Can I Use Sezzle To Pay Rent

The rent is due, but your bank account is running on fumes. In a world increasingly reliant on flexible payment options, many are turning to Buy Now, Pay Later (BNPL) services like Sezzle. But can you actually use these platforms to cover the most fundamental expense of all: rent?

While Sezzle and similar services promise convenient installment plans for purchases, their application to rent payments is more complex and often indirect. This article will delve into the feasibility of using Sezzle to pay rent, exploring the limitations, potential workarounds, and the financial implications for renters. We will examine the policies of Sezzle, the perspectives of landlords, and the alternative solutions available to those struggling with rent payments.

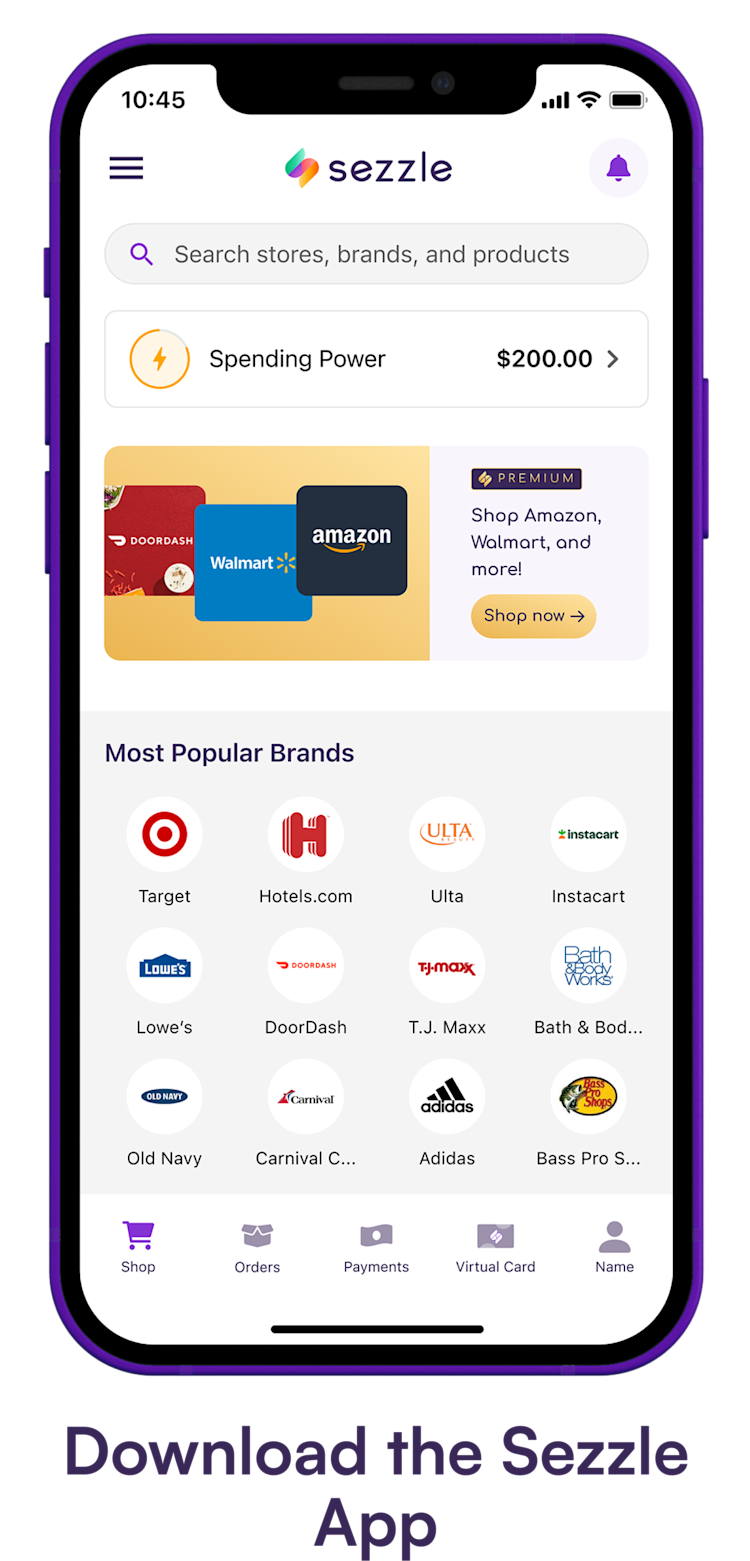

Understanding Sezzle's Functionality

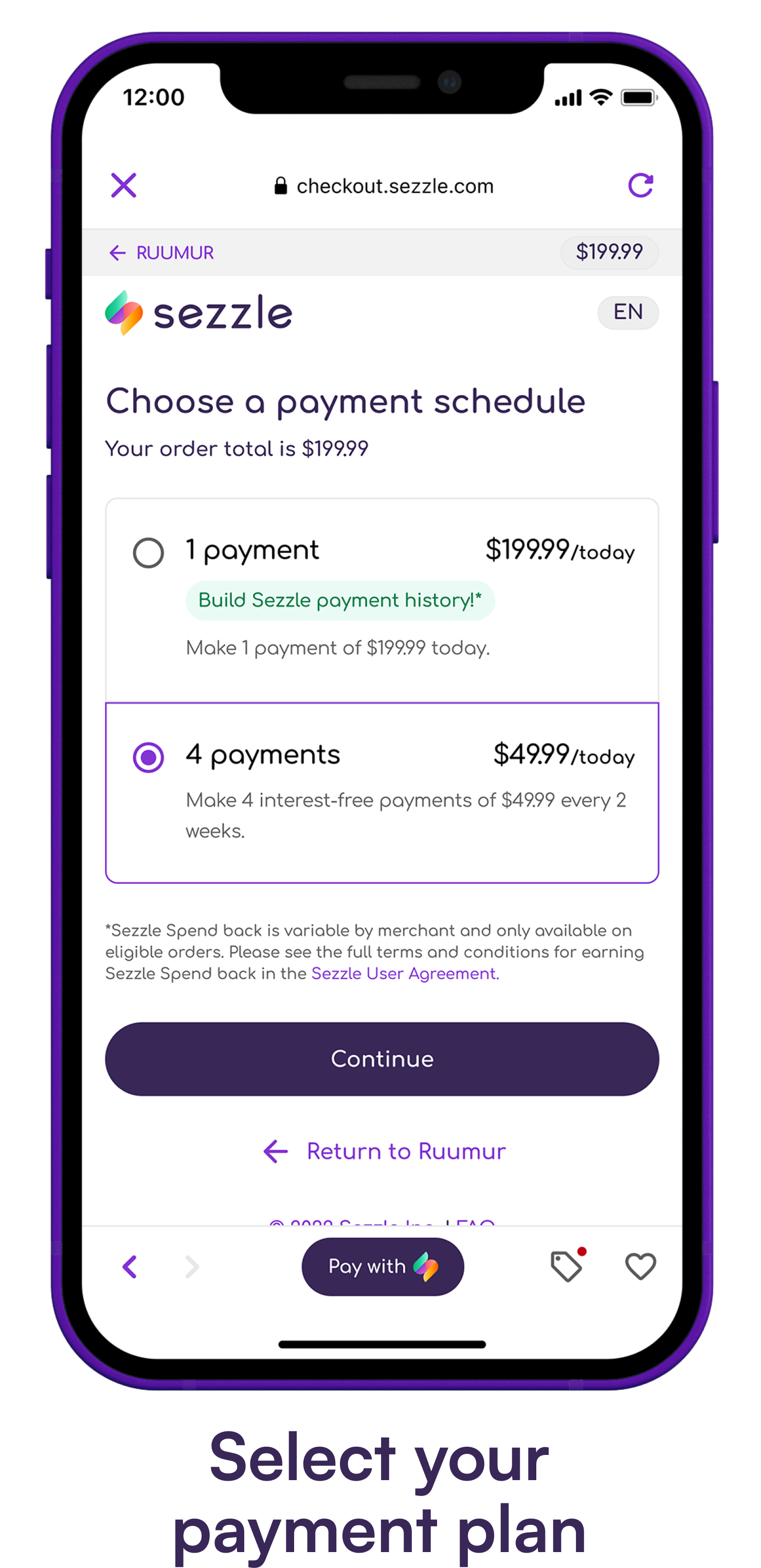

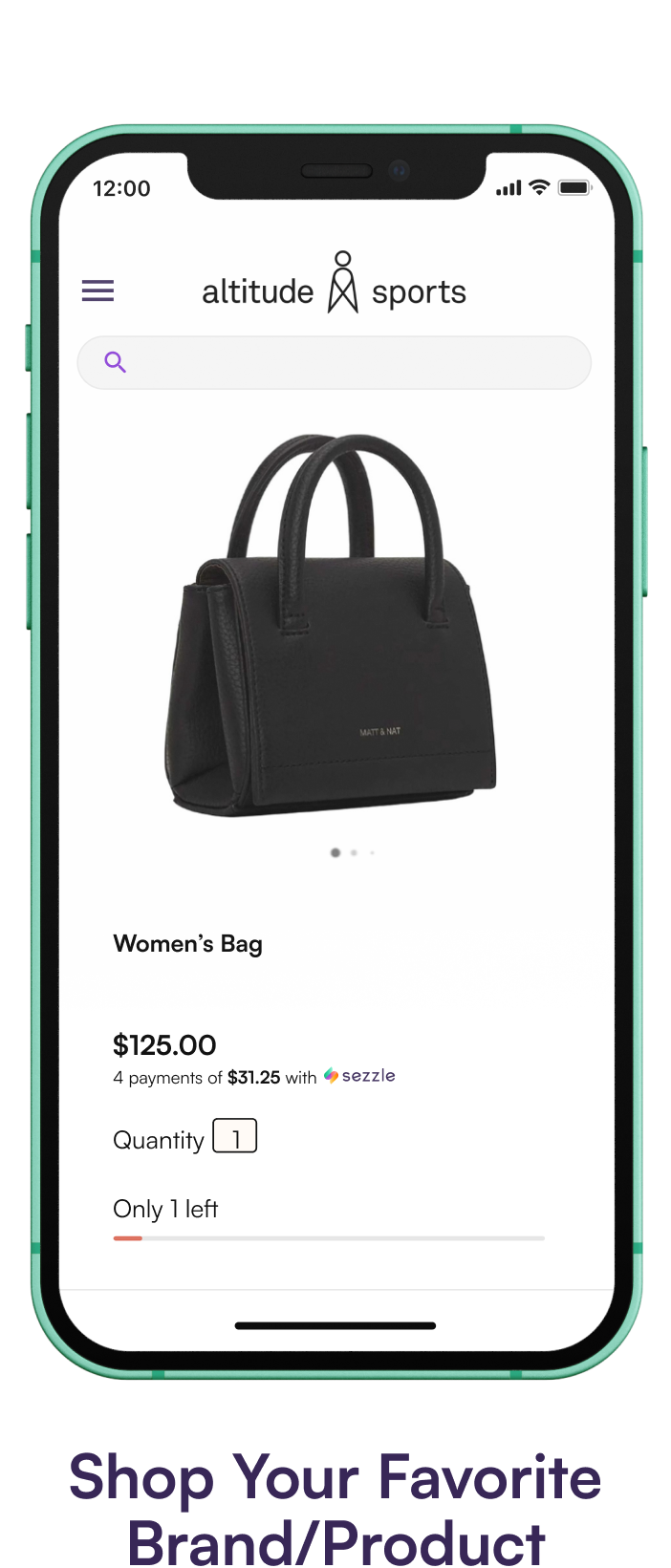

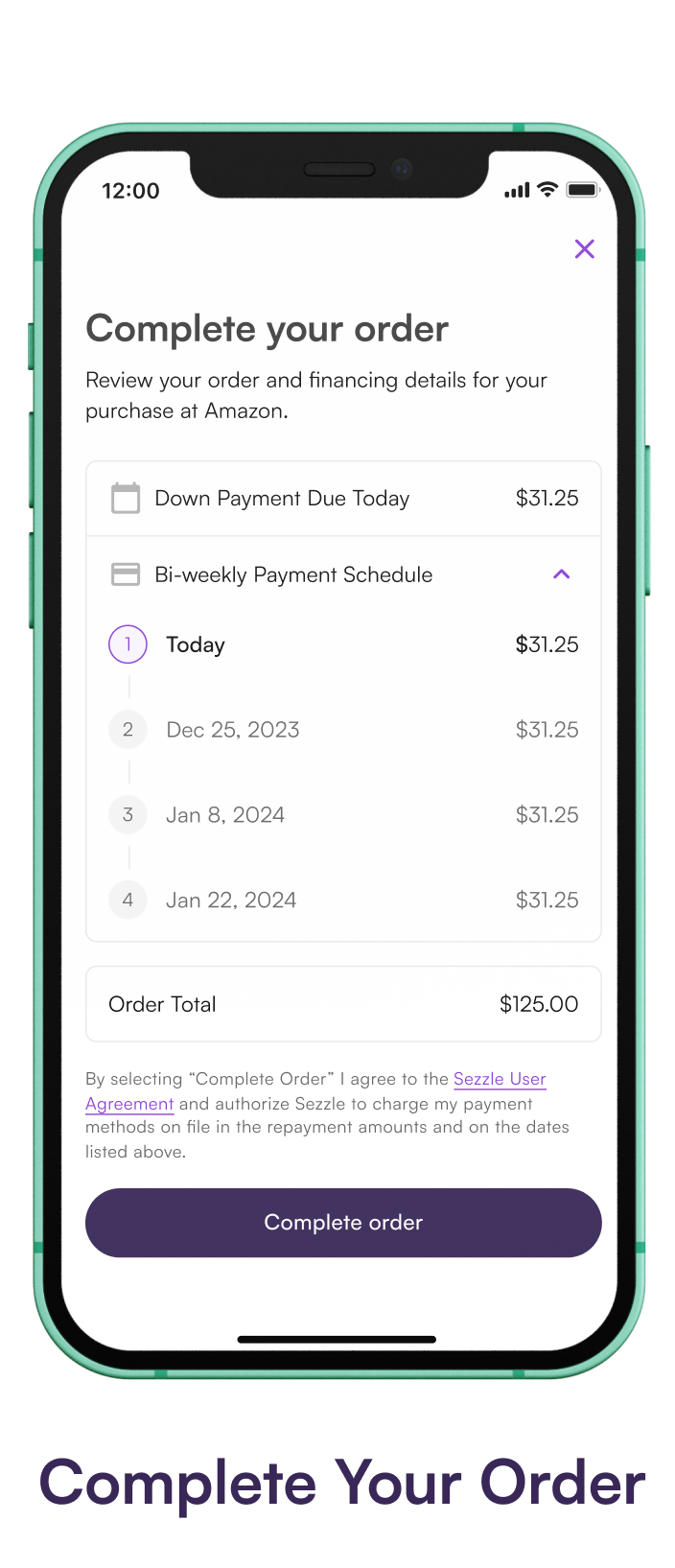

