Can I Use Sezzle To Pay Bills

Imagine this: The stack of bills on your kitchen counter seems to grow taller each week, looming over you like a financial Everest. Rent, utilities, that lingering medical expense – they all demand attention, and your paycheck feels like it vanishes the moment it arrives. You’ve heard whispers about “buy now, pay later” services, but could they possibly be the answer to managing these essential, recurring expenses? Could a platform like Sezzle truly offer a lifeline when facing the monthly bill onslaught?

This article explores whether you can use Sezzle to pay your bills. We will examine the platform’s functionalities, limitations, and explore alternative solutions for managing your financial obligations.

Understanding Sezzle and Buy Now, Pay Later

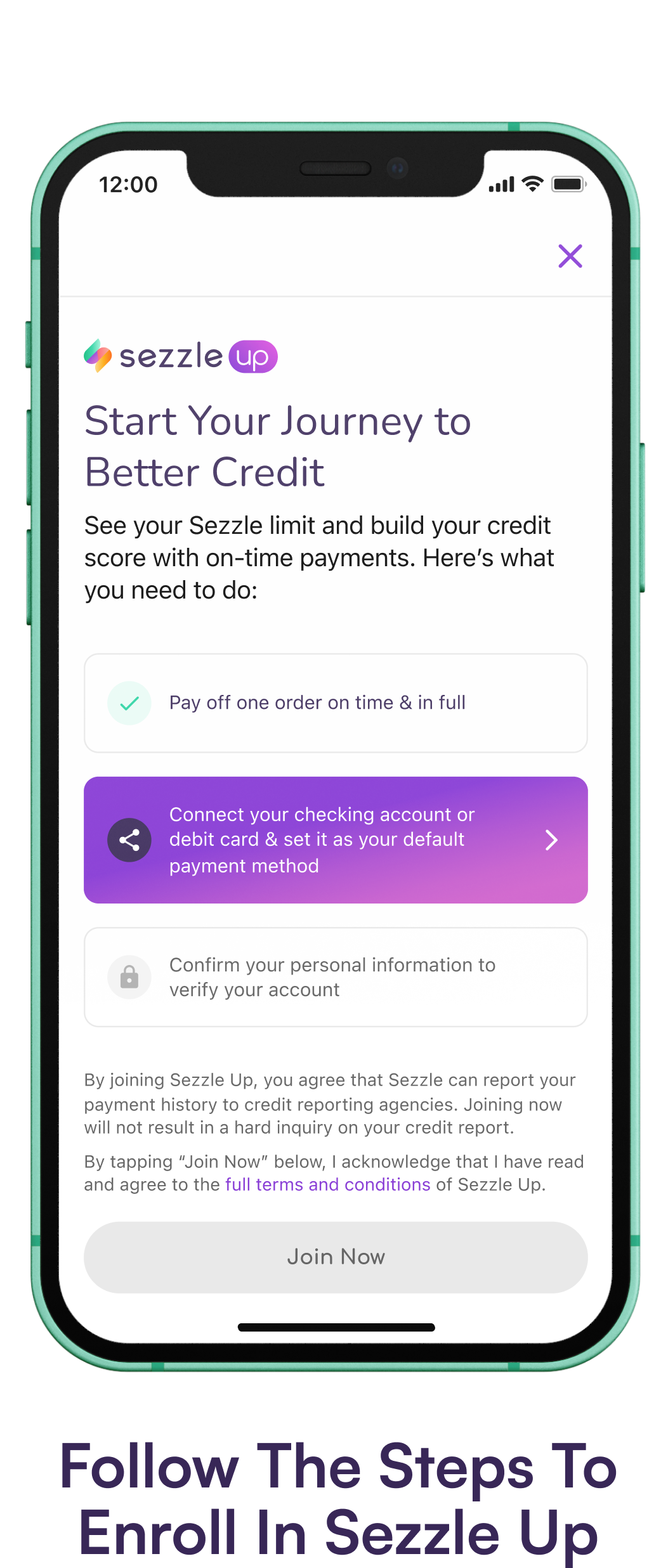

Sezzle, like other Buy Now, Pay Later (BNPL) services, has surged in popularity as a way to spread out the cost of purchases over time.

