Can You Day Trade With A Cash Account Td Ameritrade

Day traders using TD Ameritrade cash accounts face critical limitations that could severely impact their trading strategies. Understanding these restrictions is paramount to avoid account violations and maximize trading potential.

Cash Account Day Trading: The TD Ameritrade Reality

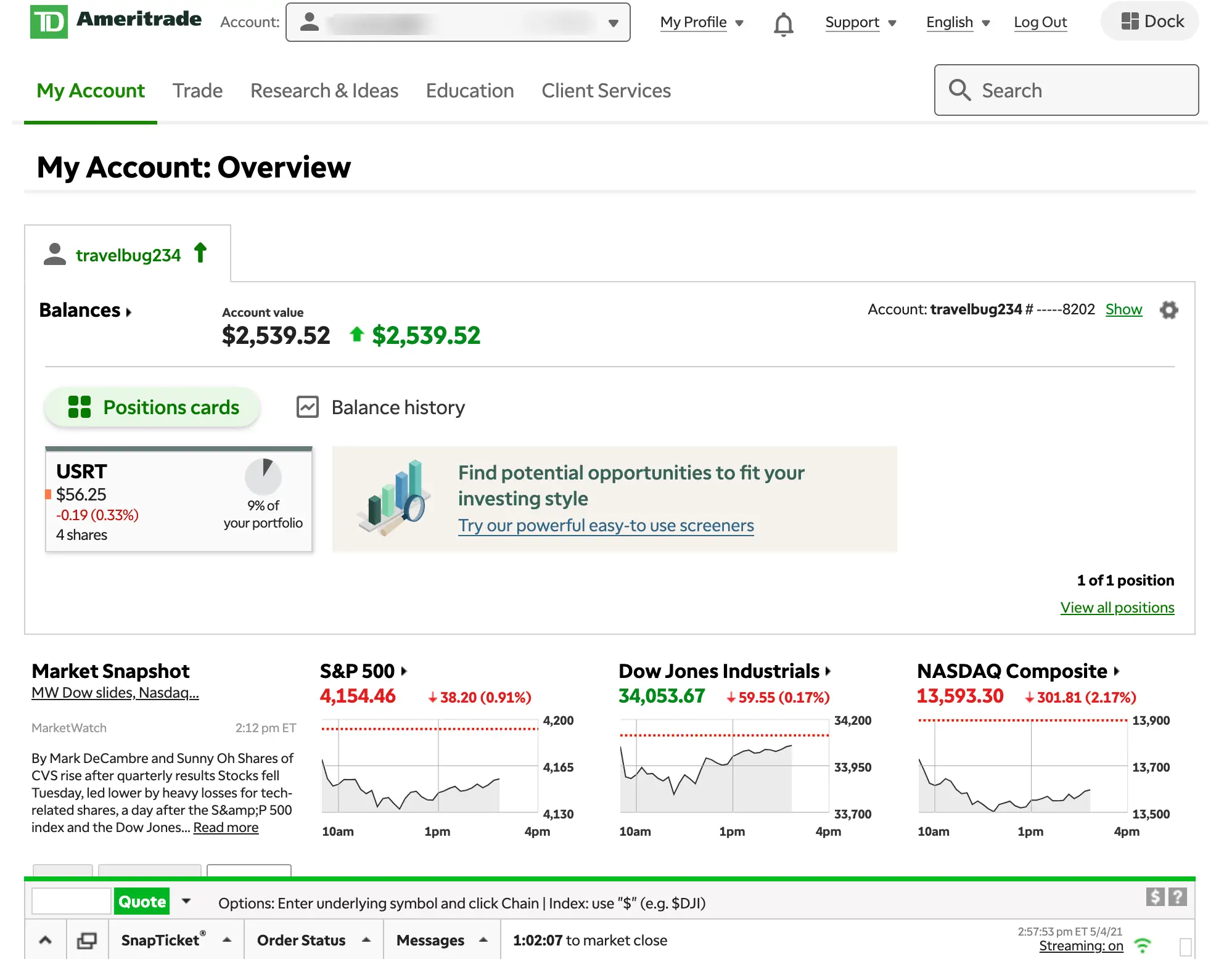

TD Ameritrade allows day trading with cash accounts, but strict rules apply. Traders must understand the settlement periods and the "free riding" rule to avoid account restrictions.

Essentially, you can only trade with settled funds. This means funds from a sale must fully settle before you can reuse them for another purchase.

Understanding Settlement Periods

Settlement periods are crucial. Stocks and ETFs typically settle in T+2 business days, meaning two business days after the trade date.

Options have a T+1 settlement period, settling one business day after the trade date. Failure to account for these periods can trigger violations.

The Peril of Free Riding

Free riding occurs when you buy securities without sufficient settled funds and then sell them before paying for the initial purchase with settled funds. This is a major violation.

TD Ameritrade monitors accounts closely. Violating the free riding rule can lead to trading restrictions, potentially freezing your account for 90 days.

