Can I Refinance My Car With A 650 Credit Score

In today's economy, managing debt is more crucial than ever, especially for car owners navigating fluctuating interest rates and household budgets. Many car owners are grappling with the question: Can I refinance my car with a 650 credit score? The answer, while not a straightforward yes or no, hinges on various factors that could either open or close the door to potentially significant savings.

Refinancing your car loan involves replacing your existing loan with a new one, ideally at a lower interest rate or with more favorable terms. This can lower your monthly payments, shorten the loan term, or both. However, your credit score plays a pivotal role in determining your eligibility and the interest rate you'll receive. With a credit score of 650, considered fair by many lenders, your options might be more limited compared to those with excellent credit, but refinancing is certainly not out of reach.

Understanding Credit Scores and Auto Refinancing

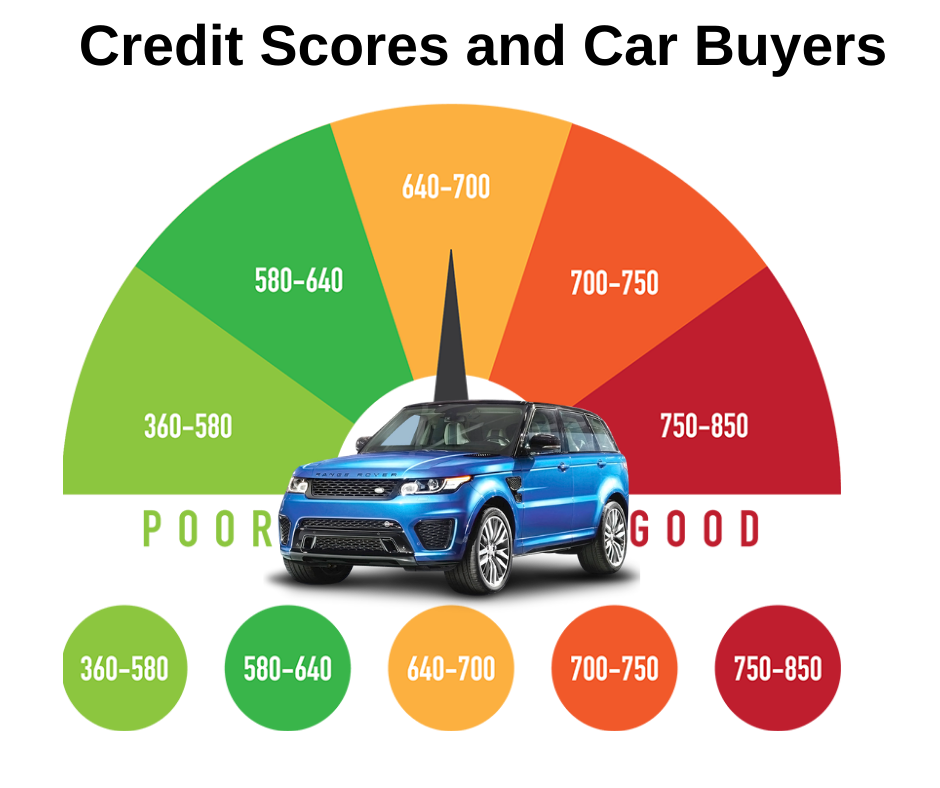

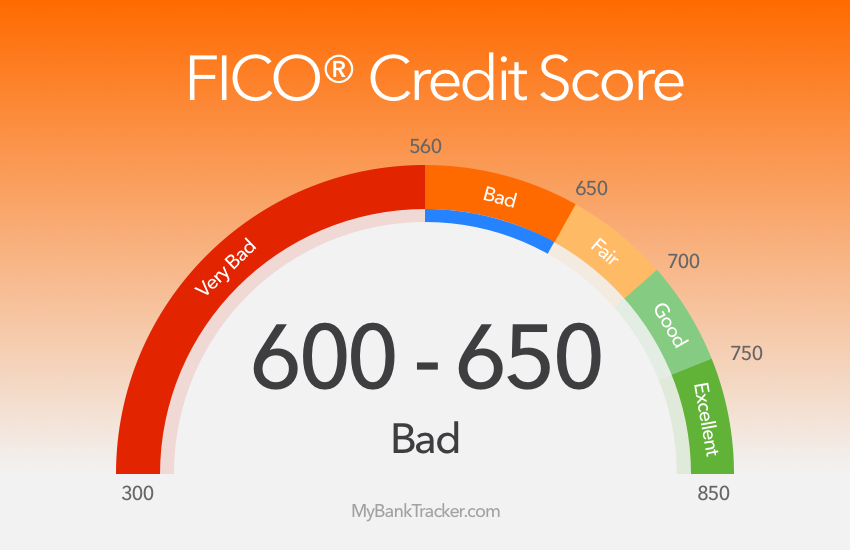

Credit scores are a snapshot of your creditworthiness, influencing almost every aspect of borrowing. Lenders use these scores to assess the risk of lending money to you. FICO scores, the most widely used credit scoring model, range from 300 to 850, with higher scores indicating lower risk.

A score of 650 falls within the "fair" range. According to Experian, this score range typically indicates that you may have some credit blemishes, such as late payments or a high credit utilization ratio. This doesn't automatically disqualify you from refinancing, but it does mean you'll need to shop around and possibly accept less favorable terms.

Factors Influencing Refinancing Approval

While your credit score is a primary factor, lenders also consider other aspects of your financial profile. Your debt-to-income (DTI) ratio, which compares your monthly debt payments to your gross monthly income, is carefully scrutinized. A lower DTI indicates you have more disposable income and are better positioned to manage loan payments.

