Can I Use My Sezzle Virtual Card Anywhere

The allure of "buy now, pay later" (BNPL) services continues to grow, offering consumers increased flexibility in their purchasing power. Among the various players in this space, Sezzle stands out, attracting users with its promise of installment payments. However, a common question arises: just how versatile is the Sezzle virtual card?

This article explores the limitations and capabilities of using a Sezzle virtual card, clarifying where and how consumers can leverage this increasingly popular payment method. Understanding these nuances is crucial for maximizing the benefits of BNPL while avoiding potential frustration at the checkout.

Sezzle's Virtual Card: The Basics

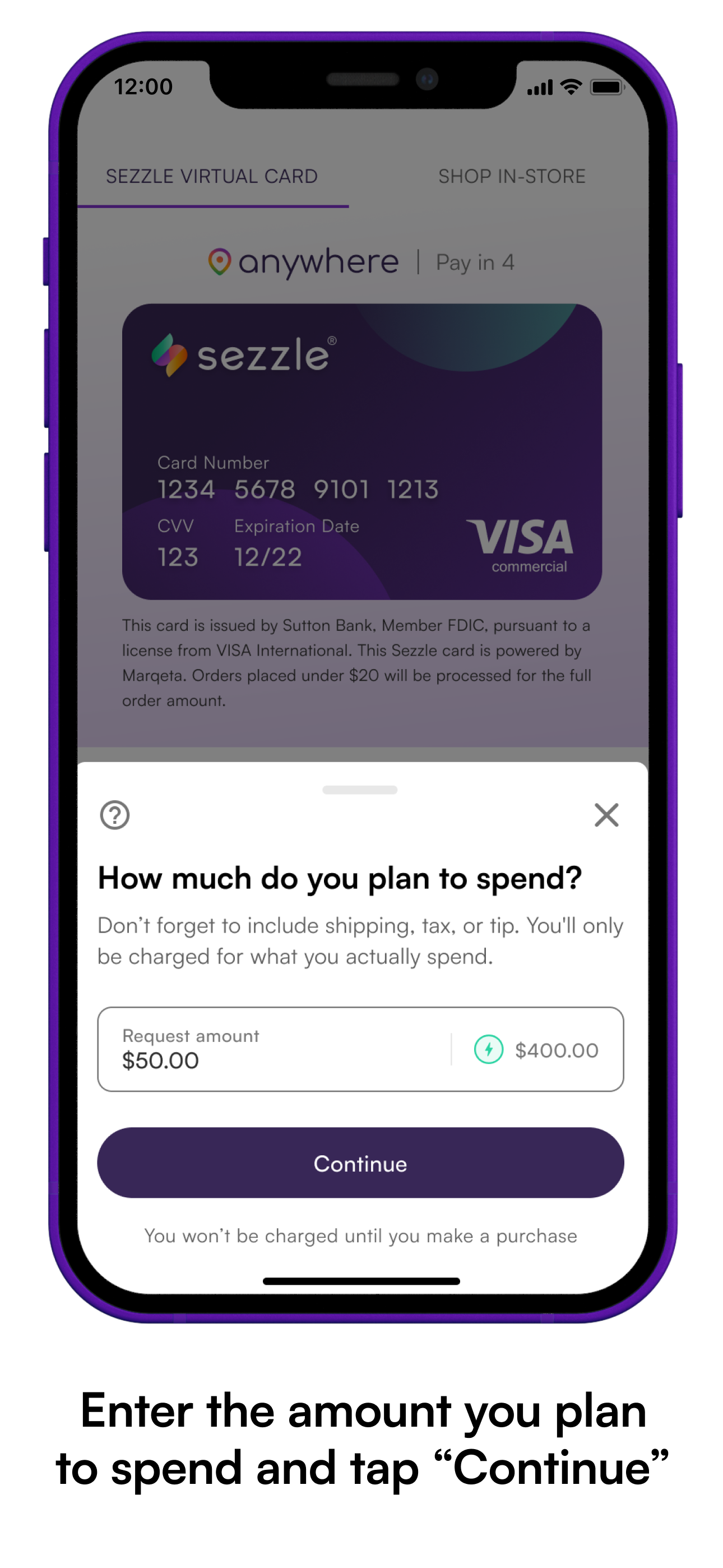

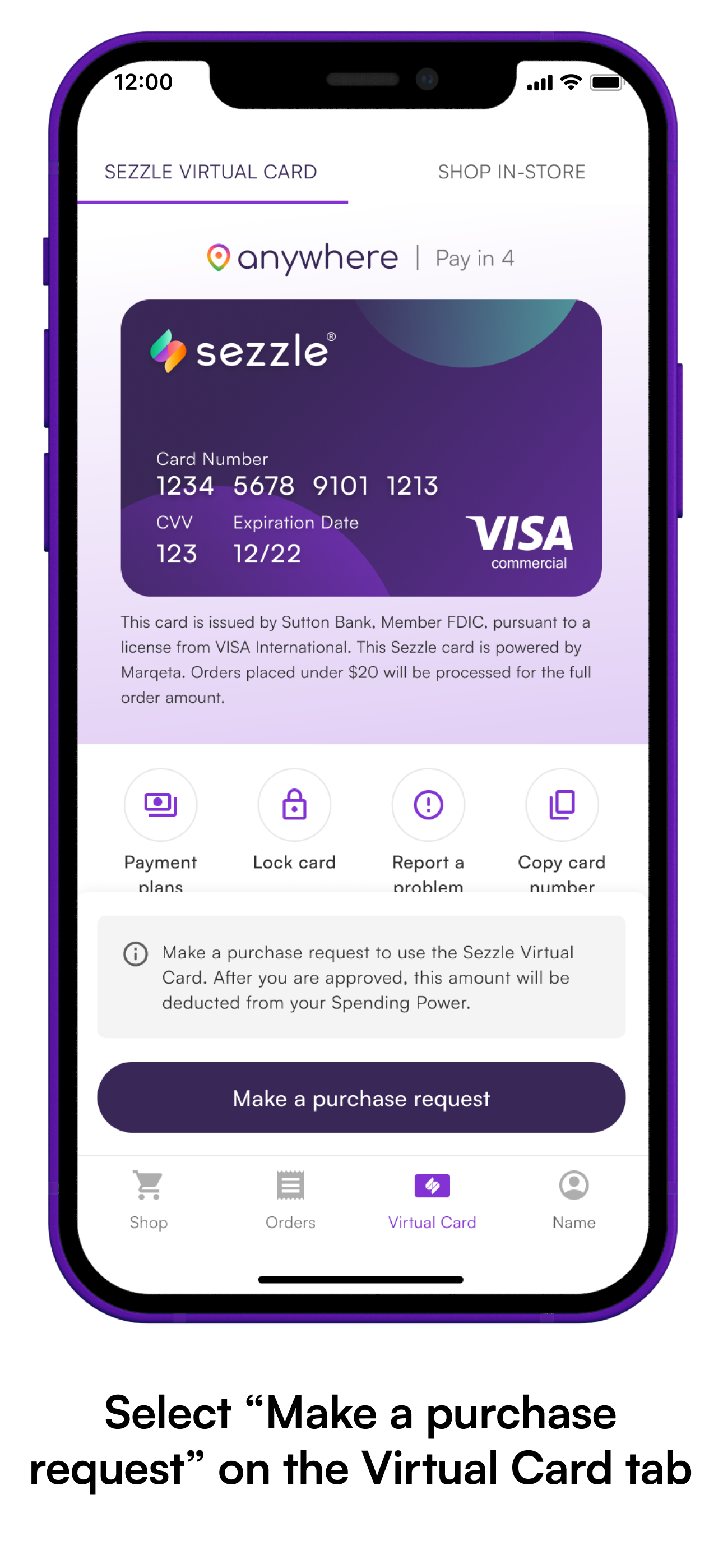

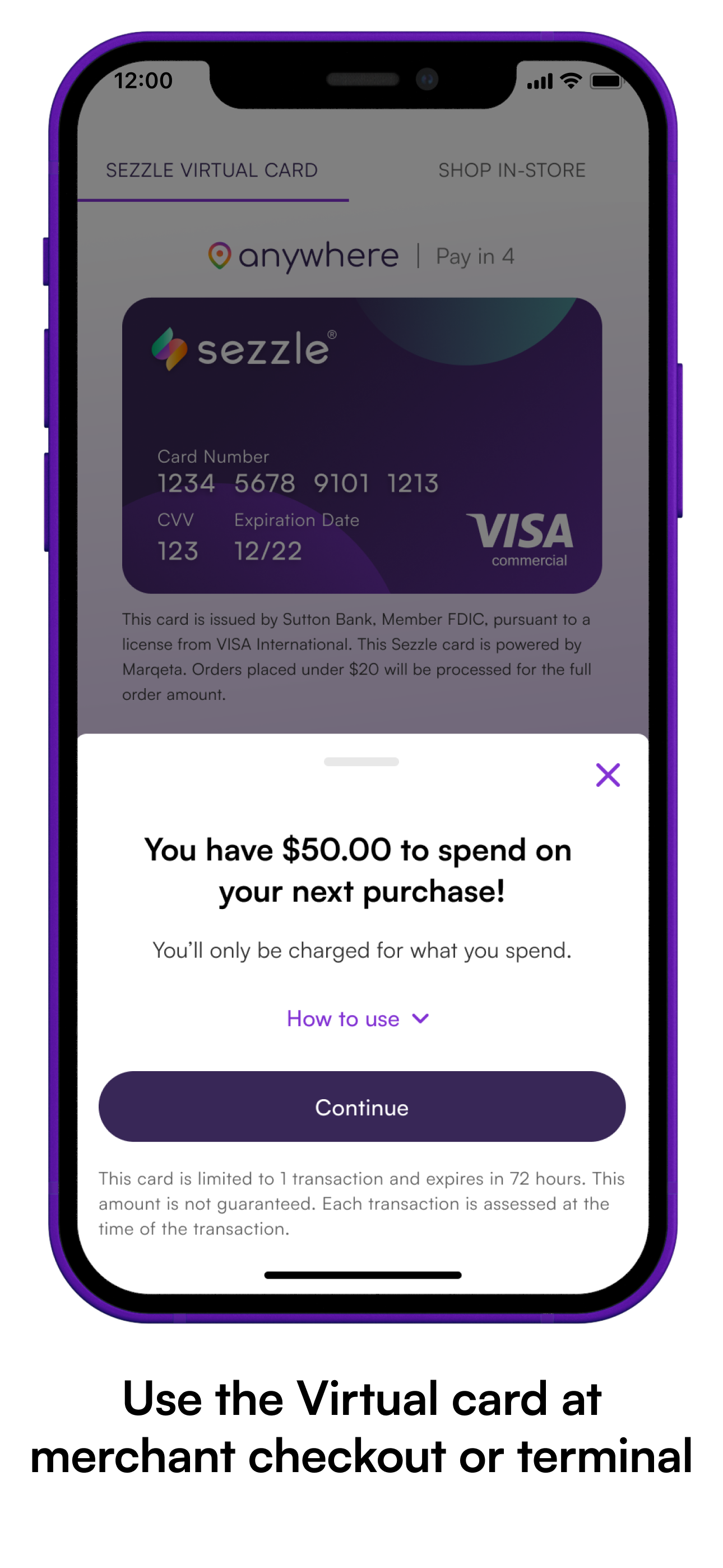

