Can I Roll My Spouse's 401 K Into Mine

Navigating the complexities of retirement savings can be daunting, especially when considering the impact of life events like marriage and divorce. One common question that arises is whether it's possible to roll a spouse's 401(k) into one's own. The answer, unfortunately, isn't a simple yes or no, and depends heavily on specific circumstances.

This article will delve into the conditions under which such a rollover might be permissible, specifically focusing on situations involving divorce and inheritance. Understanding the rules and regulations surrounding 401(k) rollovers is crucial for effective retirement planning and financial security.

Division of Assets During Divorce

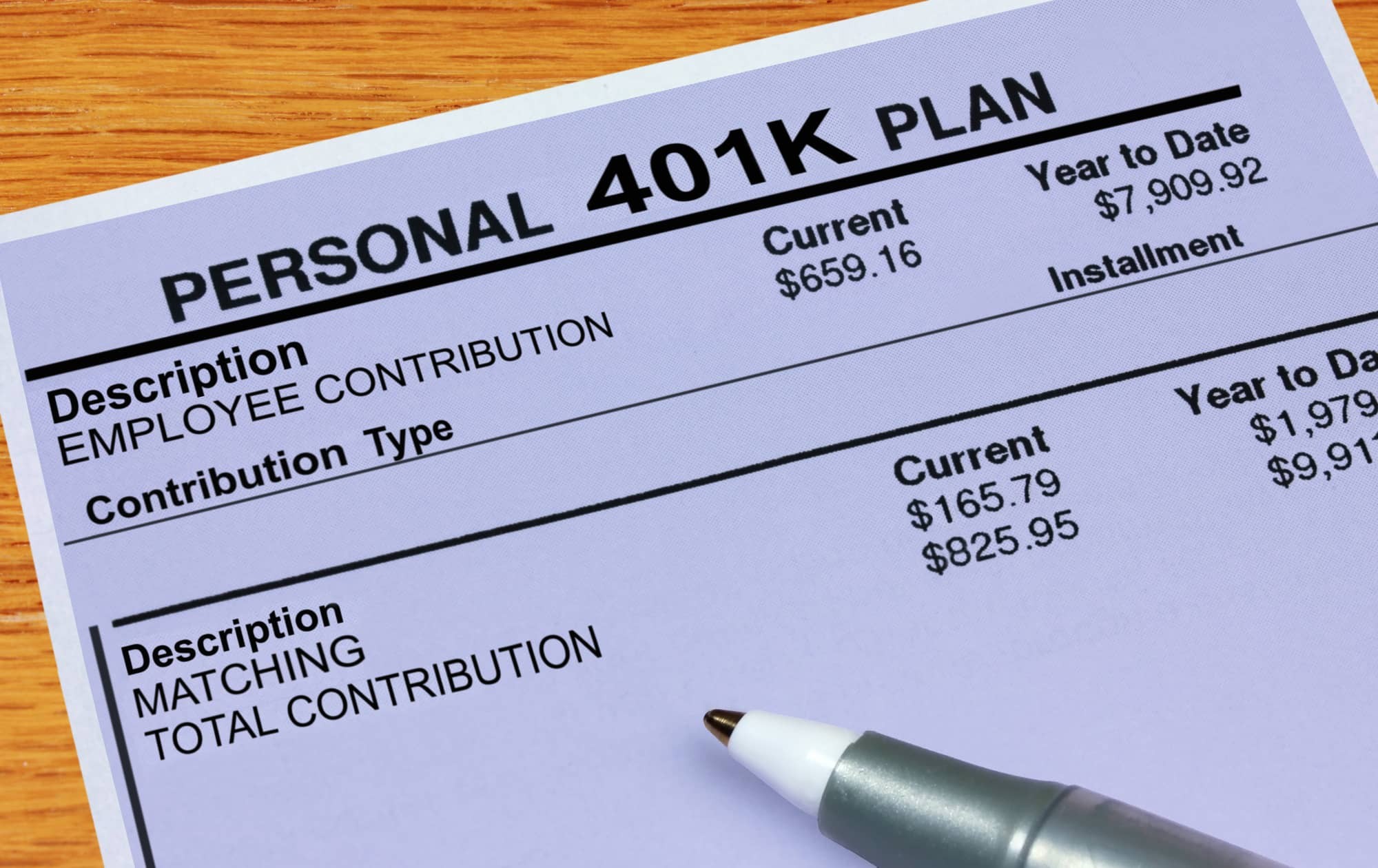

Generally, a direct rollover of a spouse's 401(k) into your own is not permitted during an ongoing marriage. However, during a divorce, retirement assets like 401(k)s are often subject to division as part of the marital property settlement.

