Both Direct Materials And Indirect Materials Are

Understanding the nuances of business operations often requires delving into the specifics of resource management, particularly when it comes to materials. Distinguishing between direct and indirect materials is fundamental for accurate cost accounting, inventory control, and ultimately, informed decision-making within an organization. These seemingly basic classifications have a ripple effect, impacting profitability, supply chain management, and even regulatory compliance.

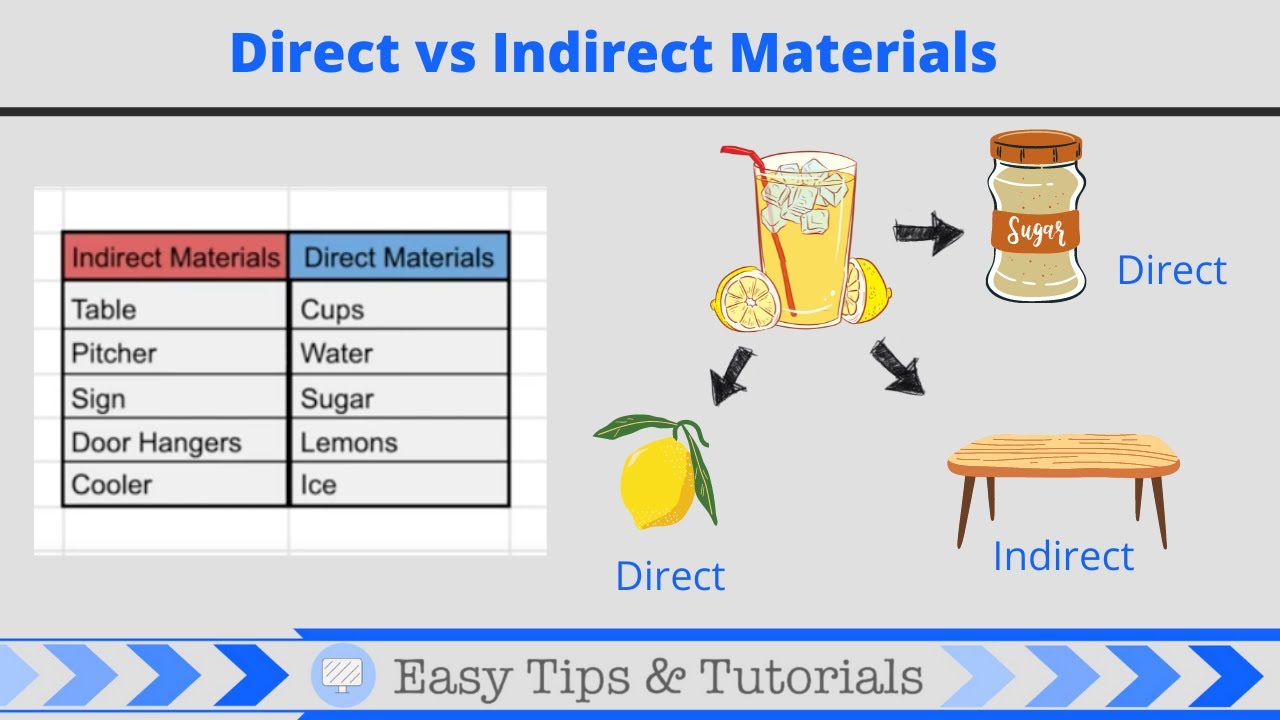

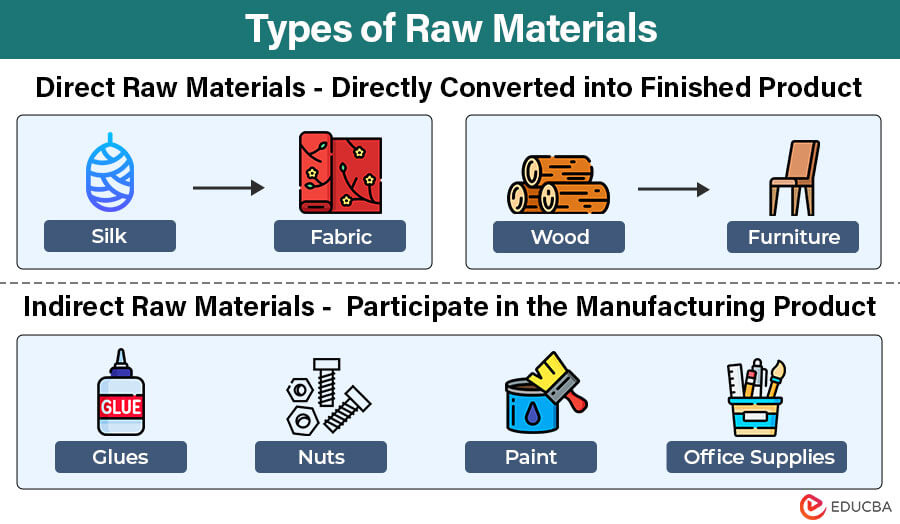

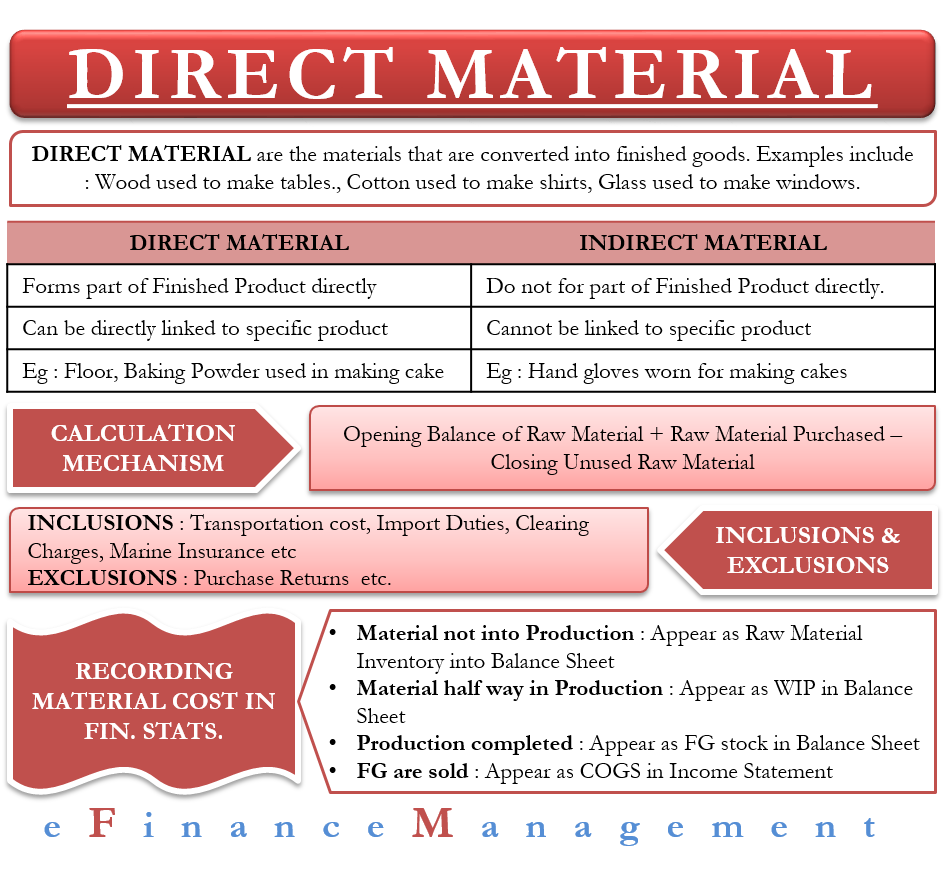

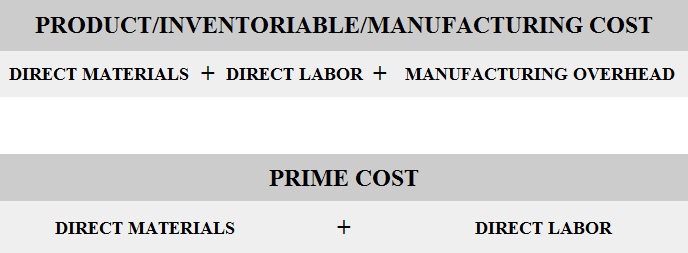

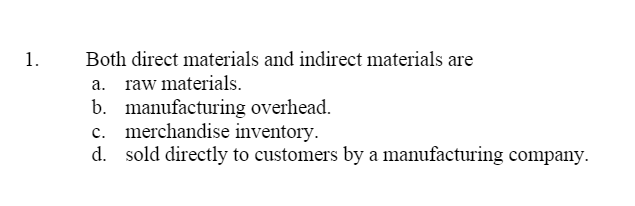

At its core, the difference lies in how these materials contribute to the final product. Direct materials become an integral part of the finished good, while indirect materials support the production process but don't directly end up in the final product. This distinction influences how costs are allocated and tracked, and how businesses strategize for operational efficiency.

Direct Materials: The Building Blocks

Direct materials are those raw materials and components that can be directly traced to the finished product. Think of the wood used to build a chair, the fabric in a garment, or the steel in a car. These are easily identifiable within the final product, and their costs are directly assignable.

The cost of direct materials typically forms a significant portion of the overall product cost. Therefore, effective management of direct materials is crucial for maintaining profitability. This involves sourcing materials at competitive prices, minimizing waste, and accurately tracking inventory levels.

Tracking Direct Material Costs