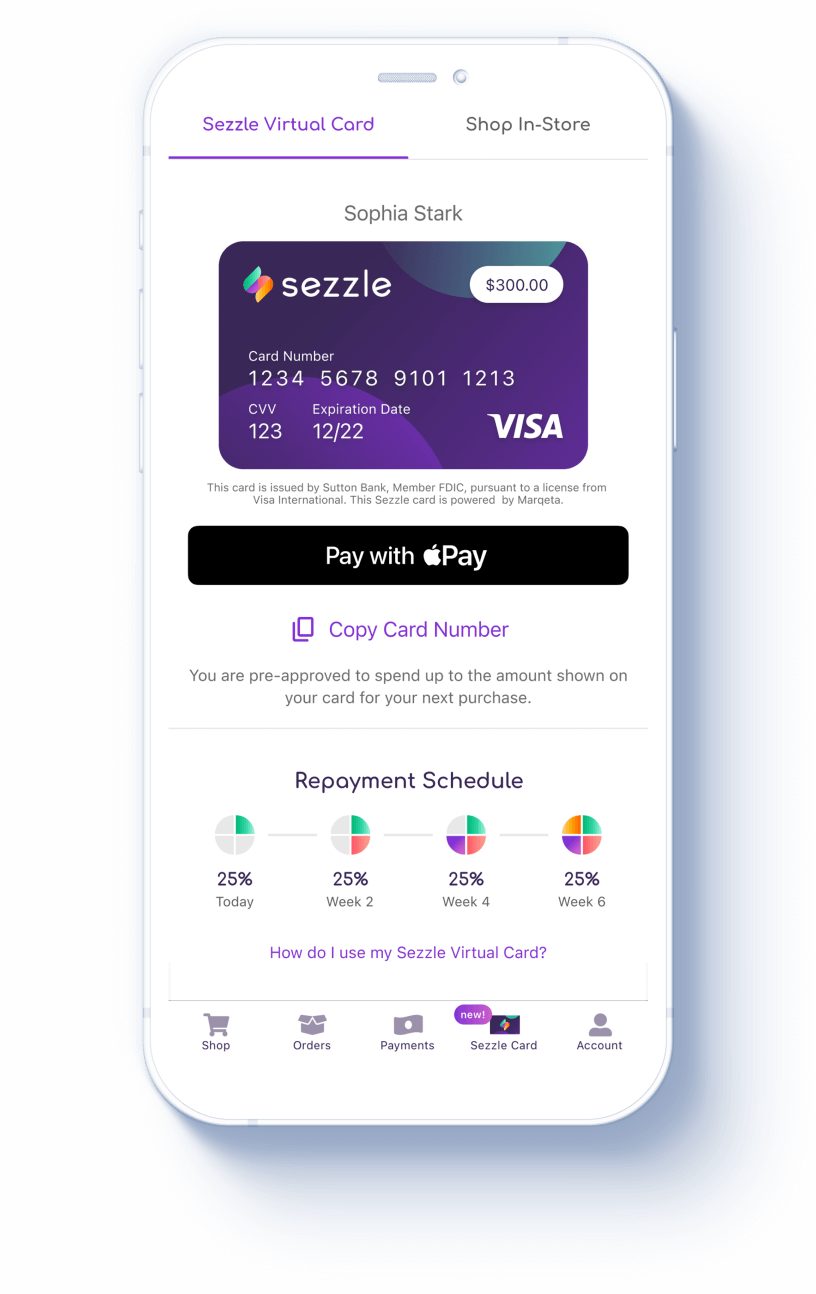

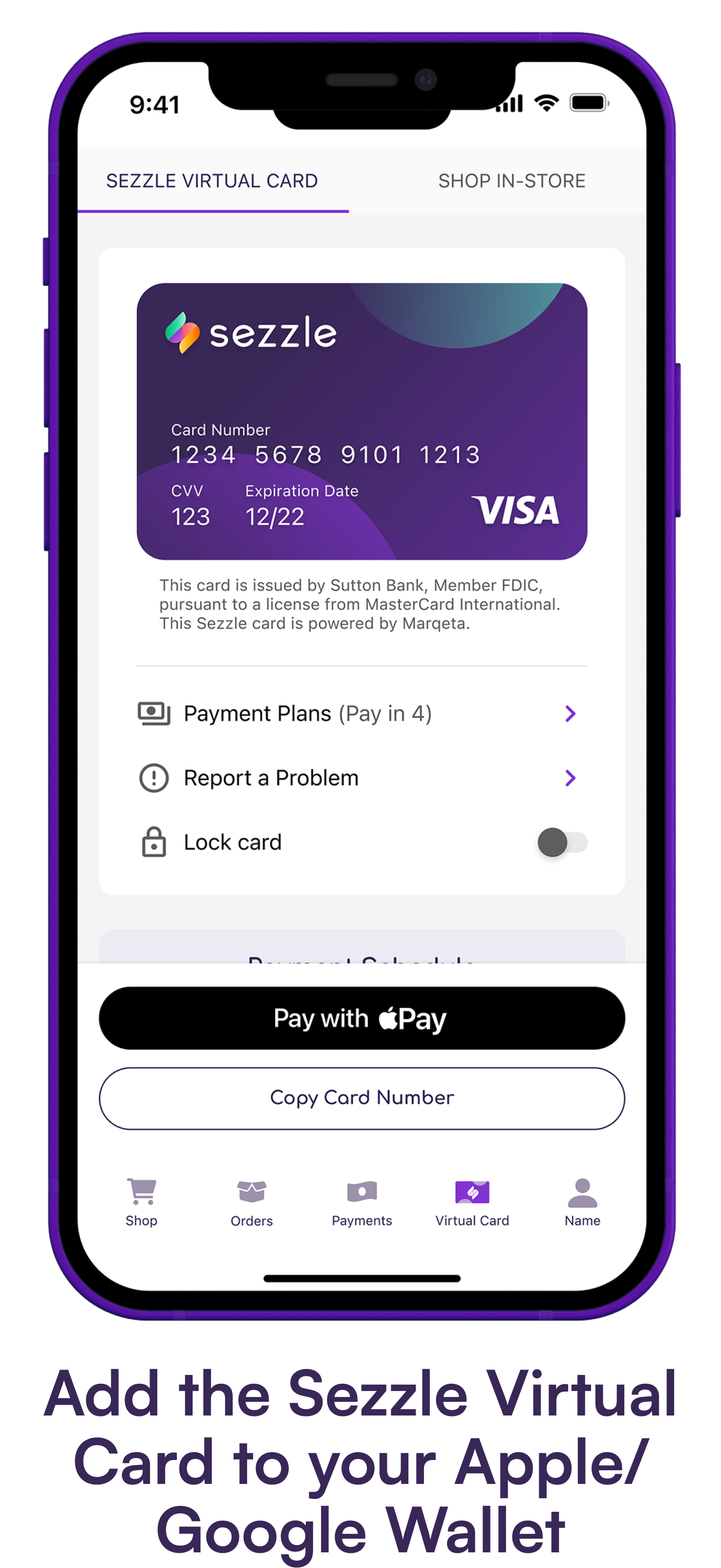

Sezzle provides users with a virtual card, accessible through their mobile app, after approval. This card functions similarly to a credit card, allowing purchases to be split into smaller installments. The key to understanding its usability lies in knowing its intended purpose.

The Sezzle virtual card is primarily designed for online transactions. It's linked to a user's Sezzle account and designated for specific online retailers that have partnered with Sezzle.

