Can I Pay Bills With Sezzle

The rise of Buy Now, Pay Later (BNPL) services has reshaped the retail landscape, offering consumers unprecedented flexibility in managing their finances. But can this seemingly boundless convenience extend to the essential, recurring expenses that underpin everyday life? Specifically, can you use Sezzle, one of the prominent players in the BNPL arena, to pay your bills?

The question of whether Sezzle can be used to pay bills touches upon the core functionality and limitations of the service. This article delves into the specifics of Sezzle's capabilities, exploring its partnerships, accepted payment methods, and potential workarounds, while also considering the broader implications of using BNPL services for essential expenses and alternative options available to consumers.

Understanding Sezzle's Functionality

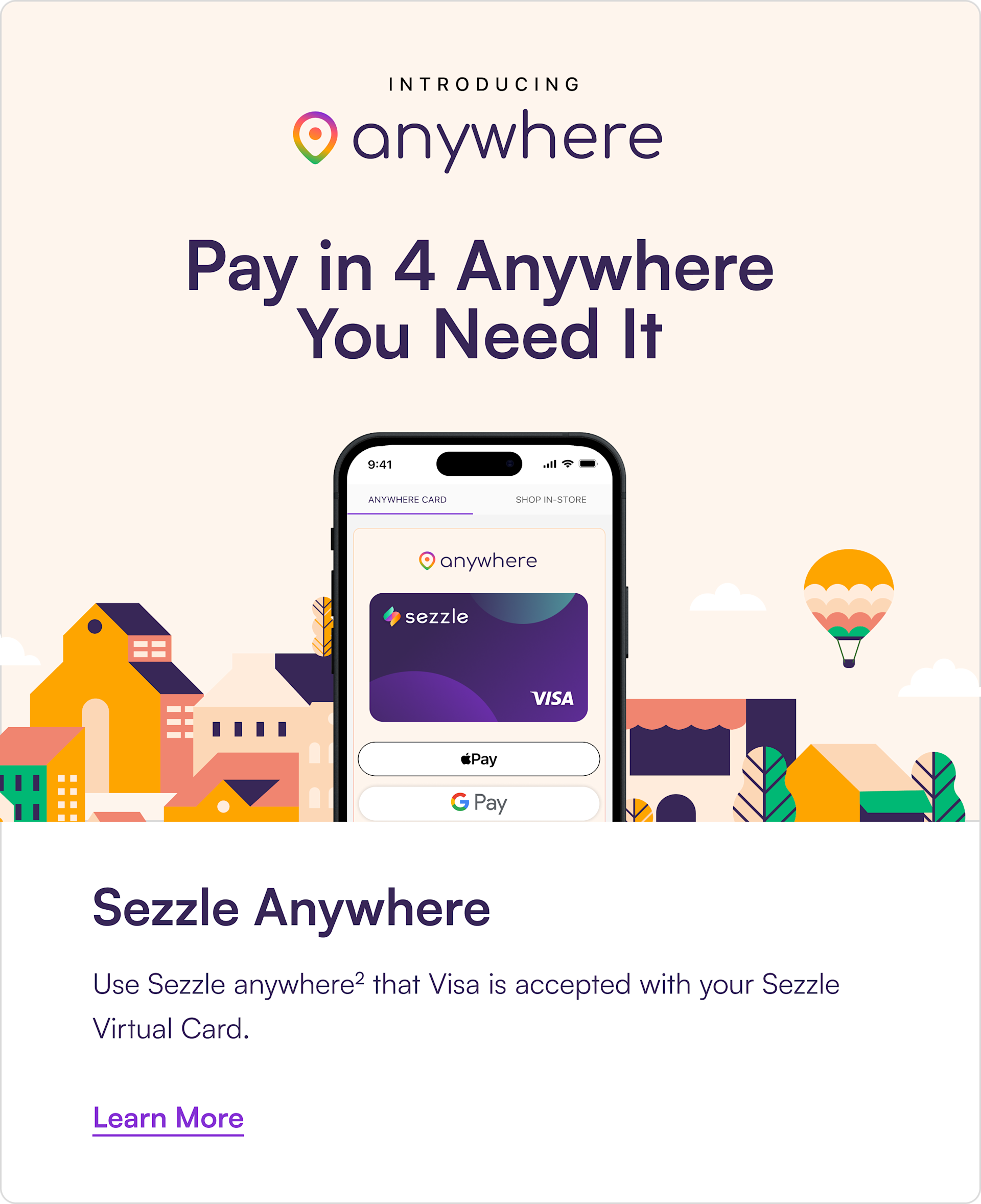

