Bollinger Bands Trend Indicator Tradingview Pdf

The Bollinger Bands technical indicator, a staple among traders for decades, continues to be a subject of intense discussion and adaptation, particularly within the digital realm of platforms like TradingView. Its use, implementation, and interpretations are widely documented, including in PDF format for easy access and offline learning.

This article examines the ongoing relevance of Bollinger Bands, its integration into TradingView, the accessibility of resources like PDFs for learning, and the overall impact on trading strategies.

What are Bollinger Bands?

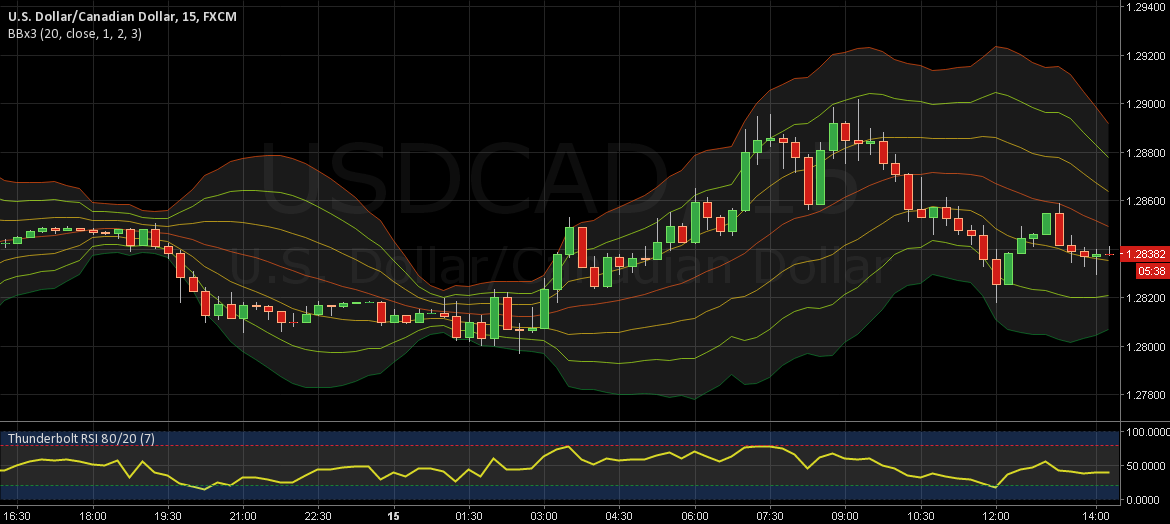

Bollinger Bands, developed by John Bollinger in the early 1980s, are a technical analysis tool used to measure a security's volatility and identify potential overbought or oversold conditions. They consist of a middle band, typically a 20-period simple moving average (SMA), and two outer bands calculated based on the standard deviation of the price.

The upper band is usually two standard deviations above the SMA, while the lower band is two standard deviations below it. The width between the bands widens and narrows as volatility increases and decreases, respectively.

Traders use Bollinger Bands to gauge whether prices are relatively high or low. When price touches or breaks the upper band, it may indicate an overbought condition, suggesting a potential price reversal. Conversely, when price touches or breaks the lower band, it may indicate an oversold condition, hinting at a potential price increase.

Bollinger Bands and TradingView

TradingView, a popular web-based charting platform, offers seamless integration of Bollinger Bands. Users can easily add the indicator to any chart with customizable parameters for the moving average period and standard deviation multiplier.

TradingView allows traders to visually analyze price action in relation to the bands, experiment with different settings, and develop personalized trading strategies. The platform’s scripting language, Pine Script, further enables users to create automated trading alerts and backtest strategies based on Bollinger Bands.

The availability of Bollinger Bands on TradingView has significantly contributed to its accessibility and popularity among both novice and experienced traders. The platform's intuitive interface and powerful analytical tools make it a valuable resource for those seeking to understand and apply the indicator effectively.

The Role of PDF Resources

The abundance of online resources dedicated to Bollinger Bands includes numerous PDF documents offering comprehensive guides, tutorials, and strategies. These PDFs typically delve into the theoretical foundations of the indicator, explain its calculation, and provide practical examples of its application in different market conditions.

Many of these resources are created by experienced traders, financial analysts, or educational institutions, offering various perspectives on how to interpret and utilize Bollinger Bands. The accessibility of these PDFs allows traders to study the indicator at their own pace, offline, and revisit key concepts as needed.

However, it is crucial for traders to critically evaluate the information presented in these PDF resources. Not all sources are created equal, and some may contain outdated information or promote specific trading biases. Verifying the author's credentials and comparing information across multiple sources is essential for forming a well-rounded understanding.

Impact on Trading Strategies

Bollinger Bands are often used in conjunction with other technical indicators, such as relative strength index (RSI) or moving average convergence divergence (MACD), to confirm trading signals and improve accuracy. For instance, a trader might look for a buy signal when price touches the lower band while the RSI is also indicating oversold conditions.

One common strategy involves identifying "squeezes," where the bands narrow significantly, indicating a period of low volatility. This can signal a potential breakout in either direction, and traders often prepare to enter a trade once the price breaks above or below the bands following the squeeze.

While Bollinger Bands can be a valuable tool, it's important to acknowledge their limitations. They are not foolproof predictors of future price movements, and relying solely on them can lead to false signals and losses. Risk management techniques, such as setting stop-loss orders, are crucial when incorporating Bollinger Bands into a trading strategy.

Challenges and Criticisms

Despite their popularity, Bollinger Bands are not without their critics. Some argue that they are too subjective and that the interpretation of signals can vary widely depending on the individual trader. Others point out that the indicator is lagging, meaning it is based on past price data and may not accurately predict future price movements.

Furthermore, Bollinger Bands can be prone to whipsaws, where the price briefly breaks above or below the bands only to reverse direction shortly after. These false breakouts can trigger premature entries and exits, leading to losses.

It is essential for traders to be aware of these limitations and to use Bollinger Bands as part of a comprehensive trading strategy that incorporates other indicators, risk management techniques, and a thorough understanding of market dynamics.

Conclusion

Bollinger Bands remain a widely used and valuable technical indicator, particularly within the digital trading landscape facilitated by platforms like TradingView. The availability of resources like PDF guides further democratizes access to knowledge and empowers traders to learn and experiment with the indicator.

However, traders should approach Bollinger Bands with a critical eye, recognizing their limitations and integrating them thoughtfully into a broader trading strategy. Combining the indicator with other technical analysis tools, robust risk management, and a solid understanding of market dynamics is crucial for maximizing its effectiveness and mitigating potential risks.

Ultimately, the continued relevance of Bollinger Bands highlights the enduring power of well-designed technical indicators in helping traders navigate the complexities of financial markets.

![Bollinger Bands Trend Indicator Tradingview Pdf [E] The Bollinger Bands Indicator - II for NSE:AXISBANK by Amit_Ghosh](https://s3.tradingview.com/i/INDXKQ8l_big.png)