Can You Use Hsa For Testosterone

A growing number of men are exploring using Health Savings Accounts (HSAs) for testosterone replacement therapy (TRT), but the eligibility remains a complex and often misunderstood issue. Confusion abounds as individuals navigate IRS regulations and specific HSA plan rules.

HSA Eligibility: The Core Question

Can you use your HSA funds to cover the costs of testosterone therapy? The answer is: it depends.

The key lies in whether TRT is considered a qualified medical expense under IRS Publication 502.

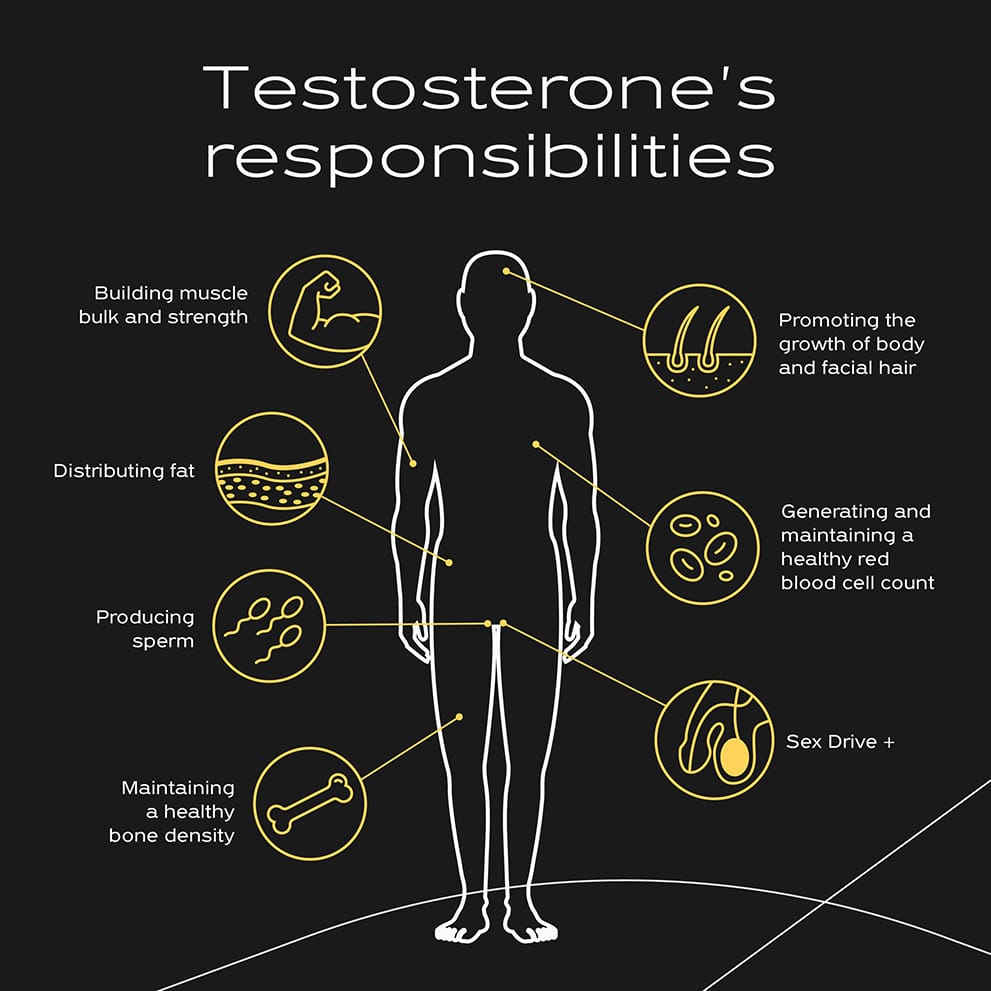

This publication defines qualified medical expenses as those incurred for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body.

What the IRS Says

The IRS generally allows HSA funds to be used for prescription medications. Testosterone, when prescribed by a licensed physician for a diagnosed medical condition, typically falls under this category.

However, the crux lies in the medical necessity. Simply wanting testosterone for performance enhancement or anti-aging purposes without a documented deficiency might not qualify.

This is crucial; the treatment must address a recognized medical need.

Diagnosed Conditions: The Green Light

If you've been diagnosed with hypogonadism, low testosterone, or another medical condition requiring TRT, the expenses are generally HSA-eligible.

