Can You Pay A Bill With Sezzle

The buy now, pay later (BNPL) landscape is rapidly evolving, and a key player in this sector, Sezzle, is expanding its service beyond traditional retail purchases. Consumers are increasingly asking: Can I use Sezzle to pay my regular bills? The answer, while not a straightforward 'yes' for all bills, reveals a growing trend toward flexible payment options for everyday expenses.

This article explores how Sezzle is being utilized to address bill payments, the limitations of this application, and the broader implications for personal finance management. We will delve into the specifics of Sezzle's offerings, examining who can benefit, what types of bills are eligible, where the service is available, when it can be used, and how the process works.

Sezzle's Core Functionality and Expanding Scope

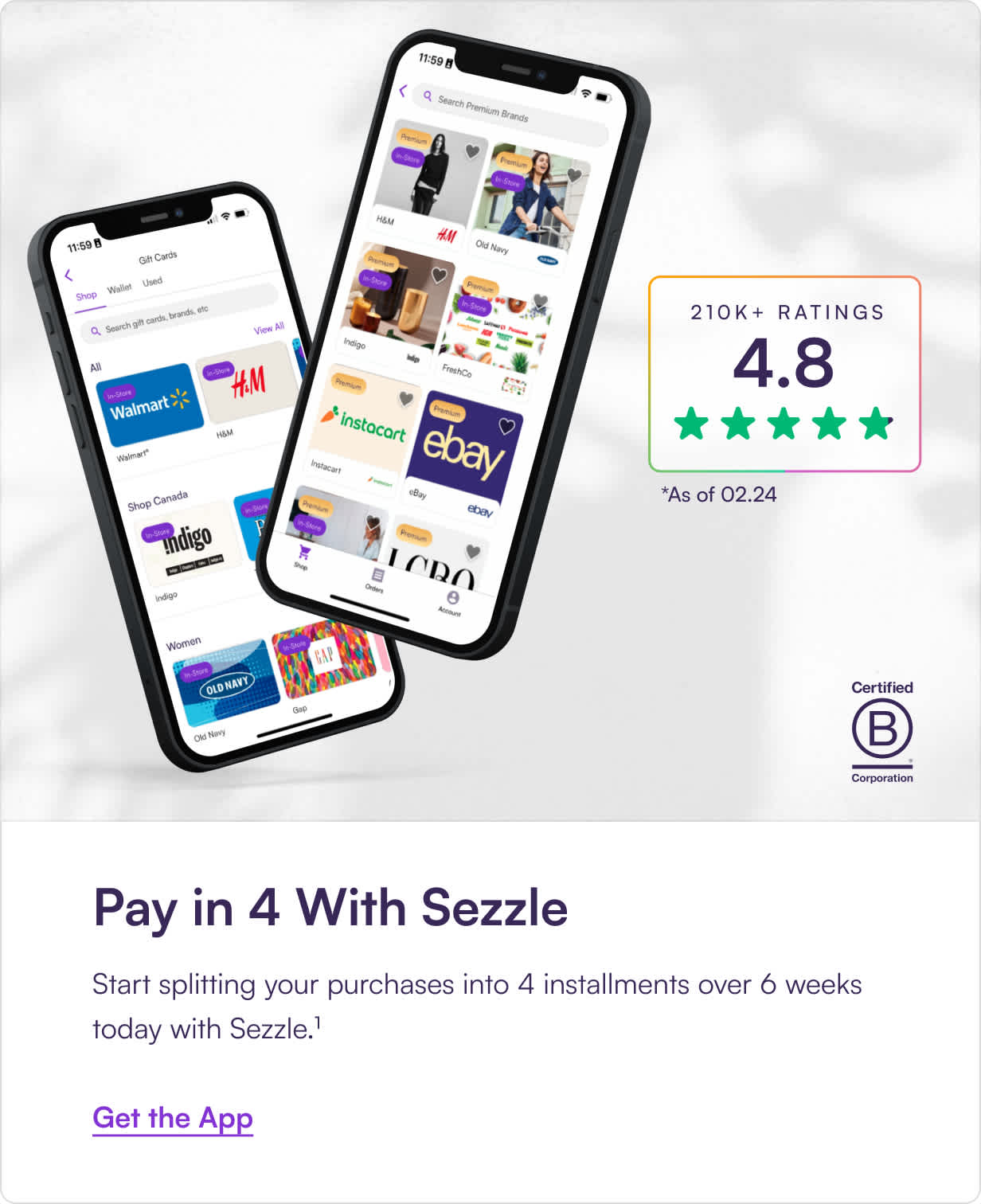

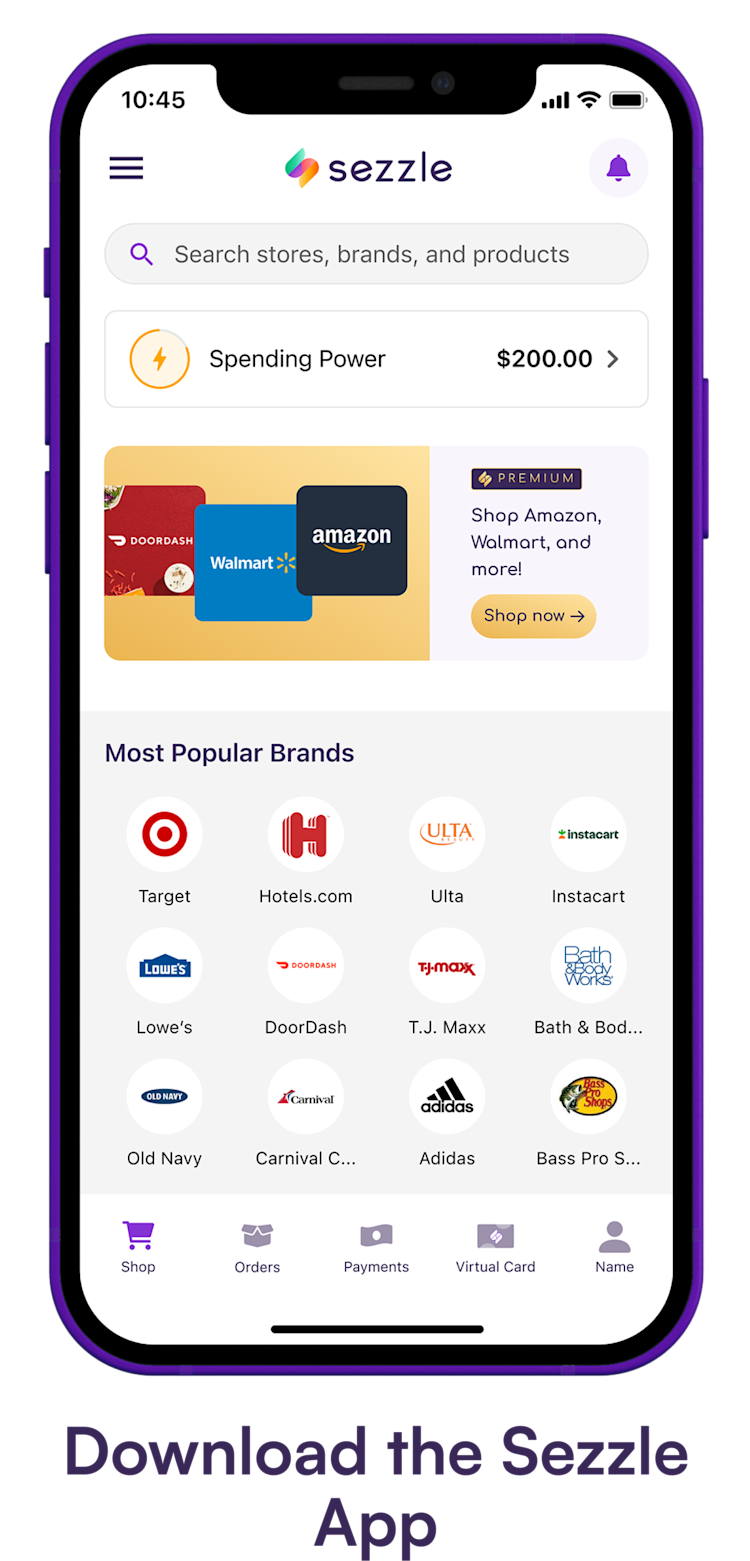

Sezzle, like other BNPL providers, allows users to split purchases into smaller, interest-free installments. Initially focused on e-commerce and in-store retail, Sezzle has been adapting to meet consumer demand for more flexible payment solutions.