Companies use various methods to track direct material costs, including standard costing and actual costing. Standard costing involves setting a predetermined cost for each material based on historical data and market analysis. Actual costing tracks the actual cost incurred for each material purchase.

Choosing the right costing method depends on the specific needs of the business and the complexity of its operations. Standard costing provides a benchmark for performance evaluation, while actual costing offers a more accurate reflection of actual costs.

“Effective direct material management is about more than just buying materials; it's about creating a streamlined process that minimizes waste, optimizes inventory, and ensures quality,” says Sarah Chen, a supply chain consultant at Acme Consulting.

Indirect Materials: Supporting the Process

Indirect materials, on the other hand, are essential for the production process but are not directly incorporated into the finished product. Examples include lubricants for machinery, cleaning supplies for the factory floor, and safety equipment for workers.

While these materials don't become part of the final product, they are vital for ensuring smooth operations and maintaining a safe working environment. The cost of indirect materials is usually a small percentage of the total product cost compared to direct materials.

Managing Indirect Material Costs

Indirect materials are typically classified as overhead costs and are allocated to products based on a predetermined overhead rate. This rate is often based on factors such as machine hours or direct labor costs.

Managing indirect material costs involves optimizing consumption, negotiating favorable prices with suppliers, and implementing inventory control measures. Although the individual cost of each indirect material may be small, the cumulative impact can be significant.