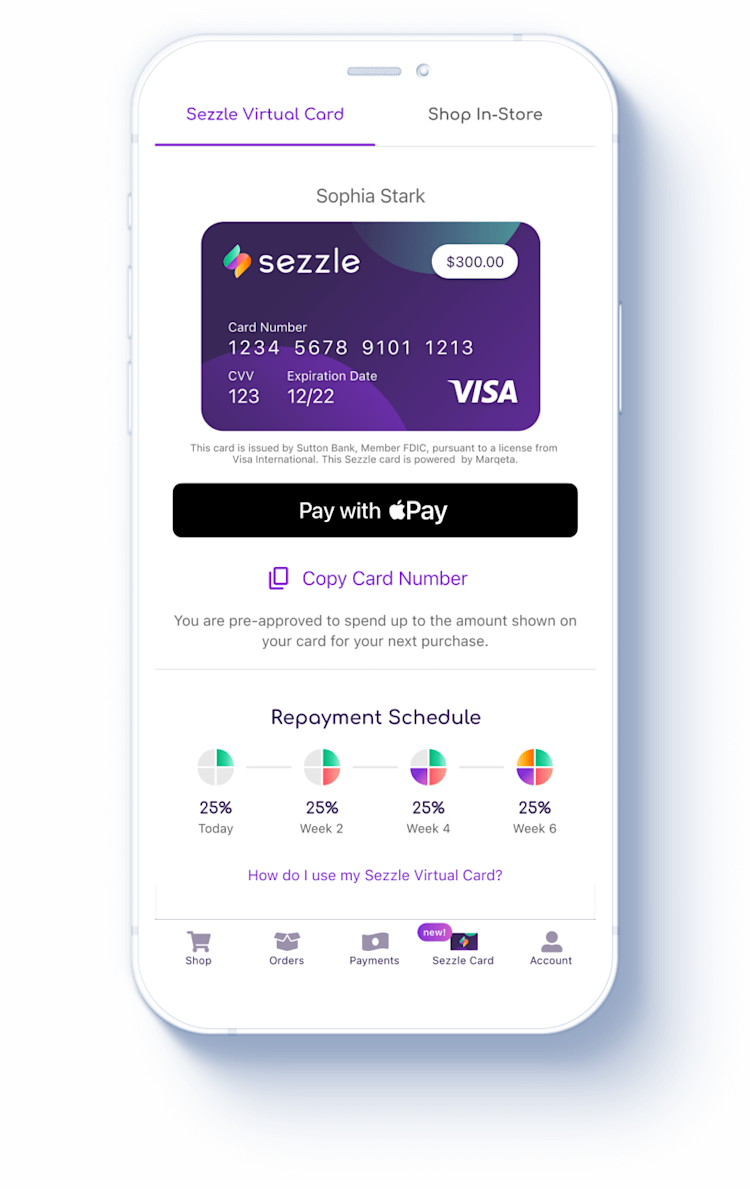

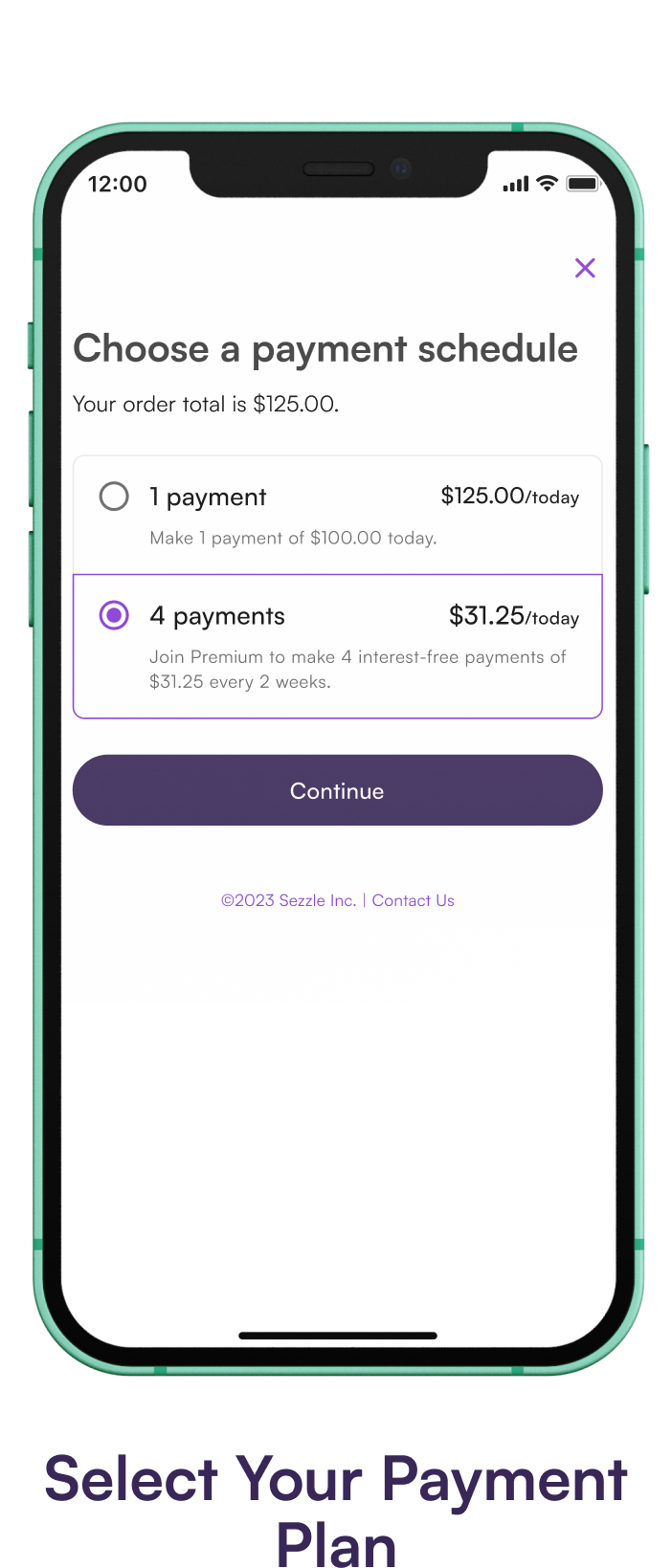

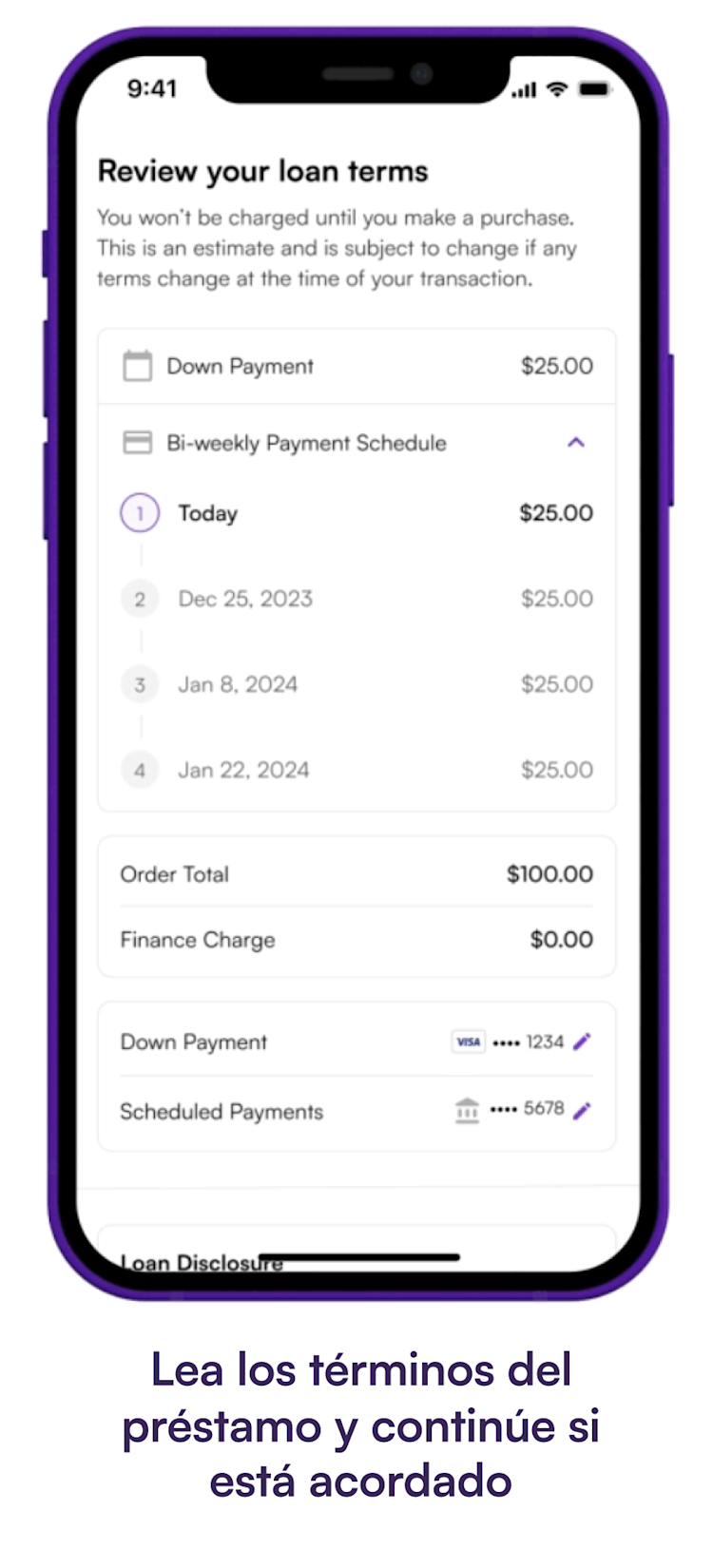

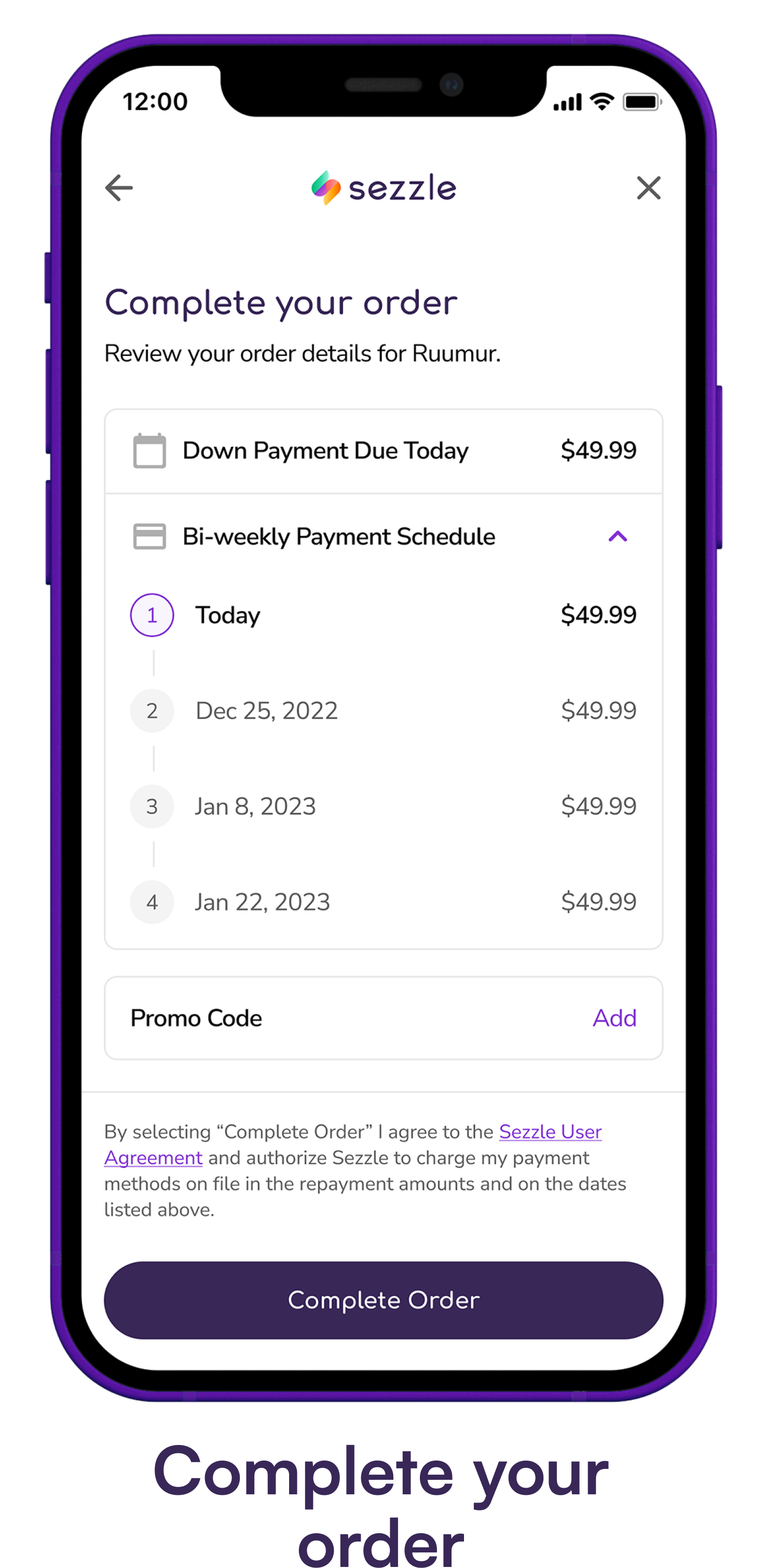

The core concept is simple: you make an initial payment at the time of purchase, and then pay the remaining balance in installments, typically over a few weeks.

This allows consumers to acquire goods and services without paying the full price upfront, making it an attractive option for budgeting and managing cash flow.

