Can I Reopen A Credit Card That Was Closed

Is that closed credit card haunting your financial history? You might be able to resurrect it, but time is of the essence.

The ability to reopen a closed credit card hinges on several factors, most critically the length of time since closure and the reason for it. Understanding these details is crucial to your success. Reopening a credit card can impact your credit score and available credit, so proceed with caution.

Can You Actually Reopen It?

Generally, reopening a closed credit card is possible, but only within a limited timeframe. Most issuers allow reopening within a few months, typically 3 to 6 months, of the closure date.

Contact the issuer directly to inquire about their specific policy. This is especially true if the account was closed due to inactivity or at your request. Beyond this window, your chances diminish significantly.

Factors That Impact Reopening

Several factors determine whether an issuer will reinstate your closed account. Payment history is paramount.

A history of on-time payments substantially improves your odds. Conversely, a record of late payments or defaults will likely lead to denial.

The reason for closure also plays a crucial role. If you closed the account voluntarily and in good standing, you have a better chance. However, if the issuer closed it due to non-payment or suspected fraud, reopening becomes nearly impossible.

Credit Score Implications

Reopening a credit card can have both positive and negative effects on your credit score. A reopened card restores your previous credit limit, which can improve your credit utilization ratio.

A lower credit utilization ratio (the amount of credit you’re using compared to your total available credit) is a positive factor in credit scoring. However, if the account was closed due to negative activity, reopening could signal instability to lenders.

The Application Process

If the issuer agrees to consider reopening your account, they may require you to complete a new application. Be prepared to provide updated financial information, including your income and employment details.

The issuer will then review your application and assess your creditworthiness. Even if you previously had a good relationship with the card issuer, they will still evaluate you based on their current lending criteria.

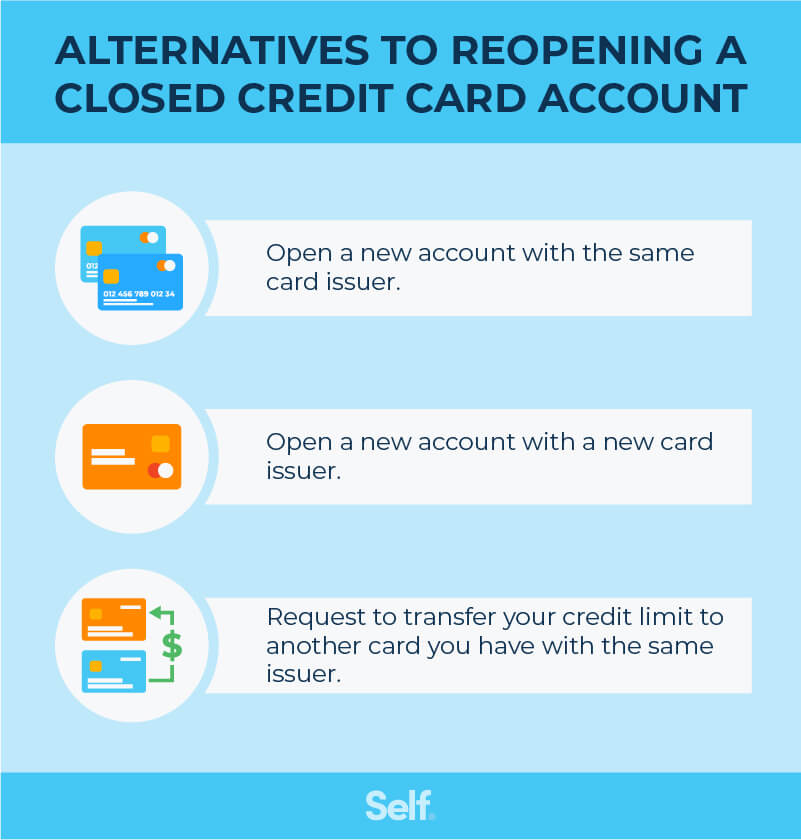

Alternatives to Reopening

If reopening your old card is not an option, explore alternative solutions. Applying for a new credit card is the most common approach. Compare offers from different issuers to find a card that suits your needs and credit profile.

Consider a secured credit card if you have a limited or damaged credit history. These cards require a security deposit, which typically serves as your credit limit.

Next Steps

Immediately contact the credit card issuer to inquire about their specific policies on reopening accounts. Have your account details readily available, including the account number and date of closure.

If reopening is not possible, start researching alternative credit card options. Rebuilding your credit takes time, so be patient and responsible with your credit management.

Monitor your credit report regularly to ensure accuracy and identify any potential issues. You can obtain a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – annually. This proactive approach will help you maintain a healthy credit profile.