Can Sezzle Be Used To Pay Bills

In an era defined by escalating living costs and the allure of immediate gratification, many are seeking innovative ways to manage their finances. A growing question among consumers revolves around the functionality of Buy Now, Pay Later (BNPL) services like Sezzle, specifically whether they can be utilized to pay routine bills.

This article delves into the feasibility of using Sezzle for bill payments. It explores the limitations, potential workarounds, and the broader implications for consumers seeking flexible payment options. Understanding the scope and restrictions of BNPL services is crucial for responsible financial planning.

Understanding Sezzle's Core Functionality

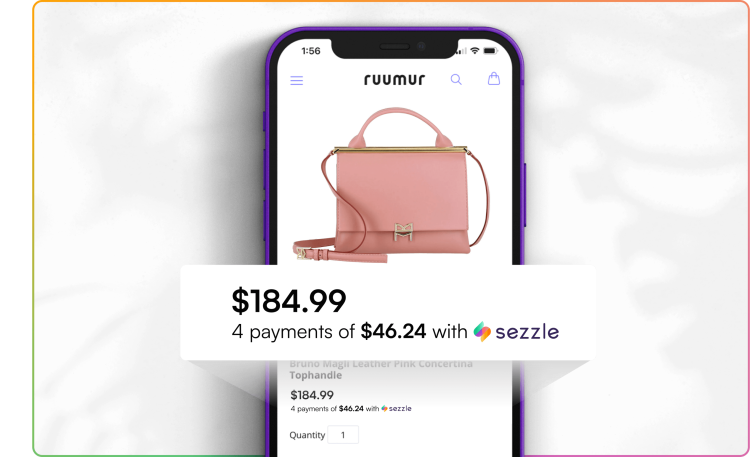

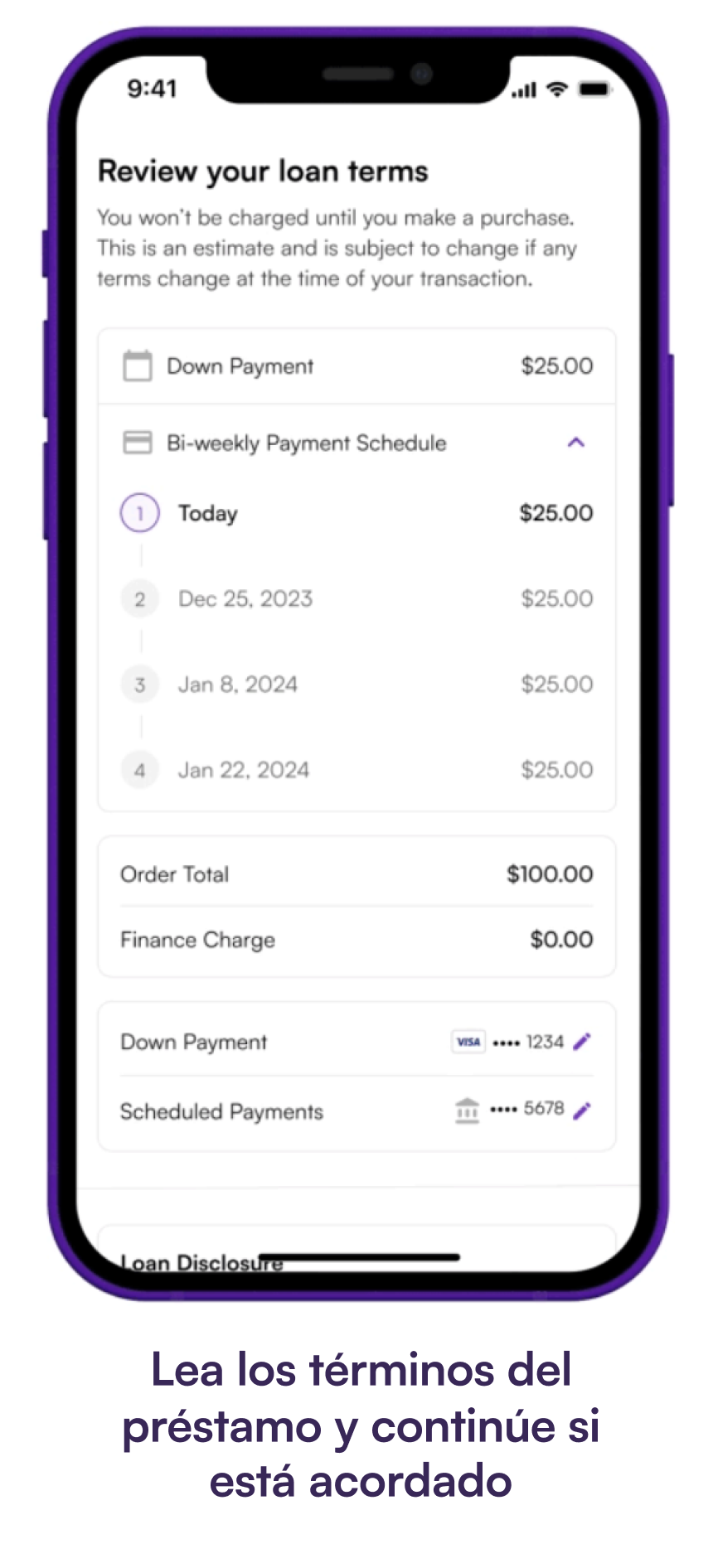

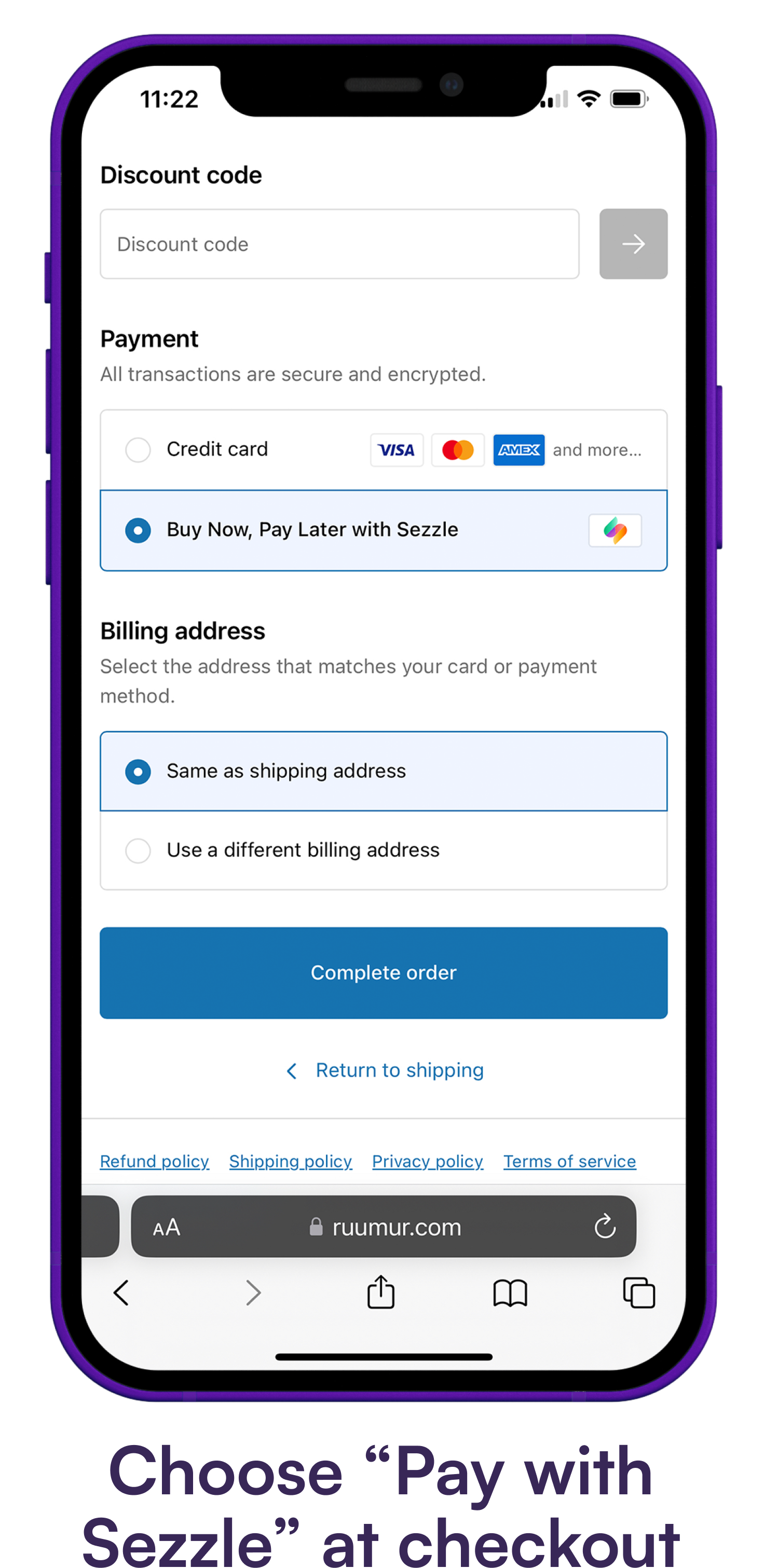

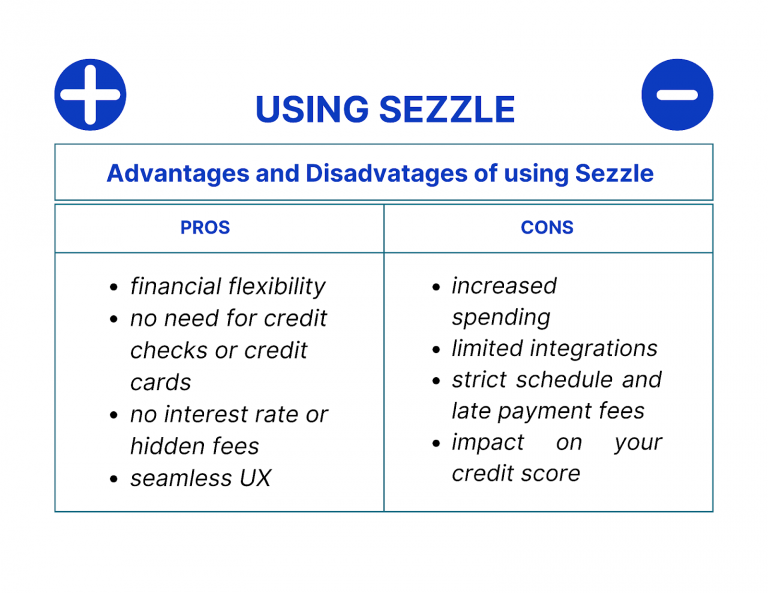

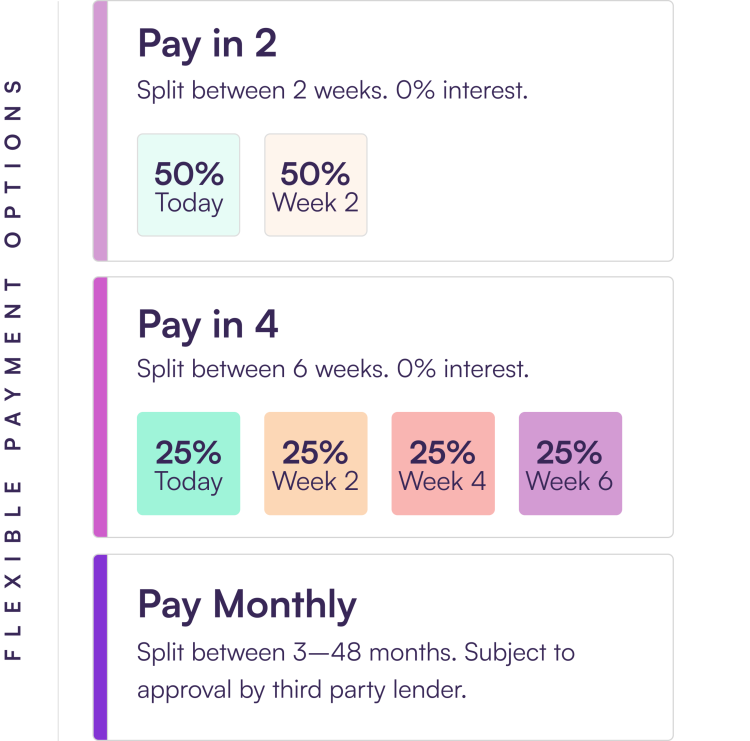