How Sezzle Typically Works

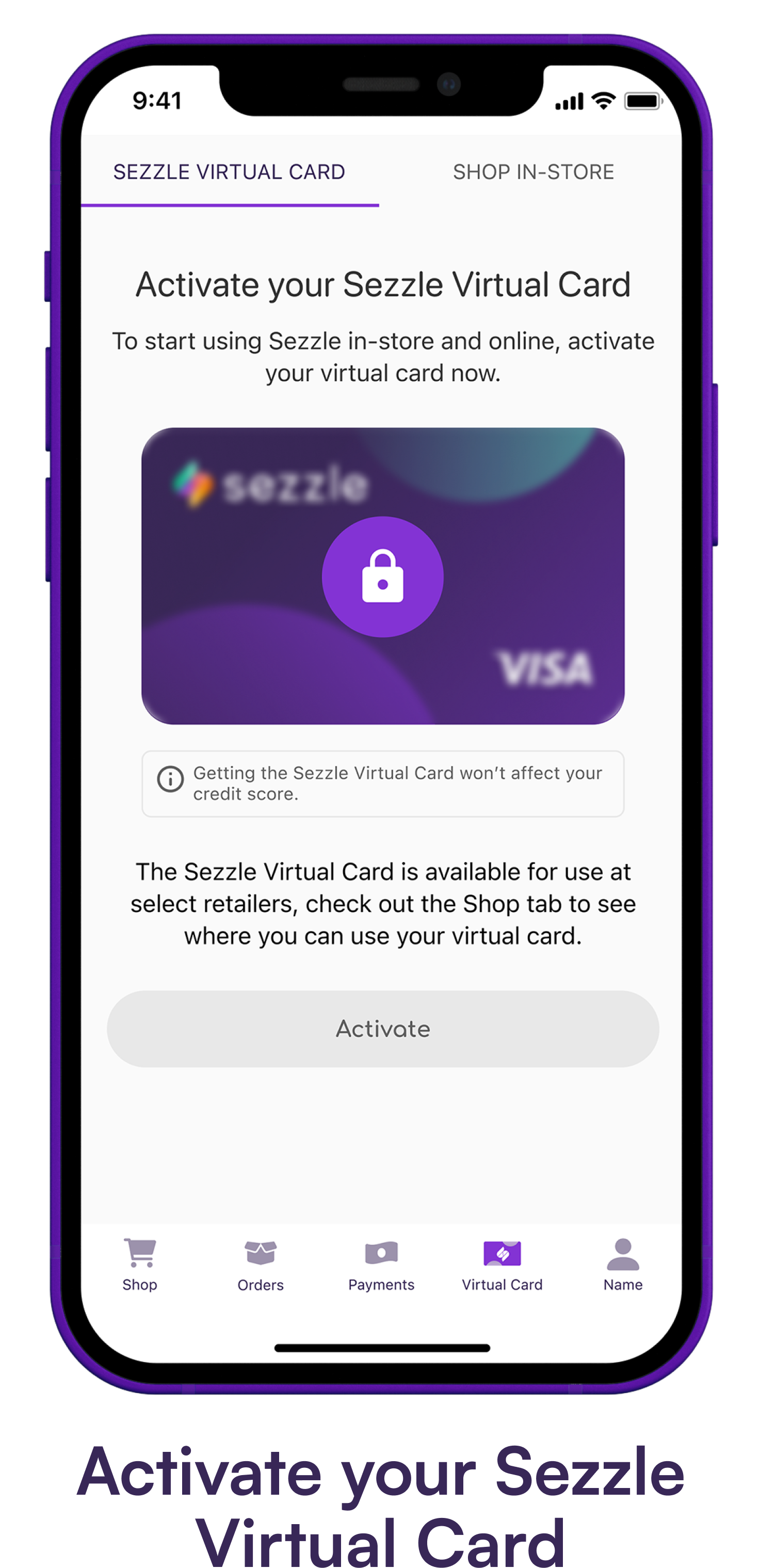

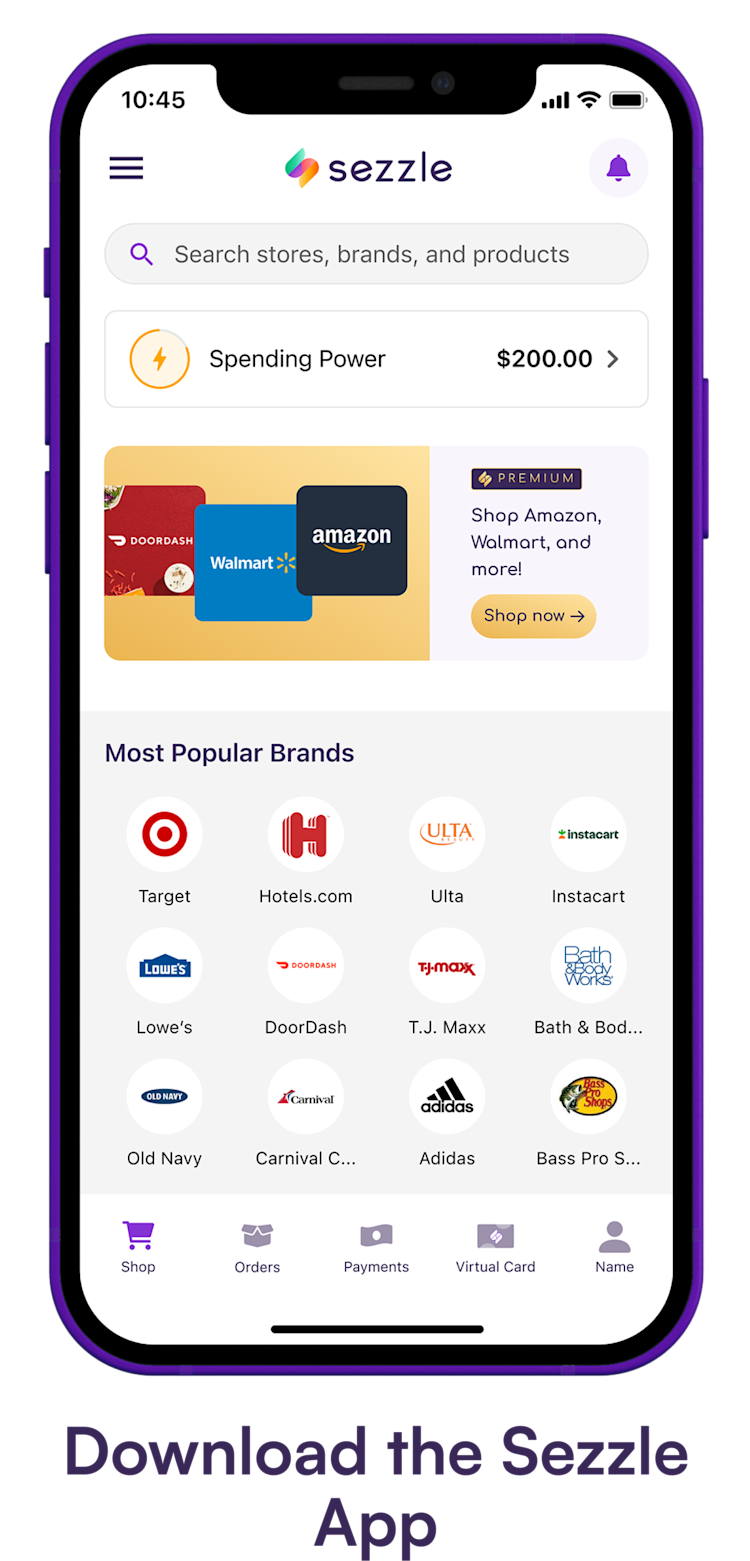

The traditional Sezzle model revolves around retail purchases.

