Can You Buy Gift Cards With Zip

The aroma of freshly brewed coffee swirled through the air, mingling with the excited chatter of last-minute shoppers. Holiday music played softly, a cheerful soundtrack to the annual gift-giving frenzy. Sarah clutched a handful of carefully chosen items, her brow furrowed slightly. She loved the holidays, but the financial strain always loomed large. This year, however, she had a secret weapon – Zip, the buy-now-pay-later service she'd been hearing so much about.

This article explores the evolving landscape of gift-giving, specifically focusing on whether you can use Zip (formerly Quadpay) to purchase gift cards. We will delve into the possibilities, limitations, and potential benefits of using buy-now-pay-later services for gift card purchases, offering a comprehensive guide for consumers looking to manage their holiday spending effectively.

The Rise of Buy-Now-Pay-Later

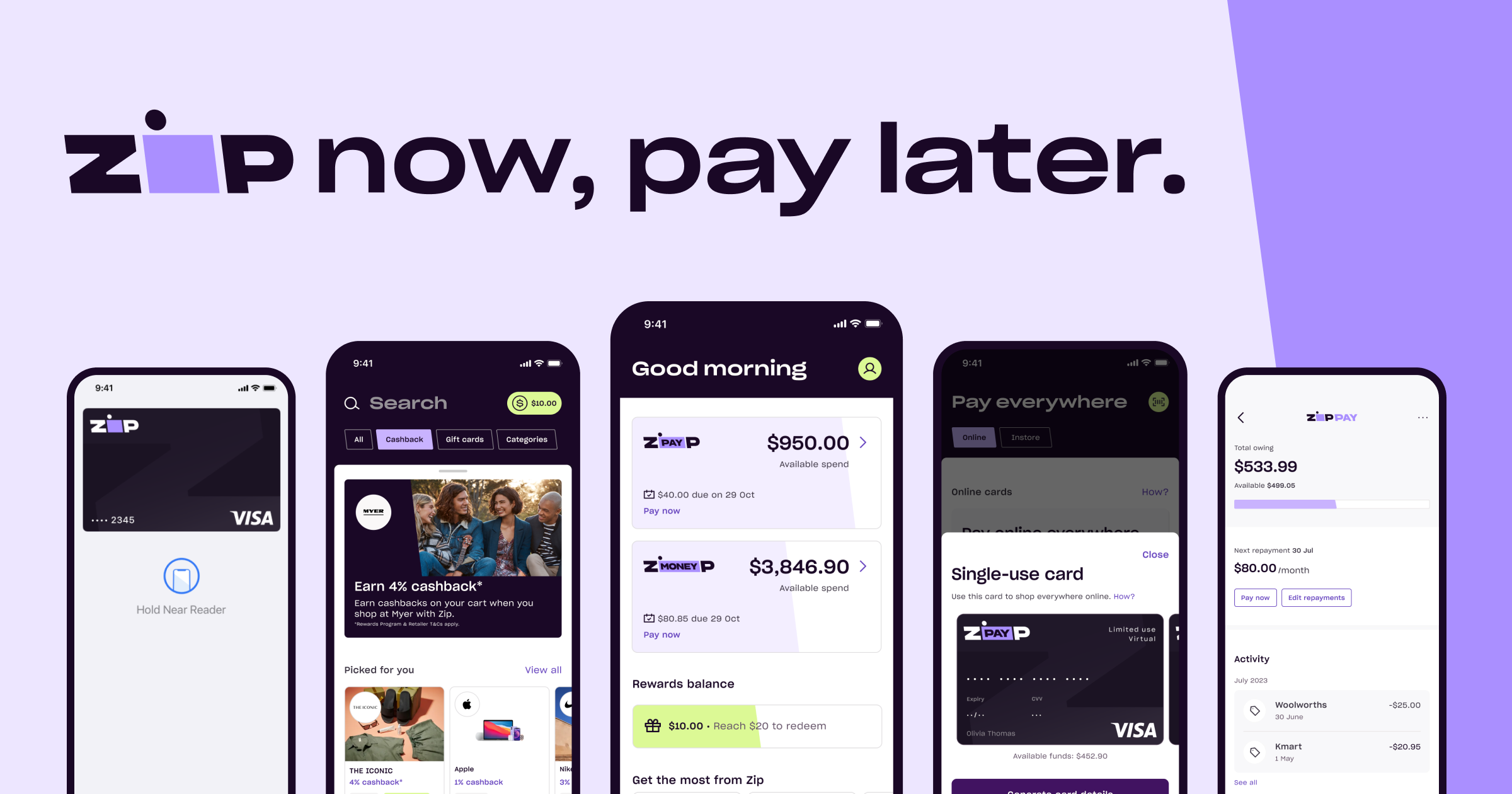

The buy-now-pay-later (BNPL) industry has exploded in recent years. Companies like Zip, Affirm, and Klarna have revolutionized how people approach online and in-store shopping. They offer consumers the ability to split purchases into smaller, more manageable installments, often without charging interest (though late fees may apply).