This division is typically governed by a Qualified Domestic Relations Order (QDRO) issued by a court. The QDRO instructs the 401(k) plan administrator on how to divide the assets and to whom they should be distributed.

With a QDRO in place, the non-employee spouse may be able to receive a portion of the employee spouse's 401(k) assets. The QDRO will specify whether the distribution will be made directly to the non-employee spouse, or whether they can roll it over into a qualified retirement account in their own name, such as an IRA or potentially a new 401(k) if their employer allows.

Understanding the QDRO Process

Securing a QDRO is a multi-step process that requires legal expertise. First, the divorce decree must specifically mention the division of the 401(k) assets.

Then, a separate QDRO document must be drafted and submitted to the court for approval. Finally, the approved QDRO is sent to the 401(k) plan administrator, who will review it for compliance and implement the asset division.

It's crucial to consult with an attorney specializing in family law and retirement benefits to navigate this process correctly. Mistakes in the QDRO can lead to significant tax consequences and delays in receiving your share of the retirement assets.

Inheriting a Spouse's 401(k)

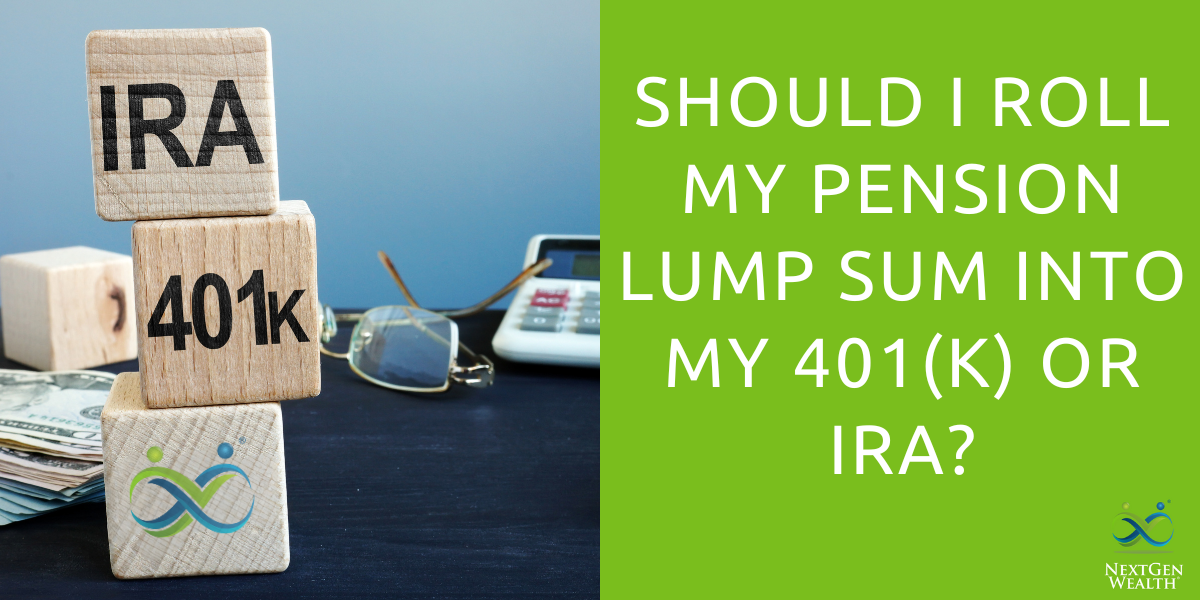

The rules regarding 401(k) rollovers differ significantly when a spouse passes away. In this case, the surviving spouse typically has several options for managing the inherited 401(k) assets.