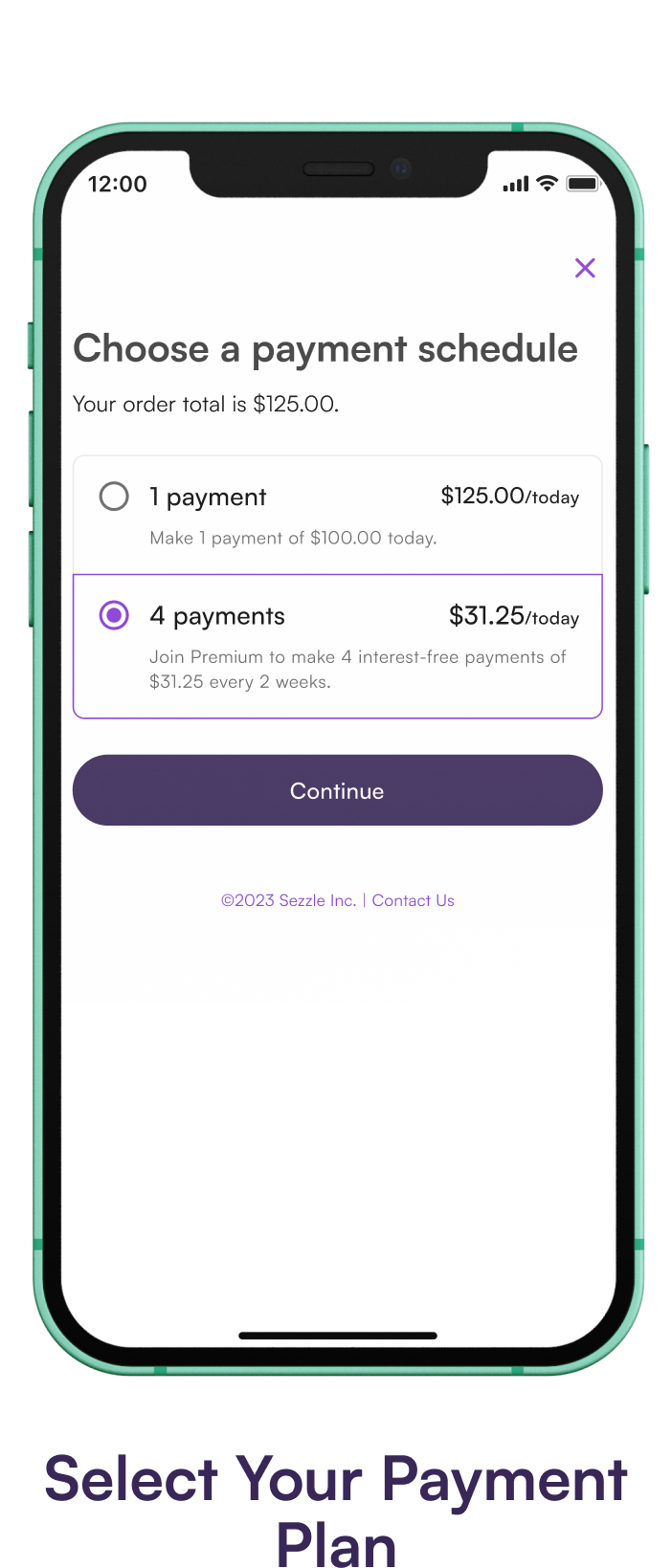

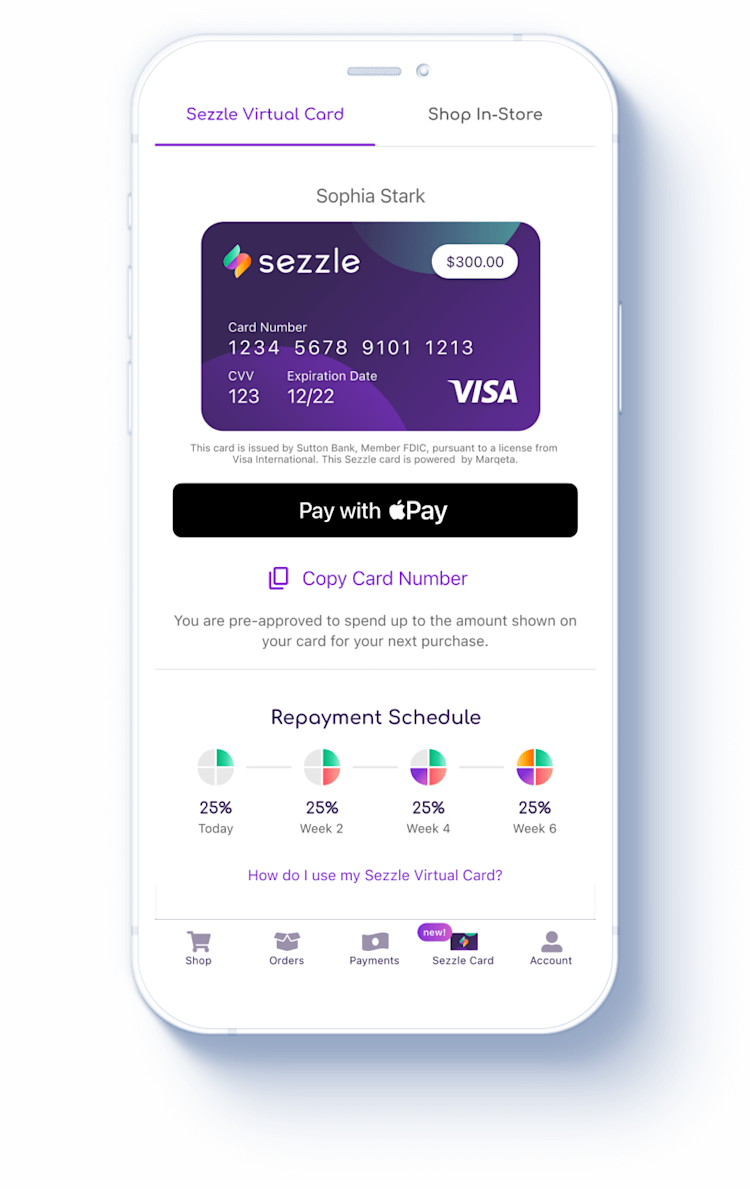

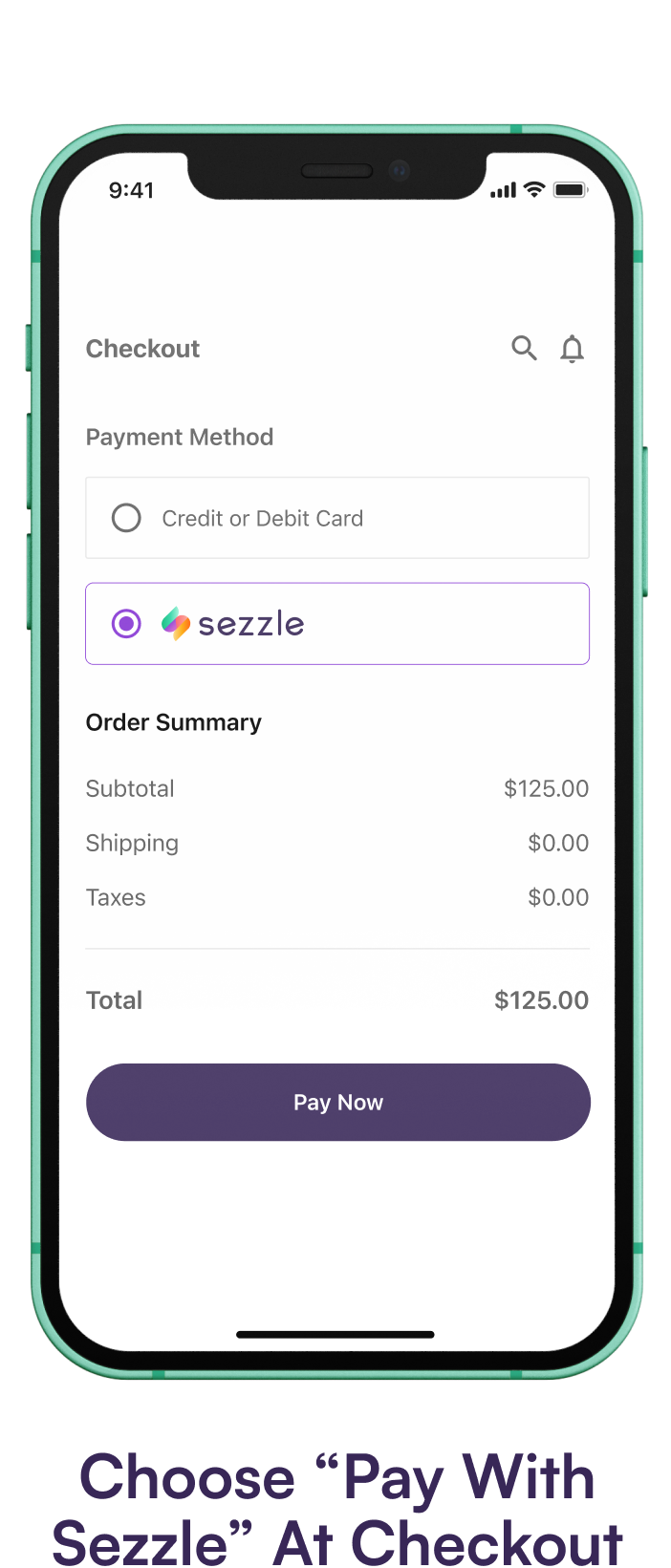

Sezzle operates as a point-of-sale installment loan provider. It allows consumers to split purchases into four interest-free payments, typically spread over six weeks. The service is integrated with online retailers and some brick-and-mortar stores, offering an alternative to traditional credit cards.

However, Sezzle isn't designed for direct rent payments. Its primary function is facilitating purchases from partnered merchants, not sending money directly to landlords.

Why Direct Rent Payment with Sezzle is Generally Not Possible

The core issue lies in Sezzle's business model. They partner with merchants to offer installment payment options for specific goods and services. Rent payments, being a recurring obligation to a landlord, don't fit this model.

Most landlords don't have direct integrations with Sezzle. Therefore, a direct transaction using Sezzle to pay rent is usually impossible.

