Can You Have More Than One Short Term Disability Policy

Imagine waking up one morning with a persistent backache that just won't go away. A visit to the doctor confirms your fears: a herniated disc. Suddenly, everyday tasks feel impossible, and your ability to work grinds to a halt. You think of your short-term disability policy, a safety net designed to provide financial support during such challenging times. But then a question pops into your head: what if one policy isn't enough? Is it even possible to have more than one?

The answer, in short, is generally yes, you can have more than one short-term disability policy. However, the implications and benefits of doing so are complex and depend on various factors, including the specific policies, state regulations, and your employer's policies. This article delves into the intricacies of stacking short-term disability coverage, helping you understand if it's a viable and beneficial option for your personal circumstances.

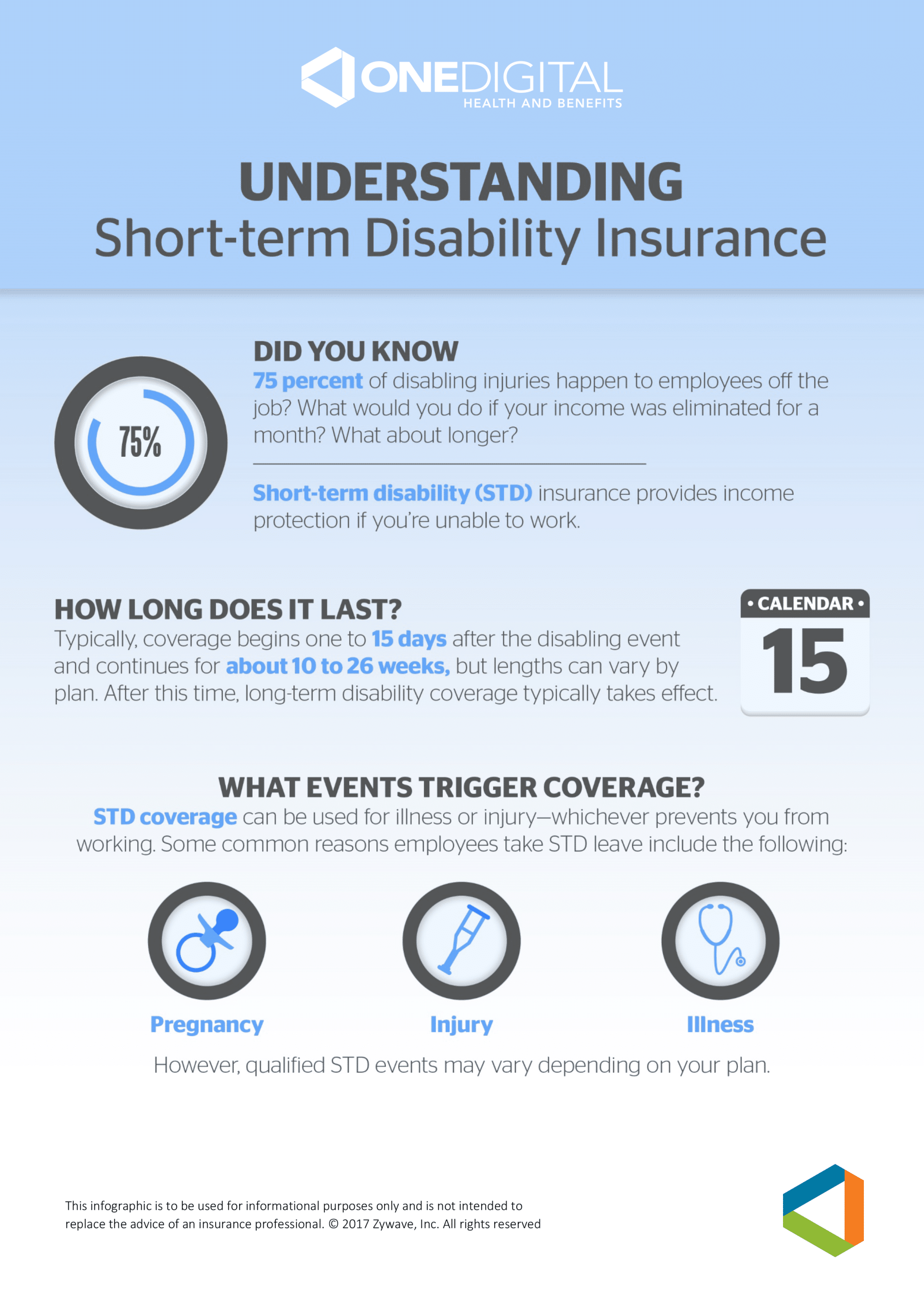

Understanding Short-Term Disability Insurance

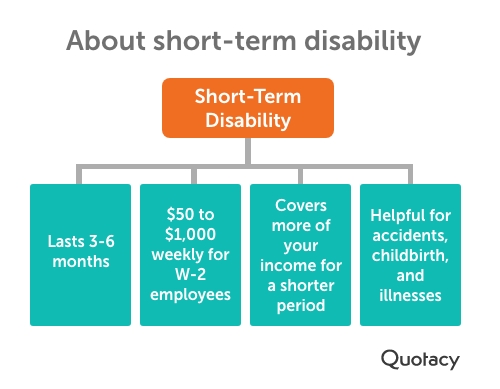

Short-term disability insurance (STD) is designed to replace a portion of your income if you're temporarily unable to work due to illness or injury. This coverage typically kicks in after a waiting period, often referred to as an elimination period, which can range from a few days to a couple of weeks.