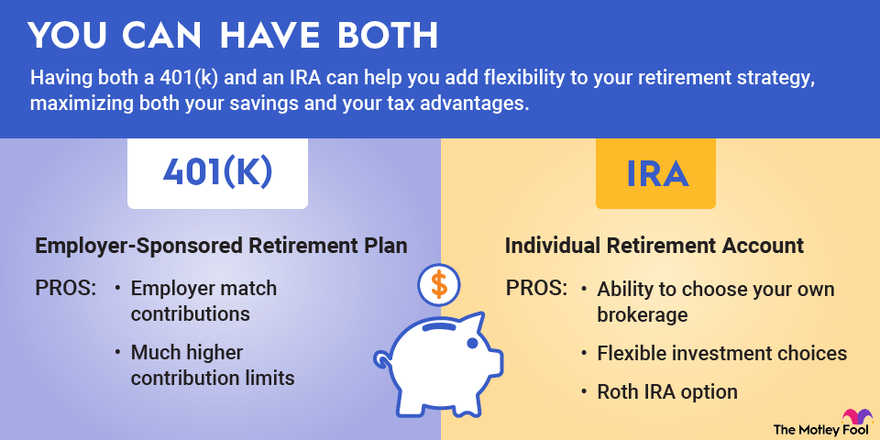

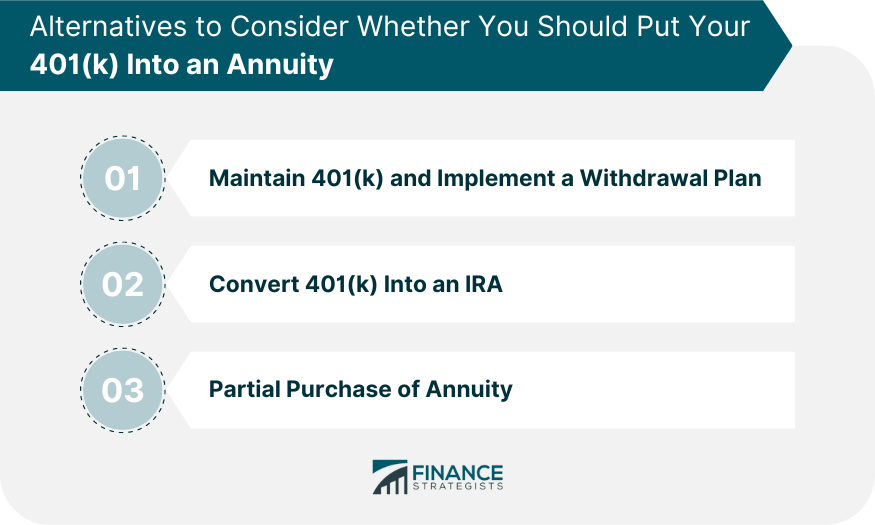

One option is to roll over the deceased spouse's 401(k) into their own IRA, either a traditional IRA or a Roth IRA, depending on the tax characteristics of the original 401(k). Another option involves the surviving spouse treating the assets as their own, essentially consolidating them into their own existing 401(k), if permitted by their employer's plan.

A further option involves a "beneficiary IRA," also known as an inherited IRA, which has specific rules for distributions. With this type of IRA, the surviving spouse typically must begin taking required minimum distributions (RMDs) based on their own life expectancy, potentially deferring taxes but not indefinitely.

The SECURE Act of 2019 significantly altered the rules for inherited retirement accounts for beneficiaries other than spouses, introducing the 10-year rule. However, these changes do not typically apply to surviving spouses who are beneficiaries.

Tax Implications and Considerations

Rollovers, in general, are not taxable events as long as the funds are moved directly from one qualified retirement account to another. This avoids triggering income tax and potential penalties.

However, it's important to be mindful of the tax implications when choosing between different options like rolling over into a Roth IRA versus a traditional IRA. Rolling over into a Roth IRA from a traditional 401(k) or IRA will trigger income tax on the amount converted, but future withdrawals will be tax-free.

Consulting with a qualified financial advisor is highly recommended to determine the best course of action based on individual circumstances and tax planning goals. Understanding the tax consequences associated with each option is essential for maximizing retirement savings and minimizing tax liabilities.

In conclusion, while directly rolling a spouse's 401(k) into your own isn't generally permissible during marriage, divorce provides a pathway through a QDRO. Inheritance also offers options for managing a deceased spouse's retirement assets. Careful planning and professional guidance are key to navigating these complexities and securing your financial future.

_into_a_Roth_IRA-1.png?width=1680&height=945&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)