Efficient inventory management systems can help businesses track indirect materials, prevent stockouts, and minimize waste. This is usually achieved with software, such as an Enterprise Resource Planning (ERP) system.

The Interplay and Significance

The distinction between direct and indirect materials is crucial for accurate cost accounting and inventory valuation. It impacts various aspects of a business, from pricing strategies to profitability analysis.

For example, a company that incorrectly classifies direct materials as indirect materials may underestimate its product costs and set prices that are too low. This could lead to reduced profitability or even losses.

Furthermore, proper classification is essential for complying with financial reporting standards and tax regulations. Accurate cost accounting provides a clear picture of a company's financial performance and ensures transparency for stakeholders.

Companies should regularly review their material classification practices to ensure accuracy and consistency. This helps identify opportunities for cost reduction and process improvement. Training employees on the proper classification of materials is also essential.

Impact on Businesses and Consumers

The way companies manage both direct and indirect materials has a direct impact on consumers. By controlling costs and optimizing production processes, businesses can offer products at competitive prices.

Efficient material management also contributes to product quality and reliability. By using high-quality materials and implementing robust quality control measures, companies can deliver products that meet consumer expectations.

Ultimately, a thorough understanding of the differences and proper management of direct and indirect materials is not just an accounting exercise; it's a strategic imperative that impacts every facet of a business, from the bottom line to the customer experience.