Can I Open A Checking Account At 17

The quest for financial independence often begins in the teenage years, and opening a checking account is a significant step. But for 17-year-olds, the process can seem like navigating a complex financial maze. The question of whether a 17-year-old can open a checking account isn't a simple yes or no. The answer depends on various factors, including state laws and individual bank policies.

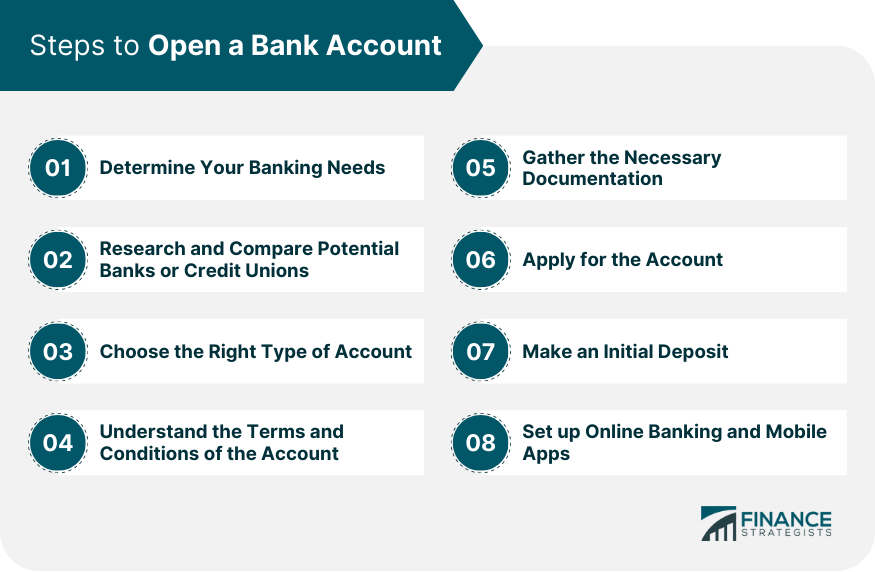

This article delves into the specifics of opening a checking account at 17, exploring the legal landscape, the roles of custodians and co-signers, and the practical steps teens and their parents should consider. We will examine the various options available and the potential benefits and drawbacks, helping readers make informed decisions about this crucial step toward financial literacy.

Understanding the Legal Framework

Legally, in most states, an individual is considered an adult at the age of 18. This milestone grants them the full legal capacity to enter into contracts, including agreements with financial institutions. Consequently, a 17-year-old is generally considered a minor and thus limited in their ability to enter into legally binding agreements independently.

However, this doesn't preclude a 17-year-old from accessing banking services. The key lies in custodial accounts or joint accounts.

Custodial Accounts: UTMA/UGMA

A custodial account, governed by the Uniform Transfers to Minors Act (UTMA) or the Uniform Gifts to Minors Act (UGMA), allows a minor to have an account managed by an adult custodian. The custodian, usually a parent or guardian, has the authority to make transactions and manage the funds for the benefit of the minor. When the minor reaches the age of majority (typically 18 or 21, depending on the state), the account ownership transfers to them.

UTMA/UGMA accounts are not exclusively checking accounts, they can hold stocks and bonds. However, many banks offer custodial checking accounts as a convenient way for teens to manage their money under adult supervision. These accounts are designed to be educational tools, fostering financial responsibility.

Joint Accounts: Co-Signers and Shared Responsibility

Another option is a joint checking account. In this scenario, the 17-year-old and an adult, typically a parent or guardian, are both listed as account holders. This means both parties have access to the funds and are responsible for the account. The adult serves as a co-signer, providing a level of assurance to the bank and sharing liability.

Joint accounts allow the teen to manage their finances with the oversight of a parent or guardian. The co-signer can help ensure that the account is handled responsibly and can intervene if necessary. However, this arrangement also means that the co-signer's credit could be affected by the teen's actions.

