Can You Use Hsa For Compounded Semaglutide

Imagine this: Sarah, a busy working mom, finally found a weight management solution that seemed to fit her lifestyle – compounded semaglutide. Elated, she went to pay, only to be met with confusion at the pharmacy counter. Could she use her HSA, the very account designed for healthcare expenses, to cover it? The answer, it turns out, isn't as straightforward as she'd hoped.

The core question at hand is whether compounded semaglutide, a customized version of the popular weight loss drug, qualifies as an eligible expense under Health Savings Account (HSA) guidelines. While HSAs offer a valuable way to save on healthcare costs, understanding the specific rules regarding compounded medications is crucial for avoiding potential tax penalties. Navigating this landscape requires careful consideration of IRS regulations, prescription requirements, and the nature of the medication itself.

The Rise of Compounded Semaglutide

Semaglutide, originally developed for type 2 diabetes under the brand names Ozempic and Rybelsus, gained widespread attention for its effectiveness in weight management, marketed as Wegovy. The demand surged, often exceeding supply, leading some individuals and healthcare providers to explore compounded versions of the drug.

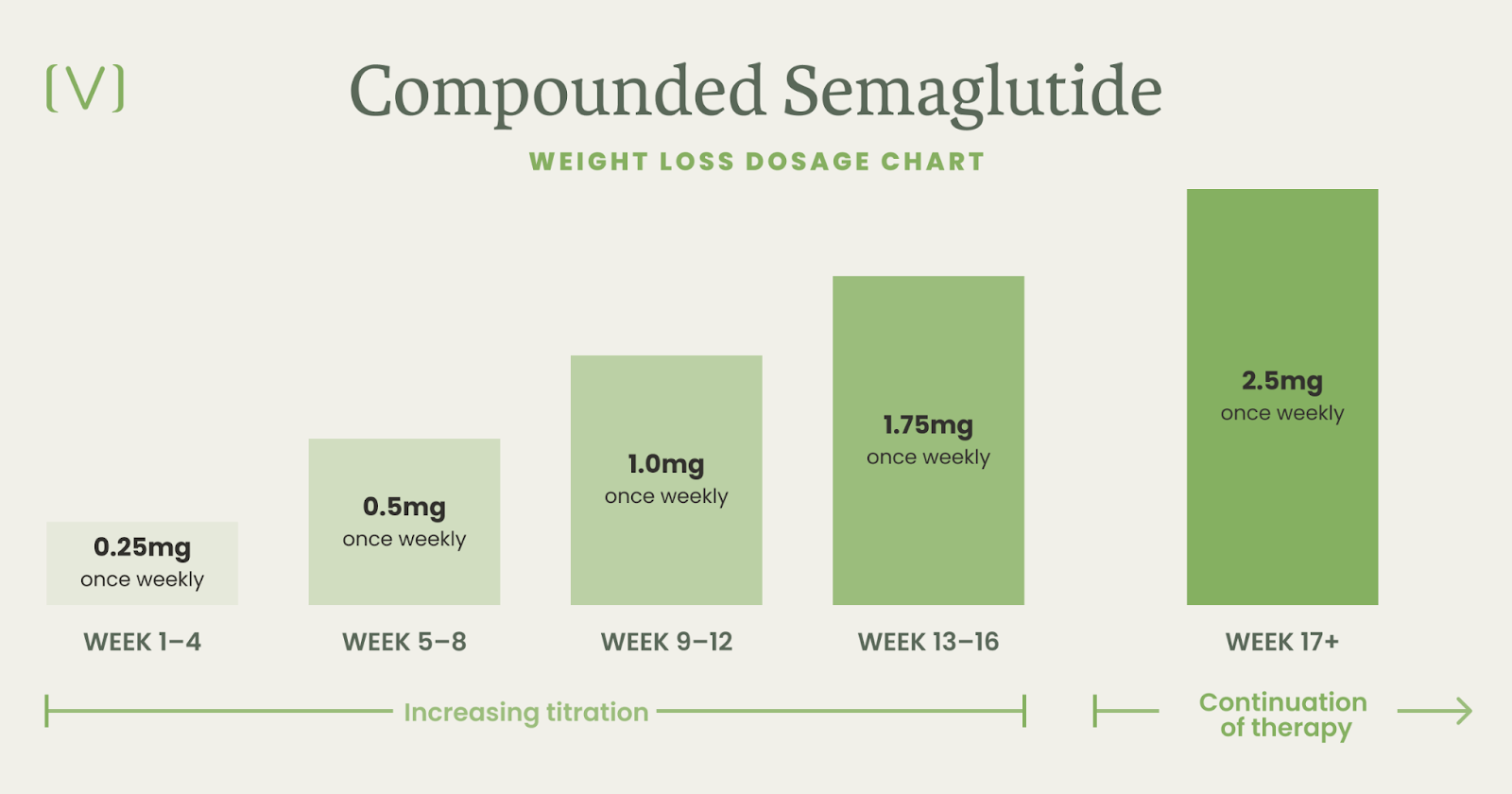

Compounding involves a pharmacist creating a customized medication, often by combining or altering ingredients. This practice can be beneficial when a commercially available drug is unavailable, contains an unsuitable dosage, or includes allergens that a patient needs to avoid.

However, compounded drugs are not subject to the same rigorous FDA approval process as manufactured medications. This difference in regulatory oversight is a key factor in determining HSA eligibility.

HSA Eligibility: What the IRS Says

The IRS Publication 969 outlines the eligible medical expenses for HSAs. According to the IRS, eligible expenses generally include amounts paid "for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body."

Importantly, the medication must be legally prescribed. This prescription requirement is critical for substantiating the medical necessity of the expense.

The IRS doesn't explicitly address compounded medications. This ambiguity creates a grey area, requiring further scrutiny of the circumstances.

Compounded vs. FDA-Approved: A Crucial Distinction

The crux of the issue lies in the FDA approval status. FDA-approved semaglutide medications (Ozempic, Rybelsus, and Wegovy) prescribed for an approved indication generally qualify as eligible HSA expenses, assuming all other requirements are met.

However, compounded semaglutide faces a higher level of scrutiny. Because it lacks FDA approval, its eligibility hinges on demonstrating medical necessity and adhering to specific state and federal regulations governing compounding pharmacies.

