Can You Pay Bills With Sezzle

Buy Now, Pay Later (BNPL) services have rapidly expanded beyond retail, prompting the question: Can you use Sezzle, a popular BNPL provider, to pay your everyday bills? The answer is nuanced and depends on the bill and how you attempt to pay it. While direct bill payment isn't a standard Sezzle feature, workarounds and evolving partnerships offer potential avenues.

This article explores the capabilities of Sezzle for bill payments, examining its limitations, available alternatives, and the broader implications for consumers navigating financial flexibility.

Sezzle: Core Functionality and Limitations

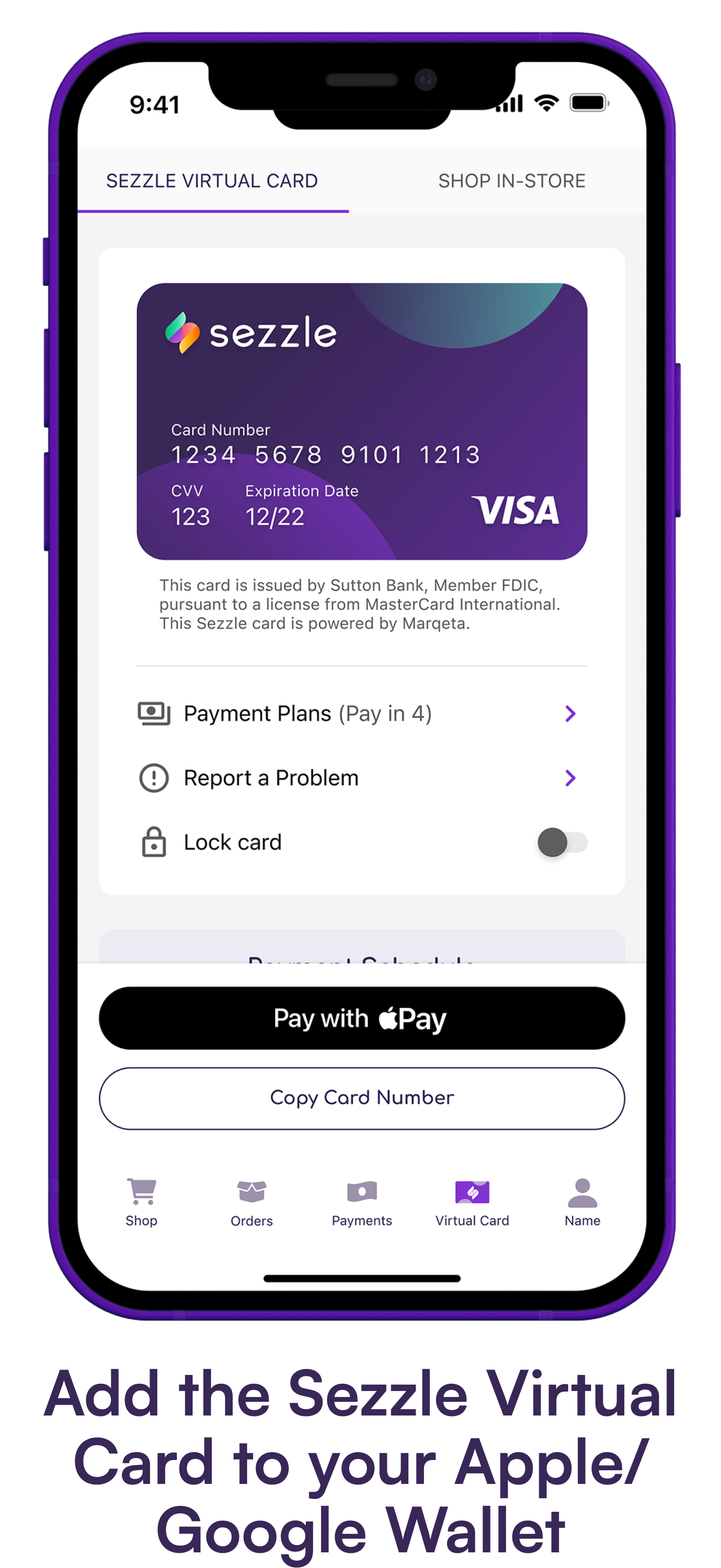

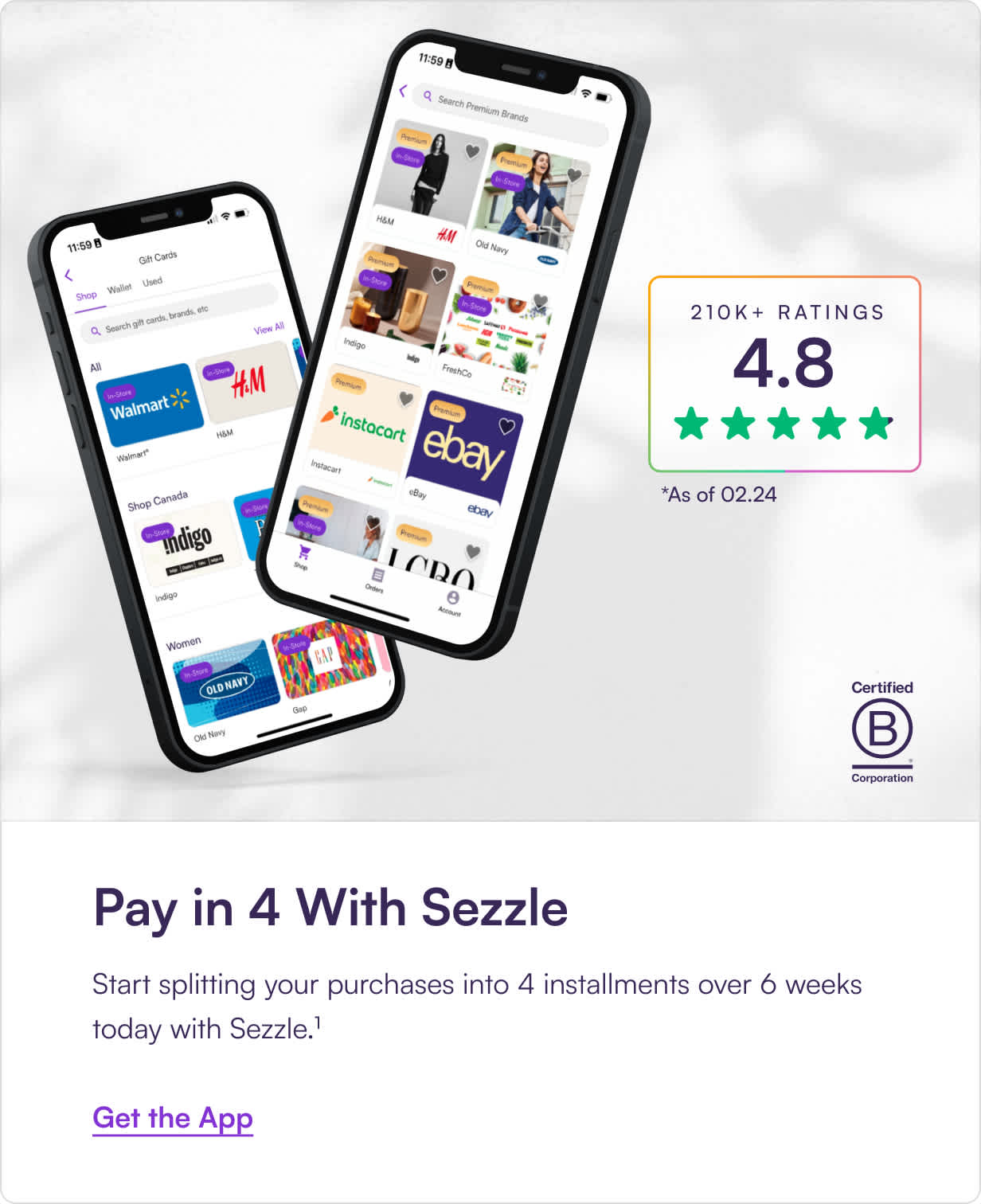

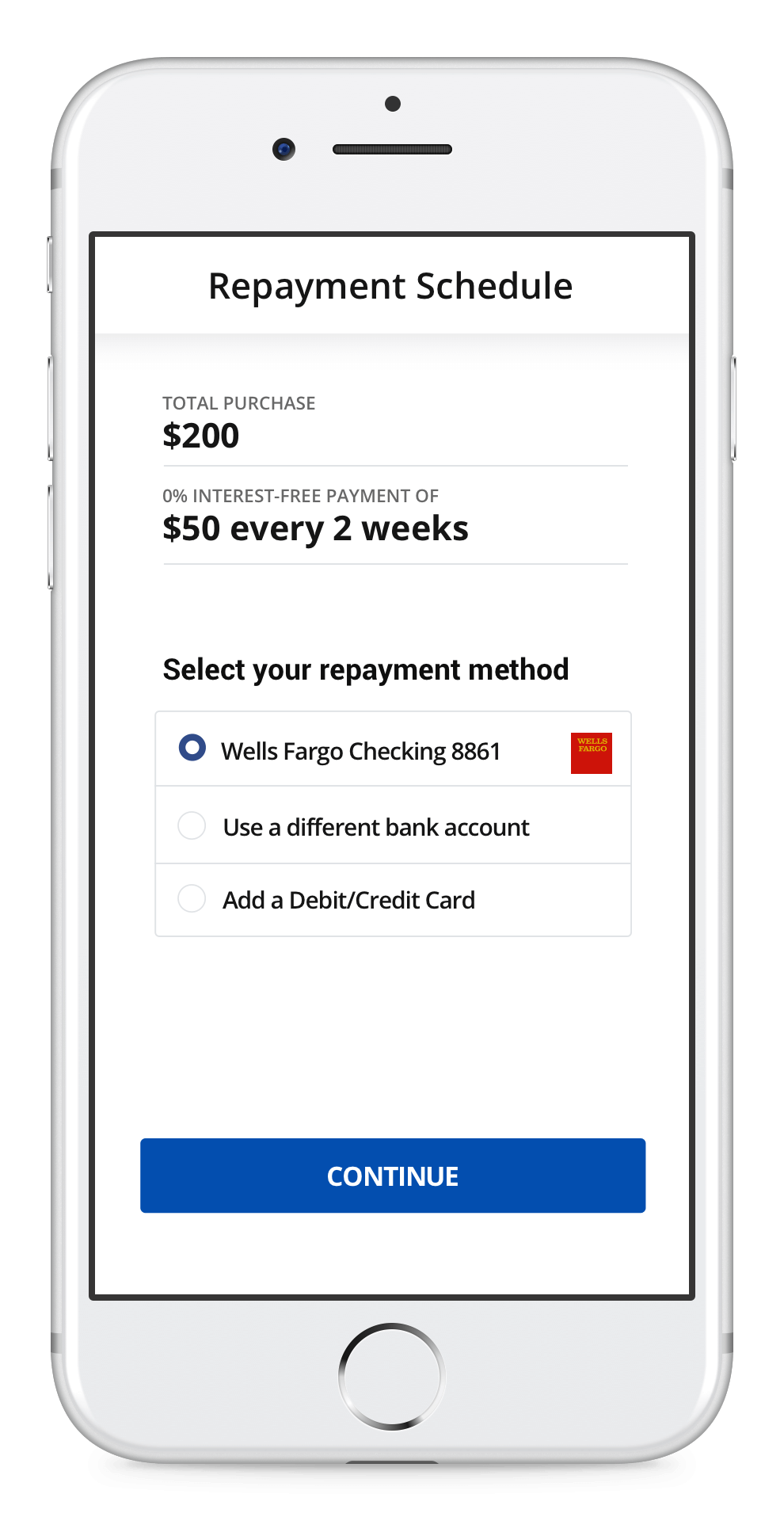

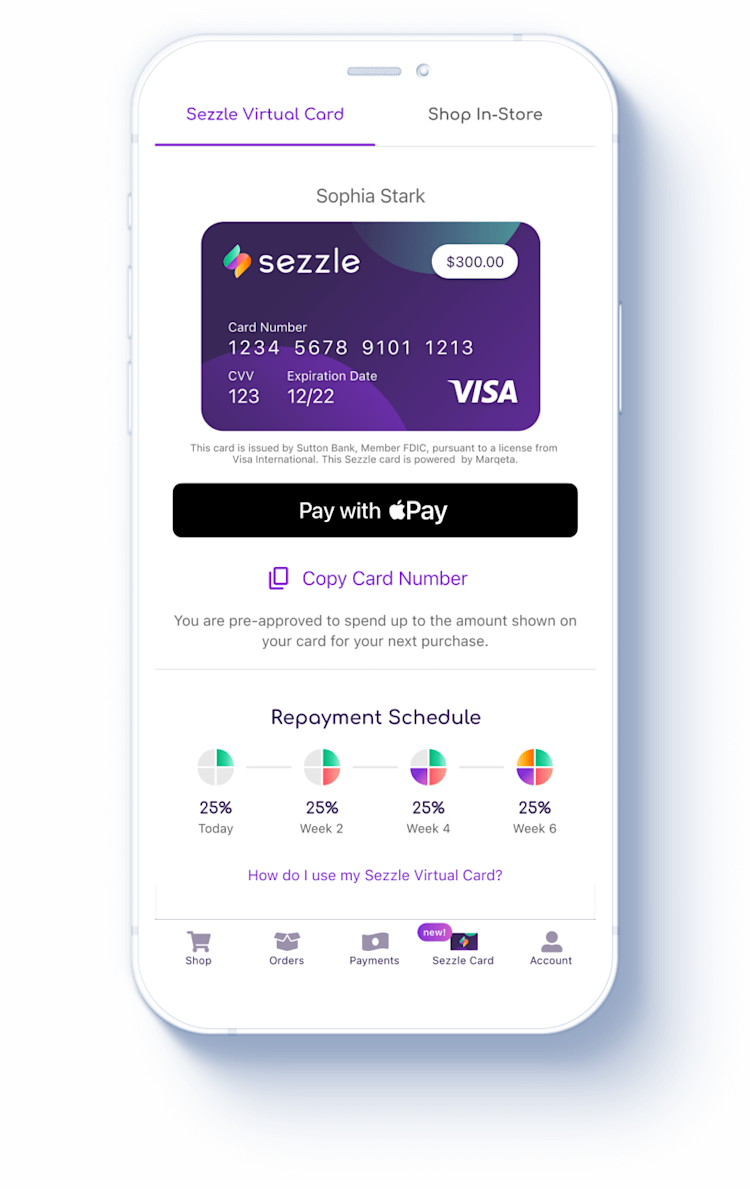

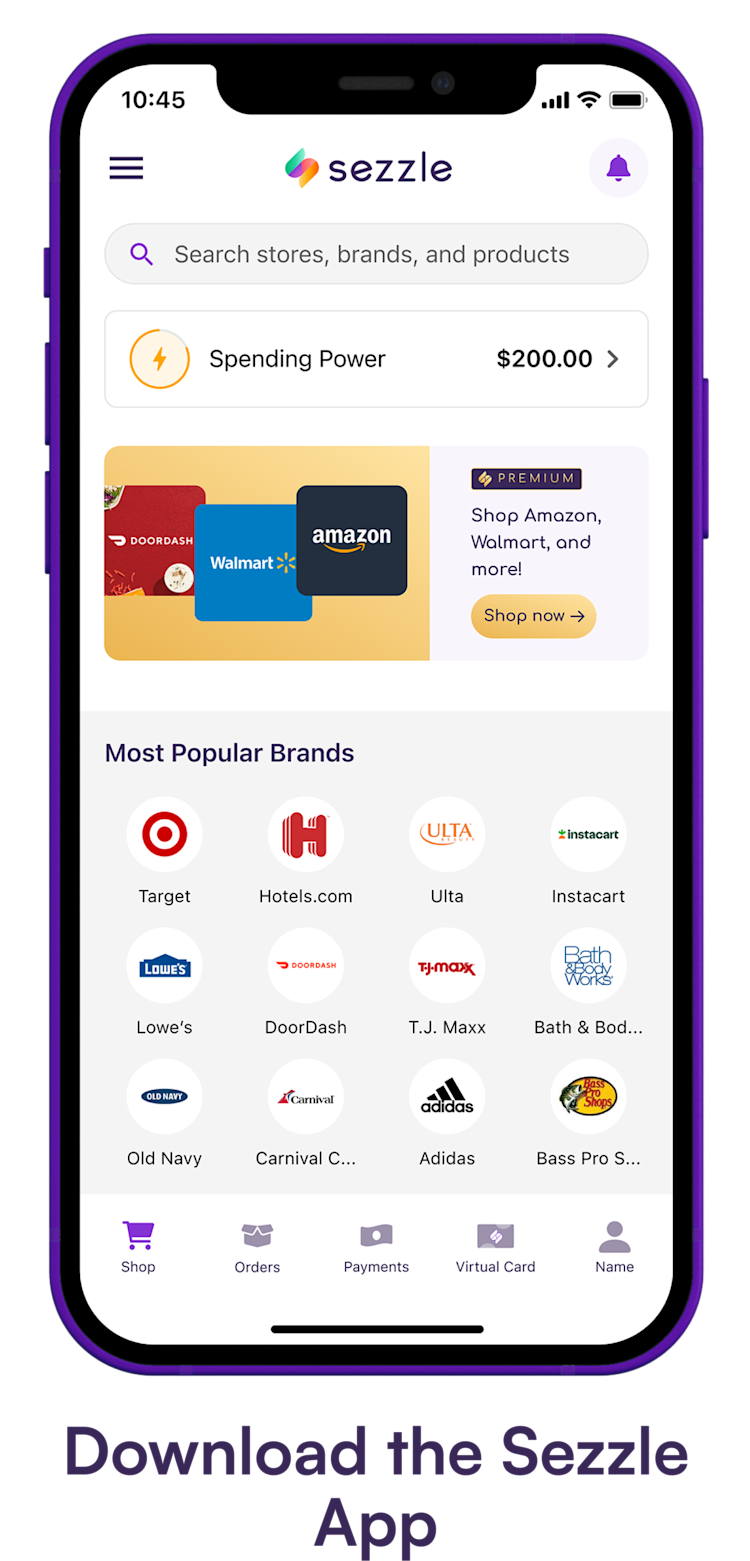

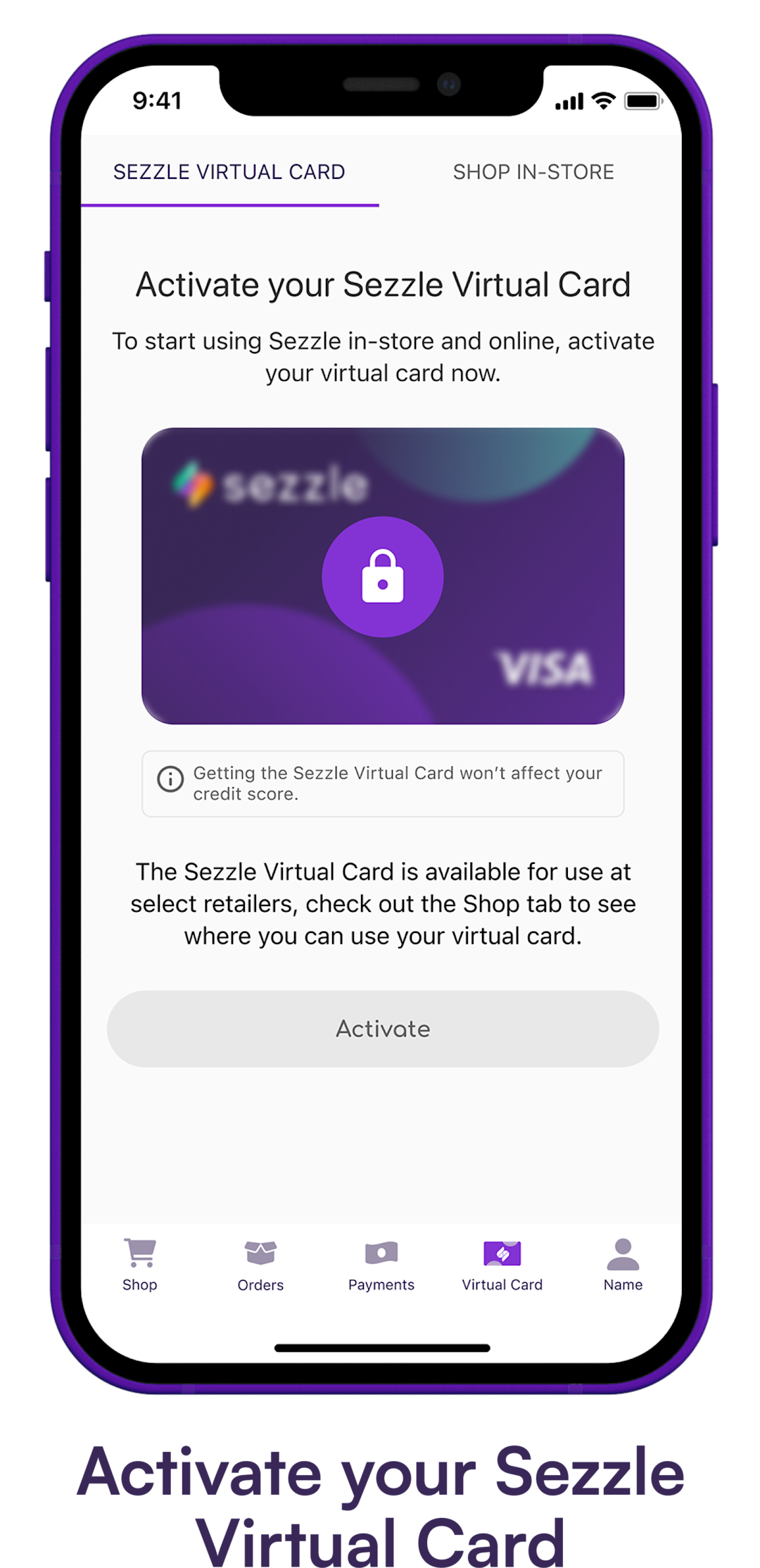

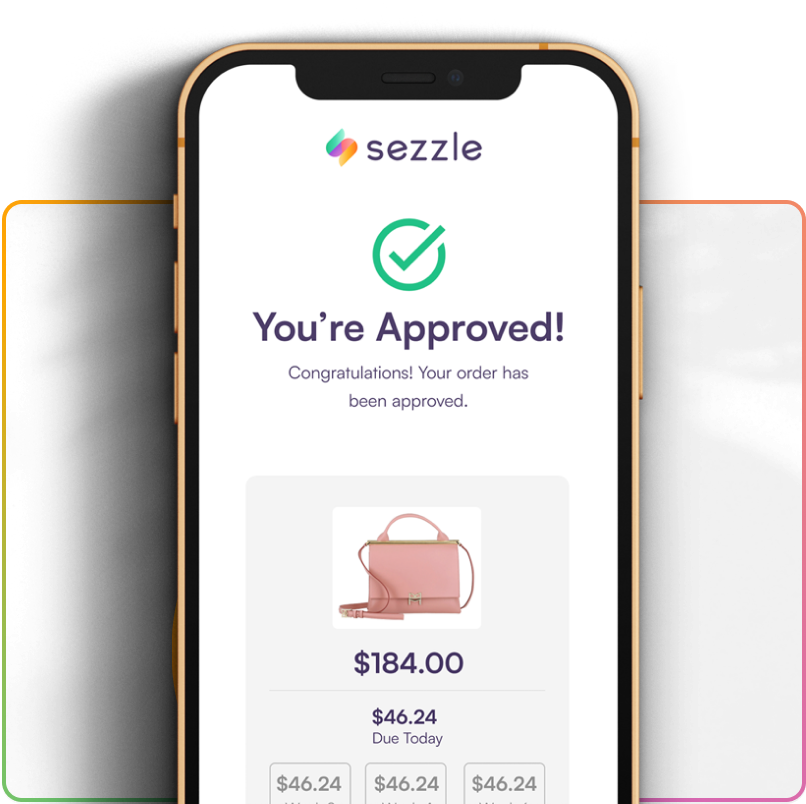

Sezzle operates primarily as a point-of-sale installment loan provider. When shopping online at participating merchants, users can split their purchase into four interest-free installments paid over six weeks.