The age and mileage of your vehicle also matter. Lenders want to ensure the car's value is sufficient to cover the loan amount, especially in case of repossession. A newer car with lower mileage is generally more attractive to lenders.

Finally, the loan amount and the loan-to-value (LTV) ratio are important. Lenders may be hesitant to refinance a loan where the outstanding balance is close to or exceeds the car's current market value. A positive equity position in your vehicle improves your chances.

Strategies for Refinancing with a 650 Credit Score

Given a 650 credit score, several strategies can improve your chances of securing a favorable refinancing deal. One approach is to improve your credit score before applying.

Paying down existing debts, correcting errors on your credit report, and avoiding new credit applications can all boost your score. Even a small increase can make a difference in the interest rates offered.

Another strategy is to shop around and compare offers from multiple lenders. Credit unions, online lenders, and traditional banks all have different lending criteria and interest rates. Don't settle for the first offer you receive; explore your options.

Consider applying with a co-signer who has a stronger credit history. A co-signer essentially guarantees the loan, reducing the lender's risk and potentially leading to better terms. However, ensure the co-signer understands the responsibility involved.

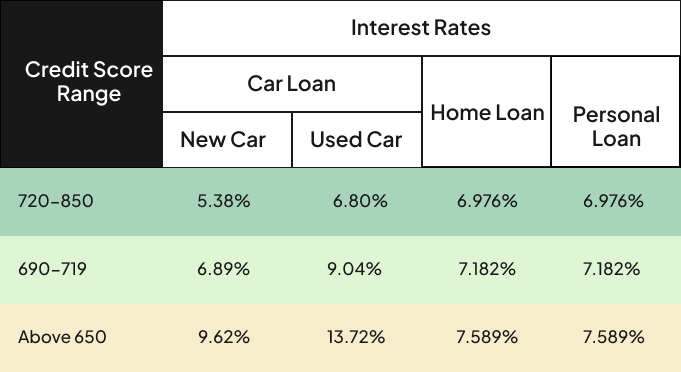

Be prepared to accept a slightly higher interest rate than someone with excellent credit. Even a slightly lower rate than your current loan can still result in significant savings over the life of the loan. Use online auto refinancing calculators to estimate potential savings based on different interest rates and loan terms.