Some HSA administrators may require additional documentation to verify the medical necessity of compounded medications. This documentation might include a Letter of Medical Necessity from the prescribing physician, detailing why the compounded version is necessary instead of an FDA-approved alternative.

Navigating the Complexities

Several factors influence whether you can use your HSA for compounded semaglutide. First, ensure you have a valid prescription from a licensed healthcare provider.

Second, confirm that the compounding pharmacy is licensed and compliant with all applicable regulations. Working with a reputable pharmacy is essential.

Third, contact your HSA administrator directly to inquire about their specific policies regarding compounded medications. Document their response for your records.

Finally, be prepared to provide supporting documentation, such as a Letter of Medical Necessity, if requested by your HSA administrator. Proactive communication and thorough documentation are key.

Seeking Professional Guidance

Given the complexities surrounding HSA eligibility and compounded medications, seeking professional advice is highly recommended. Consult with a tax advisor or financial planner to ensure compliance with IRS regulations.

A healthcare professional can also provide valuable insights into the medical necessity of compounded semaglutide and guide you in obtaining the necessary documentation.

They can help you determine the best course of action based on your individual circumstances.

The Bottom Line: Proceed with Caution

While using an HSA for healthcare expenses can be a smart financial strategy, it's crucial to exercise caution when dealing with compounded medications. Compounded semaglutide presents a unique challenge due to its lack of FDA approval and the stringent requirements for demonstrating medical necessity.

Thorough research, clear communication with your HSA administrator, and professional guidance are essential steps in navigating this complex landscape. Remember, accurate record-keeping is vital.

Failure to comply with IRS regulations could result in penalties and taxes on the withdrawn funds. Stay informed and make informed decisions.

A Final Thought

The story of Sarah highlights the growing need for clarity and transparency surrounding HSA eligibility for compounded medications. As compounded drugs become more prevalent, understanding the nuances of IRS regulations and HSA policies is essential for consumers.

While the promise of affordable and customized healthcare solutions is appealing, it's crucial to navigate the complexities with diligence and seek professional guidance when needed. Ultimately, informed decision-making empowers individuals to maximize the benefits of their HSAs while remaining compliant with the law.

Perhaps future IRS guidance will provide more specific clarification on compounded medications, alleviating confusion and ensuring fair access to HSA benefits for all. Until then, proceed with caution and knowledge as your guiding light.