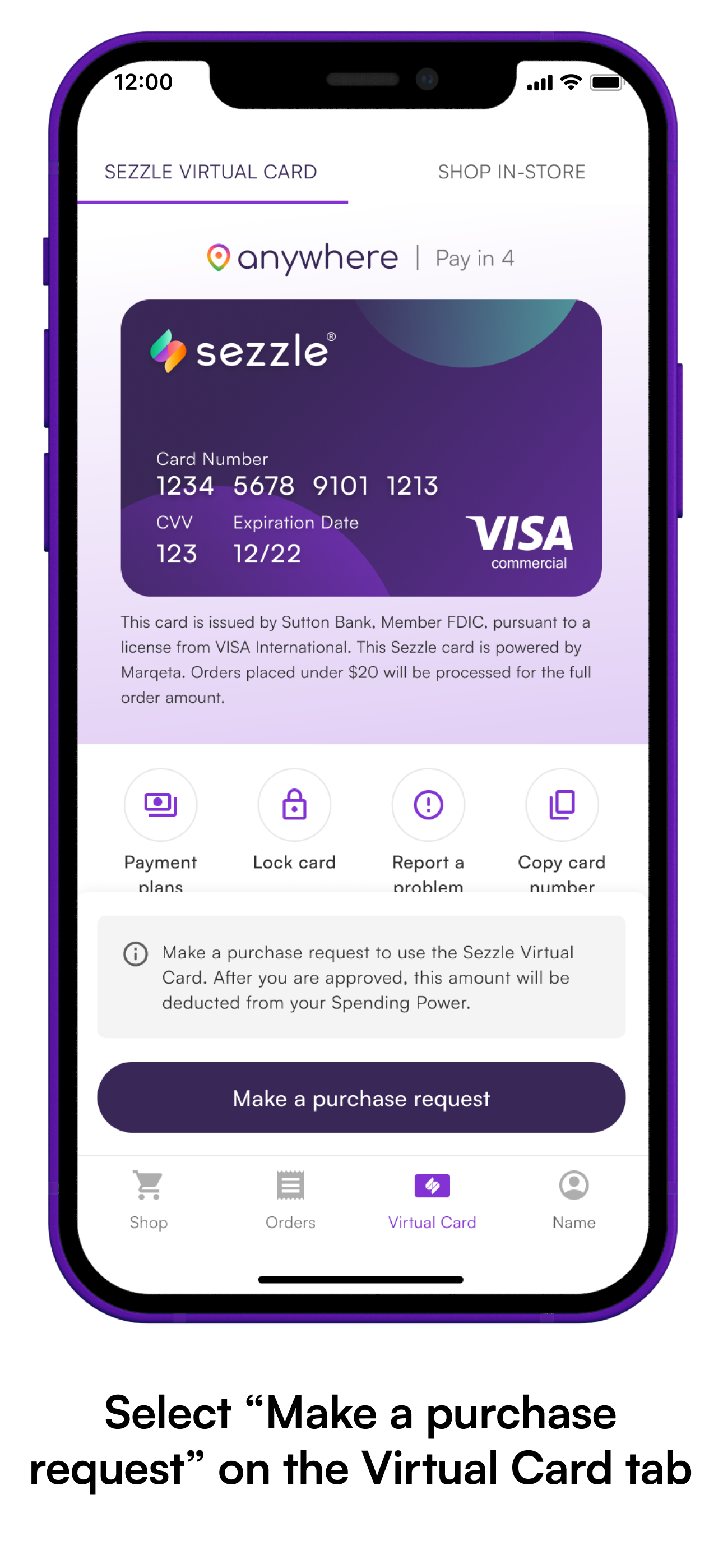

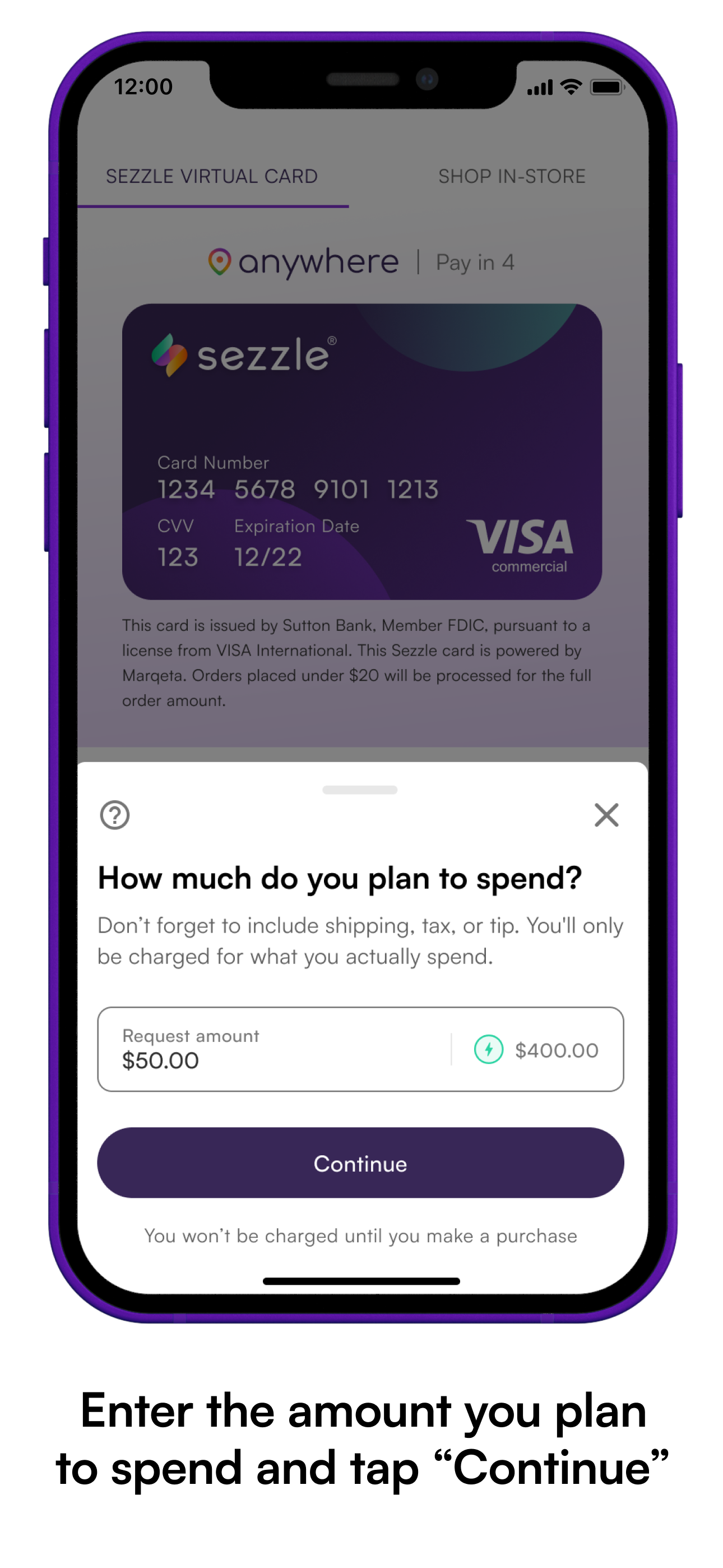

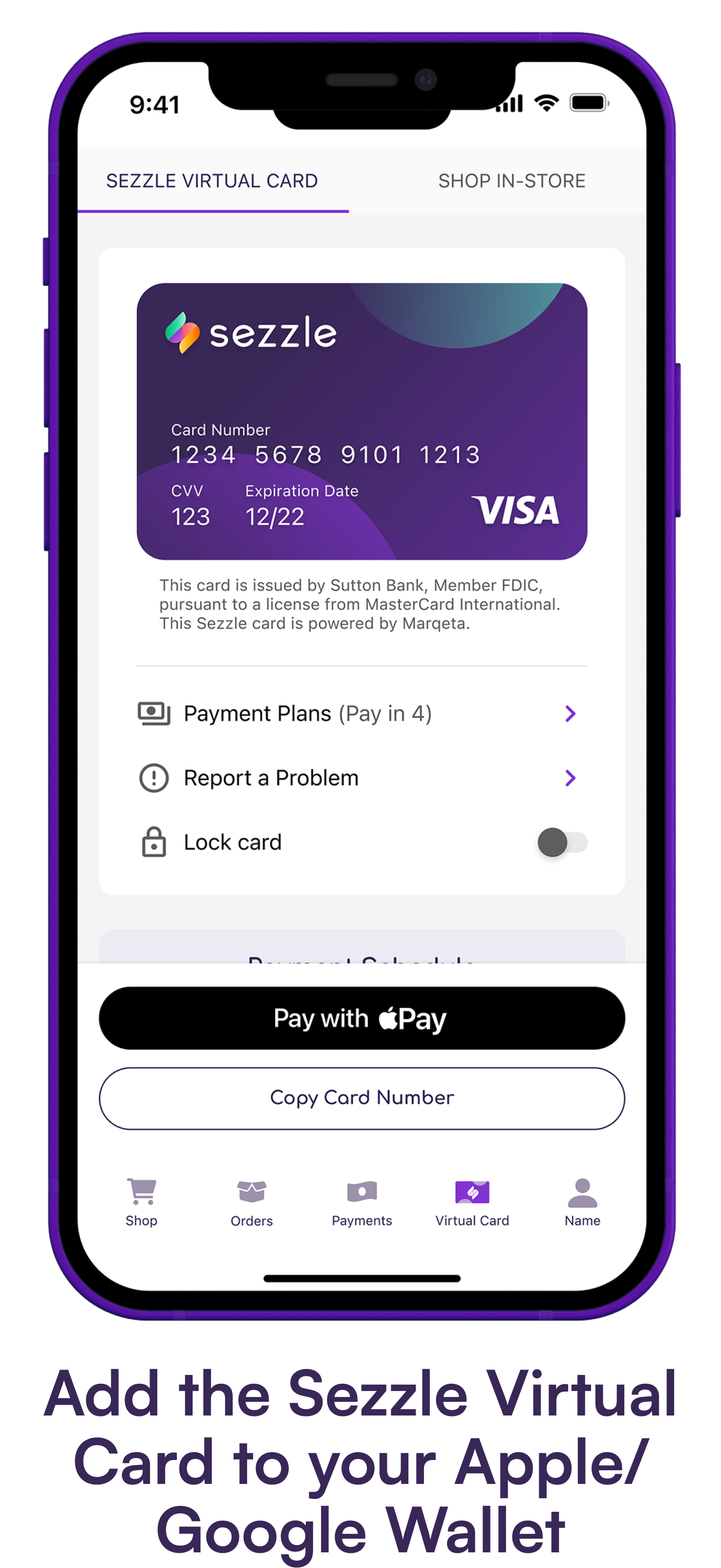

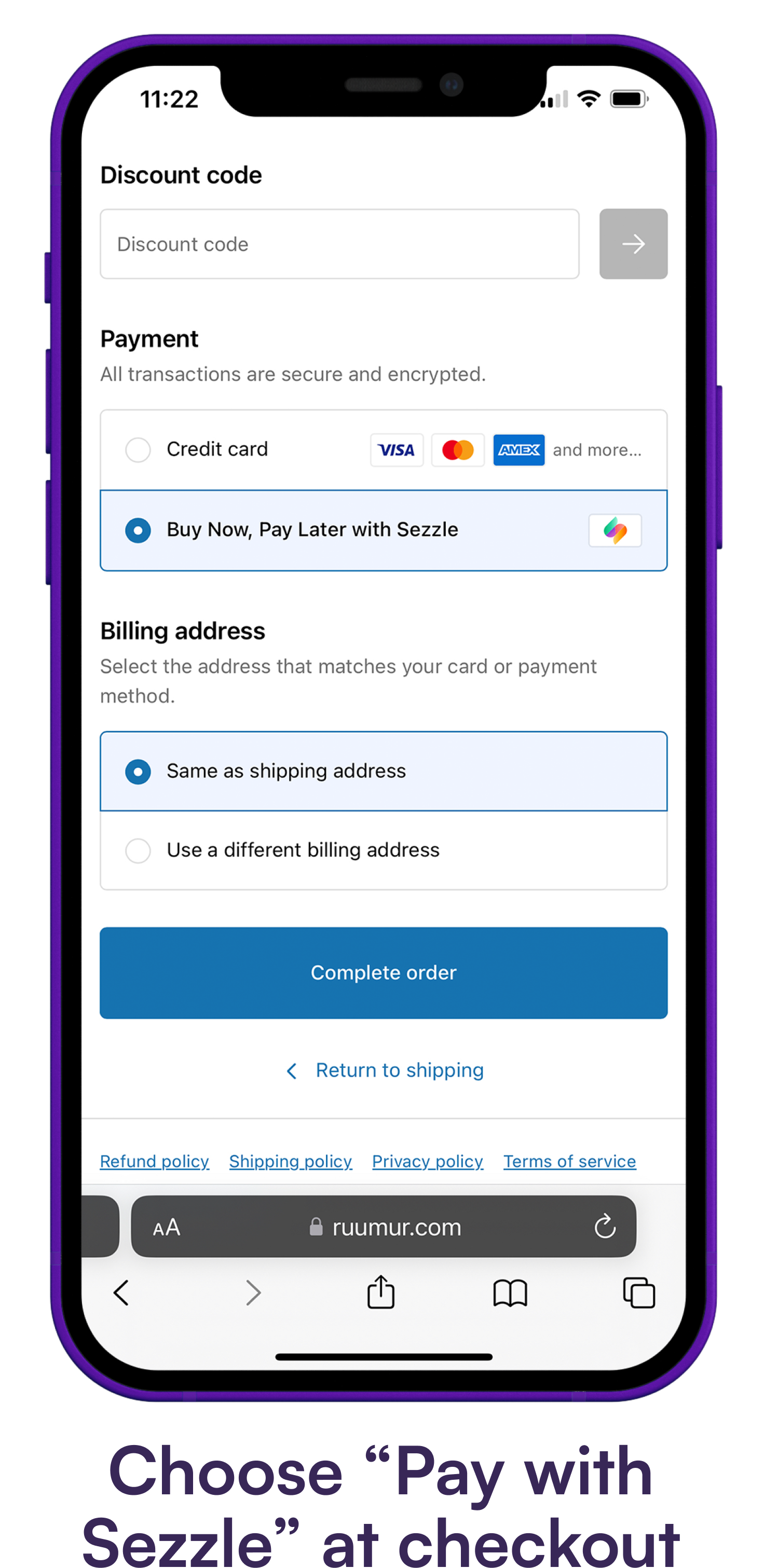

You shop at participating online or brick-and-mortar stores, select Sezzle as your payment method at checkout, and then agree to a payment plan.

Sezzle then pays the merchant in full, and you repay Sezzle in installments.

The appeal is clear: instant gratification without the immediate financial strain.

This can be particularly beneficial for larger purchases or unexpected expenses.

Can You Use Sezzle to Pay Bills Directly?

Here's the critical question: Can you use Sezzle to directly pay your utility bills, rent, or other recurring monthly expenses?

The answer, unfortunately, is generally no.

Sezzle is primarily designed to facilitate purchases from its partner merchants, not to act as a general bill payment service.

Sezzle's business model relies on partnerships with retailers.

They receive a fee from the merchant for each transaction facilitated through their platform.

Direct bill payments don't fit within this framework.

It’s important to clarify that while some creative workarounds *might* exist, they are not officially supported or encouraged by Sezzle and may come with risks.

Exploring Potential Workarounds (With Caution)

While directly paying bills through Sezzle isn’t typically possible, some individuals might explore indirect methods, but these are usually limited and come with caveats.

One potential workaround involves using Sezzle to purchase gift cards from retailers that can then be used to pay bills.