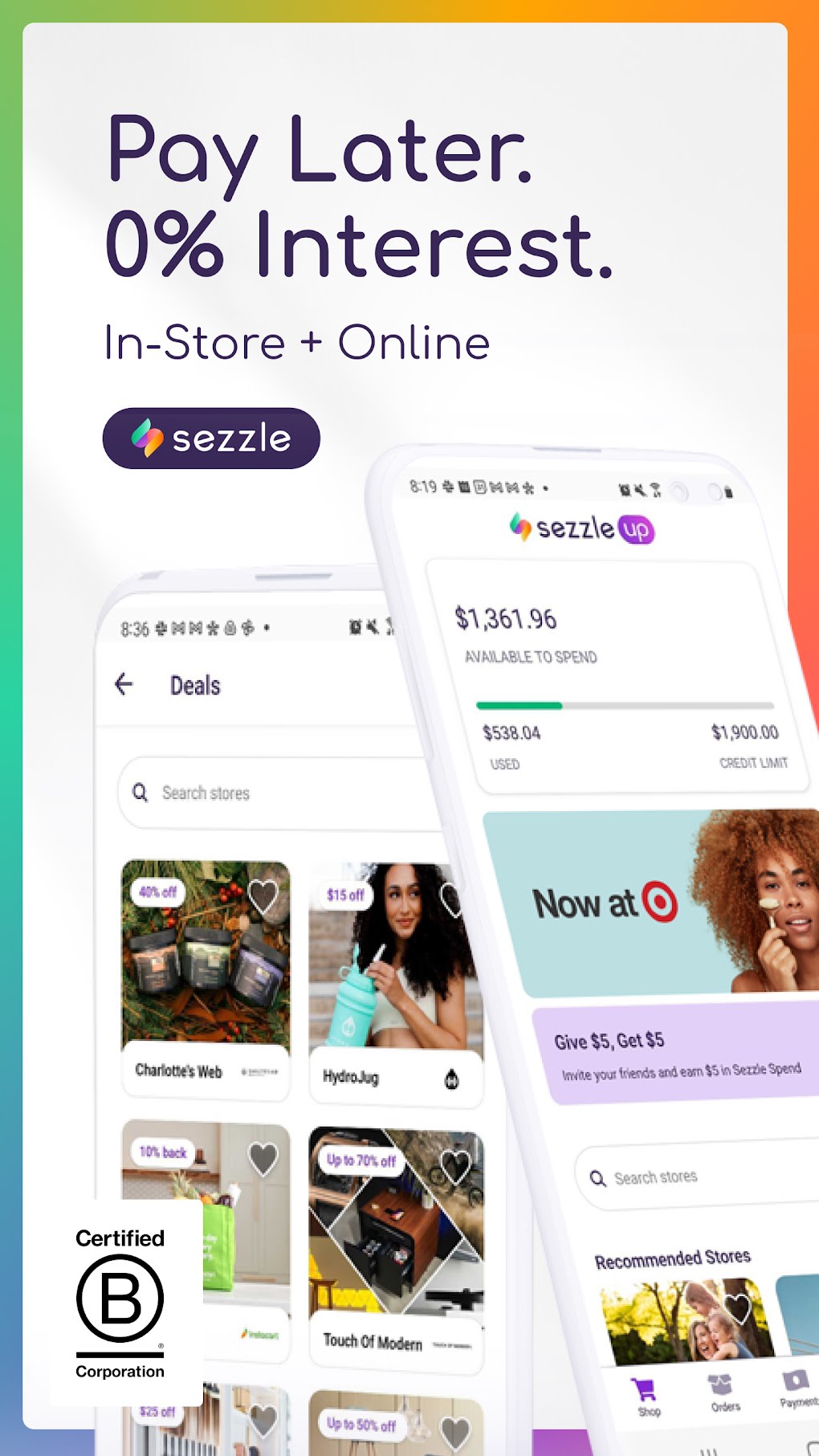

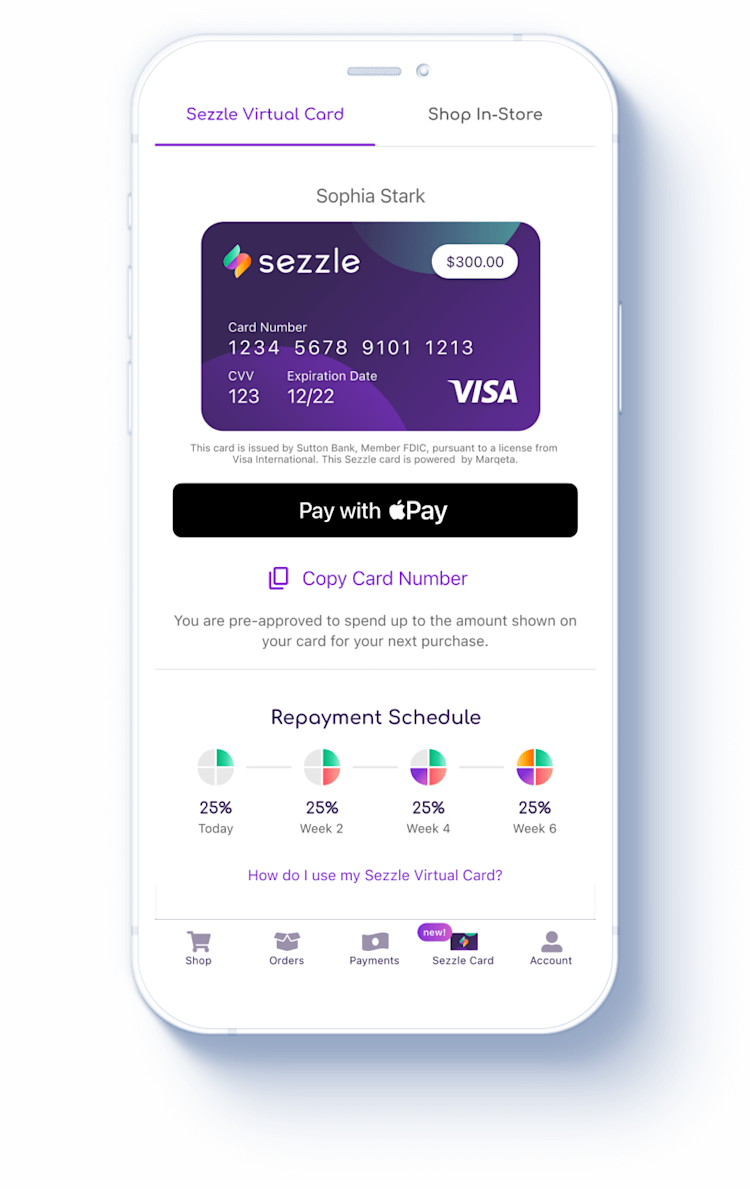

Sezzle operates primarily as a point-of-sale financing option for online and in-store purchases. It allows consumers to split their payments into four interest-free installments, typically spread over six weeks.

This model is designed to make purchases more accessible and manageable, particularly for discretionary spending. However, it also introduces certain restrictions.

