Business Partner Buyout Agreement Template

The fracturing of a business partnership can be as complex and emotionally charged as a divorce. Without a clear roadmap, disagreements can quickly escalate into costly legal battles, jeopardizing the future of the company itself.

A comprehensive business partner buyout agreement template acts as that roadmap, providing a pre-negotiated framework for dissolving the partnership and transferring ownership. The absence of such an agreement leaves businesses vulnerable to disputes over valuation, payment terms, and control, potentially leading to significant financial losses and operational paralysis.

The Nut Graf: Why a Buyout Agreement Matters

A business partner buyout agreement template is a legally binding document outlining the process and terms under which one partner can buy out the ownership stake of another partner in a business. It pre-emptively addresses critical issues such as valuation methodologies, payment schedules, and dispute resolution mechanisms, providing a structured and predictable exit strategy for partners.

This proactive approach minimizes the risk of protracted negotiations and legal challenges during a partnership dissolution.

Ultimately, a well-crafted buyout agreement can preserve the business's continuity and protect the interests of all stakeholders.

Key Components of a Comprehensive Template

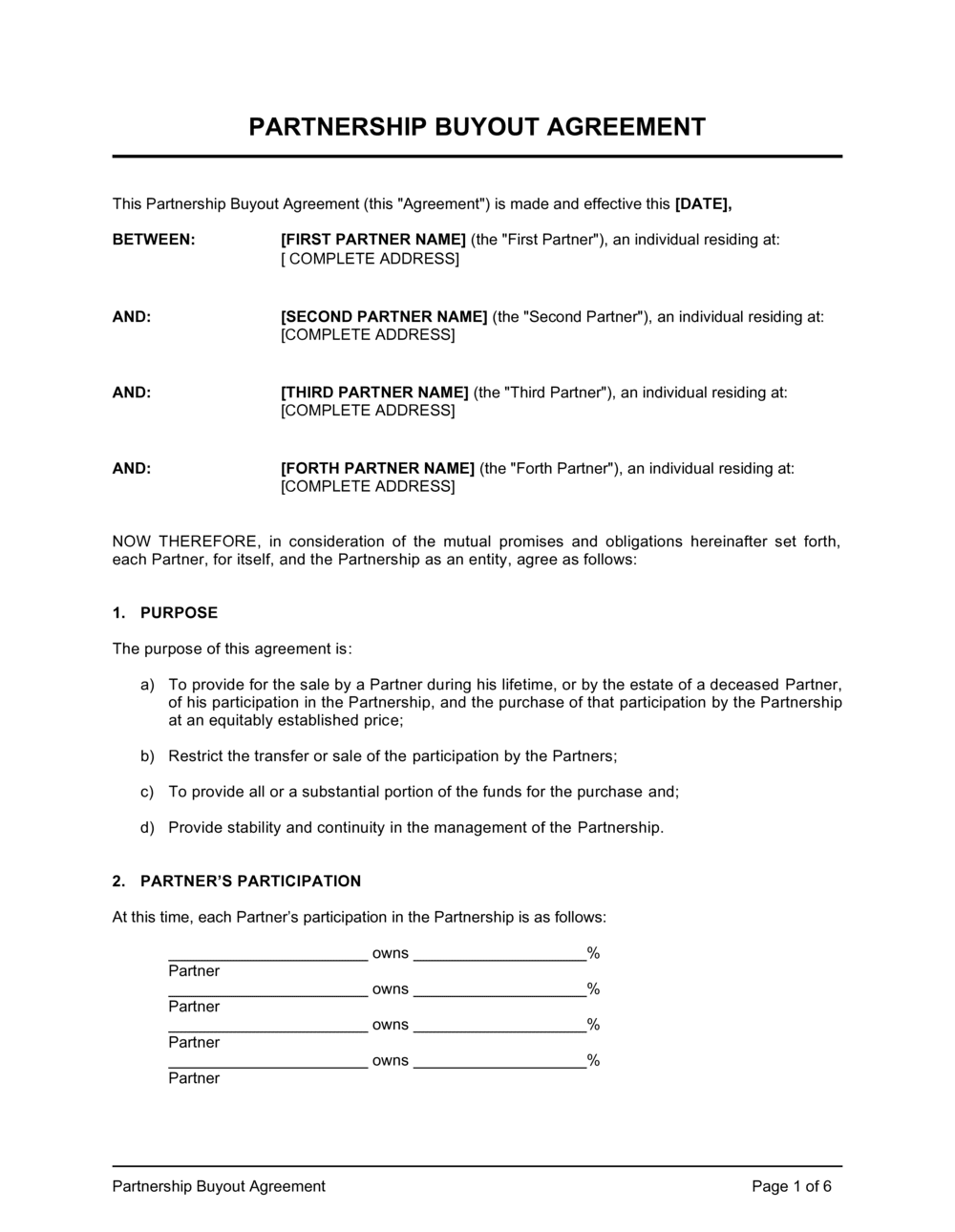

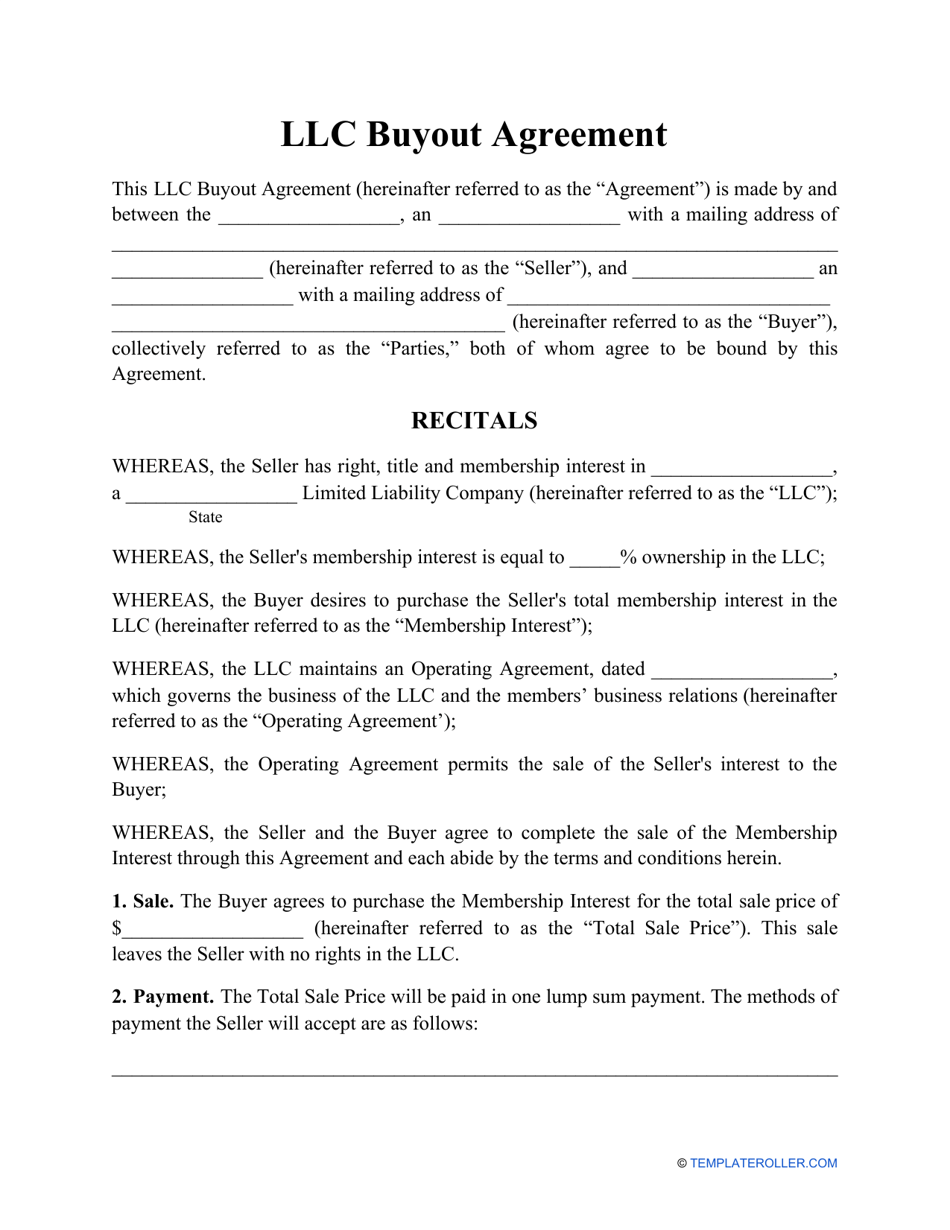

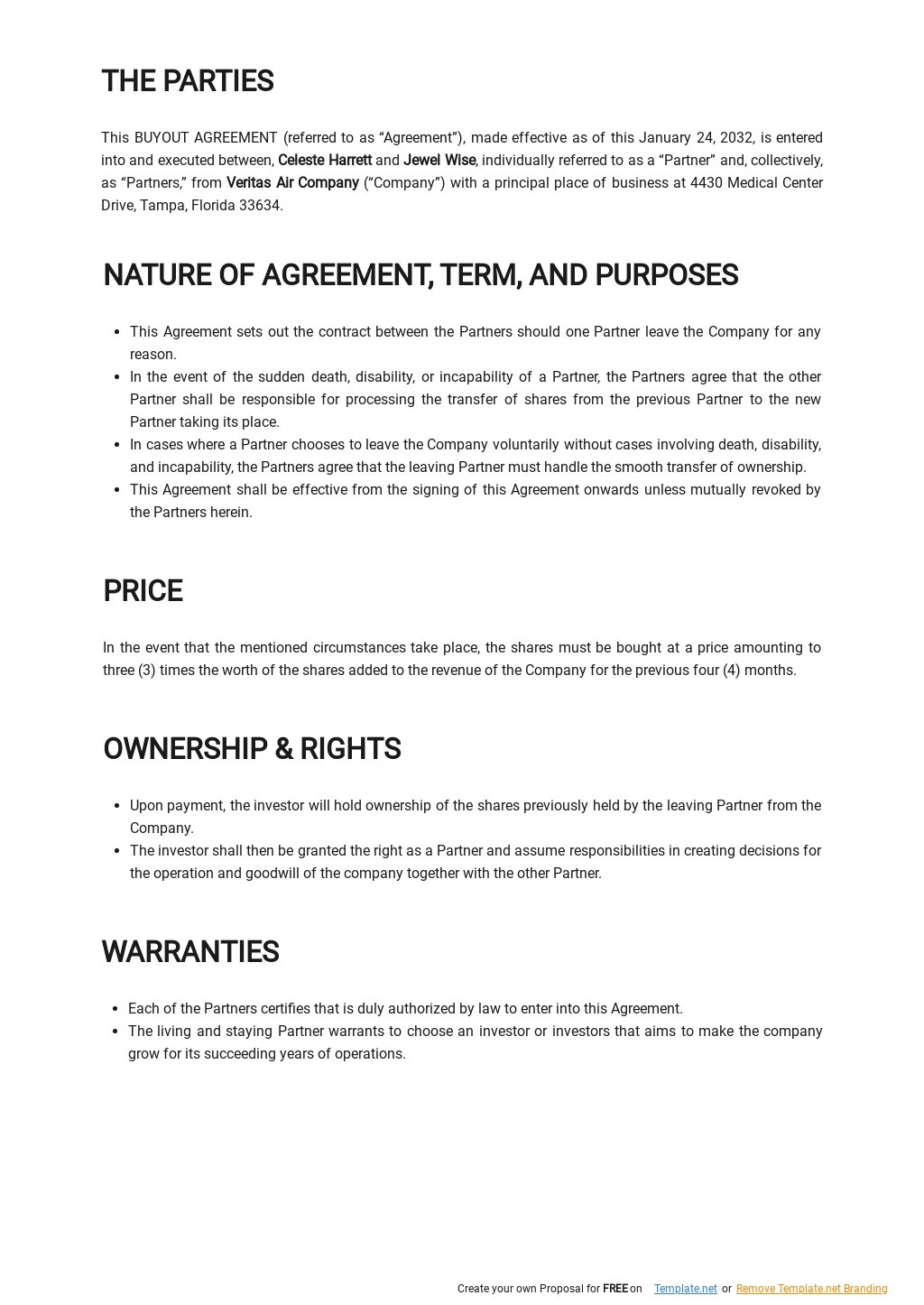

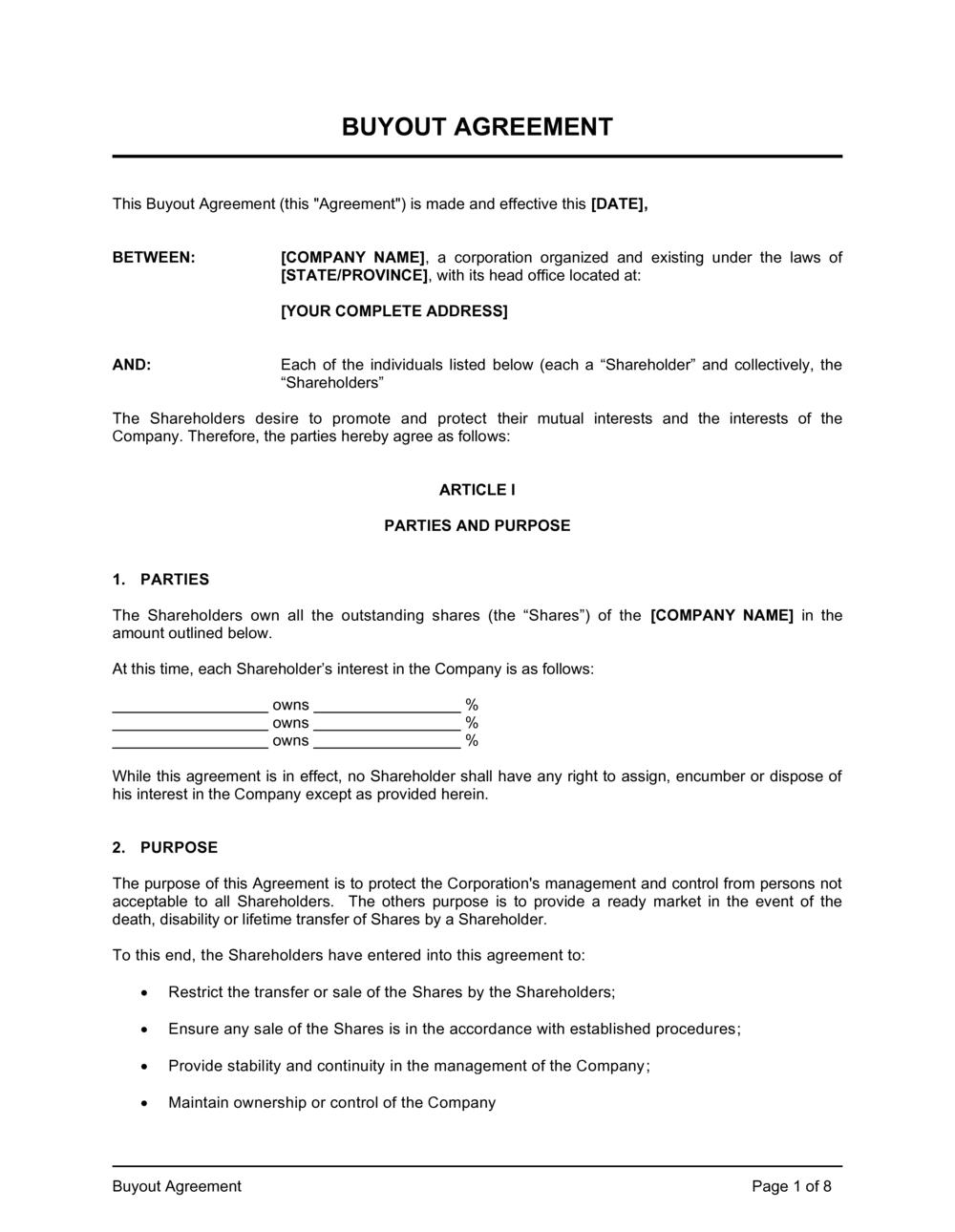

Several elements are crucial for a robust business partner buyout agreement template. Defining the events that trigger a buyout is paramount, encompassing scenarios like voluntary withdrawal, death, disability, retirement, or irreconcilable differences.

The agreement should also specify a clear and unbiased method for valuing the departing partner's share. Common valuation methods include fair market value appraisal, formula-based valuation (e.g., based on revenue or earnings), and agreed-upon valuation.

Detailing the payment terms is equally important. This involves specifying the total purchase price, the payment schedule (e.g., lump sum or installments), interest rates (if applicable), and any security or collateral offered to the departing partner.

