article aims to provide an objective overview of Big Buck Loans, exploring its operations, the terms of its loans, and the potential benefits and risks associated with engaging with this type of lender.

Big Buck Loans: A Closer Look

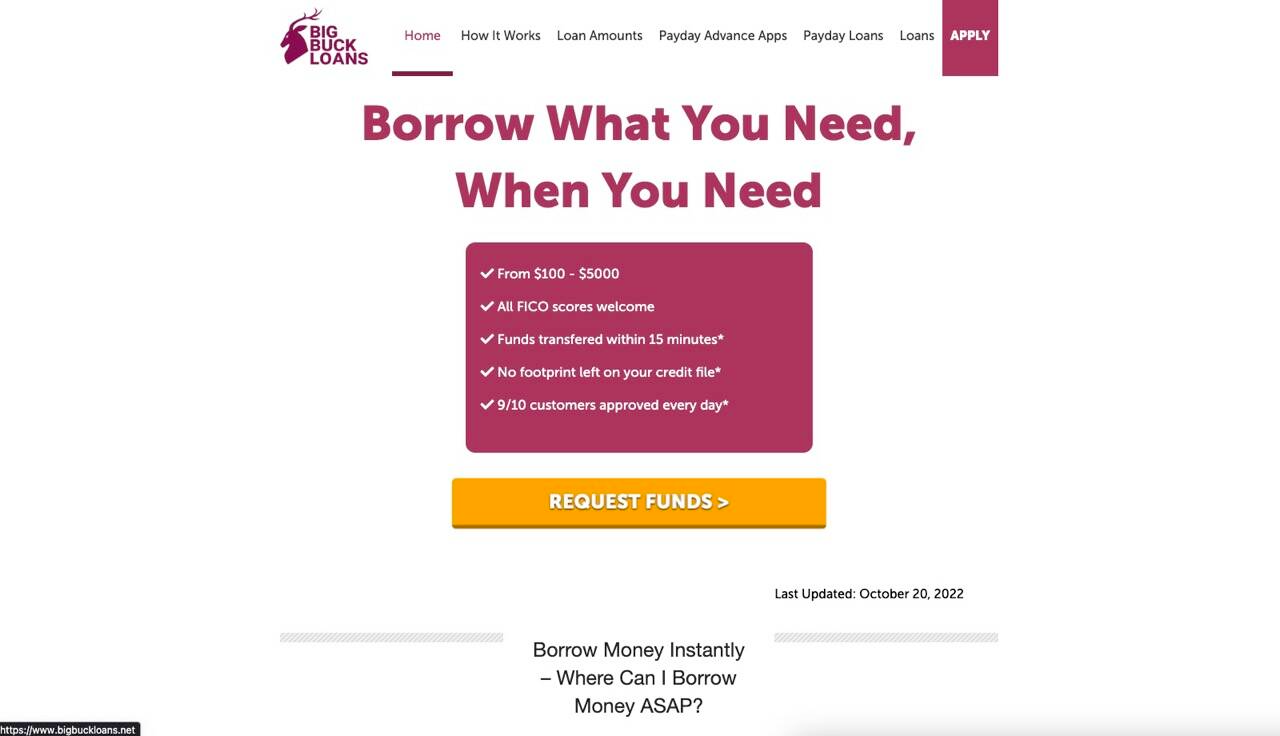

Big Buck Loans, like many other short-term lenders, offers loans specifically targeting individuals with poor or limited credit histories. This means that traditional credit checks, typically conducted by banks and credit unions, are often bypassed.

The appeal lies in the promise of rapid access to funds, often within 24 to 48 hours, without the perceived barriers of a stringent credit evaluation process.

How It Works

The application process for a Big Buck Loans loan generally involves providing basic personal and financial information online. This can include details such as income, employment status, and bank account information.