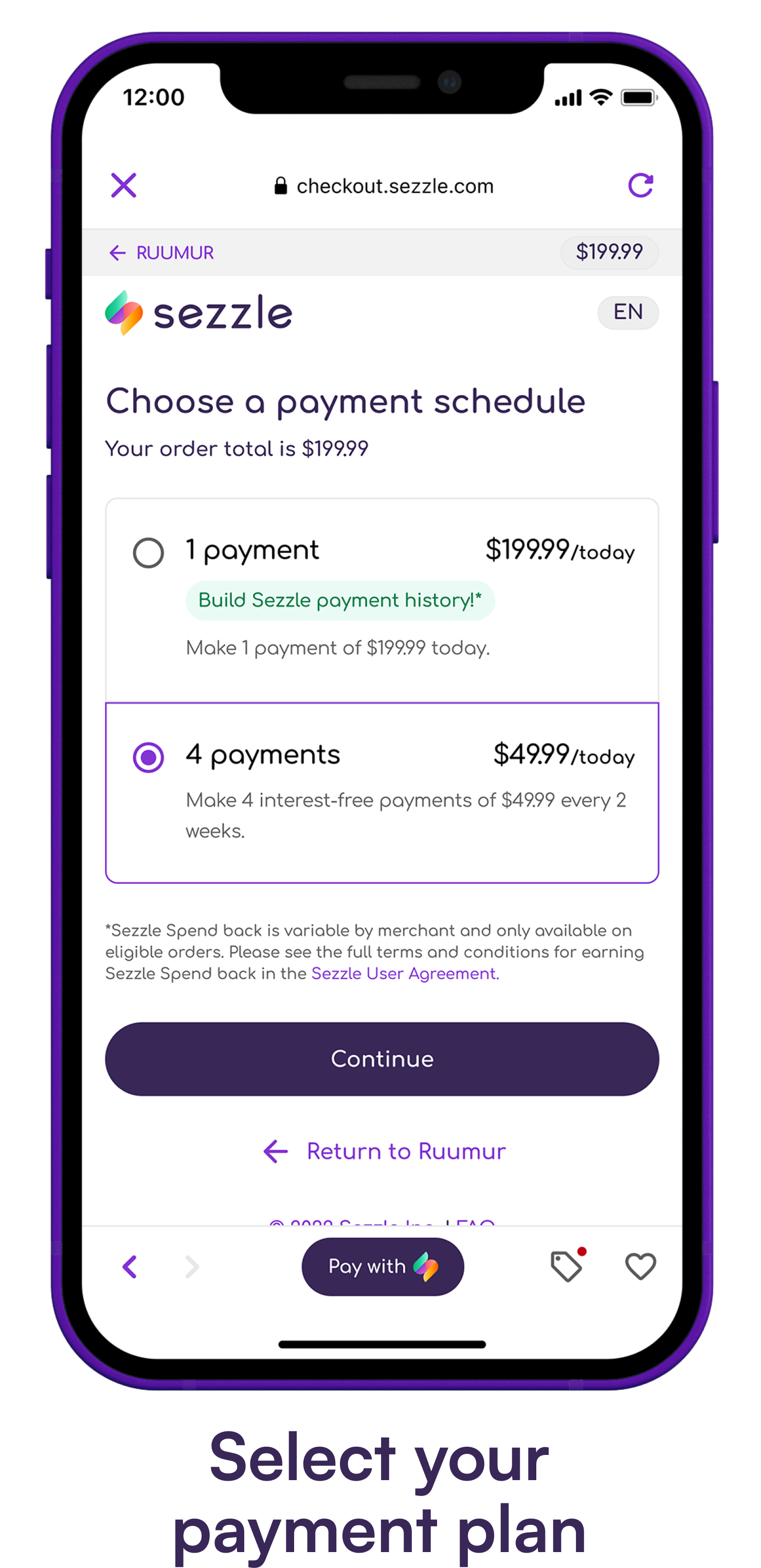

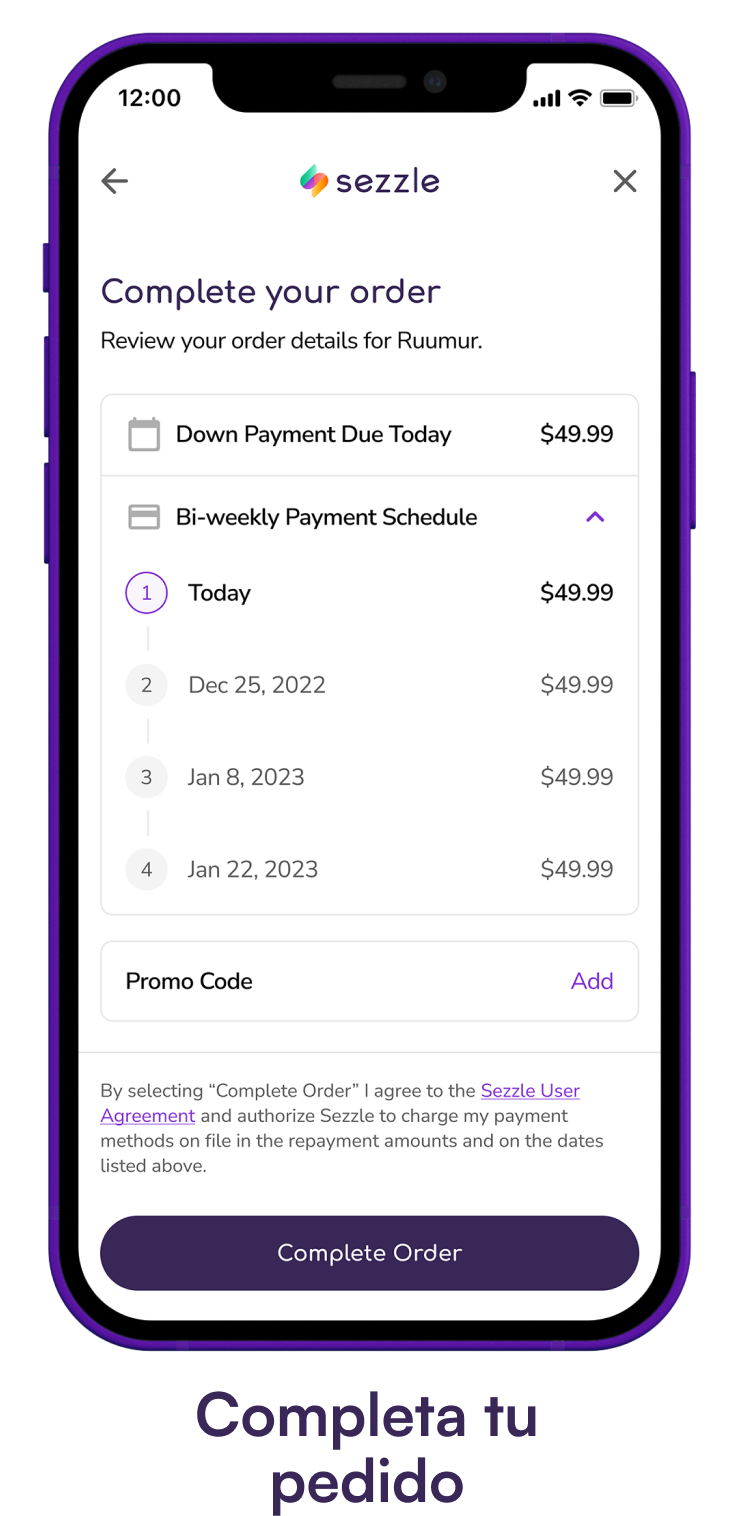

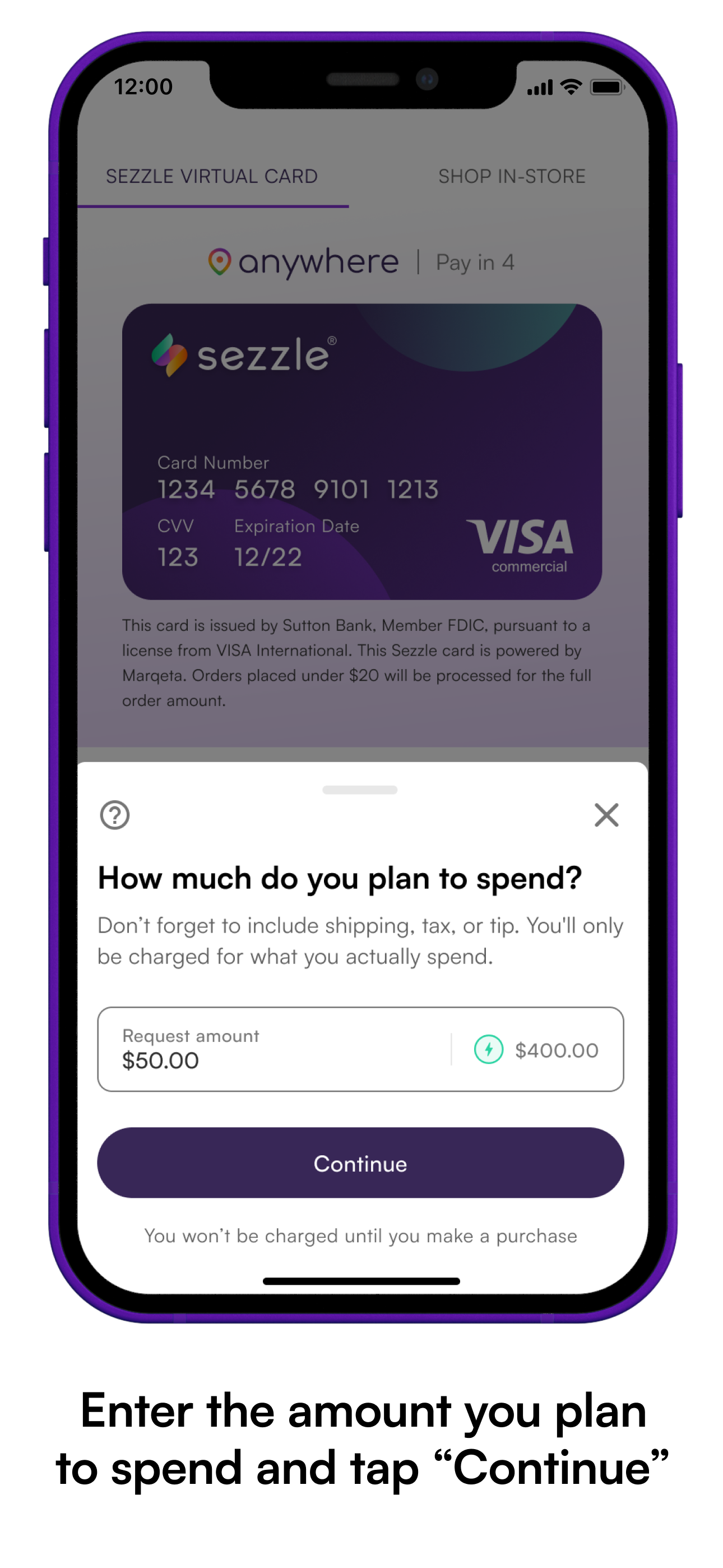

Sezzle is a popular BNPL service that allows consumers to split purchases into four interest-free installments. These payments are typically spread over six weeks. The service partners with a wide range of retailers, primarily in the e-commerce space, allowing customers to acquire goods and services immediately while deferring the full payment.

Sezzle's official website clearly outlines its primary use case: facilitating purchases from partnered merchants. The platform is designed to integrate directly with online checkout processes. This means that Sezzle acts as a point-of-sale financing option, not a general bill payment service.

Direct Bill Payment with Sezzle: A No-Go

Currently, Sezzle does not offer a direct mechanism for paying routine bills such as rent, utilities, or credit card debts. Its infrastructure is specifically geared towards transactions with affiliated merchants. Attempting to use Sezzle to pay these types of bills directly through the platform is not possible.

Sezzle's business model relies on partnerships with retailers who pay a fee for offering Sezzle as a payment option. This contrasts with bill payment services that typically charge users a fee or derive revenue from partnerships with billers.