Partnered Merchants: The Primary Playground

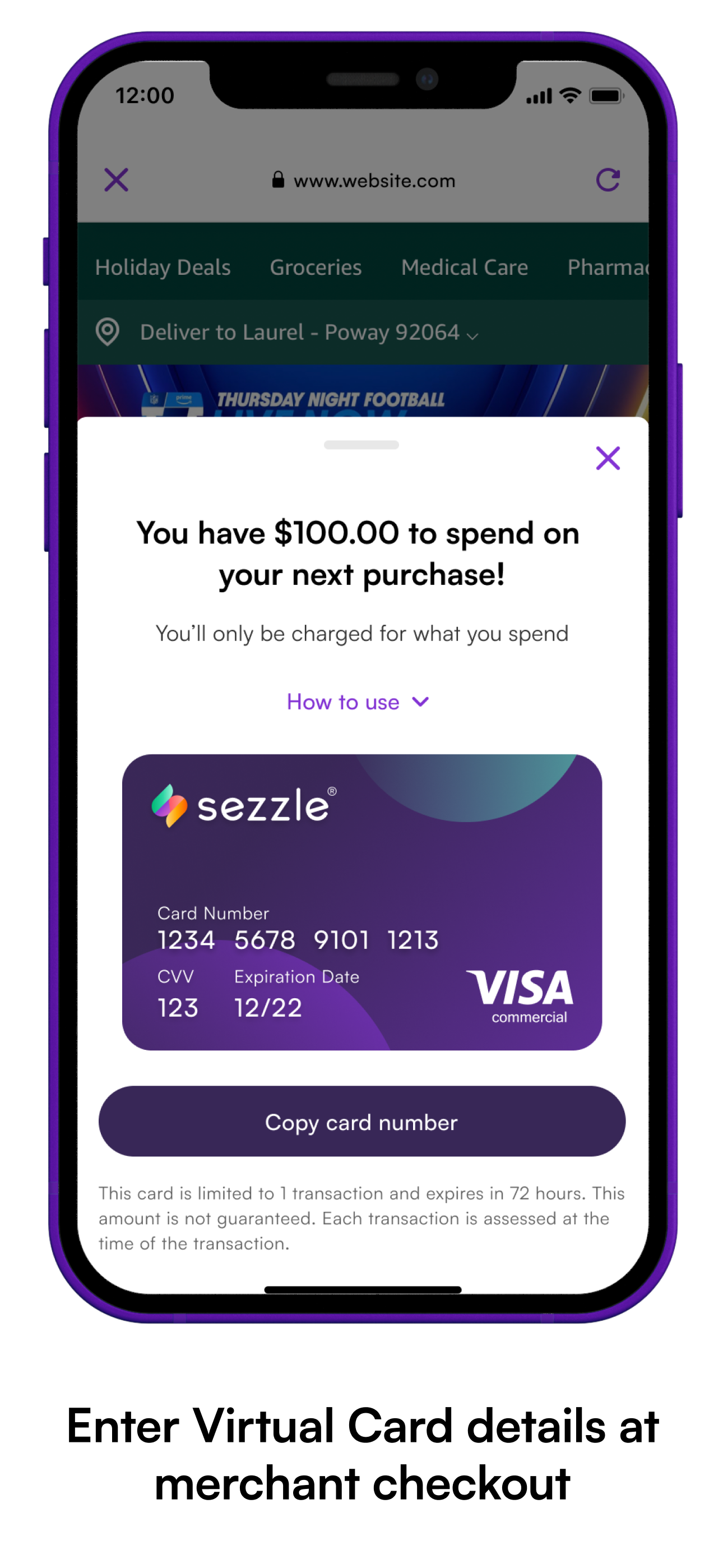

The core functionality of the Sezzle virtual card hinges on partnerships with specific online merchants. When a user initiates a purchase at a Sezzle partner store, the virtual card becomes a payment option at checkout.

Sezzle's website and app provide a directory of participating retailers. This directory should be consulted before attempting to use the virtual card.

Finding Participating Merchants

Navigating the list of Sezzle merchants is relatively straightforward. Users can search by category, keyword, or browse a curated list of popular stores.

The Sezzle app also often highlights new additions to the merchant network. Regularly checking the app can uncover new opportunities to use the virtual card.

Can I Use My Sezzle Virtual Card Anywhere Online?

The short answer is no. Unlike a traditional credit card, the Sezzle virtual card is not universally accepted online.

Its usability is restricted to merchants that have explicitly integrated Sezzle as a payment option.

What About Physical Stores?

Currently, Sezzle's primary focus is on online transactions. The Sezzle virtual card is generally not designed for use in brick-and-mortar stores.

While there may be exceptions depending on specific merchant agreements, these are rare. Consumers should not assume the virtual card will work at a physical point of sale.

Potential Future Developments

The BNPL landscape is constantly evolving. It is conceivable that Sezzle might expand its functionality to include broader acceptance in the future.

Such expansion could involve partnerships with payment networks to enable in-store use or wider online acceptance. However, as of now, these developments remain speculative.

Staying Informed

The best way to stay informed about Sezzle's functionality is to regularly consult their official website and app. Sezzle frequently updates its terms of service, merchant directory, and features.

Following Sezzle's official social media channels can also provide timely updates and announcements.

The Bottom Line

The Sezzle virtual card offers a convenient way to split online purchases into manageable installments. Its utility is limited to participating online merchants.

Users should confirm that a retailer is a Sezzle partner before attempting to use the virtual card. Understanding these limitations is key to a positive BNPL experience.