Can You Make A Deposit With A Debit Card

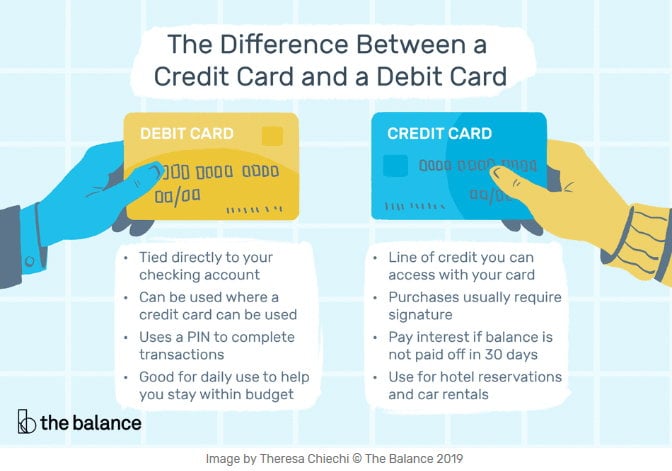

The ability to deposit funds into a bank account is a cornerstone of modern financial life, but the methods available are constantly evolving. One common question many individuals have is whether they can use a debit card to directly deposit funds, mirroring the ease of making purchases. The answer, while seemingly straightforward, involves nuances depending on the financial institution and the type of deposit being made.

This article explores the different scenarios where debit card deposits are possible, the limitations involved, and alternative methods for those situations where debit card deposits are not an option. Understanding these distinctions is crucial for individuals managing their finances and ensuring smooth transactions.

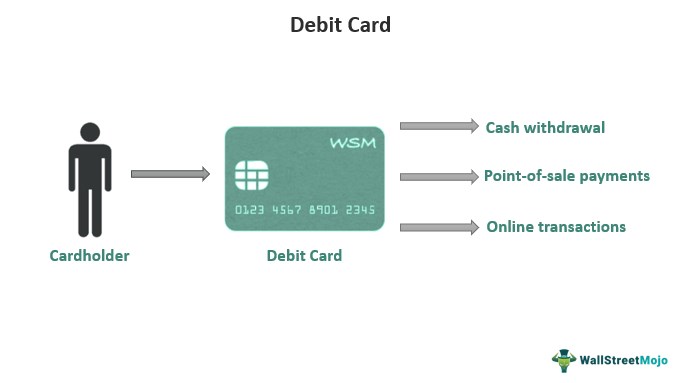

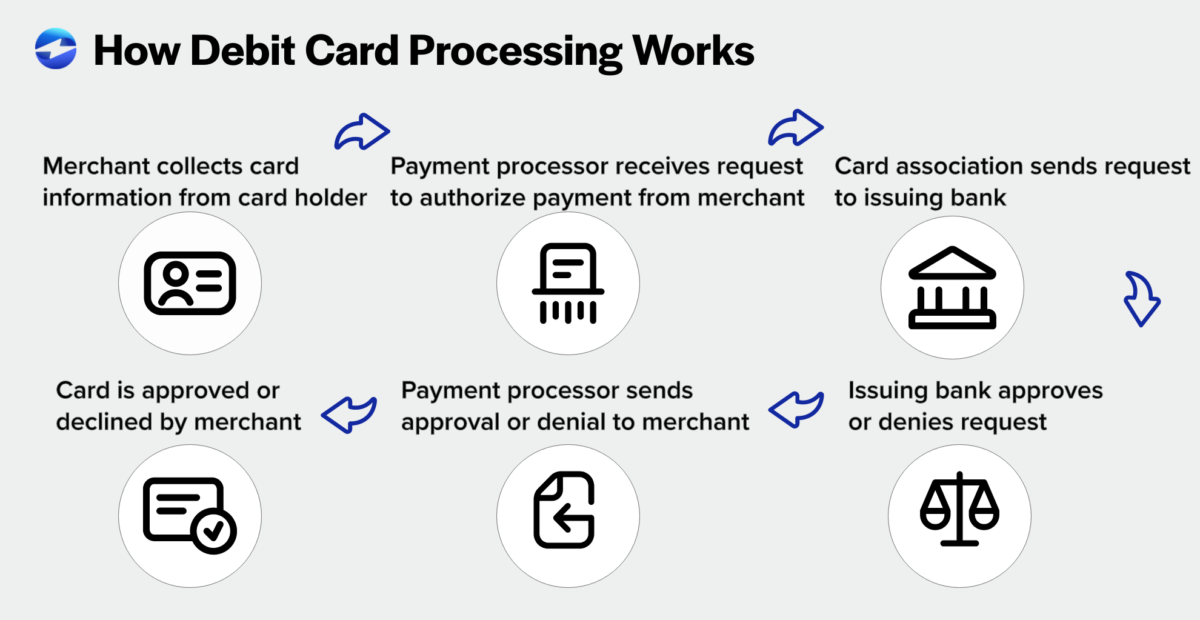

Debit Cards for In-Person Deposits

For in-person deposits, the use of debit cards is generally permitted and widely accepted at most banks and credit unions. This process typically involves visiting a local branch or using an ATM owned by your financial institution.