Direct Bill Payment is Generally Not Supported

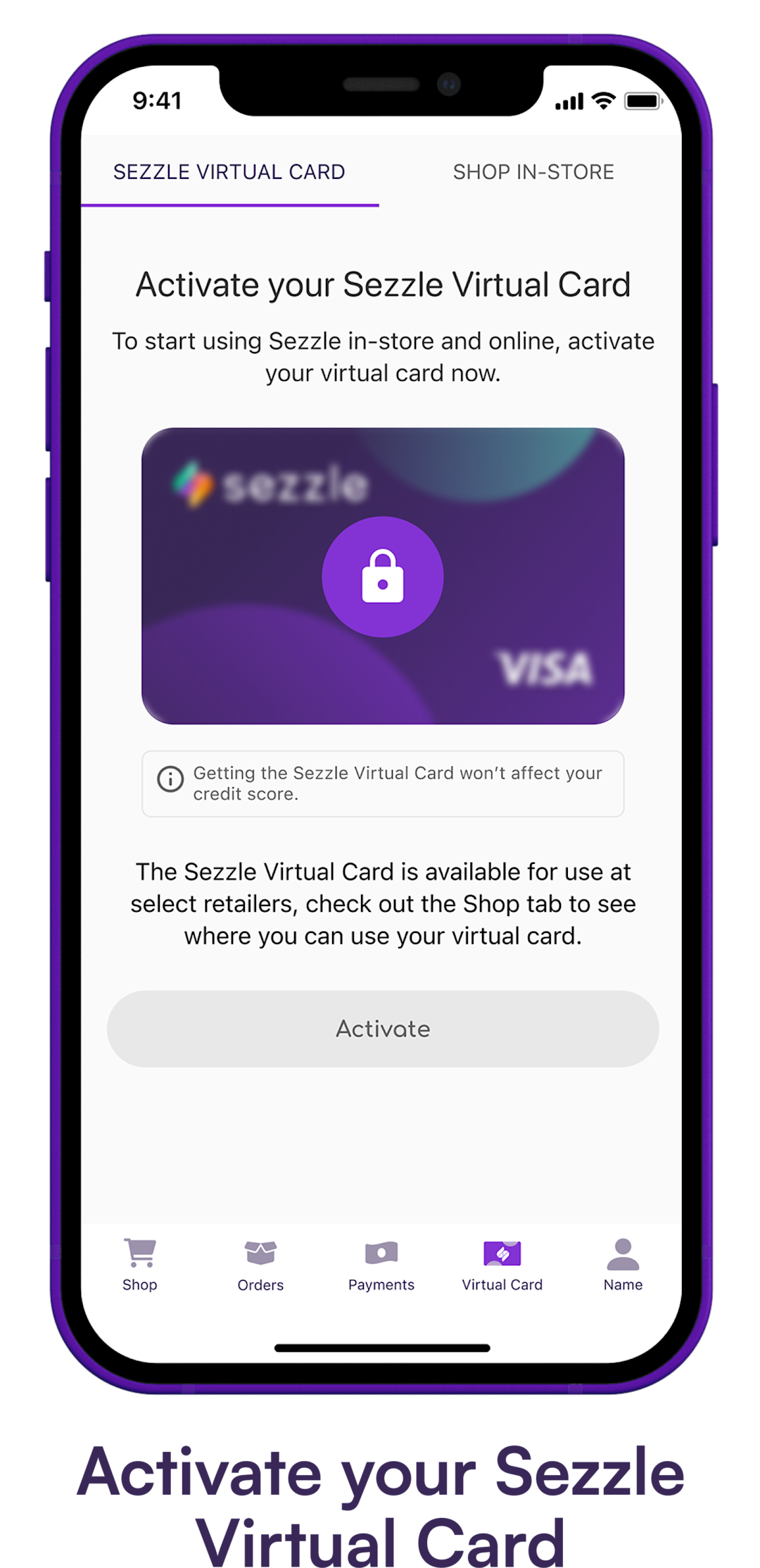

The fundamental answer is that Sezzle typically cannot be used to directly pay bills like rent, utilities, or credit card debts. Sezzle's business model relies on partnerships with merchants.

These merchants integrate Sezzle into their checkout process, enabling customers to select it as a payment option. Direct bill payments, on the other hand, often bypass these established merchant relationships.

Why the Restriction?

Several factors contribute to this limitation. Sezzle's risk assessment and underwriting processes are tailored to specific merchants and purchase types.

Applying these processes to the diverse landscape of bill payments would be significantly more complex. Fraud prevention and regulatory compliance also play a crucial role.

Sezzle needs to ensure that its services are used responsibly and in accordance with applicable laws, which can be challenging in the context of unregulated bill payment scenarios.