The company has partnered with select bill payment platforms and offers a virtual card that can be used in certain situations. This expansion aims to provide consumers with more options for managing their finances and budgeting effectively.

How Sezzle Can (Potentially) Be Used for Bill Payments

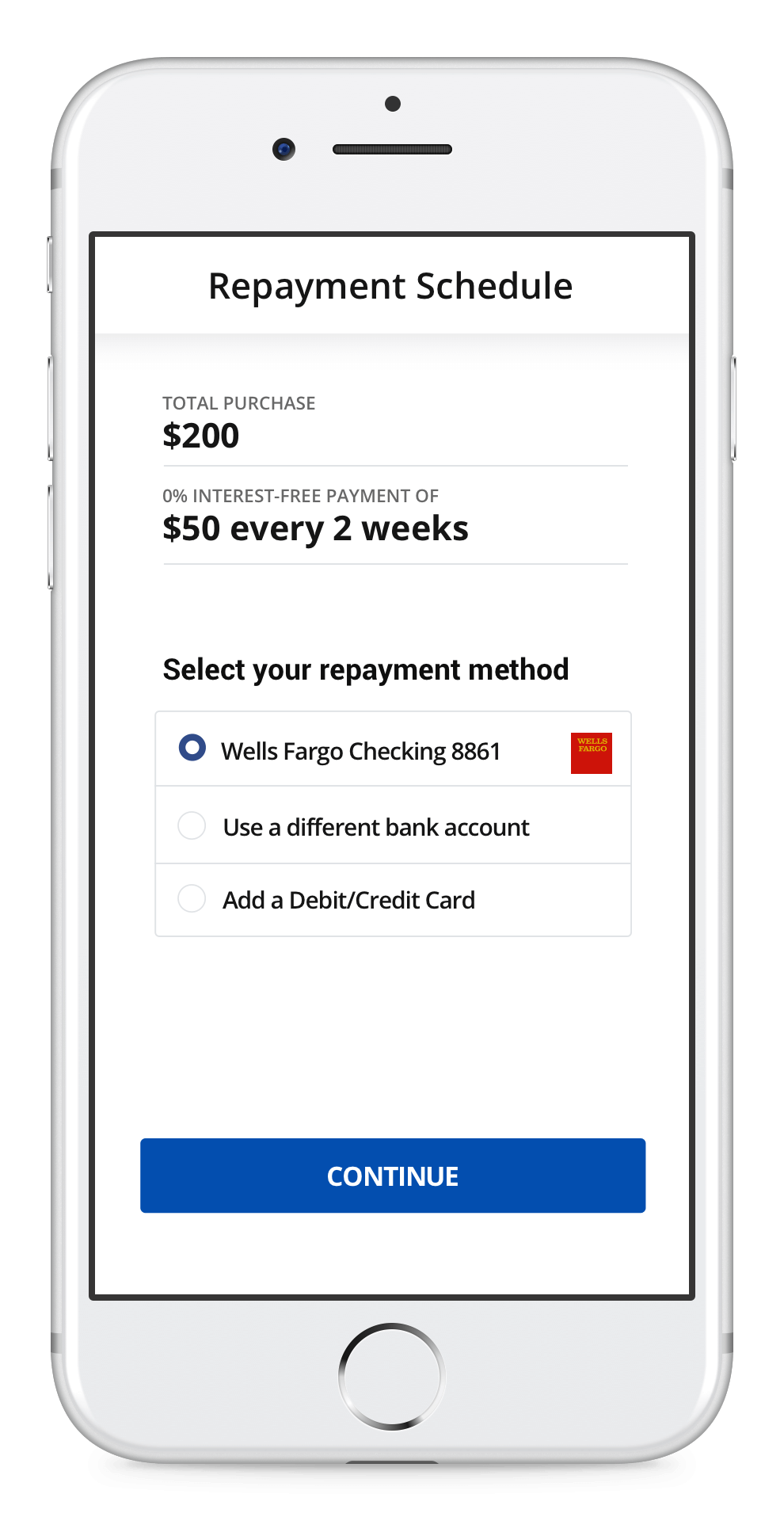

The ability to use Sezzle for bill payments depends heavily on the specific bill and the available payment methods. Direct bill payment through Sezzle is generally not available.