Potential Workarounds and Their Limitations

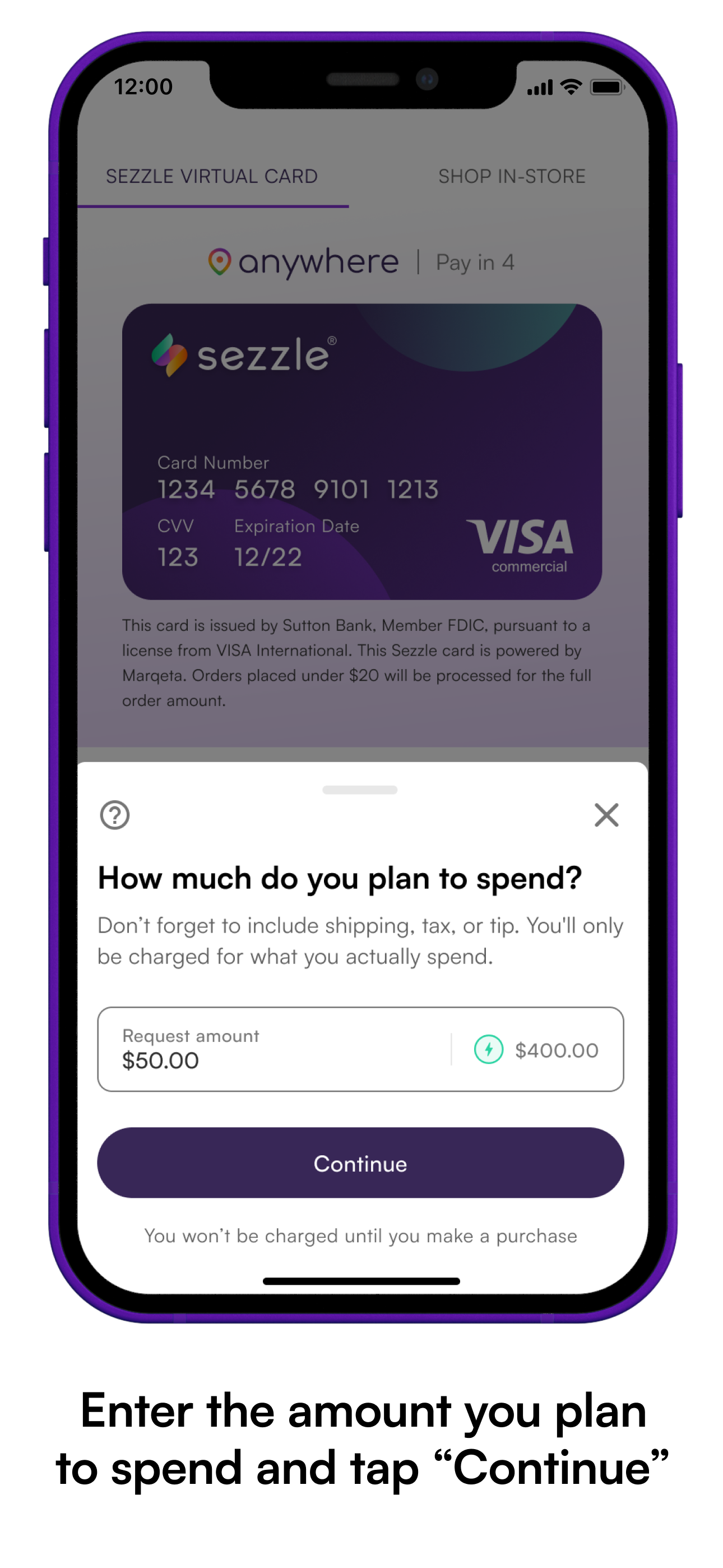

Despite the lack of direct integration, some renters explore roundabout methods to utilize Sezzle for rent payments. One potential workaround involves using Sezzle to purchase prepaid debit cards or gift cards.

These cards can then be used to pay rent if the landlord accepts them. However, this method often comes with fees associated with purchasing and activating the cards, diminishing the value of using Sezzle in the first place.

Another possibility involves using Sezzle to purchase items that can be resold for cash. This cash could then be used for rent. However, this method is highly unreliable and carries the risk of loss if the items cannot be sold quickly or at a reasonable price.

Landlord Perspectives and Acceptance

Landlords generally prefer direct and reliable payment methods. Checks, electronic transfers, and online payment portals are common and preferred options.

Landlords may be hesitant to accept alternative methods like prepaid cards due to concerns about transaction fees and the potential for fraud. They may also view it as a sign of financial instability from the tenant.

According to a survey conducted by the National Apartment Association (NAA) of its members, a very small percentage of landlords accept payment methods beyond traditional means, highlighting the challenge for renters seeking alternative options.