Exploring Potential Workarounds

While direct bill payment with Sezzle is generally not feasible, some indirect methods might offer a semblance of functionality. These methods involve leveraging Sezzle's partnerships and features to indirectly address bill payments.

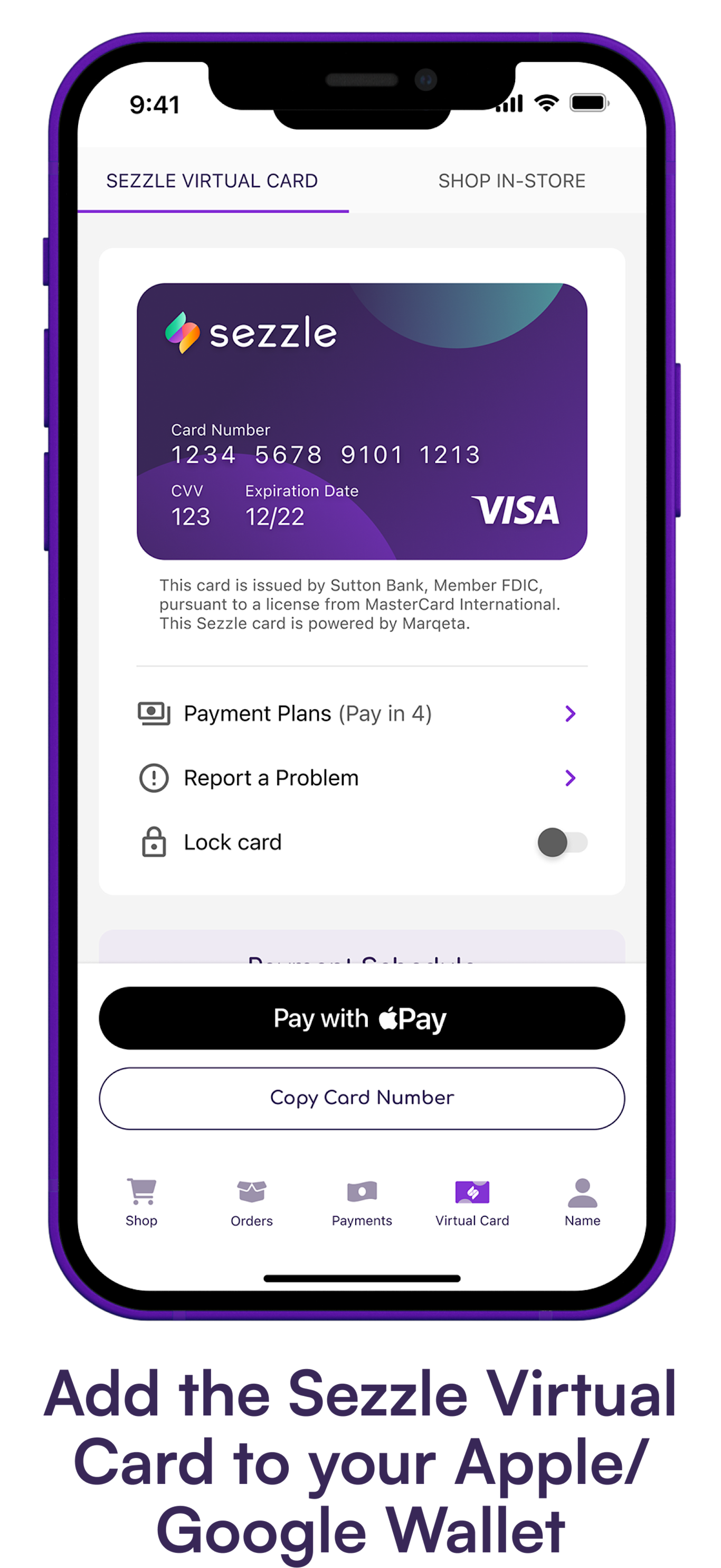

Using Sezzle to Purchase Prepaid Cards

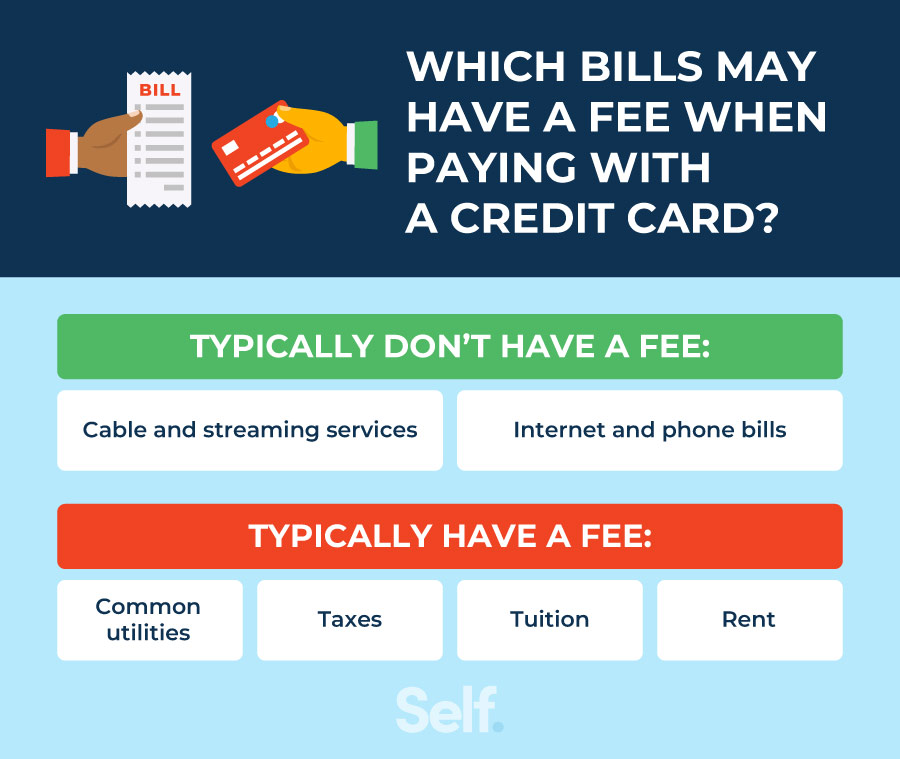

One possible workaround involves using Sezzle to purchase prepaid debit cards from participating merchants. These prepaid cards can then be used to pay certain bills online or in person.

However, it's important to note that this method may incur additional fees associated with the prepaid card itself, potentially negating the benefits of using Sezzle's interest-free installment plan.