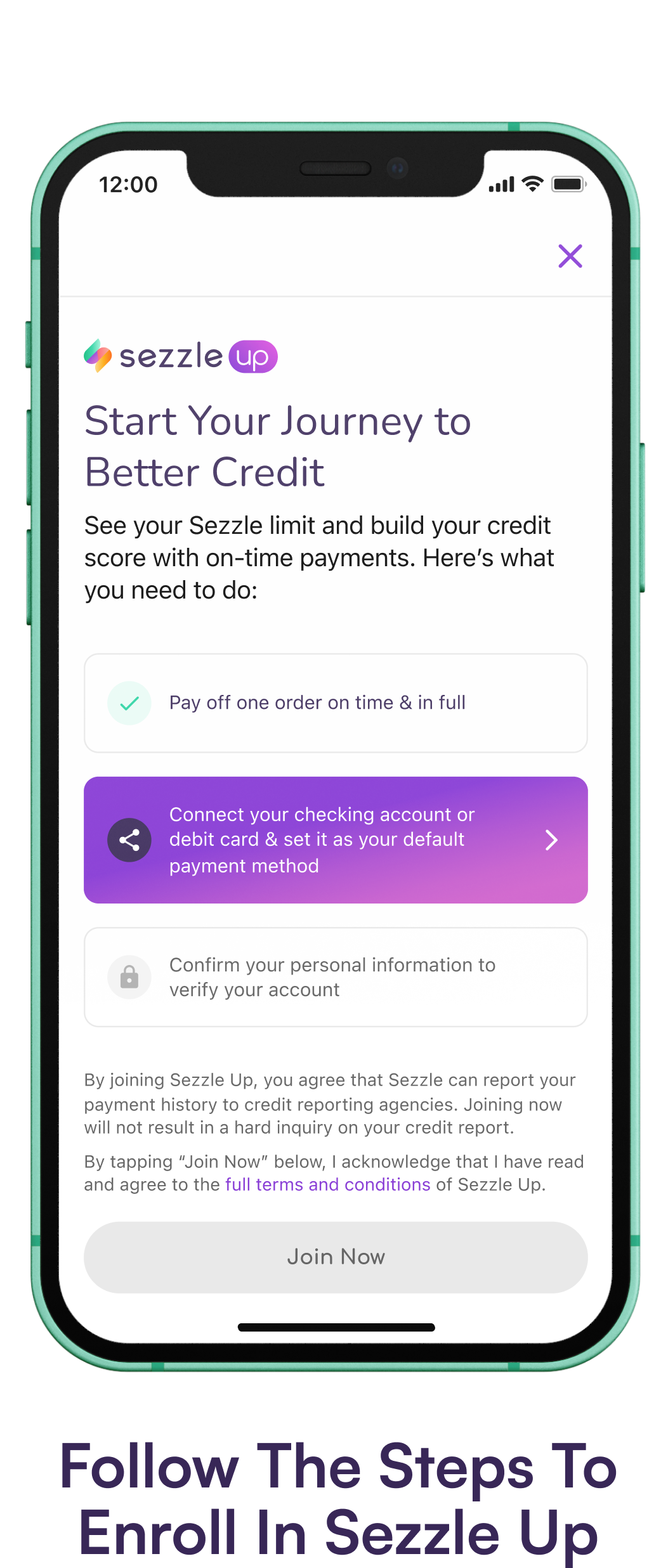

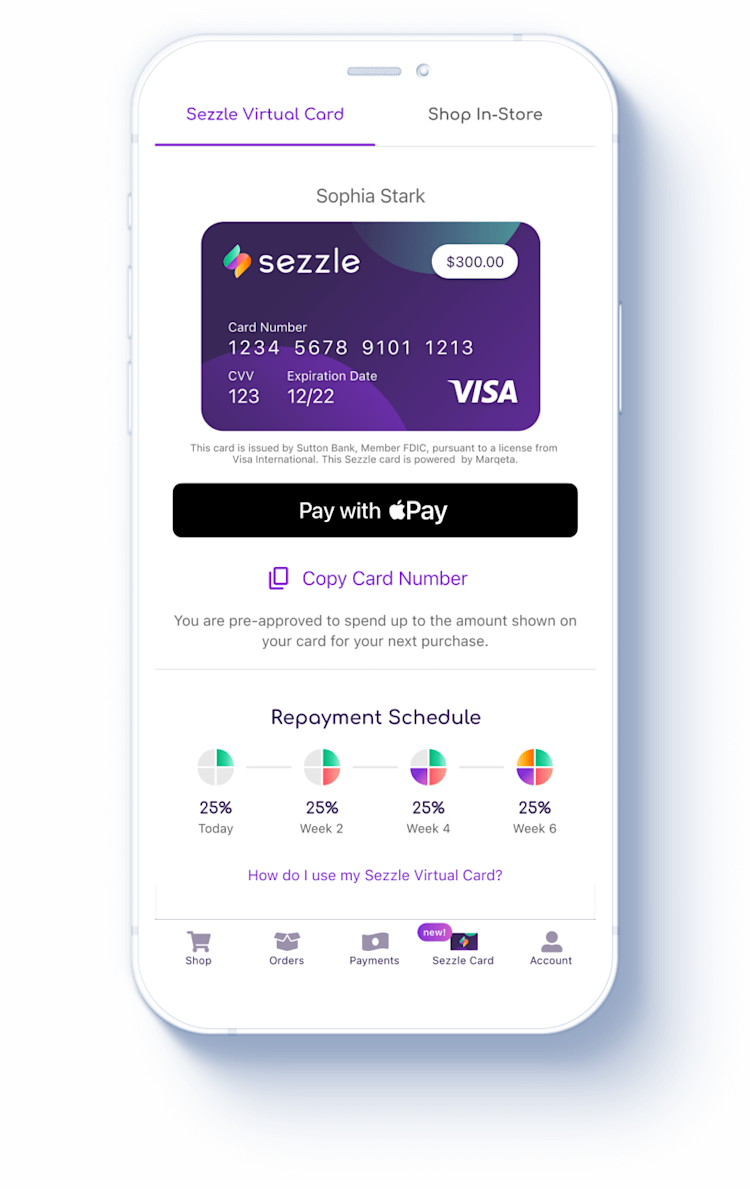

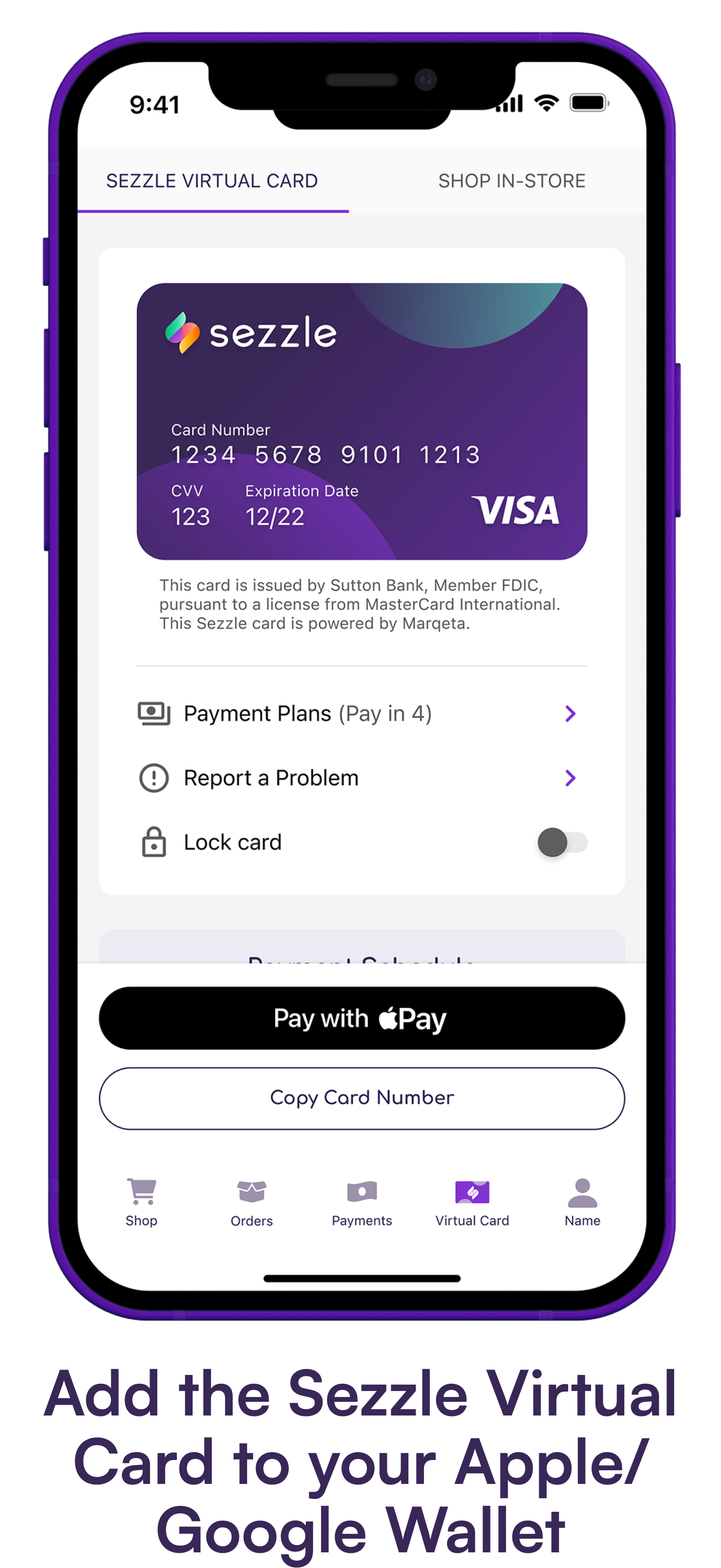

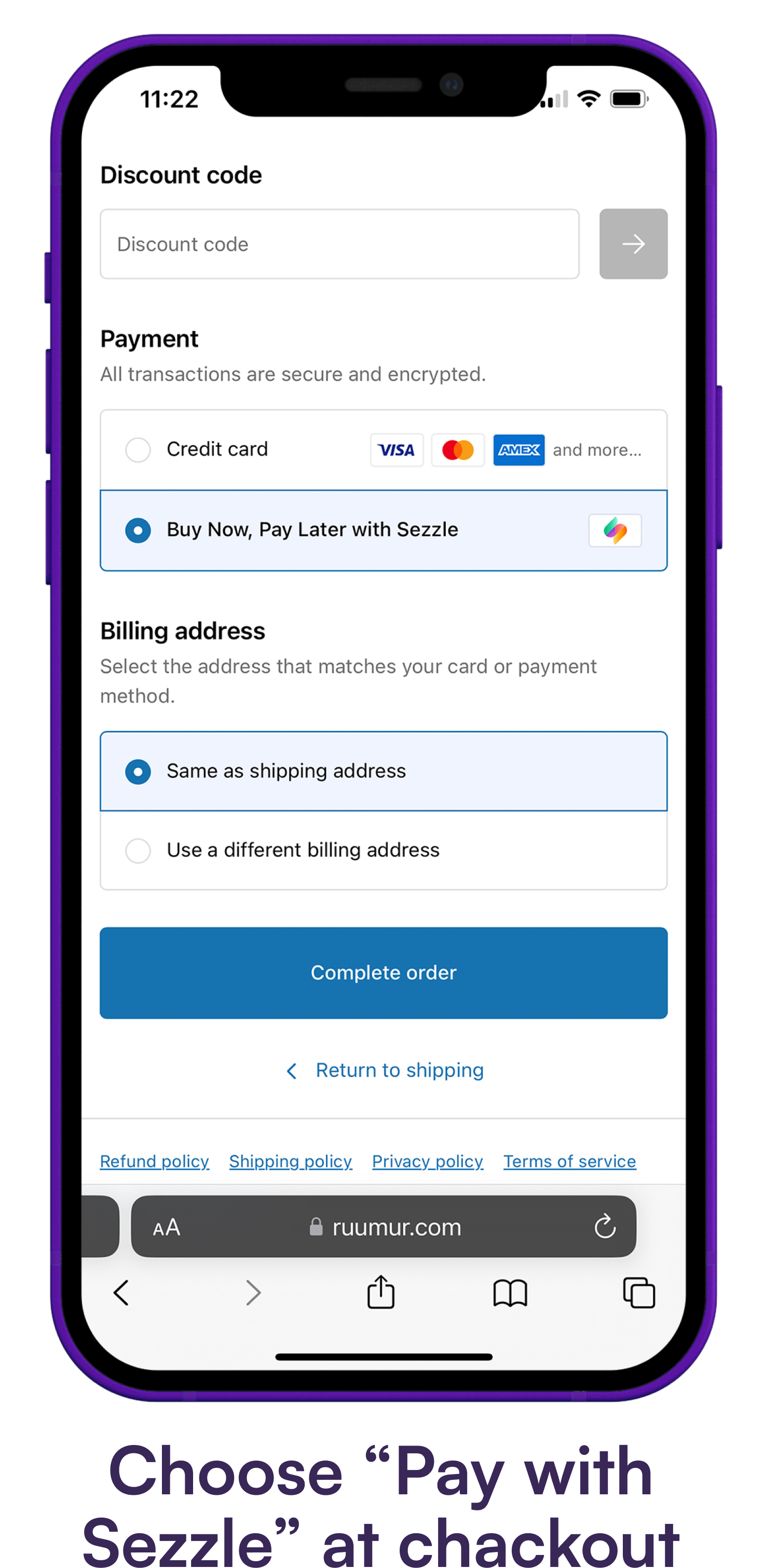

However, a workaround exists: using the Sezzle virtual card. If a bill provider accepts virtual cards or general credit cards for online payments, then the Sezzle virtual card can potentially be used.

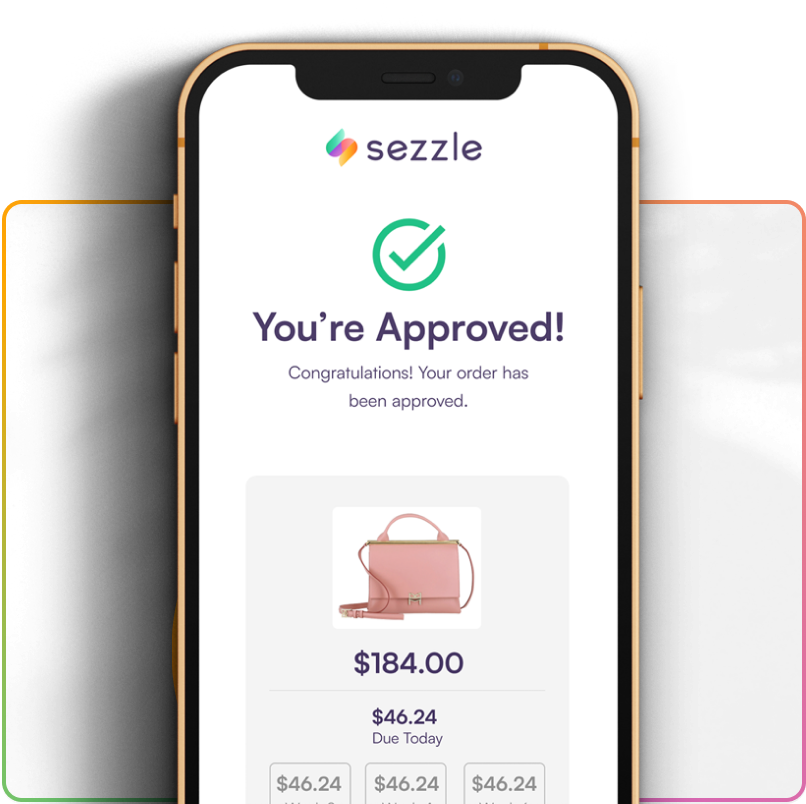

Users must first ensure they have sufficient available credit within their Sezzle account. Once the payment goes through, Sezzle will break down the bill into the agreed-upon installment plan.

Limitations and Considerations

Despite this potential application, several limitations exist. Not all bill providers accept virtual cards, significantly restricting the service's reach.

Fees might be involved if payments are missed or rescheduled, so users need to adhere strictly to the payment schedule. Late payments can also negatively impact the user's credit score and Sezzle account standing.

Furthermore, Sezzle's credit limits are generally lower than those offered by traditional credit cards. This means users might not be able to cover large bills using this method.

Partner Platforms and Bill Payment Options

While Sezzle does not directly integrate with all billers, it may partner with bill payment aggregator platforms. These platforms allow users to pay multiple bills from one place.

If the aggregator platform accepts virtual cards, and if the bills are processed as credit card transactions, the Sezzle virtual card can be an option. Users must carefully review the terms and conditions of both Sezzle and the aggregator platform to understand any fees or limitations.