This model is designed for retail transactions, not direct bill payments like utilities, rent, or loan installments. Consequently, Sezzle's official platform doesn't offer a direct "pay bill" option.

Indirect Bill Payment Options and Workarounds

While direct bill payment isn't generally supported, several indirect methods may allow Sezzle users to pay some bills.

One approach involves purchasing prepaid debit cards or gift cards using Sezzle at retailers that accept it. These cards can then be used to pay bills online or over the phone. However, this method often involves fees associated with purchasing the prepaid cards, negating some of the financial benefit.

Another possibility arises through partnerships. If a bill provider accepts payments via a platform that integrates with Sezzle, you may be able to indirectly use Sezzle to pay that bill. These integrations are still relatively uncommon for major bill providers.

It’s important to note that the availability of these workarounds depends on retailer acceptance and the specific bill provider's payment policies. Further, using Sezzle in this manner may circumvent its intended purpose, potentially leading to complications or policy violations.

Official Statements and Company Policy

Sezzle's official website and communications emphasize its use for retail purchases through partnered merchants. There are no explicit instructions or endorsements for using Sezzle to pay traditional bills.

Sezzle's terms of service discourage using the platform for unintended purposes. While not explicitly banning bill payments, using Sezzle in a manner that violates these terms could lead to account restrictions.

Contacting Sezzle directly for clarification on specific bill payment scenarios is recommended to ensure compliance with their policies.

