Can I Cash A Check At Keybank Without An Account

The simple act of cashing a check can quickly become a frustrating hurdle for individuals lacking a traditional bank account. Many find themselves asking a fundamental question: Can I cash a check at KeyBank without being a customer? The answer, while seemingly straightforward, carries significant implications for financial inclusion and access to funds.

This article delves into KeyBank's policies regarding check cashing for non-account holders, examining the associated fees, required identification, and alternative options available to those seeking to access their money quickly and efficiently. Understanding these procedures is crucial for individuals navigating the financial landscape, especially those who may not have access to conventional banking services.

KeyBank's Check Cashing Policy for Non-Customers

KeyBank, like many financial institutions, offers check cashing services to non-customers, but with specific stipulations. Typically, a fee is involved, and the amount can vary depending on the check's value and the bank's internal policies. It's important to note that KeyBank reserves the right to refuse to cash a check for a non-customer, especially if they cannot verify the check writer's account or suspect fraudulent activity.

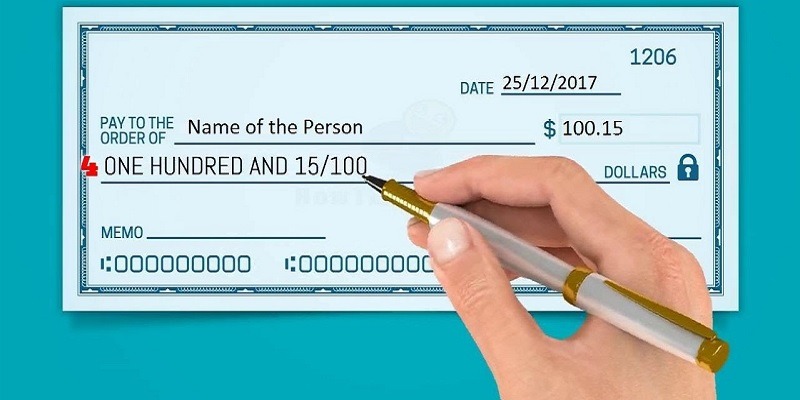

To successfully cash a check, a non-customer must present a valid, government-issued photo ID, such as a driver's license or passport. KeyBank may also require additional information to verify the individual's identity and the legitimacy of the check. These measures are in place to prevent fraud and protect both the bank and its customers.

Fees and Limitations

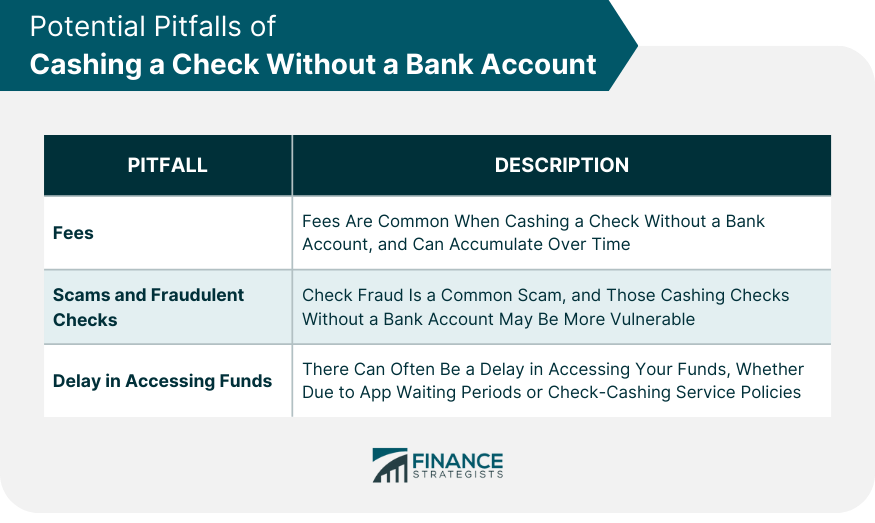

The fees associated with cashing a check at KeyBank without an account are a significant factor for many. These fees can eat into the check's value, making it less desirable than other options.

Specific fee amounts vary and are subject to change, so it's best to contact KeyBank directly or visit their website for the most up-to-date information. There may also be limits on the types of checks that can be cashed, as well as daily or monthly limits on the total amount that can be processed for non-customers.

Alternative Check Cashing Options

For individuals seeking alternatives to cashing checks at KeyBank without an account, several options exist. These include:

- Check-cashing stores: These establishments specialize in cashing checks and are often more convenient than banks. However, their fees can be considerably higher.

- Retailers: Some retailers, such as Walmart, offer check-cashing services, often with lower fees than check-cashing stores.

- Prepaid debit cards: Loading a check onto a prepaid debit card can provide access to funds and avoid the need for a traditional bank account. Fees may still apply for loading and using the card.

- Mobile banking apps: Some mobile banking apps allow users to deposit checks remotely, even without a traditional bank account, although this usually requires some form of registration and verification.

The Broader Context of Financial Inclusion

The ability to easily cash a check is a critical component of financial inclusion. When individuals lack access to traditional banking services, they often face higher fees and limited options for managing their finances.

Addressing this issue requires a multi-pronged approach, including promoting financial literacy, expanding access to affordable banking services, and exploring innovative solutions like mobile banking and prepaid cards. KeyBank, along with other financial institutions, plays a role in this effort.

Looking Ahead

The landscape of check cashing is evolving, driven by technological advancements and a growing awareness of financial inclusion. KeyBank and other banks are likely to continue adapting their policies and services to meet the changing needs of their customers and the broader community.

Consumers should remain informed about their options and carefully consider the fees and terms associated with each check-cashing method. By understanding their rights and responsibilities, individuals can make informed decisions and navigate the financial system with greater confidence. Ultimately, easier and more affordable access to financial services can empower individuals and contribute to a more equitable economic environment.

:max_bytes(150000):strip_icc()/when-do-checks-expire.asp-final-370e92b6578547989244e03a08040053.png)