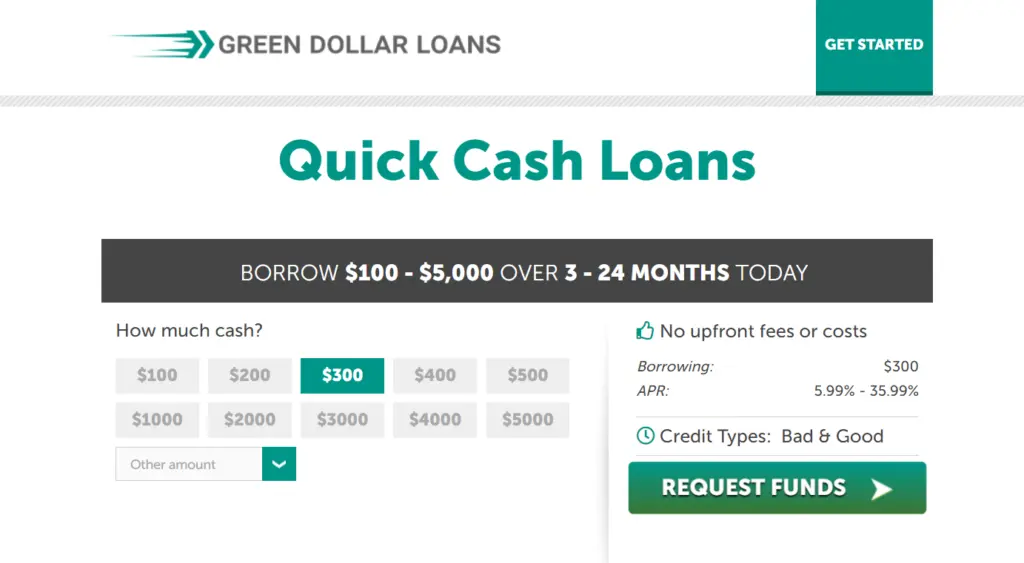

Loan amounts are typically smaller than those offered by traditional lenders, often ranging from a few hundred to a few thousand dollars. Repayment terms are also significantly shorter, frequently requiring repayment within a matter of weeks or months.

The absence of a traditional credit check does not mean there are no requirements. Lenders like Big Buck Loans often rely on alternative methods of assessing risk, such as verifying employment and income, and may also access databases that track short-term lending activity.

The Cost of Convenience

While the accessibility of Big Buck Loans can be attractive, it's crucial to understand the associated costs. The interest rates and fees charged by these lenders are significantly higher than those of traditional financial institutions.

According to data from the Consumer Financial Protection Bureau (CFPB), payday loans, which share similarities with the loans offered by Big Buck Loans, can carry annual percentage rates (APRs) of over 300% or even higher. This translates to a substantial cost for borrowers, especially if they struggle to repay the loan on time.

Late payment fees and other penalties can further exacerbate the financial burden, potentially leading borrowers into a cycle of debt.

Potential Benefits and Risks

For some individuals, Big Buck Loans can provide a crucial lifeline during times of emergency. When faced with unexpected expenses, such as medical bills or car repairs, quick access to funds can prevent further financial hardship.

However, the high cost of borrowing can quickly outweigh the benefits, particularly if borrowers are already struggling with debt. The short repayment terms can also be challenging to meet, leading to a reliance on further borrowing to cover existing debts.

One significant risk is the potential for debt accumulation. If borrowers are unable to repay the loan on time, they may be tempted to roll it over or take out another loan, perpetuating a cycle of debt that can be difficult to escape.

Regulations and Consumer Protection

The short-term lending industry is subject to varying levels of regulation at both the state and federal levels. Some states have implemented stricter rules regarding interest rates and fees, while others have fewer restrictions.

The CFPB has also taken steps to protect consumers from predatory lending practices, although its authority in this area has been subject to legal challenges. Consumers should research the regulations in their state and understand their rights before taking out a loan.

It's also important to be wary of lenders who are not licensed or operating legally. These lenders may engage in abusive practices and offer little recourse for borrowers who encounter problems.

Alternatives to Big Buck Loans

Before considering a Big Buck Loans loan, it's wise to explore alternative options. These may include borrowing from friends or family, seeking assistance from local charities or non-profit organizations, or negotiating payment plans with creditors.

Credit counseling services can also provide valuable assistance in managing debt and developing a budget. If a loan is necessary, exploring options with traditional lenders, such as credit unions or community banks, may offer more favorable terms, even if the application process is more involved.

Building an emergency fund, even a small one, can provide a financial cushion to help manage unexpected expenses without resorting to high-cost loans.

Conclusion

Big Buck Loans and similar lenders offer a seemingly convenient solution for individuals in need of quick cash. However, the high cost of borrowing and the potential for debt accumulation should give borrowers pause.

A thorough understanding of the terms and conditions, along with careful consideration of alternatives, is essential to making an informed decision.

Ultimately, responsible borrowing practices and proactive financial planning are the best defenses against falling into a cycle of debt.