Potential Benefits and Risks

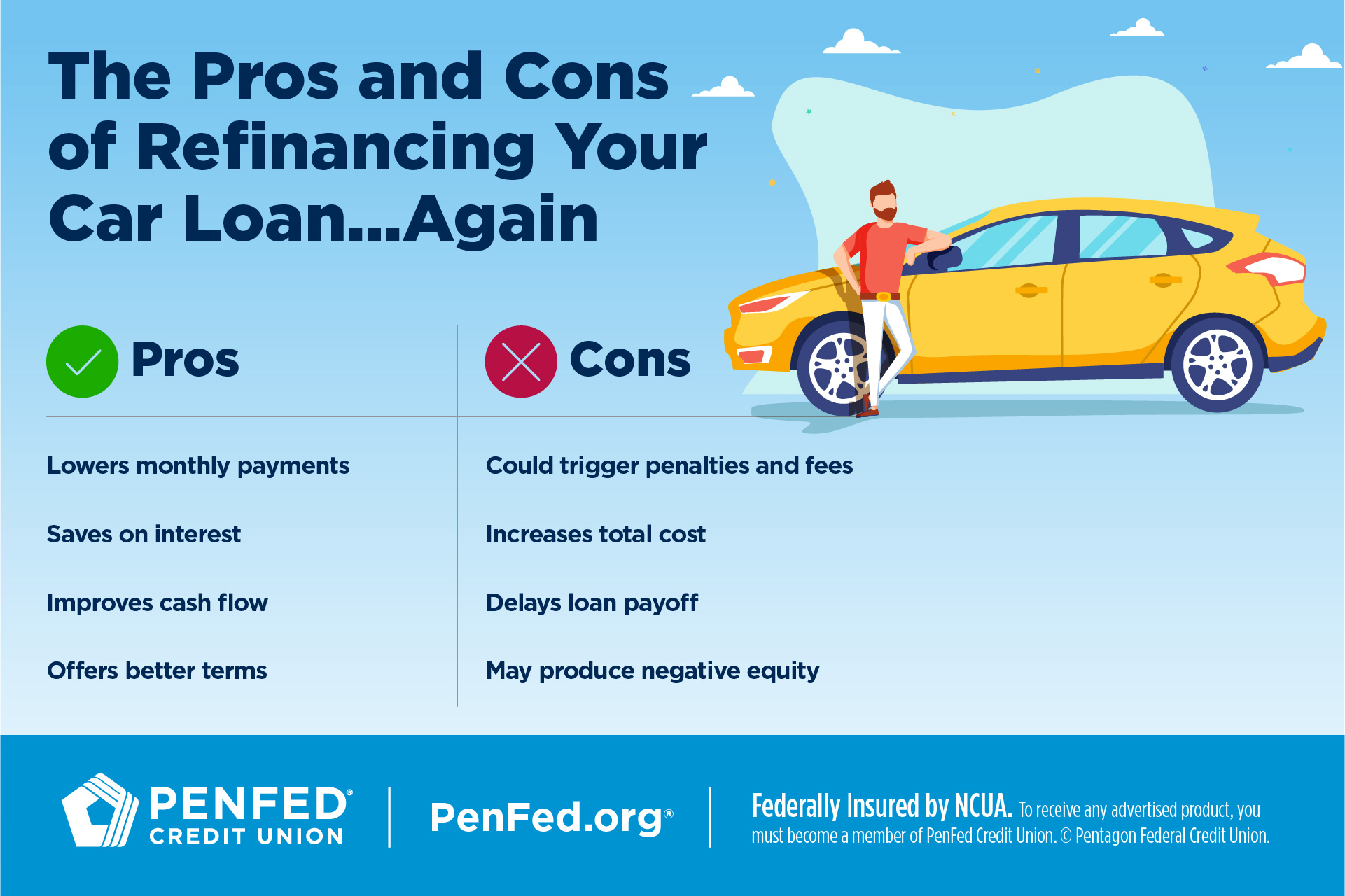

The primary benefit of refinancing is the potential to lower your monthly payments, freeing up cash for other financial goals. Refinancing can also shorten your loan term, allowing you to pay off your car sooner and save on interest in the long run.

However, there are risks to consider. Refinancing often involves fees, such as application fees or prepayment penalties on your existing loan. Make sure the savings from refinancing outweigh these costs. Stretching out the loan term can lower your monthly payments, but it also means paying more interest over the life of the loan.

Looking Ahead

Refinancing a car with a 650 credit score is possible, but it requires research, preparation, and a realistic understanding of your options. As the automotive lending landscape evolves, staying informed about interest rate trends, lender requirements, and your own financial standing is crucial.

Continuously working to improve your credit score will not only open up more refinancing opportunities in the future but also benefit your overall financial health. By taking proactive steps, you can increase your chances of securing a favorable refinancing deal and achieving your financial goals.

.png)

+(1080+×+1080+px).png)