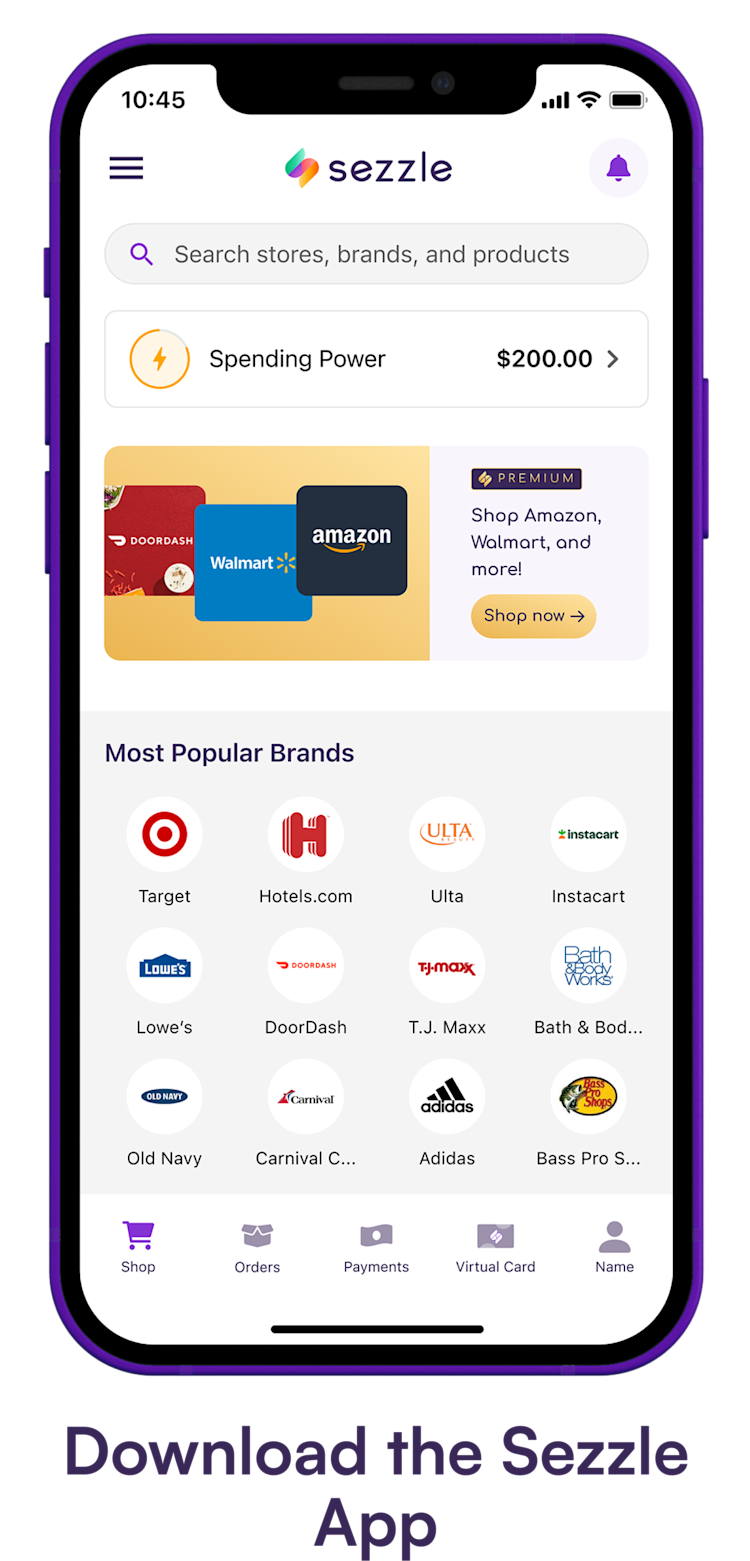

Leveraging Sezzle-Enabled Services

Some services that facilitate bill payments may accept Sezzle as a payment option. This is an indirect approach, and requires the consumer to find a third-party service that bridges the gap between Sezzle and the specific biller.

The availability of such services and their associated fees should be carefully evaluated before pursuing this option.

The Broader Context: BNPL and Essential Expenses

Using BNPL services for essential expenses raises several concerns. While it might seem appealing to spread out the cost of rent or utilities, relying on BNPL for such payments can create a cycle of debt.

Missed payments can lead to late fees and negatively impact credit scores, ultimately exacerbating financial difficulties.

Responsible Use is Key

Financial experts generally advise against using BNPL services for recurring essential expenses. It is crucial to carefully assess your ability to repay the installments on time.

Consider alternative solutions, such as budgeting, debt counseling, or seeking assistance from social services, before resorting to BNPL for bills.

Alternative Payment Solutions

Several alternatives exist for managing bill payments and avoiding reliance on BNPL services.

- Budgeting and Financial Planning: Creating a detailed budget can help you track your income and expenses, identify areas where you can save money, and prioritize bill payments.

- Negotiating with Creditors: Contacting your creditors and negotiating payment plans or hardship programs can provide temporary relief during financial difficulties.

- Seeking Assistance from Social Services: Numerous government and non-profit organizations offer assistance with rent, utilities, and other essential expenses.

The Future of BNPL and Bill Payments

The BNPL landscape is constantly evolving. As the industry matures, Sezzle and other providers may explore new partnerships and features that could potentially extend their services to bill payments.

However, regulatory scrutiny and concerns about consumer debt are likely to shape the future direction of the BNPL industry. It remains to be seen whether direct bill payment will become a mainstream feature of BNPL services.

In conclusion, while some indirect methods might exist, Sezzle is generally not designed for or intended to be used for direct bill payments. Consumers should exercise caution and explore alternative solutions before relying on BNPL for essential expenses.