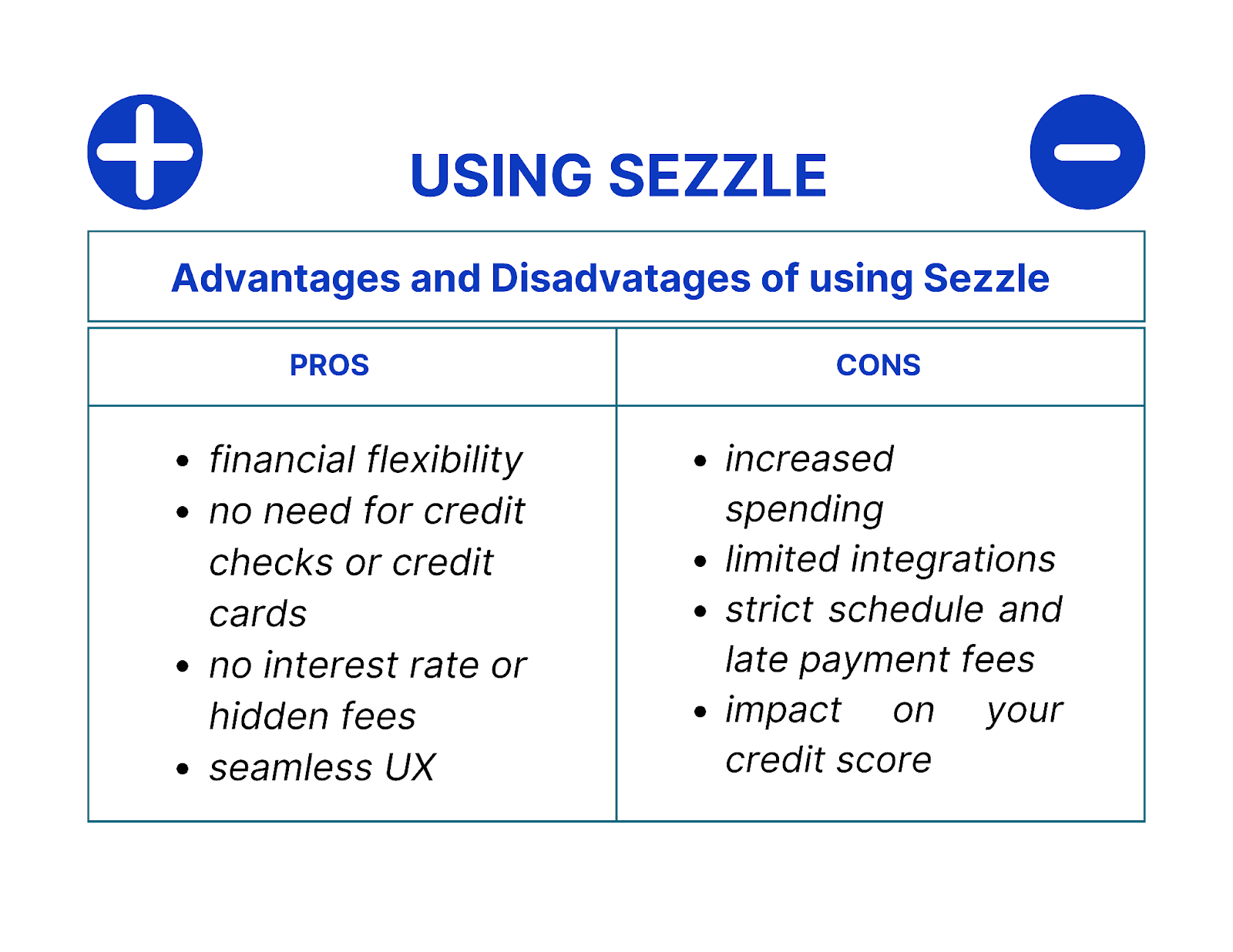

Consumer Perspectives and Potential Risks

For consumers struggling with cash flow, the allure of using Sezzle to pay bills is understandable. However, it's crucial to consider the potential risks and costs involved.

The fees associated with prepaid cards or other workarounds can erode any perceived savings. Additionally, relying on Sezzle for essential bills could lead to overspending and debt accumulation. Missing a Sezzle payment can result in late fees and negative impacts on your credit score.

Financial experts generally advise against using BNPL services for essential bills. They suggest exploring alternative options like budgeting, negotiating payment plans with bill providers, or seeking assistance from non-profit credit counseling agencies.

