Can I Overdraft My Woodforest Account At Any Atm

Imagine this: you're standing at an ATM, ready to withdraw some cash for a weekend getaway. The machine whirs, asks for your PIN, and then…denial. A wave of anxiety washes over you. Can you overdraft your account here? Especially if it's a Woodforest National Bank account? The question looms large, tinged with the potential sting of fees.

Understanding Woodforest's overdraft policies, specifically regarding ATM withdrawals, can save you from unexpected charges and financial hiccups. The short answer? It depends. Woodforest generally does not allow overdrafts at ATMs. This means that if you try to withdraw more money than you have available in your account, the transaction will typically be denied.

Woodforest's Overdraft Stance

Woodforest National Bank, like many financial institutions, has specific guidelines surrounding overdrafts. Their policy generally aims to prevent customers from spending beyond their means, especially at ATMs. This is primarily to protect both the bank and the customer from accumulating excessive debt and fees.

However, it's crucial to delve deeper into the nuances of this policy.

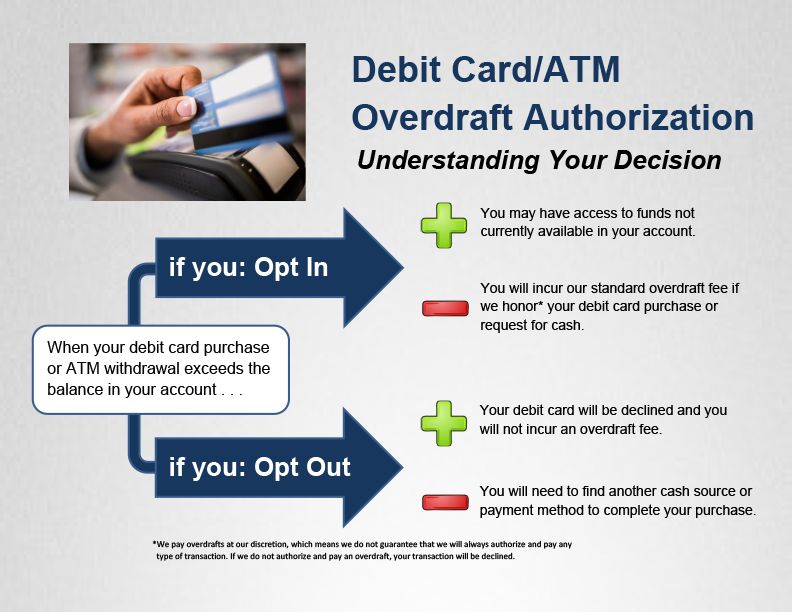

The Overdraft Privilege Program

Woodforest offers an optional service called Overdraft Privilege. This program might allow you to overdraft your account for certain transactions, but ATM withdrawals are generally excluded.

This means that even if you’re enrolled in Overdraft Privilege, attempting to withdraw funds beyond your available balance at an ATM will most likely result in a declined transaction. This aligns with common practices to prevent large, potentially unmanageable debts from accumulating through ATM access.

Why the ATM Restriction?

Limiting overdrafts at ATMs is a strategic decision. Banks often view ATM withdrawals as a direct cash disbursement, making them riskier for overdrafts.

Card transactions, on the other hand, might offer a window for evaluation before final settlement. Withdrawing cash is more immediate.

Avoiding Overdrafts: Practical Tips

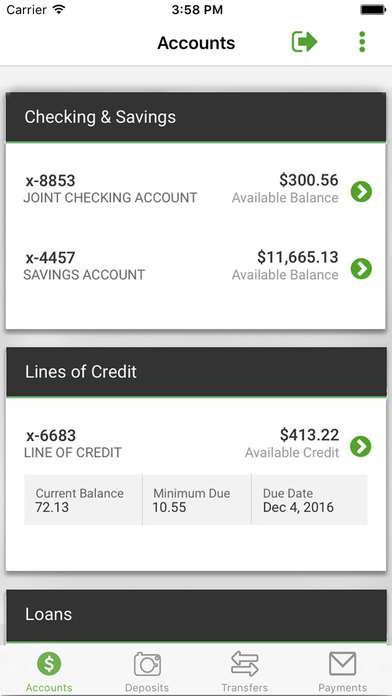

The best strategy is always to avoid overdrafts altogether. Careful planning and monitoring of your account can make all the difference. Regularly check your account balance through Woodforest's online banking platform or mobile app.

Set up balance alerts. These alerts will notify you when your account balance falls below a certain threshold. Link your Woodforest account to a savings account or line of credit for overdraft protection. If you try to overdraw, funds will automatically transfer from the linked account to cover the difference, potentially avoiding overdraft fees (though transfer fees might apply).

A Word from Woodforest

"We encourage our customers to manage their accounts responsibly and to utilize the tools and resources we provide to help them avoid overdrafts,"says a Woodforest spokesperson. "Our goal is to provide convenient banking services while also protecting our customers' financial well-being."

Always check the latest terms and conditions with Woodforest National Bank. Banking policies can change, and it’s crucial to stay informed. Consider contacting Woodforest's customer service directly for personalized clarification on your account and overdraft options.

So, while the allure of accessing emergency funds at any ATM might be tempting, it's essential to understand the limitations and potential consequences. Managing your account wisely and leveraging available resources can help you navigate your finances smoothly and avoid those unwelcome ATM denial moments.