Indirect Methods and Potential Workarounds

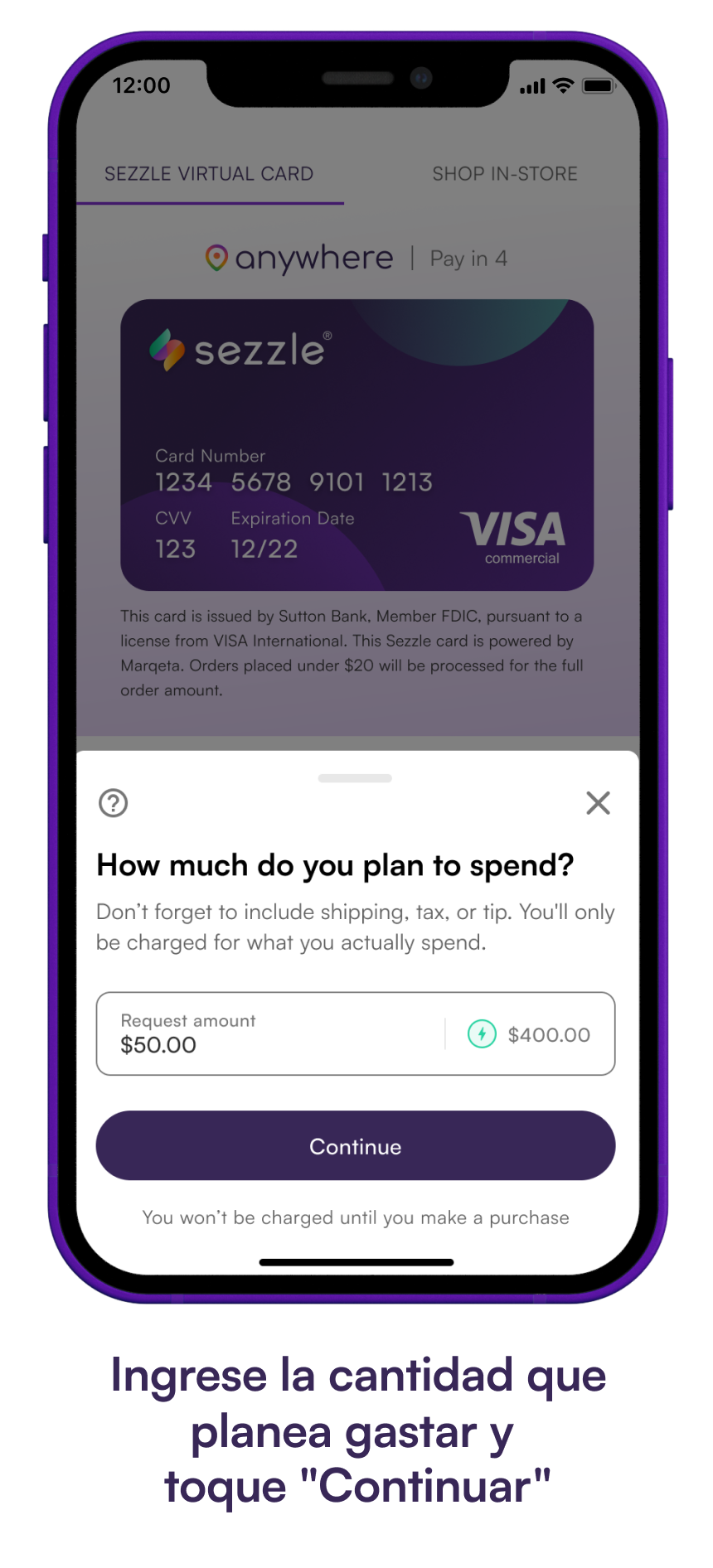

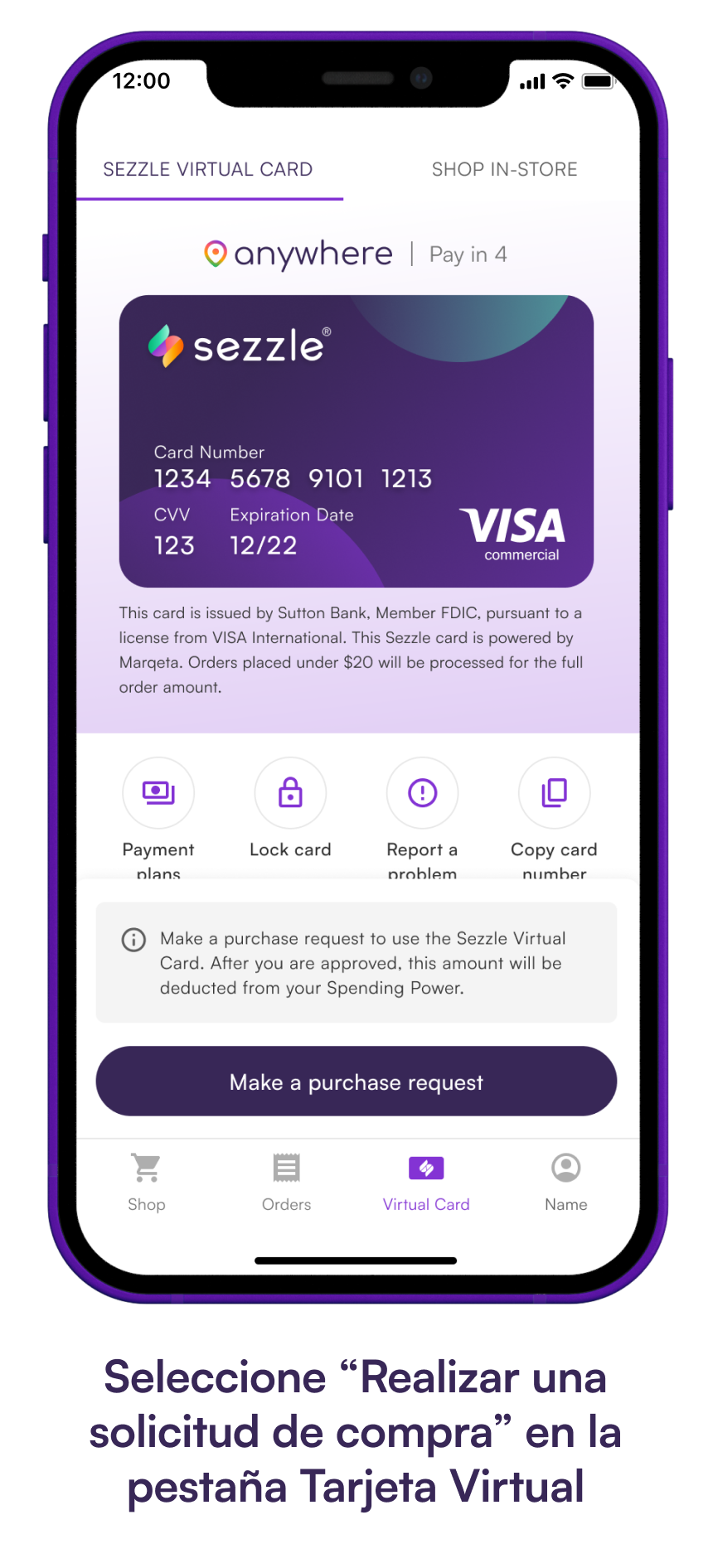

While direct bill payments are not supported, some consumers explore indirect methods to leverage Sezzle for bill-related expenses. These workarounds often involve purchasing prepaid cards or gift cards from merchants that accept Sezzle.

