Can I Use Sezzle On Paypal

Imagine this: you're browsing your favorite online store, eyeing that perfect dress or the gadget you've been saving up for. The price tag stings a little, but your excitement outweighs the hesitation. Then, you see the familiar logos at checkout: PayPal, a trusted friend, and Sezzle, promising to break down the cost into manageable installments. A wave of relief washes over you. But a question lingers: can these two work together to make your shopping dreams a reality?

The burning question many shoppers have is whether they can combine the convenience of PayPal with the buy-now-pay-later (BNPL) flexibility of Sezzle. Unfortunately, the direct answer is generally no. While both offer ways to manage payments, they don't typically integrate to allow you to use Sezzle to pay through PayPal's platform or vice versa.

Understanding Sezzle and PayPal

Let's take a closer look at what each of these platforms offers.

PayPal is a global online payment system that allows users to send and receive money securely. It acts as a digital wallet, storing your bank account and credit card information, so you don't have to share it with every online merchant.

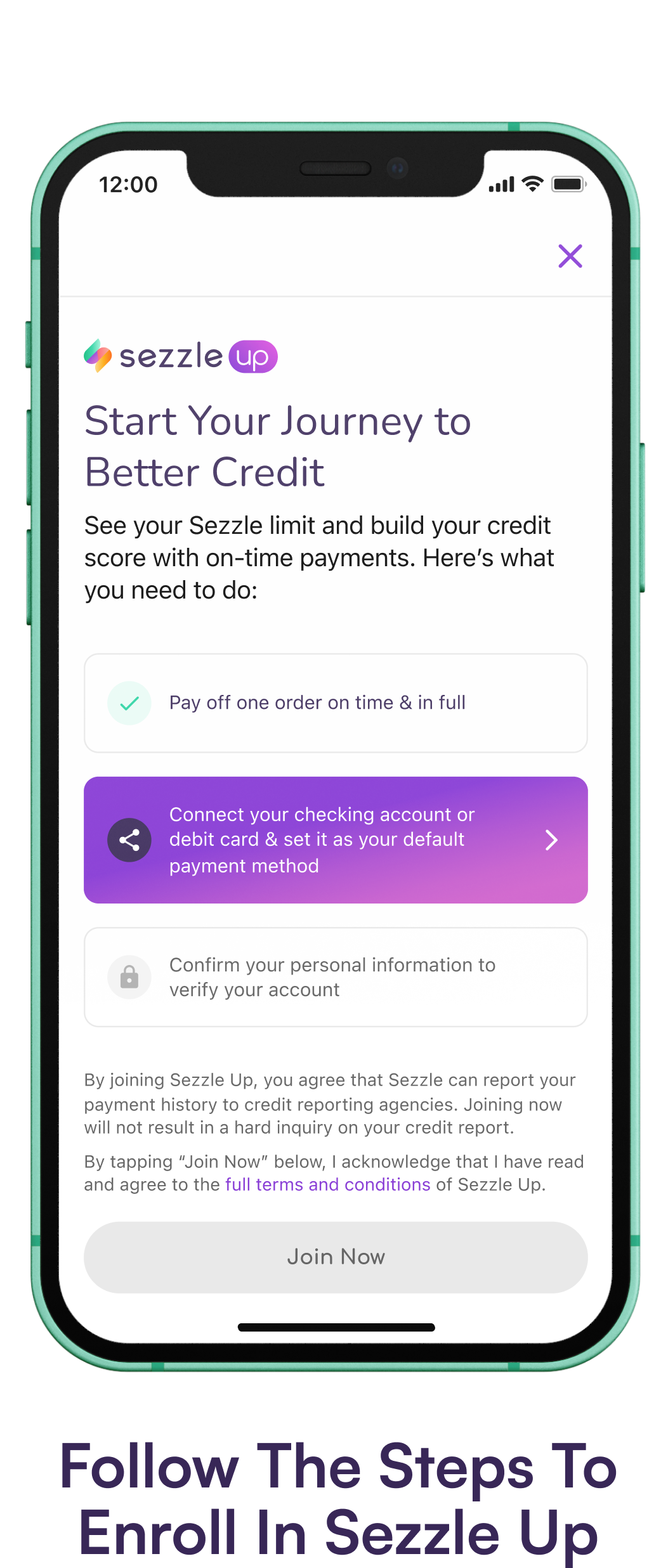

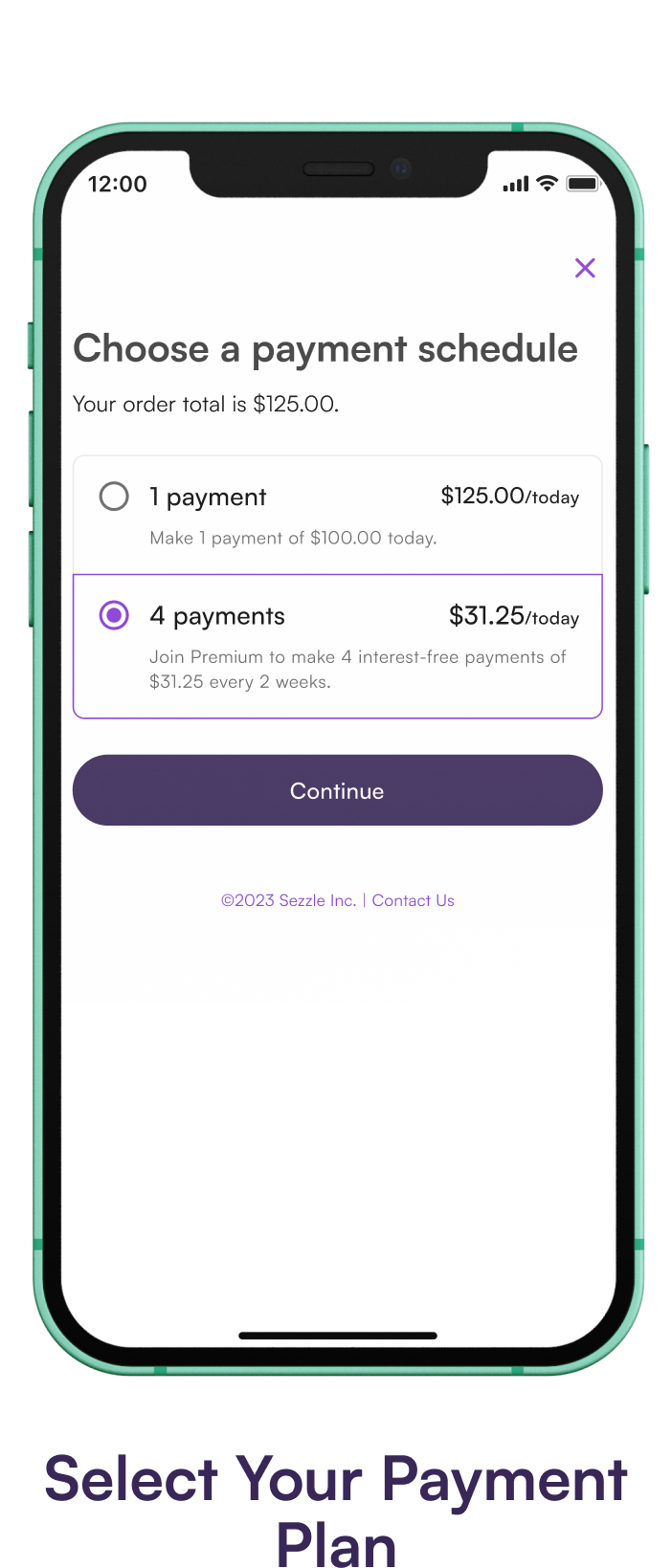

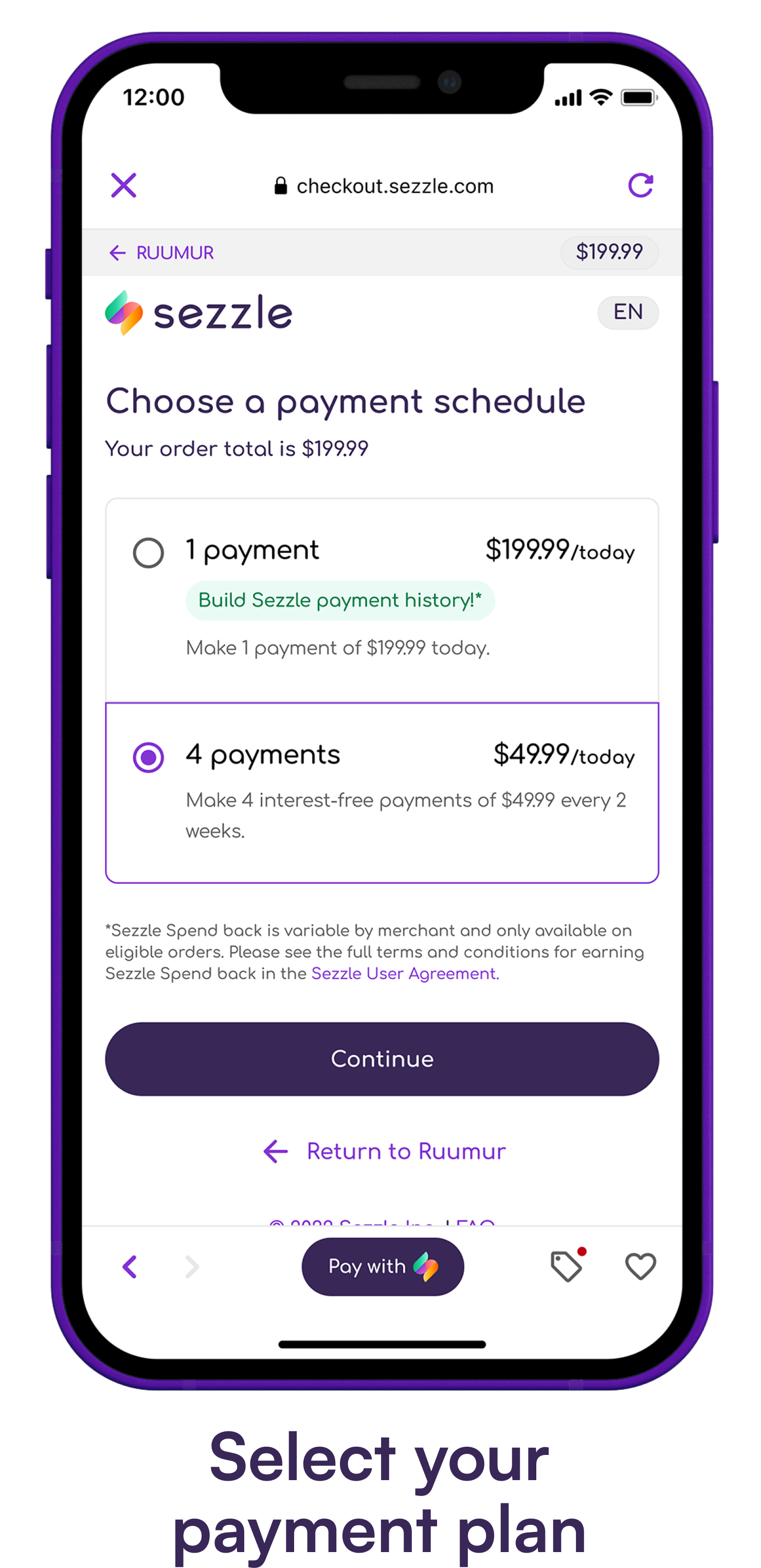

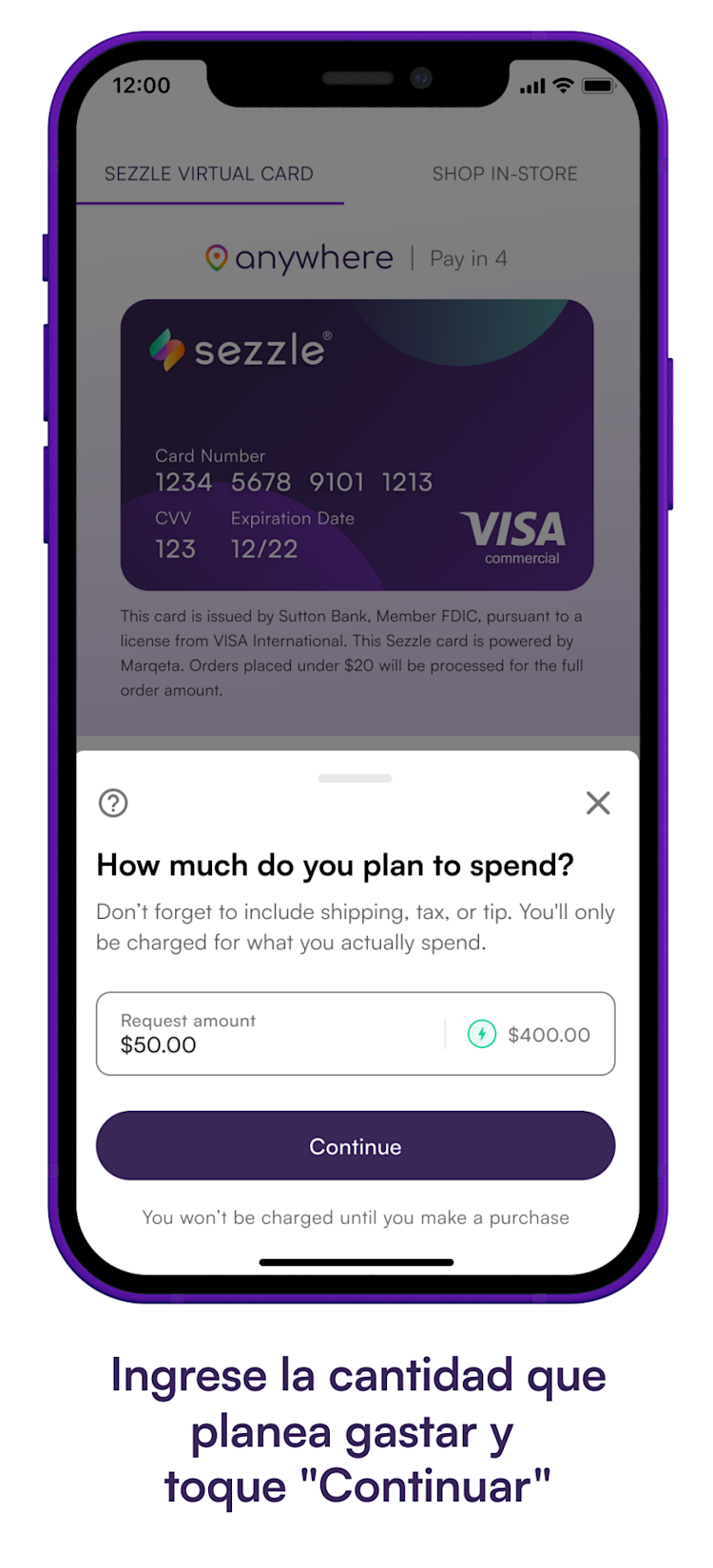