The Future of BNPL and Bill Payments

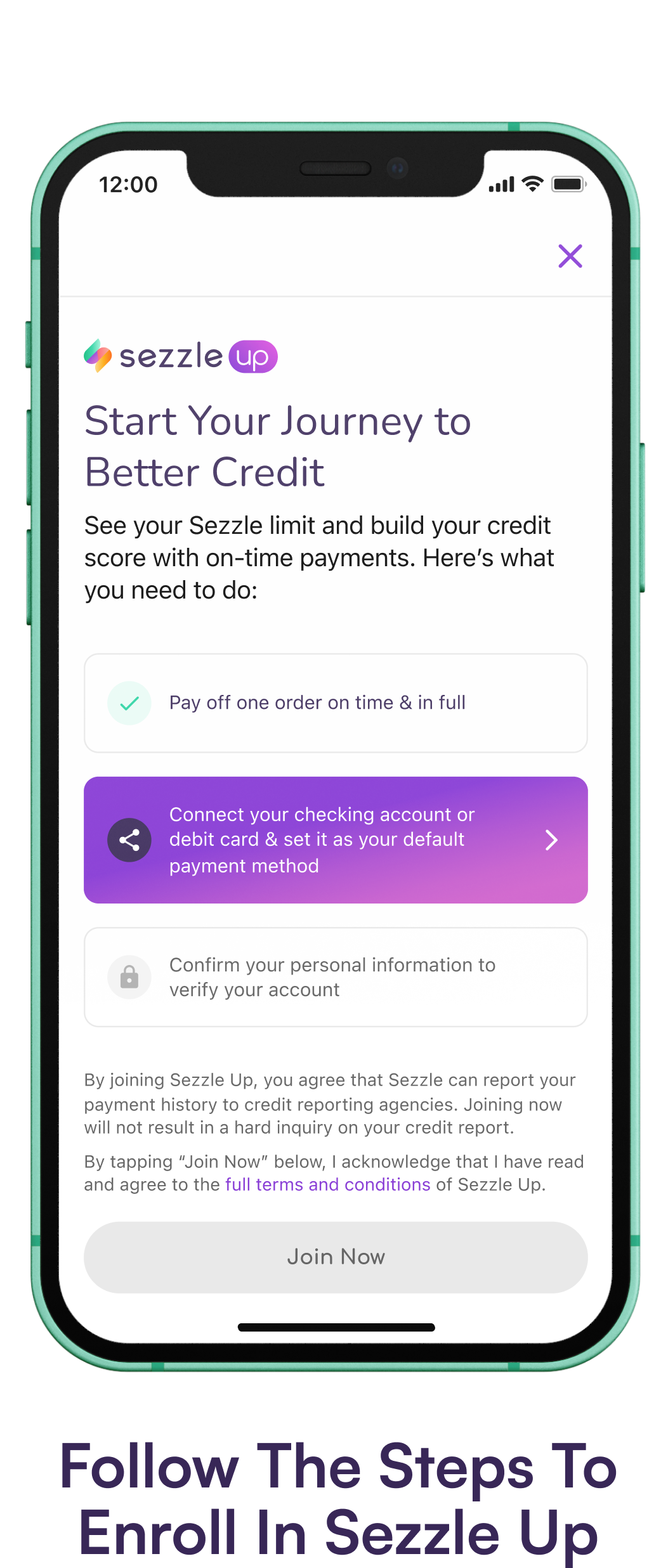

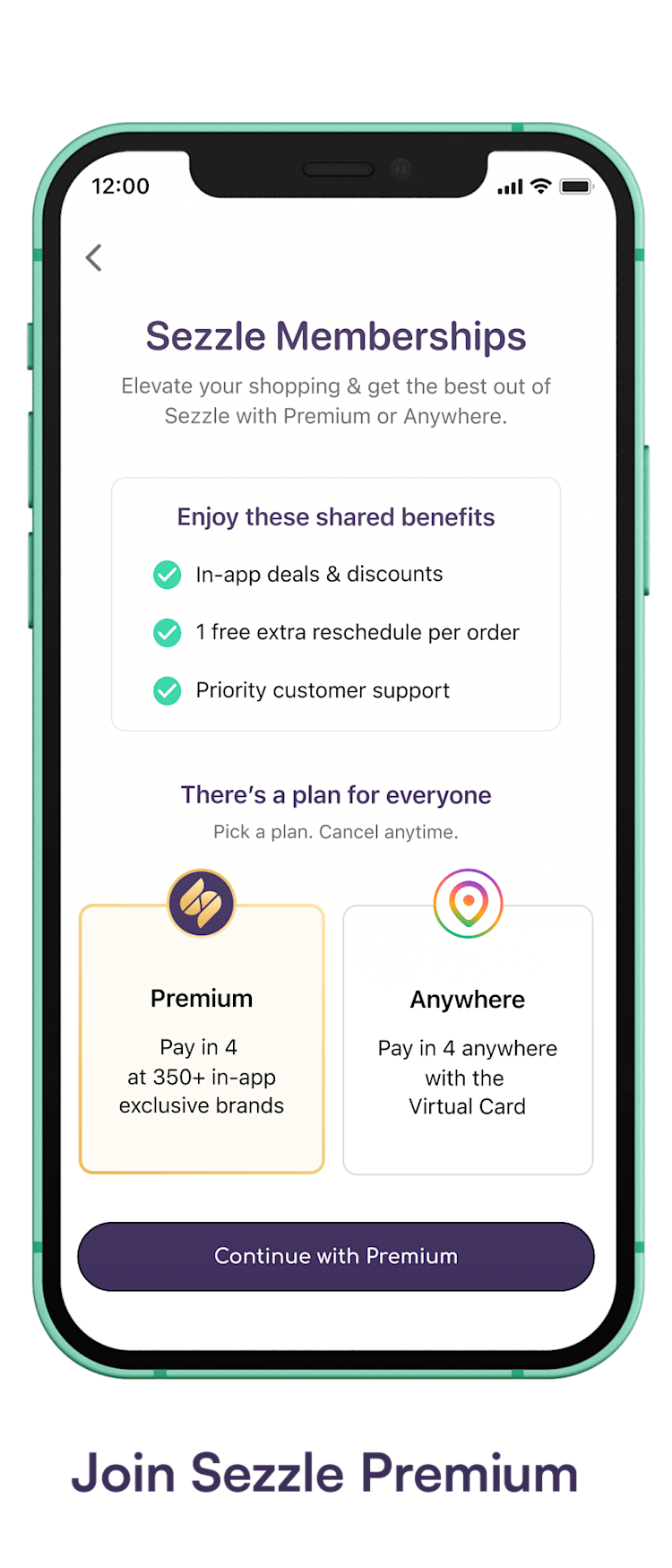

The BNPL industry is rapidly evolving, with companies constantly exploring new ways to integrate into consumers' financial lives. It's possible that Sezzle, or other BNPL providers, may offer direct bill payment options in the future.

However, regulatory scrutiny and concerns about debt accumulation are also increasing. Governments and consumer protection agencies are closely monitoring the BNPL industry, potentially leading to stricter regulations and limitations on its use.

Consumers should stay informed about the latest developments in the BNPL space and carefully evaluate the risks and benefits before using these services for any type of payment.

Conclusion

Currently, using Sezzle to directly pay bills is not a standard or recommended practice. While workarounds exist, they often involve fees and potential risks. Sezzle is intended for retail transactions with partnered merchants.

Consumers seeking financial flexibility for bill payments should explore alternative options and carefully consider the terms and conditions of any financial product they use. Responsible financial planning and budgeting remain the most effective strategies for managing expenses and avoiding debt.

As the BNPL landscape evolves, it's crucial to stay informed and make informed decisions based on your individual financial circumstances.