Consumer Impact and Responsible Use

The availability of BNPL options for bills can be a double-edged sword. On one hand, it provides a short-term solution for managing cash flow during financial emergencies.

On the other hand, it can encourage overspending and debt accumulation if not used responsibly. Financial experts advise that users carefully consider their ability to repay before using Sezzle for bill payments.

"Using BNPL services requires a clear understanding of one's financial situation and the commitment to repay on time," advises Jane Doe, a certified financial planner.

The Future of BNPL and Bill Payments

As the BNPL industry matures, it is likely that more providers will explore direct integrations with bill payment systems. This could simplify the process and make it more accessible to a wider range of consumers.

However, increased regulatory scrutiny is also expected. Lawmakers and consumer protection agencies are examining the potential risks associated with BNPL services, particularly concerning transparency and debt accumulation.

The long-term viability of using Sezzle or similar services for bill payments will depend on these factors. Whether BNPL will become a mainstream payment method for bills remains to be seen.

Conclusion

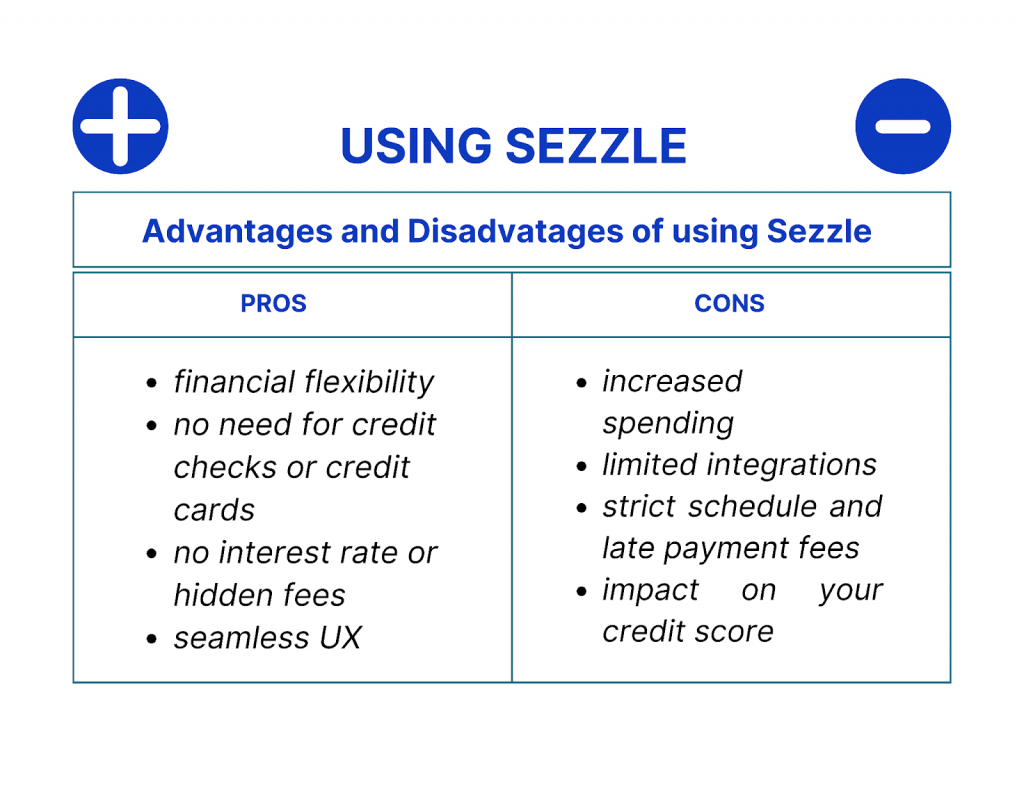

While directly paying most bills through Sezzle isn't currently possible, the potential to use a virtual card for select bill payments exists. The process requires careful consideration of the bill provider's payment policies and the user's financial responsibility.

As the BNPL landscape evolves, consumers should stay informed about the potential benefits and risks of using these services. Responsible use and a clear understanding of the terms and conditions are crucial for avoiding debt and maximizing the value of flexible payment options.

Ultimately, while Sezzle offers a potential tool for managing bills in specific situations, it's essential to weigh the convenience against the potential for added financial strain. Responsible budgeting and financial planning remain the most effective ways to manage bills in the long run.