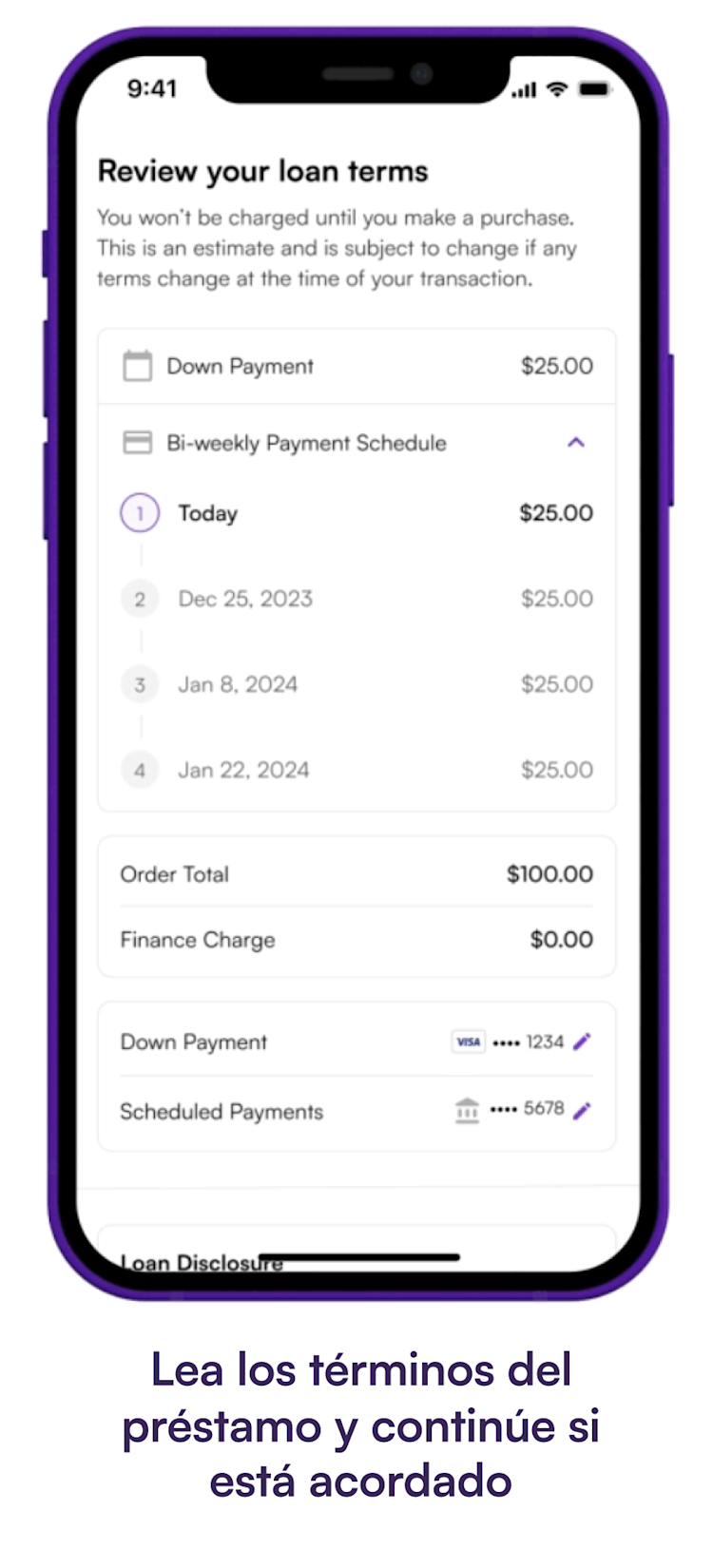

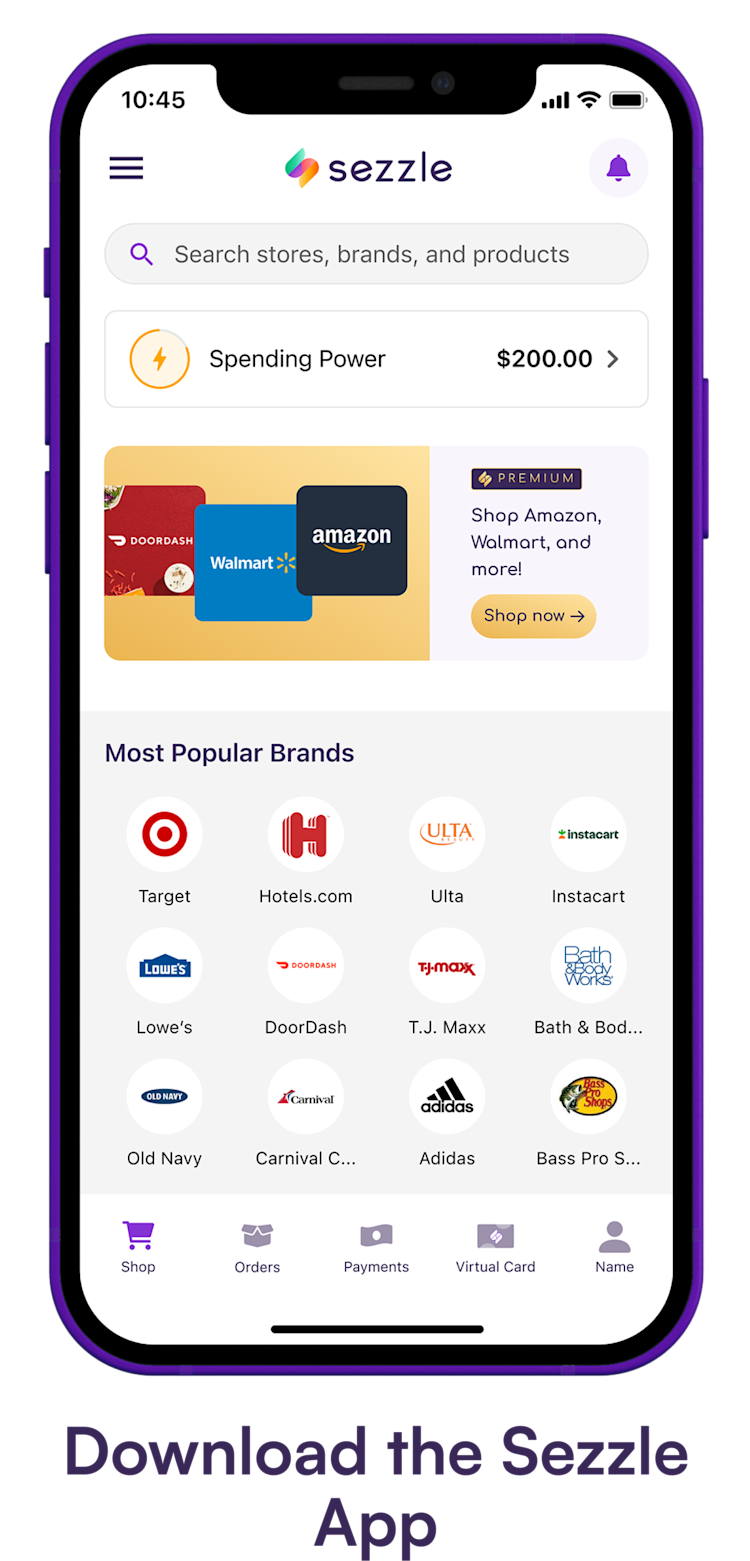

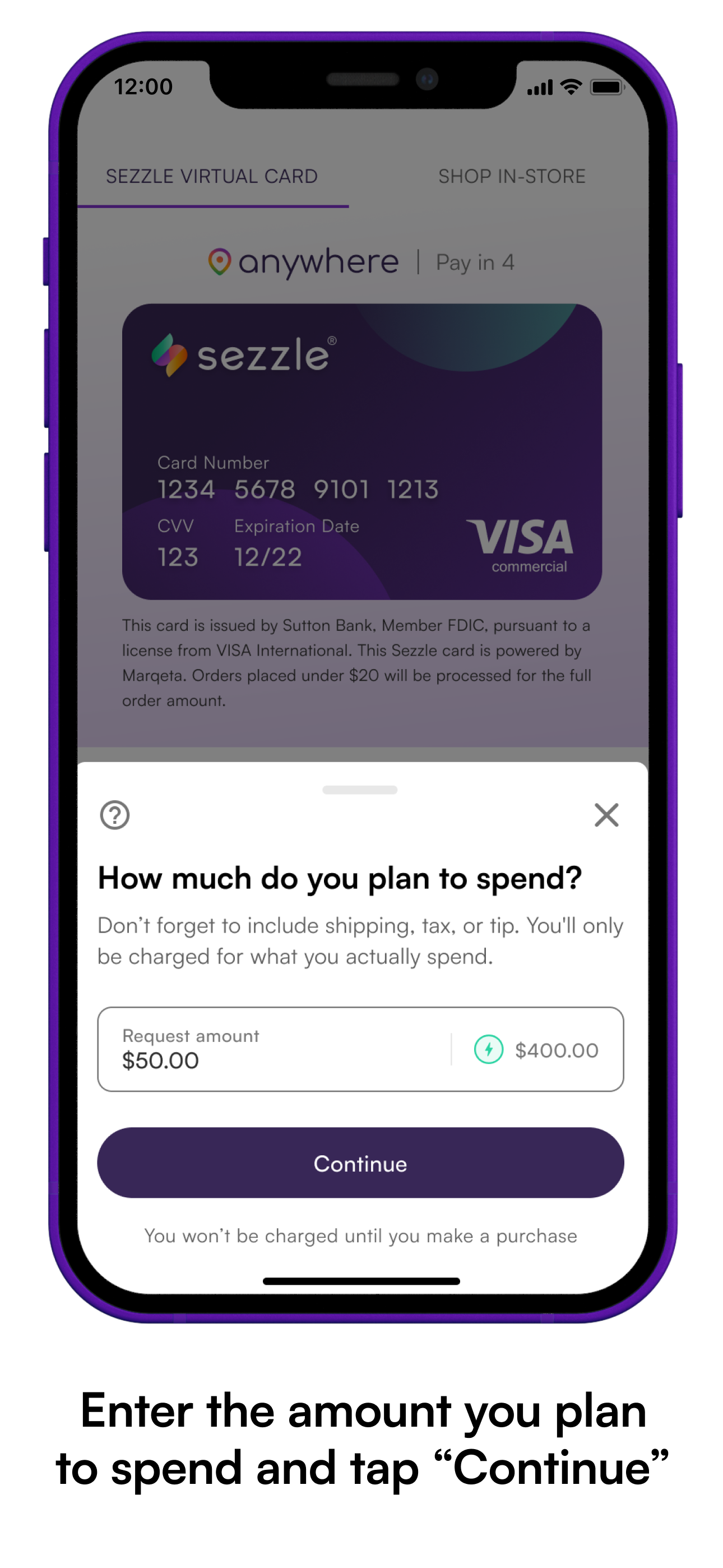

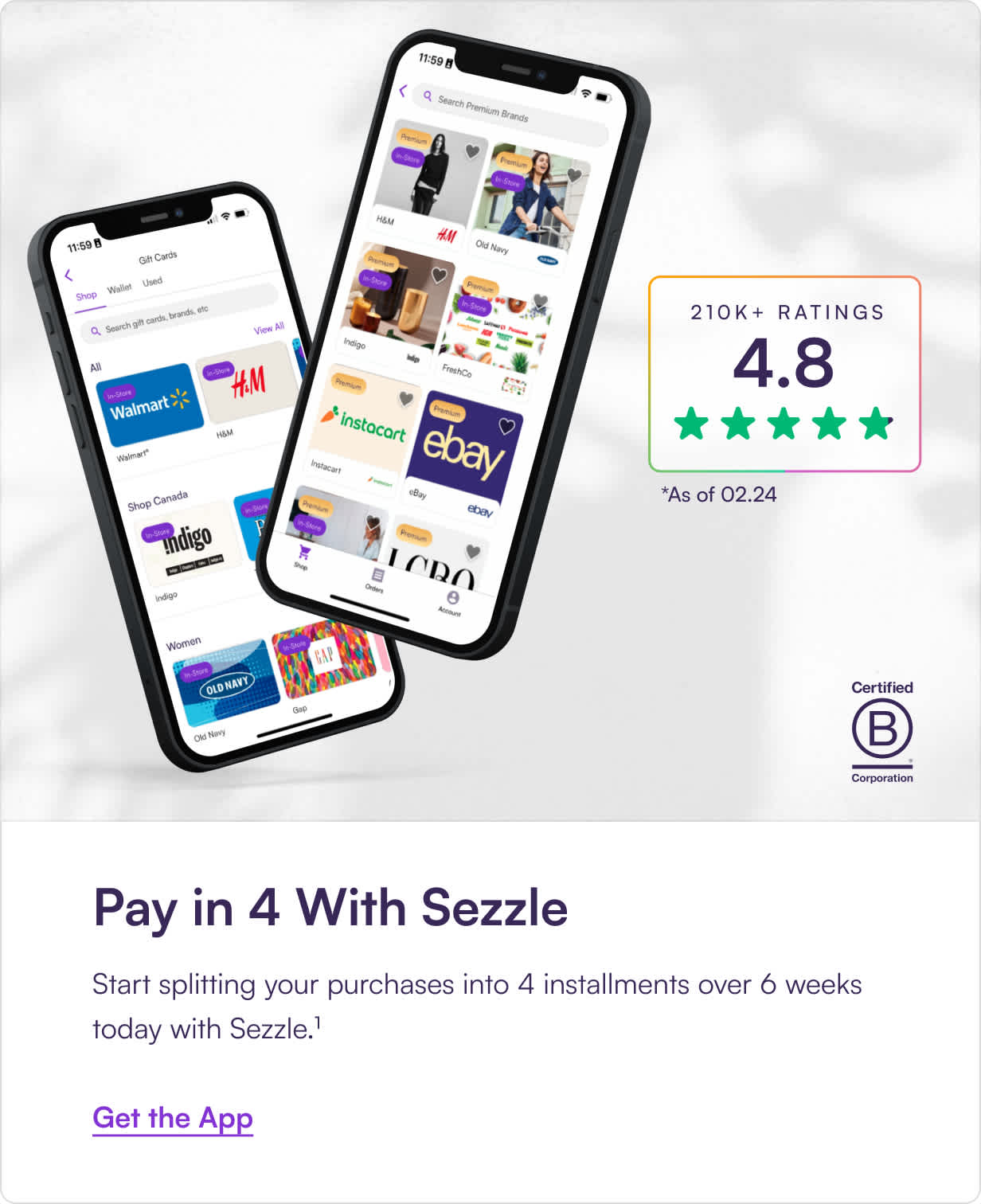

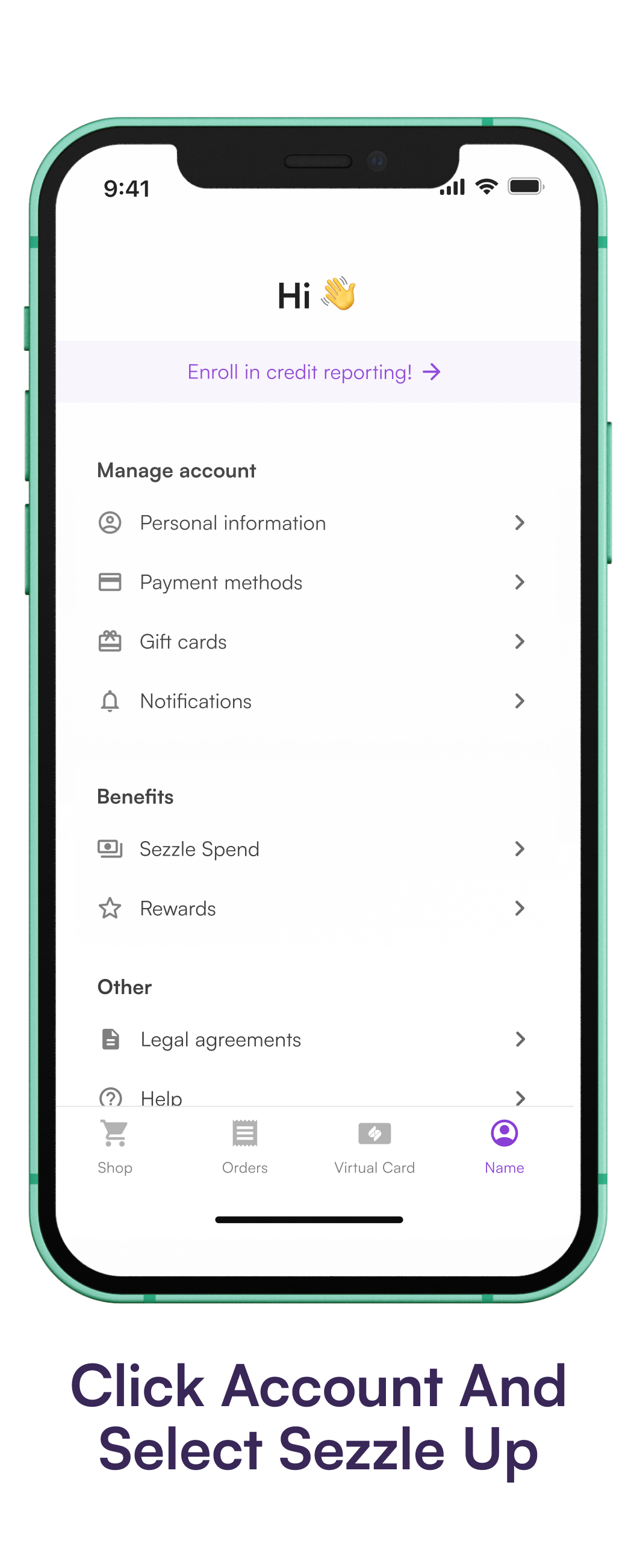

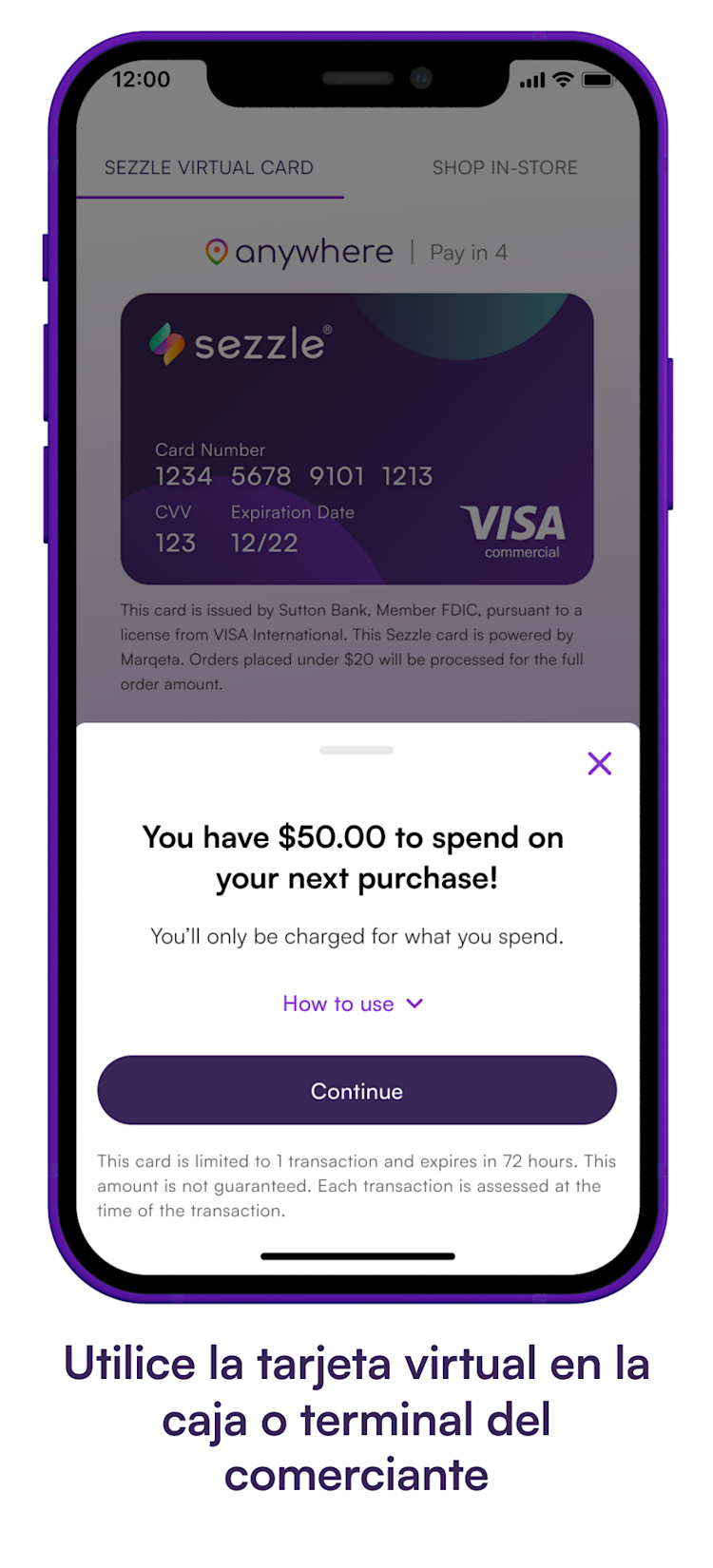

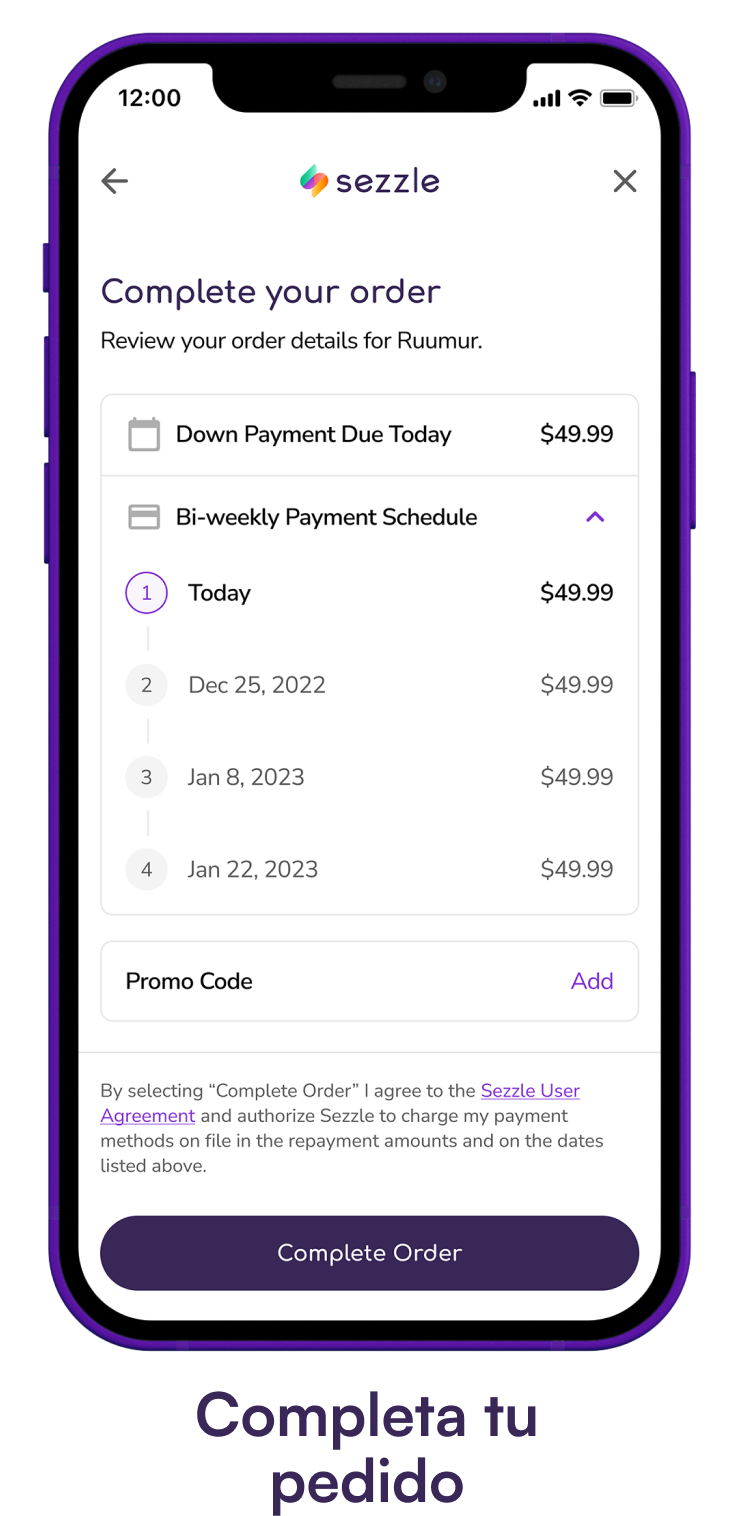

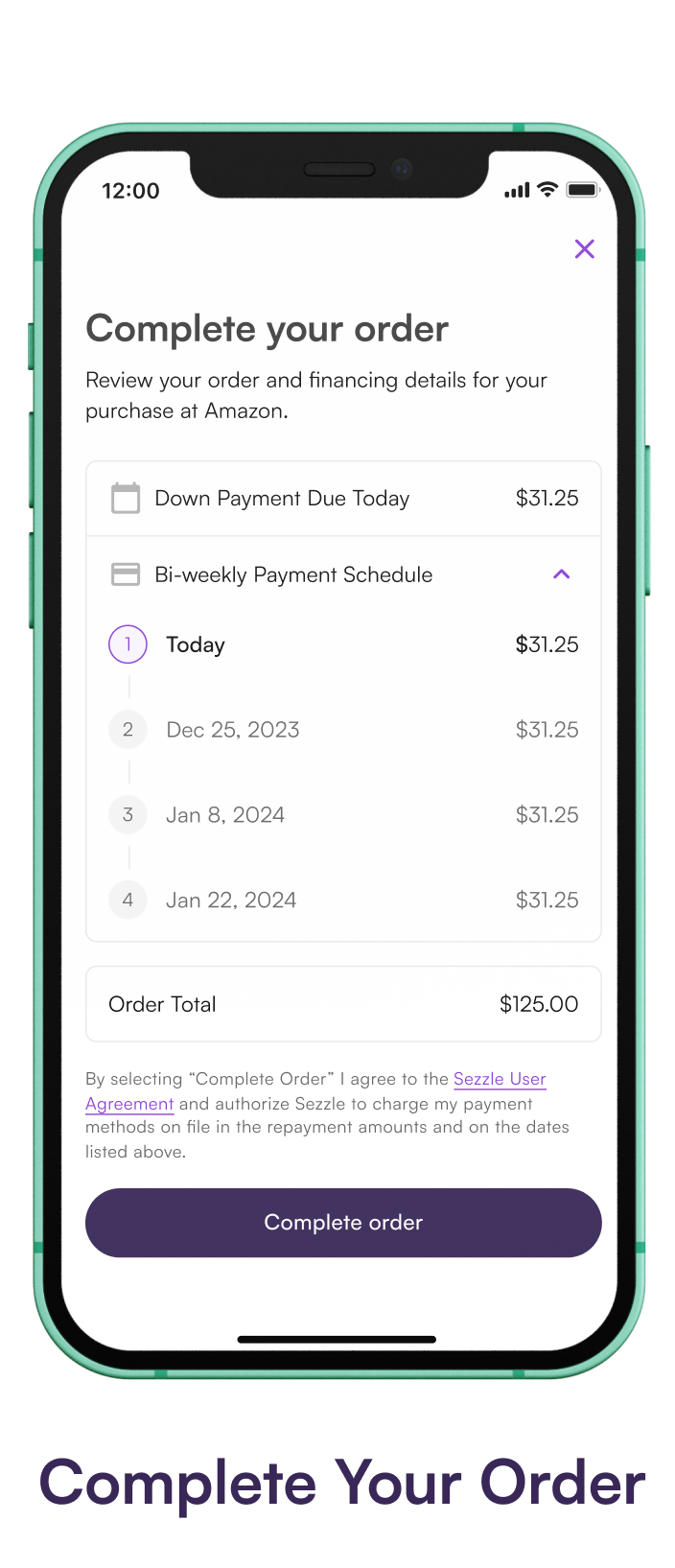

Sezzle, on the other hand, is a BNPL service that lets you split your purchases into four interest-free installments over six weeks. It approves or declines you based on an internal scoring system and when approved, it allows for purchases while paying in installments.

Why the Lack of Direct Integration?

The primary reason for the absence of direct integration lies in the business models of PayPal and Sezzle.

They are, in a way, competitors. PayPal offers its own installment payment options, such as "Pay in 4," which directly competes with Sezzle and similar BNPL services. Therefore, supporting direct integration with competitors would undermine PayPal's own offerings.

Technical and contractual agreements are another hurdle. Integrating two distinct payment systems requires significant technical collaboration and legal agreements, which may not always be feasible or mutually beneficial for both companies.

Exploring Alternative Solutions

While a direct Sezzle-PayPal link might not be possible, there are alternative ways to potentially achieve a similar outcome.

One workaround is to use a credit card that offers rewards or cashback through PayPal and then use that card with Sezzle. This effectively lets you leverage PayPal's rewards while enjoying Sezzle's installment plan.

Another option is to simply choose merchants that directly offer both PayPal and Sezzle as separate payment options at checkout. This allows you to select the payment method that best suits your needs for each purchase.