Benefits usually last for a defined period, generally between three to six months, although some policies offer coverage for up to a year. The benefit amount is typically a percentage of your pre-disability income, often around 60% to 80%.

Sources of Short-Term Disability Coverage

STD coverage can come from various sources. Employer-sponsored plans are common, where your employer either provides the coverage as a benefit or offers it as an option you can enroll in.

Individual policies are purchased directly from an insurance company. These are often favored by self-employed individuals, freelancers, or those seeking supplemental coverage to what they already have.

Some states, like California, New York, New Jersey, Rhode Island, and Hawaii, offer state-mandated disability insurance programs. These programs provide benefits to eligible workers who become disabled.

The Possibility of Multiple Policies

Having more than one STD policy is permissible, but it's not always straightforward. The key is understanding how the different policies interact and whether they will actually provide additional benefits.

For example, if you have an employer-sponsored plan and also purchase an individual policy, you might assume that both will pay out if you become disabled. However, many insurance companies include coordination of benefits clauses in their policies.

These clauses dictate how the policy interacts with other sources of disability income, potentially reducing the amount you receive from one policy to prevent you from receiving more than 100% of your pre-disability earnings.

Coordination of Benefits

Coordination of benefits is a crucial concept when considering multiple disability policies. The purpose is to prevent over-insurance, where an individual receives more income while disabled than they would if they were working.

Typically, an employer-sponsored plan will be considered the primary policy, and any individual policy you have will be considered secondary. The secondary policy may reduce its benefits to ensure your total disability income doesn't exceed a certain percentage of your pre-disability earnings.

However, some individual policies are designed to supplement employer-sponsored plans. These policies may pay out a fixed amount regardless of other coverage, but they often come with higher premiums.

Potential Benefits of Multiple Policies

Despite the complexities, there are situations where having multiple STD policies can be advantageous. Consider the case of a self-employed individual who also works part-time for an employer offering STD benefits.

If this individual becomes disabled, they could potentially receive benefits from both their individual policy and their employer's plan, although coordination of benefits will likely apply. This could provide a more substantial safety net than relying on a single policy.

Another scenario where multiple policies might be beneficial is if one policy has a longer elimination period than another. The policy with the shorter waiting period could provide immediate income replacement while waiting for the longer-term benefits to kick in.

Considerations and Potential Drawbacks

Before purchasing multiple STD policies, it's essential to carefully consider the potential drawbacks. The most significant is the cost of premiums.

Paying for multiple policies can be expensive, and if coordination of benefits reduces the payout from one or more policies, you may not get the full value for your investment. Additionally, the application process for multiple policies can be cumbersome and time-consuming.

It's also important to understand the specific terms and conditions of each policy, including any exclusions or limitations. Some policies may exclude coverage for pre-existing conditions or specific types of injuries.

Consulting with a Professional

Navigating the world of short-term disability insurance can be challenging, especially when considering multiple policies. Seeking advice from a qualified insurance broker or financial advisor is highly recommended.

A professional can help you assess your individual needs and determine whether having multiple policies is the right strategy for you. They can also help you compare different policies, understand the coordination of benefits clauses, and ensure you're getting the best possible coverage at a reasonable price.

They can also review your existing coverage and identify any gaps that need to be addressed. Remember, the goal is to create a comprehensive and cost-effective safety net that protects your income in the event of a disability.

Case Studies and Examples

To illustrate the complexities, consider two hypothetical scenarios: Sarah, a freelance writer, and John, a corporate employee with a side business.

Sarah has both an individual STD policy and is covered under her state's disability insurance program. If she becomes disabled, the state program will likely be the primary payer, and her individual policy will supplement it, potentially increasing her total income replacement.

John has an employer-sponsored STD plan and an individual policy. If he becomes disabled, his employer's plan will likely pay first. His individual policy may then reduce its benefits to prevent him from exceeding his pre-disability income.

The Future of Disability Insurance

The landscape of disability insurance is constantly evolving. As more people become self-employed or work in the gig economy, the demand for flexible and portable disability coverage is likely to increase.

Insurance companies are adapting to this trend by offering more customizable policies and exploring new ways to coordinate benefits. Technology is also playing a role, with digital platforms making it easier to compare policies and manage claims.

As the workforce continues to change, it's crucial for individuals to stay informed about their options and proactively plan for potential income disruptions due to disability.

Conclusion

While it is indeed possible to have more than one short-term disability policy, the wisdom of doing so depends heavily on your individual circumstances. The key is to fully understand how these policies interact, especially the coordination of benefits provisions.

Consider your income sources, your risk tolerance, and the specific terms of each policy. Consulting with an insurance professional can provide clarity and help you make an informed decision.

Ultimately, the goal is to create a robust safety net that provides peace of mind, knowing that you're financially protected should the unexpected happen. It's not just about having multiple policies; it's about having the right policies, tailored to your unique needs.