Addressing Potential Disputes

A comprehensive template should also incorporate a dispute resolution mechanism. This might include mediation or arbitration, providing a less adversarial and more cost-effective alternative to litigation.

Clarity around confidentiality obligations and non-compete clauses are important. These ensure the departing partner won't use confidential information to compete against the remaining business.

Finally, the agreement should outline the transfer of ownership rights, including the assignment of intellectual property, customer relationships, and other assets.

Perspectives on Buyout Agreements

The importance of a buyout agreement is almost universally acknowledged among legal and business professionals. "Having a clear buyout agreement in place is essential for business partnerships," says Sarah Chen, a partner at a leading corporate law firm. "It provides a framework for resolving disagreements and ensures a smooth transition of ownership, protecting both the departing partner and the remaining business."

However, some argue that standardized templates may not adequately address the unique complexities of every business. "While a template can serve as a helpful starting point, it's crucial to customize it to reflect the specific circumstances of the partnership," advises David Lee, a small business consultant.

He recommends consulting with legal and financial professionals to tailor the agreement to the specific industry, financial situation, and individual partner needs.

Beyond the Template: Seeking Professional Guidance

While a business partner buyout agreement template offers a valuable foundation, it's not a substitute for professional legal counsel. Consulting with an attorney ensures that the agreement complies with applicable state laws and accurately reflects the partners' intentions.

Furthermore, engaging a financial advisor can help determine a fair and accurate valuation of the business, minimizing the risk of future disputes. The Small Business Administration (SBA) also offers resources and guidance on partnership agreements and business succession planning.

By combining a well-structured template with expert advice, businesses can create a robust buyout agreement that protects their interests and ensures a smooth transition of ownership when the time comes.

Looking Ahead: Adapting to Changing Business Landscapes

The business landscape is constantly evolving, and buyout agreements must adapt accordingly. As businesses become more complex and rely on intangible assets like intellectual property and data, the valuation and transfer of these assets must be carefully addressed in the agreement.

Furthermore, the rise of remote work and distributed teams may necessitate adjustments to non-compete clauses and confidentiality obligations. Regularly reviewing and updating the buyout agreement ensures that it remains relevant and effective in protecting the business's long-term interests.

By proactively addressing potential challenges and seeking expert guidance, businesses can ensure that their buyout agreements provide a solid foundation for a successful and equitable partnership dissolution.