Financial Implications and Risks

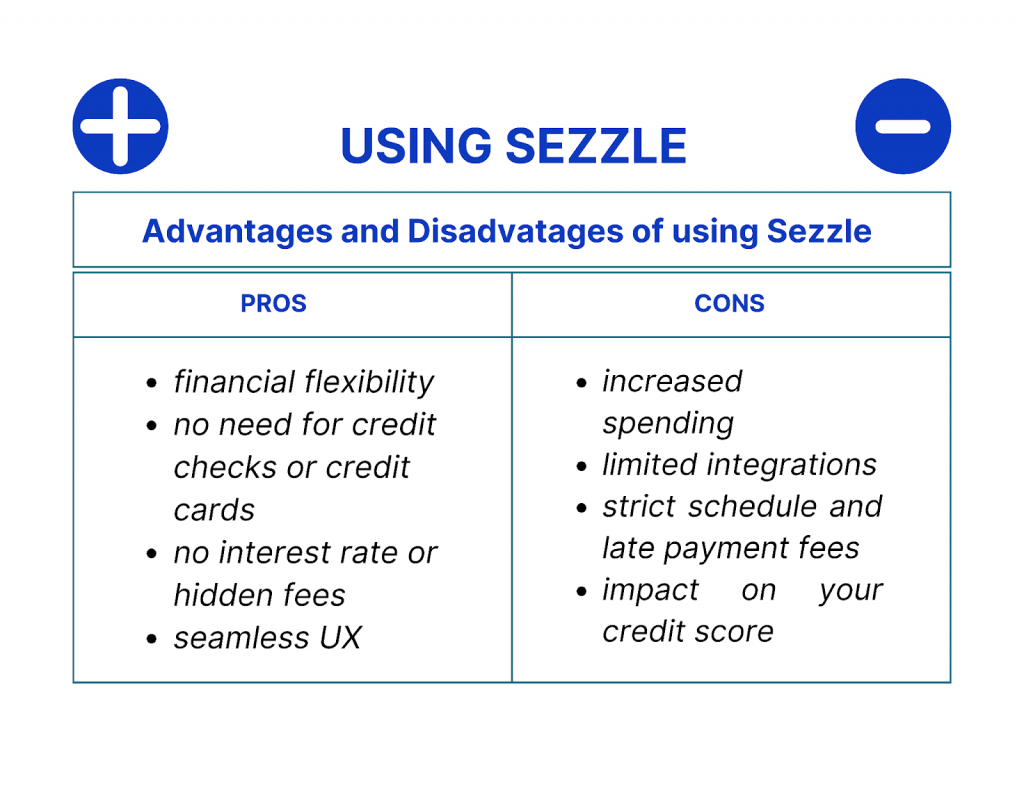

Using Sezzle, even indirectly, for rent payments carries financial risks. While Sezzle boasts interest-free payments, late fees can quickly accumulate if installments are missed.

Relying on BNPL services for essential expenses like rent can create a cycle of debt. It could signal a larger underlying financial problem that needs addressing.

Furthermore, using Sezzle to purchase prepaid cards or resell items involves additional fees and potential losses, increasing the overall cost of rent.

Alternative Solutions for Rent Payment Assistance

For renters struggling to pay rent, several alternative solutions offer more sustainable support. Government assistance programs, such as Section 8 housing vouchers, can provide long-term rent subsidies.

Local charities and non-profit organizations often offer emergency rental assistance to those in need. Contacting these organizations can connect renters with resources and support services.

Negotiating a payment plan with the landlord is another viable option. Open communication and a willingness to create a mutually agreeable arrangement can help avoid eviction.

The Future of Rent Payment Options

While Sezzle may not be a direct solution for rent payments currently, the increasing demand for flexible payment options could drive innovation in the future. We may see collaborations between BNPL providers and property management companies.

New platforms specifically designed to facilitate installment payments for rent could emerge. However, these solutions would need to address the concerns of both renters and landlords, ensuring transparency, reliability, and affordability.

For now, exploring traditional avenues of assistance and maintaining open communication with landlords remains the most prudent approach to managing rent payments.

Conclusion

In conclusion, directly using Sezzle to pay rent is generally not feasible due to the platform's business model and lack of integration with landlords. While workarounds exist, they often involve additional fees and risks.

Renters struggling with rent should prioritize seeking assistance from government programs, charities, and landlords themselves. These avenues provide more sustainable and reliable solutions for managing housing costs.

The future may hold more integrated payment options, but for now, caution and responsible financial planning are essential when facing rent payment challenges.