For example, if your utility company accepts prepaid debit cards, you might theoretically use Sezzle to purchase a prepaid card from a participating retailer and then use that card to pay your bill.

However, this approach is often cumbersome and may incur additional fees.

Another workaround might involve using Sezzle to purchase essential goods (like groceries) freeing up other funds to be used on bills.

This is more of a budgeting strategy rather than direct bill payment.

Disclaimer: Attempting to use Sezzle in ways not intended by the platform may violate its terms of service. Always review the terms carefully before attempting any workarounds.

Why Sezzle Isn't Designed for Bill Payments

Several factors contribute to Sezzle's focus on retail purchases rather than bill payments.

Firstly, the platform’s infrastructure is built around merchant partnerships, as previously mentioned.

Secondly, processing recurring bill payments often requires a different set of technological and logistical capabilities than processing one-time retail transactions.

Furthermore, the risk profile associated with bill payments may be higher than that of retail purchases.

The risk of fraud or non-payment can be greater when dealing with recurring bills compared to one-time transactions with established retailers.

Alternatives to Sezzle for Managing Bills

If Sezzle isn’t the solution for direct bill payments, what are some viable alternatives for managing your financial obligations?

Several options exist, ranging from traditional budgeting techniques to specialized financial tools.

Budgeting and Financial Planning

The cornerstone of responsible bill management is a solid budget.

Tracking your income and expenses, identifying areas where you can cut back, and prioritizing essential bills are fundamental steps.

Numerous budgeting apps and tools can assist you in this process, such as Mint, YNAB (You Need a Budget), and Personal Capital.

Bill Payment Apps and Services

Several apps and services are specifically designed to help you manage and pay your bills.

These platforms often allow you to consolidate your bills into a single dashboard, set up automatic payments, and receive reminders to avoid late fees.

Examples include Prism, Doxo, and even the bill pay features offered by many banks and credit unions.

Negotiating Payment Plans

Don't hesitate to contact your service providers directly to explore payment plan options.

Many utility companies, landlords, and medical providers are willing to work with you to create a manageable payment schedule, especially if you're experiencing temporary financial hardship.

Proactive communication can often prevent late fees and protect your credit score.

Debt Consolidation and Credit Counseling

If you're struggling with overwhelming debt, consider exploring debt consolidation or credit counseling services.

These options can help you lower your interest rates, consolidate multiple debts into a single payment, and develop a sustainable repayment plan.

Nonprofit credit counseling agencies can provide valuable guidance and support.

The Importance of Responsible BNPL Usage