Day Trading Strategies and Cash Account Limitations

Day trading requires nimble execution. However, the settlement delays in cash accounts severely limit the frequency of trades.

You cannot execute multiple day trades on the same stock within a single day unless you have sufficient settled funds to cover all purchases. This significantly hinders active trading strategies.

Alternatives: Margin Accounts

A margin account offers greater flexibility. Margin accounts allow you to borrow funds from the brokerage, providing immediate access to capital for trading and bypassing settlement delays.

However, margin accounts come with their own set of risks, including margin calls and interest charges. Traders must carefully consider these risks.

According to TD Ameritrade's website, opening a margin account requires meeting specific eligibility requirements and understanding the terms and conditions.

Avoiding Violations: Practical Steps

The most effective strategy is meticulous planning. Track your trades and settlement dates carefully.

Consider using a spreadsheet or other tool to monitor your available settled funds. Always ensure you have sufficient settled funds before executing a trade.

Alternatively, deposit more funds into your account. This increases your available settled cash and provides greater trading flexibility.

Contact TD Ameritrade's customer service for clarification. They can provide guidance on your account's trading limitations and settlement periods.

TD Ameritrade's Resources

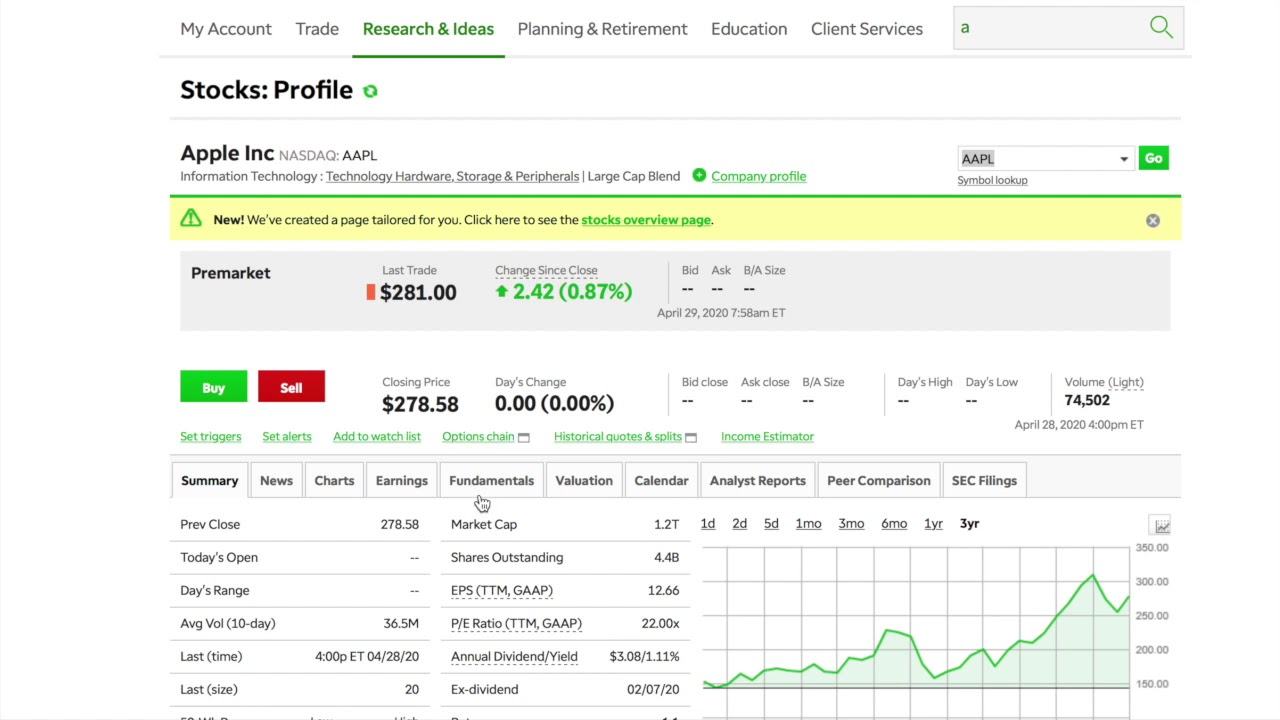

TD Ameritrade offers educational resources on its website. These resources can help you understand the nuances of cash accounts and day trading.

Specifically, look for information on "Good Faith Violations" and settlement procedures. Understanding these topics is critical for successful cash account day trading.

Conclusion: Proceed with Caution

Day trading with a TD Ameritrade cash account is possible, but challenging. The restrictions imposed by settlement periods and the free riding rule demand careful planning and diligent monitoring.

Traders should thoroughly research these limitations. Evaluate whether a cash account aligns with their trading style and risk tolerance.

Consider exploring margin account options if greater flexibility is required. Consult with a financial advisor to determine the best course of action for your individual circumstances. Ongoing monitoring of TD Ameritrade's policies is crucial as regulations and platform features may evolve.