Bnp Paribas Document D'enregistrement Universel 2023

Imagine peering through the grand glass doors of a Parisian building on the Rue de Rivoli, the heart of France's financial district. Sunlight streams onto polished marble floors, reflecting the quiet hum of activity within. This is where BNP Paribas, a global financial institution, meticulously crafts its annual reflection – the Document d'enregistrement universel – a comprehensive overview of its performance, strategy, and outlook.

The Document d'enregistrement universel 2023, or Universal Registration Document, serves as a vital compass for investors, stakeholders, and the broader public. It offers a transparent and detailed account of BNP Paribas’s financial health, its commitment to environmental and social responsibility, and its strategic direction in a rapidly evolving global landscape. Understanding this document is crucial for anyone seeking insights into the bank's future and its role in shaping the global economy.

A Legacy of Banking and Global Reach

BNP Paribas has deep roots, tracing back to the mid-19th century with the founding of Banque de Paris et des Pays-Bas. Over the decades, it has grown through strategic mergers and acquisitions to become one of the world’s leading banking groups.

Today, the bank boasts a presence in nearly 70 countries, offering a wide array of financial services, from retail banking and investment solutions to corporate and institutional banking. This extensive network allows BNP Paribas to play a significant role in facilitating international trade, supporting economic growth, and connecting businesses and individuals across borders.

Deciphering the 2023 Document

The Document d'enregistrement universel 2023 is more than just a collection of numbers. It's a narrative woven with data, outlining the bank’s performance over the past year and its strategic vision for the future.

One key aspect is the detailed financial reporting, including balance sheets, income statements, and cash flow statements. These provide a clear picture of BNP Paribas’s profitability, solvency, and financial stability.

Beyond the financial figures, the document delves into the bank's risk management practices, explaining how it identifies, assesses, and mitigates various risks, including credit risk, market risk, and operational risk. This section is crucial for understanding the bank’s resilience in the face of economic uncertainties.

ESG: A Core Commitment

In recent years, environmental, social, and governance (ESG) factors have become increasingly important to investors and stakeholders. BNP Paribas recognizes this and has integrated ESG considerations into its core business strategy.

The Document d'enregistrement universel 2023 dedicates significant space to outlining the bank's ESG initiatives, including its commitment to reducing its carbon footprint, promoting diversity and inclusion, and upholding ethical business practices. This includes detailed metrics and targets for sustainable finance activities.

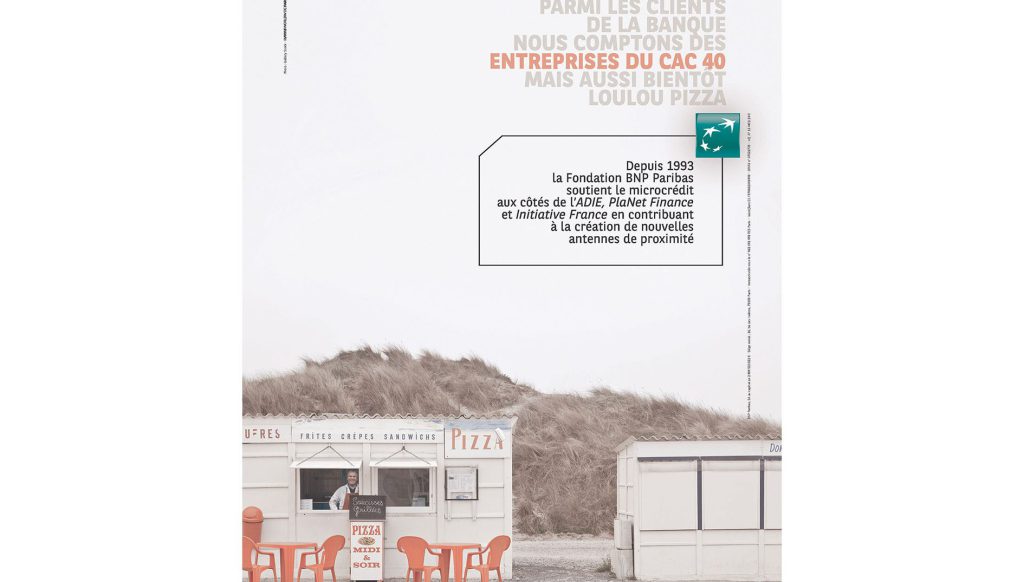

For example, the document will likely detail the bank's progress in financing renewable energy projects, supporting social enterprises, and promoting financial inclusion. It also transparently outlines the challenges and opportunities associated with transitioning to a more sustainable business model.

Strategic Outlook and Future Growth

The document also offers insights into BNP Paribas’s strategic priorities for the coming years. This includes details on its investment in technology and digitalization, its plans for expanding into new markets, and its initiatives to enhance customer experience.

The bank is likely to emphasize its commitment to innovation and its efforts to leverage data and artificial intelligence to improve its products and services. This focus on technology is critical for remaining competitive in the rapidly changing financial landscape.

Furthermore, the document may outline BNP Paribas’s plans for navigating the evolving regulatory environment and adapting to changing customer preferences. It is a roadmap that tries to anticipates future challenges and capitalize on emerging opportunities.

Understanding the Wider Context

The significance of the Document d'enregistrement universel 2023 extends beyond the confines of BNP Paribas itself. It provides valuable insights into the broader trends shaping the global financial industry.

By analyzing the bank's performance and strategy, observers can gain a better understanding of the challenges and opportunities facing the banking sector as a whole. This includes insights into the impact of rising interest rates, geopolitical risks, and technological disruption.

Moreover, the document offers a window into the evolving role of banks in society, particularly in relation to sustainable development and social responsibility. It highlights the growing importance of ESG factors in investment decisions and the increasing pressure on banks to align their business practices with broader societal goals.

Transparency and Accountability

The publication of the Document d'enregistrement universel 2023 underscores BNP Paribas’s commitment to transparency and accountability. It's a vital mechanism for building trust with stakeholders and demonstrating responsible corporate governance.

By providing a comprehensive and detailed account of its performance and strategy, the bank allows investors, regulators, and the public to assess its financial health, its risk management practices, and its commitment to ESG principles. This transparency is essential for maintaining the stability and integrity of the financial system.

This annual report reflects a dedication to fostering a relationship of openness and responsibility with all those who interact with BNP Paribas, directly or indirectly.

A Final Reflection

The Document d'enregistrement universel 2023 is more than just a compliance exercise. It is a testament to BNP Paribas' commitment to transparency, sustainability, and responsible banking. It provides a valuable resource for understanding the bank's role in the global economy and its aspirations for the future. Reading it allows a deeper insight into the complexities of modern finance and the growing importance of ESG considerations.

As the sun sets on another year, casting long shadows on the Rue de Rivoli, the document stands as a comprehensive record, a strategic compass, and a promise of continued dedication to navigating the complexities of the global financial landscape with integrity and purpose.

![Bnp Paribas Document D'enregistrement Universel 2023 How to Buy Crypto with BNP Paribas [2024]](https://assets.finbold.com/uploads/2023/03/BNP-Paribas.jpg)