While Sezzle and other BNPL services can be helpful for managing cash flow, it's crucial to use them responsibly.

Over-reliance on BNPL can lead to accumulating debt and financial strain, especially if you're unable to make the scheduled payments.

Always consider your ability to repay before using BNPL, and avoid using it for non-essential purchases.

According to a report by the Consumer Financial Protection Bureau (CFPB), BNPL usage is on the rise, and consumers need to be aware of the potential risks involved.

These risks include late fees, accumulating debt, and potential negative impacts on credit scores if payments are missed.

It's important to remember that BNPL is a form of credit, and should be treated with the same level of caution and responsibility as any other type of borrowing.

Conclusion: Exploring Alternatives and Prioritizing Financial Wellness

While the answer to “Can I use Sezzle to pay bills?” is generally no, this doesn't mean you're without options.

Focusing on sound budgeting practices, exploring bill payment apps, and communicating with service providers are all effective ways to manage your financial obligations.

Ultimately, fostering financial wellness requires a proactive and informed approach, prioritizing responsible spending and seeking help when needed.

Instead of solely relying on quick fixes, let's strive to build sustainable financial habits, empowering ourselves to navigate the complexities of modern life with confidence and peace of mind. Remember, the journey to financial stability is a marathon, not a sprint, and every small step counts.