Bank Policies and Requirements

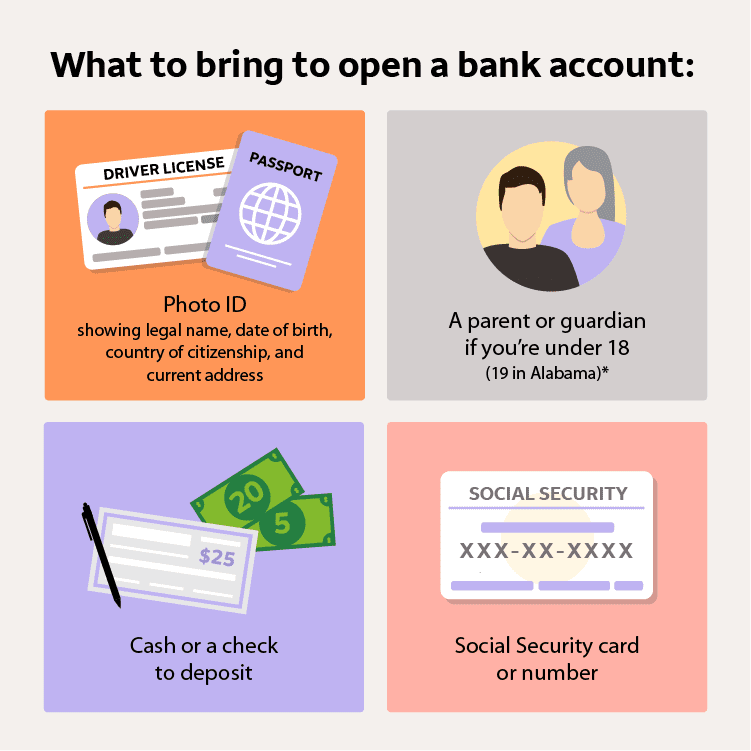

Even within the legal framework of UTMA/UGMA and joint accounts, individual banks can have their own policies regarding opening accounts for minors. Some banks may require specific documentation, such as proof of guardianship or parental consent forms. Others may have minimum balance requirements or restrictions on certain types of transactions.

Contacting banks directly or visiting their websites is essential. This research allows prospective account holders to understand the specific requirements and offerings. Some financial institutions may offer specialized teen checking accounts with features like parental controls and financial literacy resources.

Benefits and Considerations

Opening a checking account at 17 offers numerous benefits. It provides a safe and convenient way for teens to manage their money, pay bills, and make purchases. It also introduces them to essential financial concepts like budgeting, saving, and responsible spending.

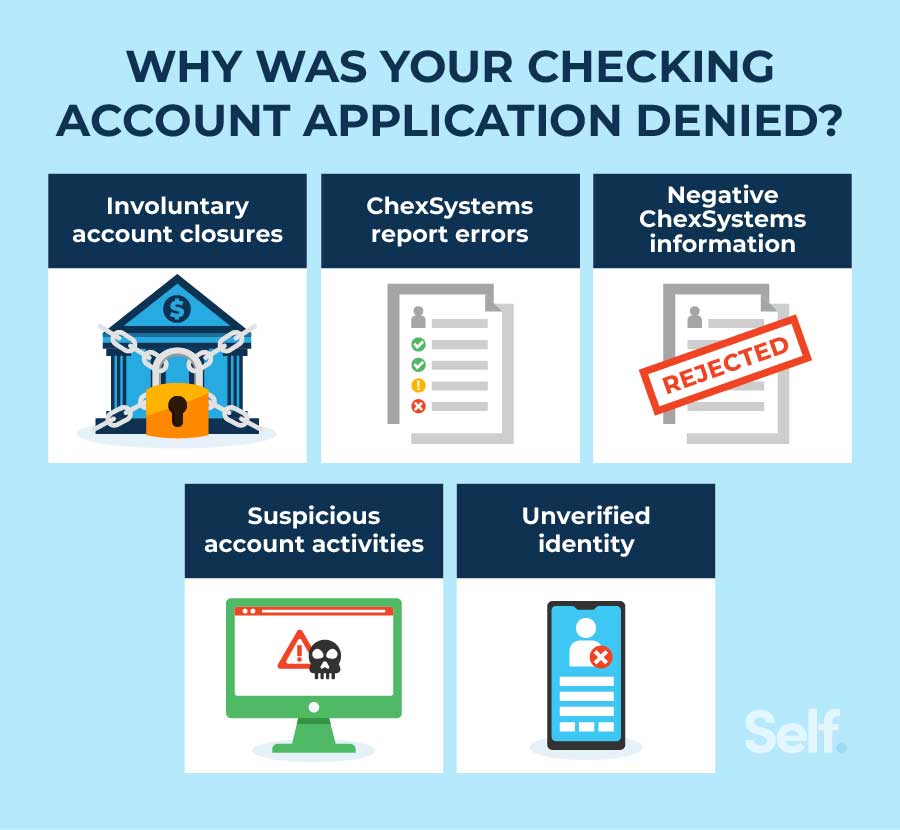

However, there are also considerations. The potential for overdraft fees, the importance of protecting against fraud, and the need to understand interest rates are important aspects of using a checking account. Education and parental guidance are vital in helping teens navigate these complexities.

The Future of Teen Banking

The trend toward financial literacy at a young age is gaining momentum. More and more banks are recognizing the importance of catering to the needs of teen customers. This trend is reflected in the increasing availability of teen-focused checking accounts with features designed to promote financial responsibility and education.

As technology evolves, we can expect to see even more innovative banking solutions emerge for teenagers. From mobile banking apps with parental controls to gamified financial literacy tools, the future of teen banking is poised to empower young people to take control of their financial futures. By understanding the legal framework, exploring different account options, and prioritizing financial education, 17-year-olds can successfully navigate the path to financial independence and build a solid foundation for their future financial success.

![Can I Open A Checking Account At 17 How To Open a Checking Account [The Complete Guide]](https://investedwallet.com/wp-content/uploads/2019/08/How-To-Open-a-Checking-Account.png)

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)