Can You Buy Part Of A Stock On Td Ameritrade

Imagine you've been eyeing Tesla, captivated by its innovation and bold vision. But that hefty stock price seems miles out of reach. Does owning a piece of the future, or any promising company for that matter, require emptying your savings? Not necessarily anymore.

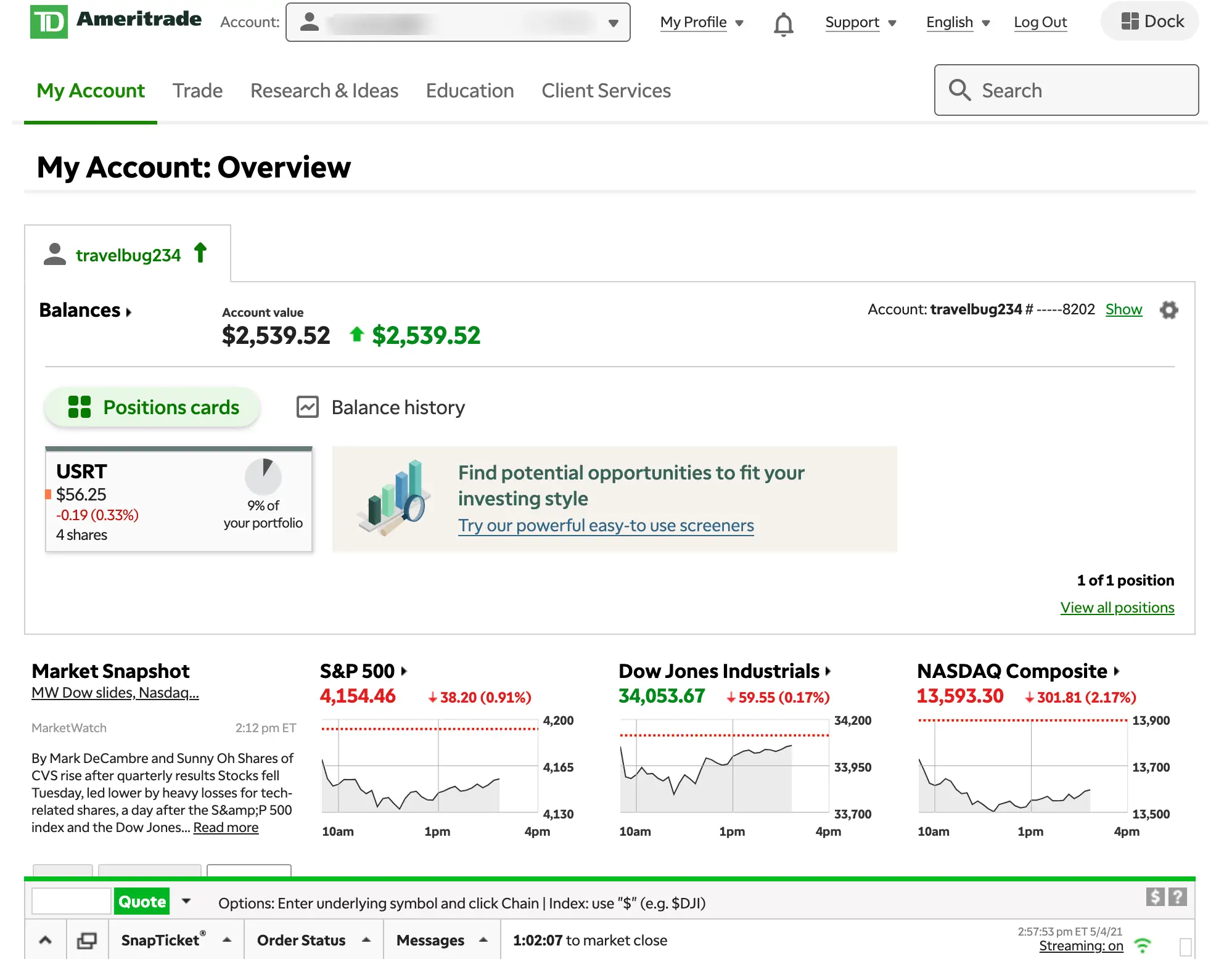

The good news is: Yes, you absolutely can buy part of a stock on TD Ameritrade. Fractional shares have democratized investing, making it possible for everyday folks to own a slice of companies they believe in, regardless of the stock's full price.

The Rise of Fractional Shares

Fractional shares aren't exactly a new invention, but their widespread availability through major brokerages like TD Ameritrade is a relatively recent and welcome development. Traditionally, you had to buy whole shares, locking many out of investing in high-value companies.

This accessibility aligns with a broader trend of making financial markets more inclusive. TD Ameritrade, now part of Schwab, has embraced this trend, offering fractional shares on a wide range of stocks.

How it Works on TD Ameritrade

With TD Ameritrade, you can buy fractional shares through what’s often called "dollar-based investing". This means you decide how much money you want to invest, rather than how many shares you want to purchase.

Let's say you only have $50 to invest. You can allocate that $50 to a stock like Amazon, even though a single share costs thousands.

TD Ameritrade then purchases a fraction of a share equivalent to your $50 investment.

The process is usually seamless through the TD Ameritrade platform, both online and through their mobile app. Simply search for the stock you're interested in, enter the dollar amount you wish to invest, and execute the trade.

Benefits of Fractional Shares

The advantages of fractional shares are significant. Firstly, it drastically lowers the barrier to entry for new investors.

You no longer need large sums of money to start building a diversified portfolio. This allows you to spread your investments across various companies and sectors, mitigating risk.

Moreover, fractional shares make it easier to reinvest dividends. Instead of waiting until you have enough to buy a whole share, you can immediately reinvest those dividends, accelerating your portfolio's growth through the power of compounding.

Things to Consider

While fractional shares offer numerous benefits, it's essential to be aware of certain considerations. Liquidity might be a factor, although with major stocks on a platform like TD Ameritrade, this is rarely an issue.

Brokerage platforms usually handle fractional share transactions internally, ensuring a smooth buying and selling experience. Always review the TD Ameritrade platform details for any specific restrictions or fees associated with fractional shares.

As with any investment, thorough research is crucial. Understand the company you're investing in, even if it's just a fraction of a share.

Investing Made Accessible

Fractional shares are transforming the investment landscape. They provide access for those who previously felt excluded from the market.

TD Ameritrade’s embrace of fractional shares is a testament to the evolving nature of investing. It's a shift toward greater inclusivity and empowerment.

So, if you've been dreaming of owning a piece of a company but felt priced out, explore the world of fractional shares on TD Ameritrade. It might just be the key to unlocking your financial future, one small piece at a time.

/ETRADEvs.TDAmeritrade-5c61bc0a46e0fb00017dd692.png)