At a bank teller, you can present your debit card along with the cash or check you wish to deposit. The teller will then process the deposit, crediting the funds to your account. Similarly, many ATMs allow you to insert your debit card and follow the on-screen prompts to deposit cash or checks. These machines are often available 24/7, providing convenient access outside of regular banking hours.

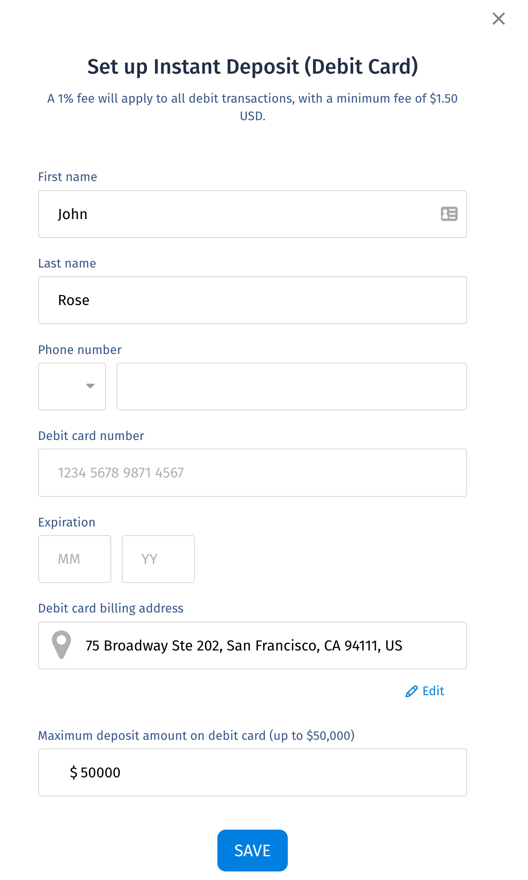

Online and Mobile Deposits: A Different Story

The landscape changes when considering online or mobile deposits. While debit cards are ubiquitous for online purchases, they are generally not used for making deposits directly through a bank’s website or mobile app.

This is primarily because these platforms are designed to accept deposits via electronic transfers from other accounts or through mobile check deposit functionalities. For example, most banking apps allow users to deposit checks by taking a photo of the front and back of the check using their smartphone's camera.

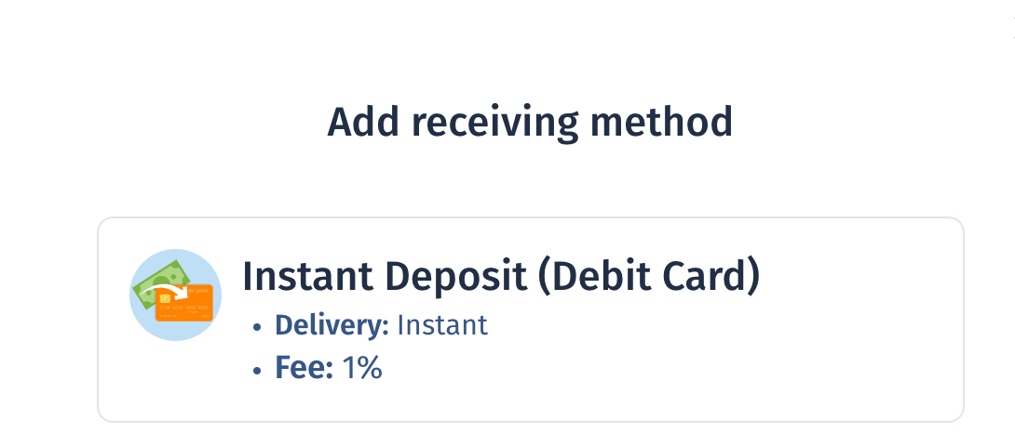

Alternative Deposit Methods

If a debit card cannot be used for a specific deposit situation, several alternative methods are available. These include cash deposits at ATMs, electronic transfers from other bank accounts, and wire transfers.

Electronic transfers involve linking an external bank account to your primary account and initiating a transfer through the bank’s website or app. Wire transfers are another option, particularly for larger sums of money, although they often involve fees.

Some banks also partner with retail locations, allowing customers to make cash deposits at participating stores. Walmart, for instance, has partnerships with several banks that allow customers to add funds to their accounts at the register. These partnerships often require a specific barcode or account information to be presented at the retail location.

The Impact of Deposit Methods

The availability of various deposit methods significantly impacts individuals' financial convenience and accessibility. Offering diverse options ensures that customers can manage their funds effectively, regardless of their location or access to traditional banking services.

For example, individuals without easy access to a physical bank branch may rely heavily on mobile check deposit or retail partnerships. Conversely, those who prefer face-to-face interactions may opt for in-person deposits with a teller.

"Financial institutions must continue to adapt and innovate to meet the evolving needs of their customers," says Jane Doe, a banking analyst at Financial Insights Group. "Providing a range of deposit options is critical for ensuring financial inclusion and customer satisfaction."

In conclusion, while debit cards are widely accepted for in-person deposits at banks and ATMs, they are generally not used for online or mobile deposits. Individuals should explore alternative methods such as electronic transfers, mobile check deposit, or retail partnerships when a debit card deposit is not feasible. Understanding these nuances enables effective financial management and ensures access to banking services tailored to individual needs.