For example, if a consumer needs to pay their electricity bill, they might purchase a prepaid debit card from a store that partners with Sezzle. They can then use the prepaid card to pay the bill. However, this approach comes with caveats.

The Prepaid Card Caveat

Purchasing prepaid cards with Sezzle and then using them to pay bills involves potential fees and limitations. Many prepaid cards have activation fees, usage fees, or monthly maintenance fees. These fees can erode the value of the card and negate the benefits of using Sezzle.

Furthermore, not all billers accept prepaid cards as a form of payment. Some utility companies, landlords, or credit card issuers may not process payments made with prepaid debit cards. This significantly limits the utility of this workaround.

Gift Cards: Another Limited Option

Similar to prepaid cards, purchasing gift cards from Sezzle-affiliated merchants can be a roundabout way to address bill-related needs. For instance, a consumer could purchase a gift card to a grocery store and use it to buy essential food items, freeing up funds to pay other bills.

However, this method does not directly pay the bill. It merely reallocates funds. It also relies on the consumer's ability to find merchants that align with their essential spending needs.

The Risks of Relying on BNPL for Essential Expenses

Using BNPL services like Sezzle for essential expenses, even through workarounds, carries inherent risks. BNPL services are designed for discretionary spending, not for covering necessary bills.

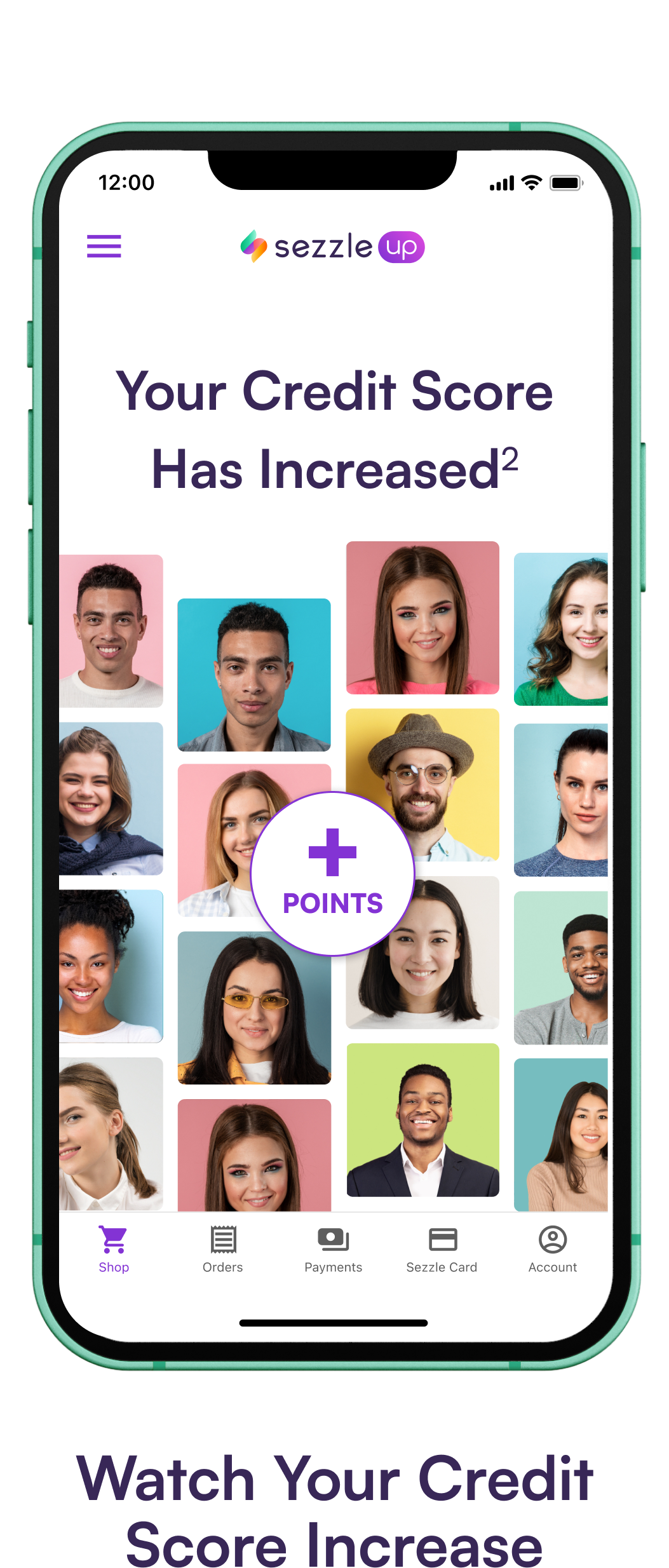

Over-reliance on BNPL for bills can lead to a cycle of debt. Missed payments can result in late fees and negatively impact credit scores. The convenience of splitting payments can mask the underlying financial strain, potentially leading to unsustainable borrowing habits.

Financial experts caution against using BNPL services to cover essential expenses. They advocate for budgeting, building an emergency fund, and seeking financial counseling when facing difficulties paying bills. These are more sustainable solutions than relying on short-term financing options.