Looking at Merchant Partnerships

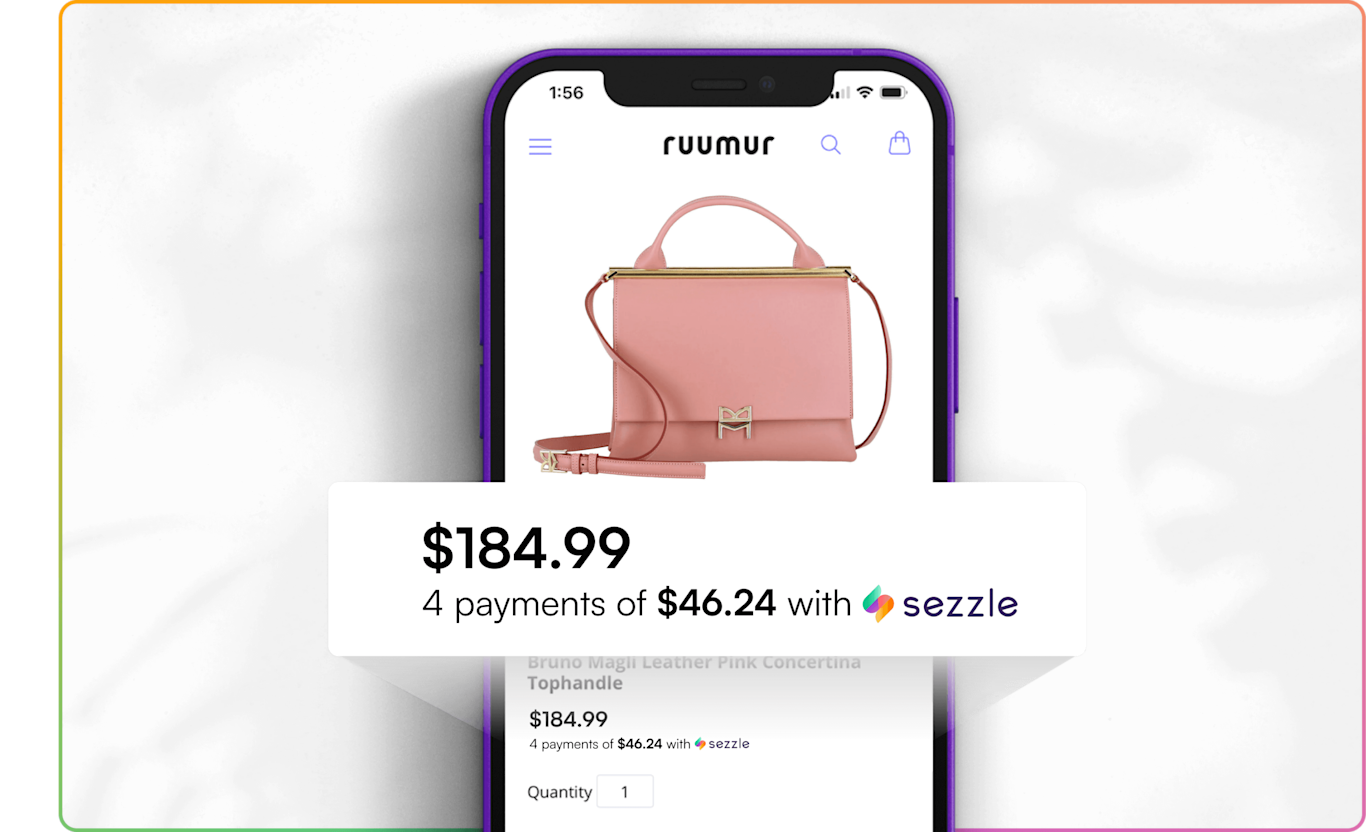

The availability of Sezzle often depends on the individual merchant's partnerships and integrations.

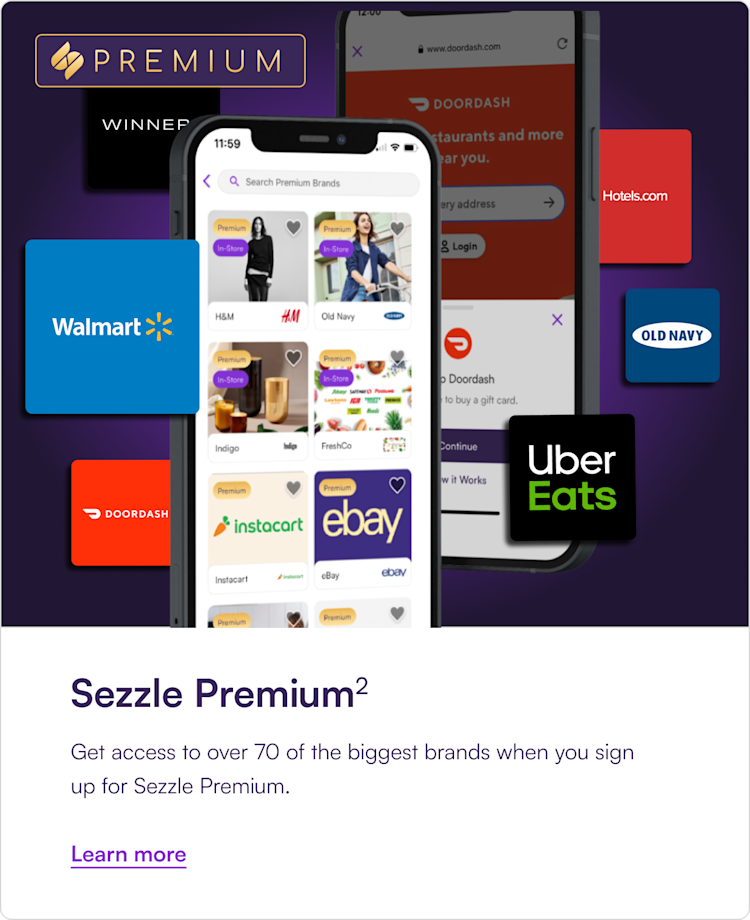

Many online retailers are now partnering with multiple BNPL providers, including Sezzle, to offer customers more flexible payment options. Check directly with the store to see if it is an option when checking out.

It's always worth checking a merchant's website or contacting their customer service to confirm the available payment methods before making a purchase.

The Rise of Buy-Now-Pay-Later

The popularity of BNPL services like Sezzle has surged in recent years, especially among younger consumers.

According to a report by Statista, the global BNPL market is projected to reach $680 billion in transaction value by 2025. This rapid growth reflects a changing consumer preference for flexible and accessible payment options.

Several factors are driving this trend, including increased online shopping, a desire to avoid high-interest credit card debt, and the convenience of spreading out payments over time.

Responsible Use of BNPL Services

While BNPL services can be a convenient way to manage expenses, it's crucial to use them responsibly.

The Financial Consumer Agency of Canada (FCAC) has cautioned users to be aware of the terms and conditions of BNPL agreements, including any late fees or potential impacts on credit scores. Overspending and relying too heavily on BNPL can lead to debt accumulation.

Always ensure you can comfortably afford the installment payments before committing to a BNPL plan. Budgeting and careful financial planning are essential to avoid falling into a debt trap.

The Future of Payments

The payment landscape is constantly evolving, with new technologies and business models emerging all the time.

We may see more collaborations and integrations between different payment platforms in the future, but for now, understanding the limitations and alternatives is key to making informed purchasing decisions.

Innovation within the financial sector means options like PayPal and Sezzle are continually updated. Stay up to date on current offerings by consulting the platform’s official websites.

In Conclusion

While a direct Sezzle-PayPal integration isn't currently available, the world of online payments offers numerous ways to achieve similar flexibility and convenience. By exploring alternative solutions, staying informed about merchant partnerships, and using BNPL services responsibly, you can navigate the payment landscape with confidence.

Remember to prioritize financial well-being and make informed choices that align with your budget and spending habits. Happy shopping!