This model has proven particularly attractive to younger generations and those who prefer flexible payment options. The appeal is clear: acquire the desired goods or services immediately while spreading the cost over several weeks or months.

Can You Buy Gift Cards with Zip?

The answer, unfortunately, isn't a straightforward yes or no. Zip's availability for gift card purchases largely depends on the specific retailer and Zip's partnership with that retailer.

Many retailers do not allow the direct purchase of gift cards using BNPL services like Zip. This is primarily due to concerns about fraud and potential misuse of the service.

However, there are exceptions. Some retailers that partner with Zip may allow gift card purchases, particularly for their own branded gift cards. Checking Zip's app or website for partnered stores is crucial.

Navigating Zip's Website and App

Zip's website and app are the primary resources for determining whether a particular retailer accepts Zip for gift card purchases. Users can search for specific stores and view Zip's payment options.

The app often features a directory of partner stores. These stores have integrated Zip directly into their checkout process.

It's always best to confirm with the retailer directly before attempting a purchase. Contacting customer service can save time and prevent any unexpected issues.

Why Some Retailers Restrict Gift Card Purchases

The primary reason for restricting gift card purchases with BNPL services is the potential for fraud. Gift cards are easily resold or used anonymously, making them attractive to scammers.

BNPL services aim to facilitate responsible spending. Gift cards can be seen as a way to circumvent this by enabling large purchases that may not align with the user's repayment capacity.

Retailers are also wary of users acquiring gift cards and then defaulting on their BNPL payments, leaving the retailer with the loss.

Alternative Strategies for Using Zip

If direct gift card purchases are not possible, there are alternative strategies to consider. One option is to use Zip to purchase items directly from a retailer and then gift those items.