Official Stance and Regulatory Landscape

Sezzle's official communications primarily focus on its core function as a point-of-sale financing option for retail purchases. The company does not actively promote or endorse using its service for bill payments. Their FAQs and user agreements do not explicitly address the issue of bill payments.

The regulatory landscape surrounding BNPL services is evolving. Consumer protection agencies are scrutinizing the industry, focusing on transparency, fee disclosures, and potential risks to consumers. Future regulations may impact how BNPL services can be used, including potential restrictions on using them for certain types of expenses.

Alternatives to Sezzle for Bill Payments

For consumers struggling to pay bills, several alternatives offer more sustainable solutions than relying on Sezzle. These include establishing payment plans with billers. Many companies are willing to work with customers to create affordable payment arrangements.

Another option is seeking assistance from non-profit organizations. Charities and government agencies often provide financial aid or resources for individuals facing hardship. Credit counseling services can also help consumers develop debt management plans and improve their financial literacy.

The Future of BNPL and Bill Payments

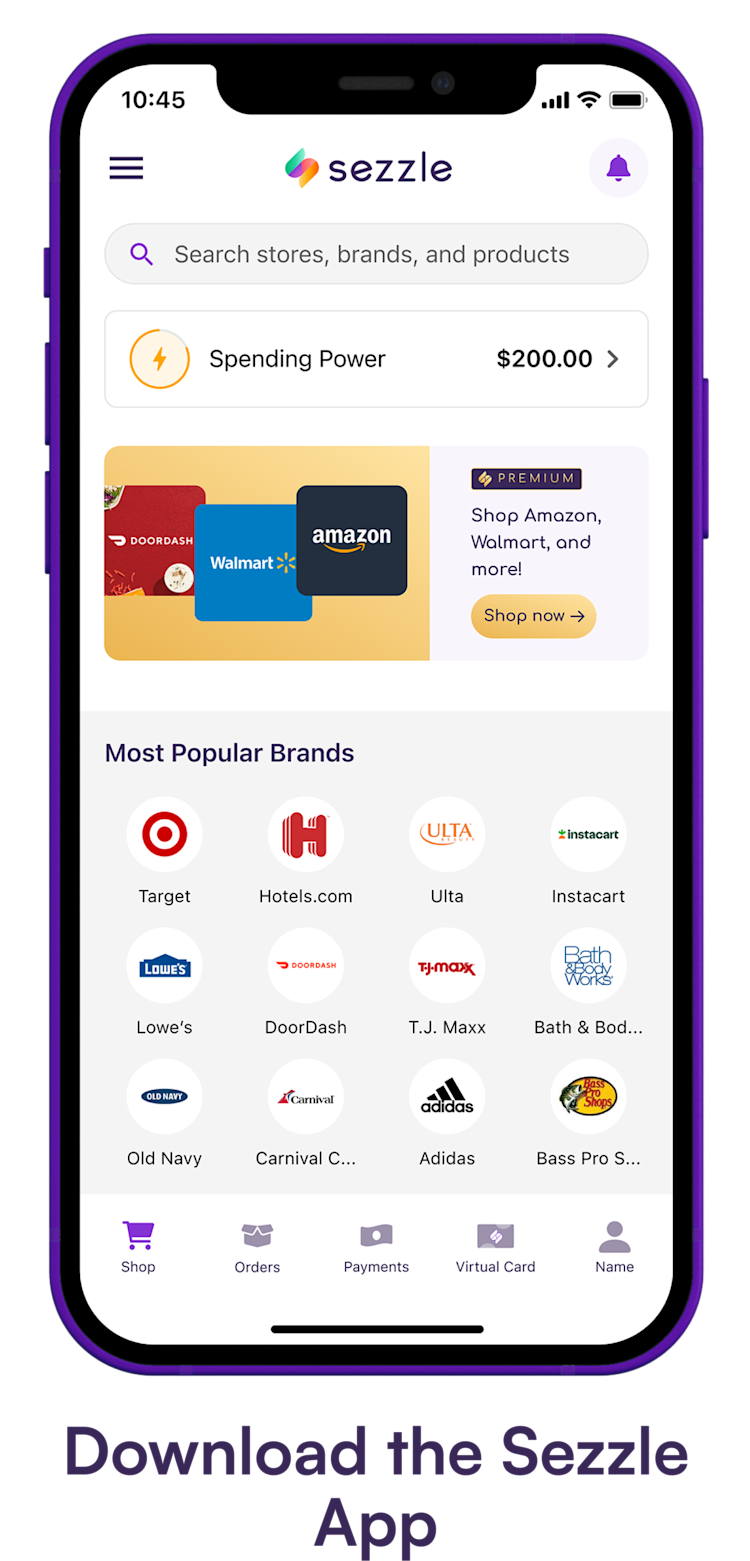

While Sezzle currently does not support direct bill payments, the BNPL landscape is constantly evolving. Some BNPL providers are exploring new features and services, including options for managing recurring expenses.

It is conceivable that in the future, BNPL services may offer more direct integration with bill payment systems. However, this would require significant changes to their business models and regulatory frameworks. Consumers should stay informed about the evolving landscape and understand the risks and benefits of using BNPL services for different types of expenses.

In conclusion, while some workarounds exist, Sezzle is not designed for paying routine bills. Relying on BNPL services for essential expenses can lead to financial strain and should be approached with caution. Consumers are better served by exploring alternative solutions such as budgeting, seeking financial assistance, and establishing payment plans with billers.