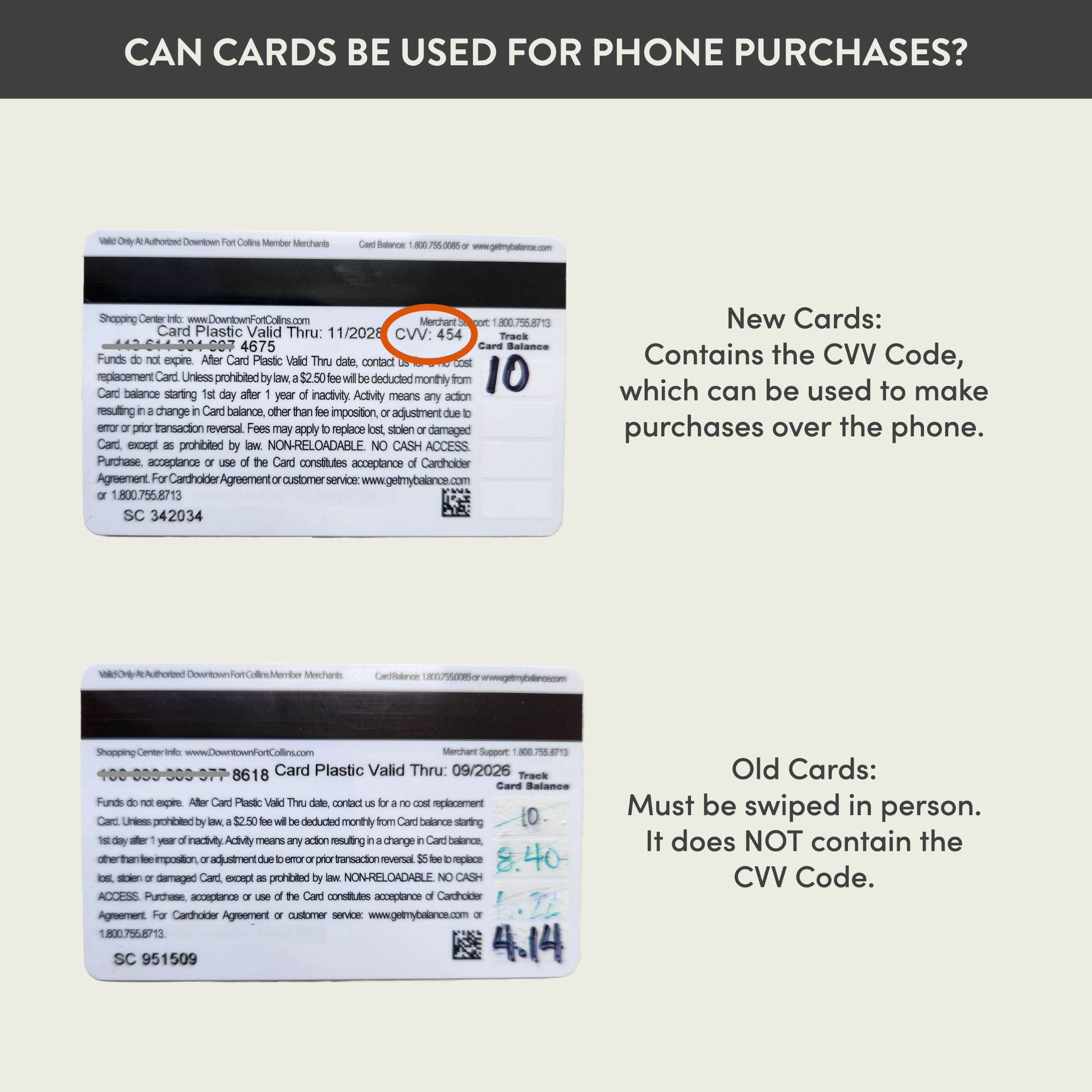

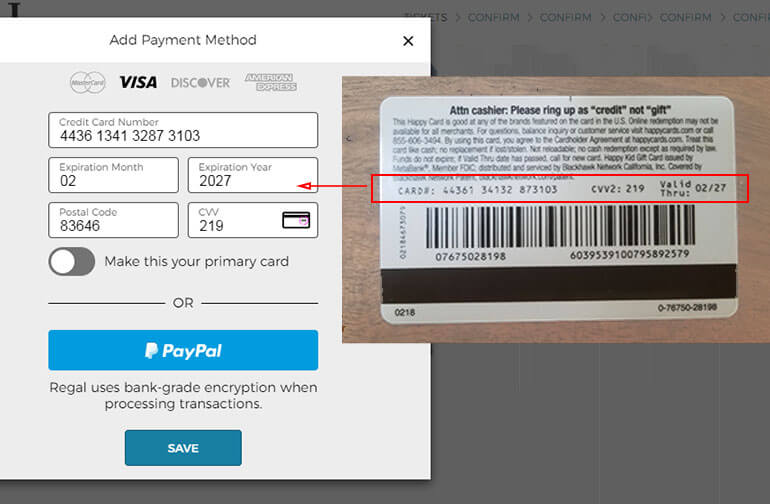

Another approach is to use Zip to purchase general-purpose prepaid cards (if allowed by the retailer). These cards can then be used like a debit card to purchase gifts.

However, be aware that these prepaid cards may come with activation fees and other charges, potentially negating some of the benefits of using Zip.

The Fine Print: Terms and Conditions

Before using Zip to purchase anything, especially gift cards, it's crucial to read the terms and conditions carefully. Pay attention to any restrictions or limitations regarding gift card purchases.

Understand the repayment schedule and any potential fees associated with late payments. Responsible use of BNPL services is essential to avoid debt accumulation.

According to Zip's website, users should familiarize themselves with the 'User Agreement', which outlines permissible and restricted uses of the service.

The Benefits of Using Zip (When Applicable)

When used responsibly, Zip can offer several benefits. It allows consumers to spread out the cost of purchases over time, making budgeting easier.

For those who struggle with impulse spending, Zip can help manage finances by breaking down large purchases into smaller, more manageable payments.

The absence of interest charges (assuming payments are made on time) is a significant advantage compared to traditional credit cards.

The Risks of Using Zip

Despite the benefits, it's essential to be aware of the risks associated with BNPL services. Overspending is a common pitfall, as the ease of splitting payments can lead to purchasing more than one can afford.

Late fees can quickly add up, turning a seemingly manageable purchase into a costly burden. Missed payments can also negatively impact credit scores.

According to a study by Credit Karma, a significant percentage of BNPL users have missed at least one payment, highlighting the importance of responsible usage.

Ethical Considerations

The rise of BNPL services raises ethical questions about encouraging consumer debt. While convenient, these services can potentially lead to financial instability for some individuals.

Retailers and BNPL companies have a responsibility to promote responsible spending and provide clear information about the terms and conditions of these services.

Consumers should also be mindful of their spending habits and avoid using BNPL services to purchase items they cannot realistically afford.

The Future of BNPL and Gift Cards

The landscape of BNPL services is constantly evolving. As the industry matures, we may see more retailers explicitly allowing or disallowing gift card purchases with BNPL options.

Increased regulation may also play a role in shaping the future of BNPL and its relationship with gift card sales. Government oversight could lead to stricter guidelines and consumer protections.

For now, consumers should remain vigilant and informed about the terms and conditions of the BNPL services they use.

Expert Opinions

Financial experts generally advise caution when using BNPL services. They emphasize the importance of budgeting and avoiding overspending.

Consumer Reports recommends carefully reviewing the terms and conditions of any BNPL service before making a purchase.

Experts suggest using BNPL services only for purchases that you would have made anyway and can comfortably afford to repay.

Sarah, after carefully researching Zip's policies and the retailer's terms, discovered she could use Zip to purchase a physical item for her niece, a stylish backpack she knew she would love. This, she realized, was a much better approach than a generic gift card. She smiled, a sense of relief washing over her. She could still give a thoughtful gift without breaking the bank. The coffee shop buzzed around her, but Sarah was no longer stressed. She was ready for the holidays.