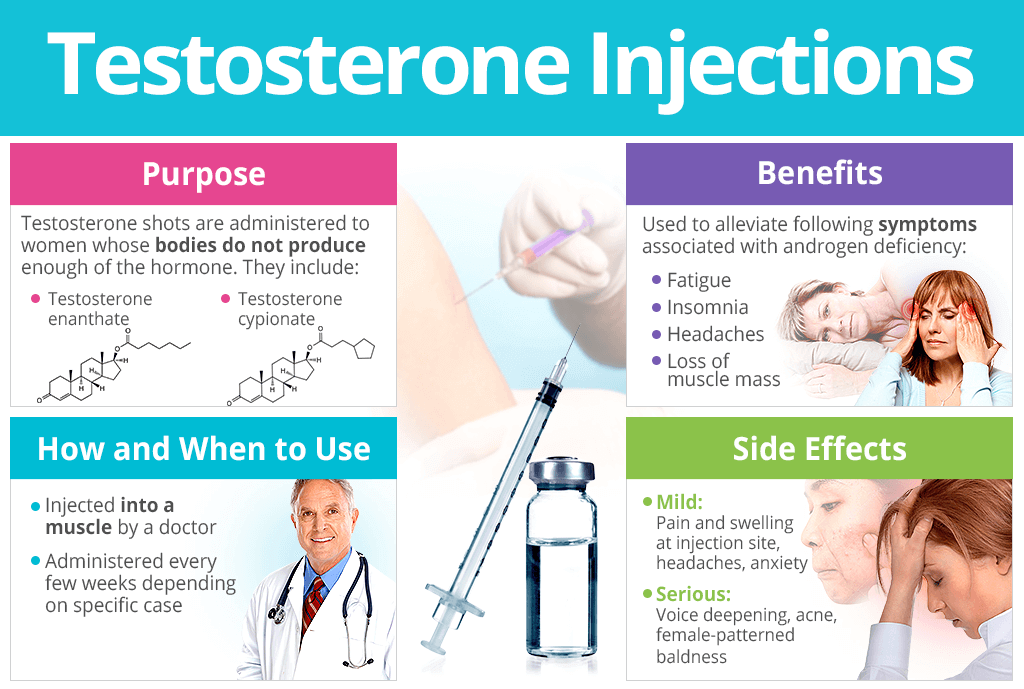

This includes doctor's visits, lab tests to monitor testosterone levels, and the testosterone medication itself, whether it's injections, gels, or patches.

Maintaining meticulous records of diagnoses, prescriptions, and payments is critical for substantiating these expenses.

The Importance of a Prescription

A valid prescription from a licensed physician is non-negotiable. Over-the-counter testosterone boosters or supplements are unlikely to qualify for HSA reimbursement.

The prescription must clearly state the medical condition being treated and the prescribed dosage.

Without it, the expense is likely to be deemed ineligible by your HSA administrator.

HSA Administrator Rules: A Key Factor

While the IRS provides guidelines, individual HSA administrators have the final say in determining eligibility. Some administrators might have stricter interpretations of qualified medical expenses.

Contact your HSA administrator directly to clarify their specific policies regarding TRT coverage. Understand their documentation requirements and appeal process, if needed.

Misunderstanding these policies could lead to penalties if ineligible expenses are withdrawn.

What Expenses are Typically Covered?

With a valid prescription and a qualifying medical condition, the following expenses are often HSA-eligible:

- Doctor's visits for diagnosis and monitoring

- Lab tests to measure testosterone levels

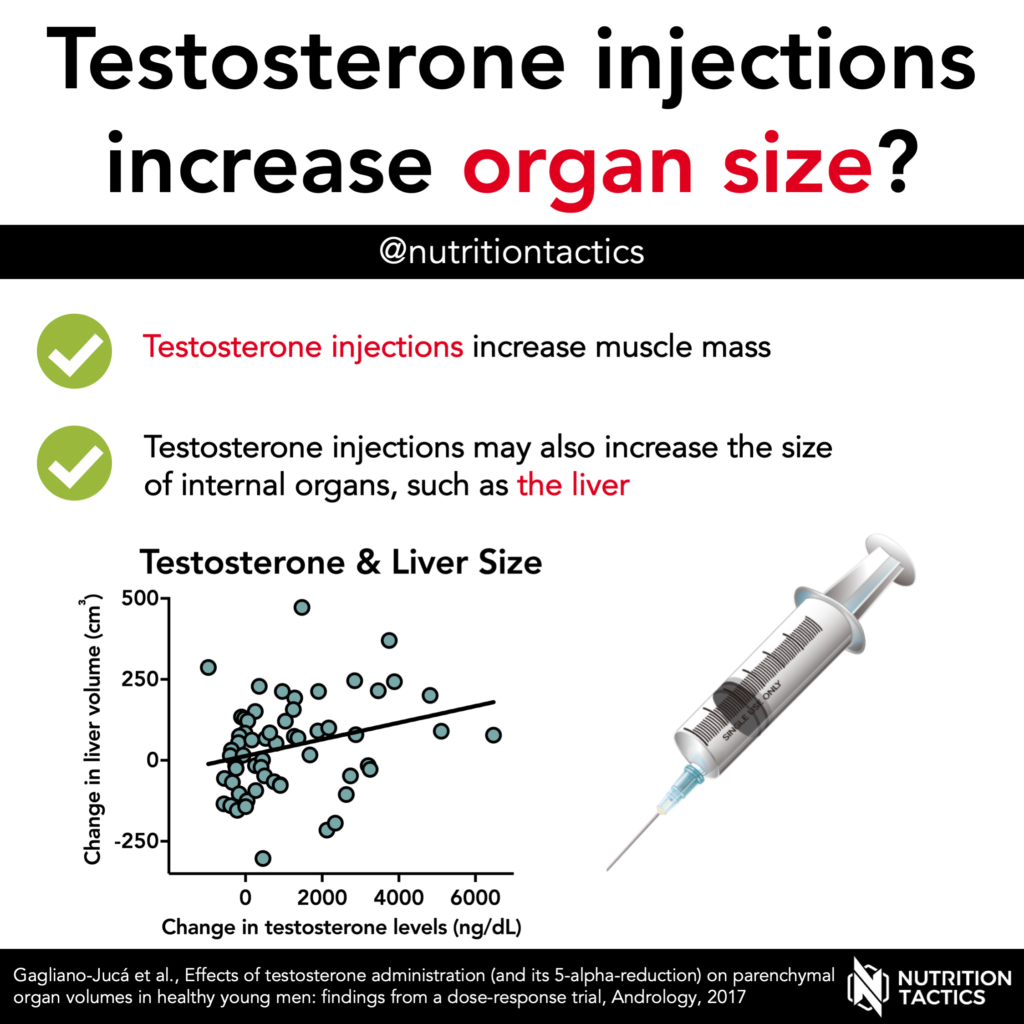

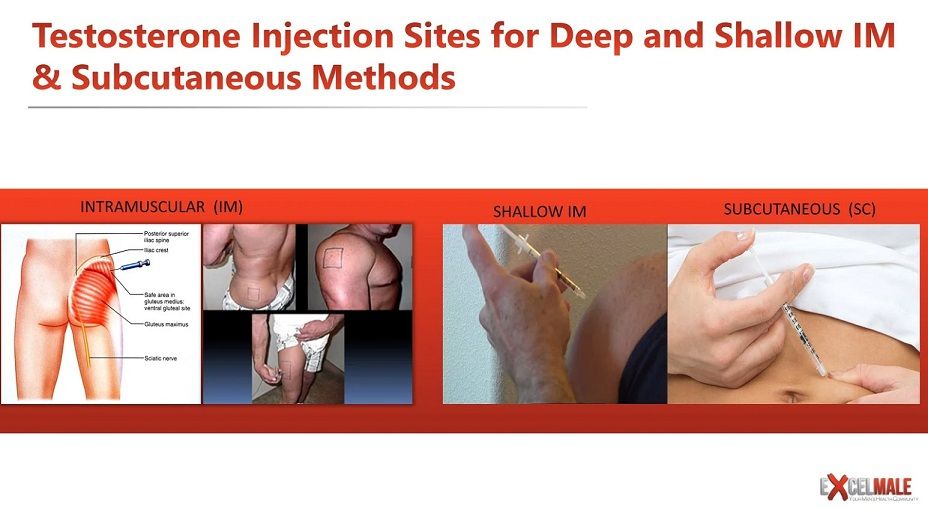

- Prescription testosterone medication (injections, gels, patches)

- Necessary medical supplies (syringes, alcohol swabs, etc.)

Again, confirm these are covered with your HSA administrator beforehand.

What Expenses are Typically Not Covered?

Expenses likely not covered include:

- Over-the-counter testosterone boosters

- Testosterone therapy for purely cosmetic or performance enhancement purposes without a medical diagnosis

- Expenses not directly related to the medically necessary treatment

Always err on the side of caution and consult with your HSA provider.

Potential Risks and Penalties

Using HSA funds for non-qualified medical expenses can result in penalties. The IRS may impose taxes and penalties on the amount withdrawn for ineligible expenses.

It's your responsibility to ensure that all HSA withdrawals comply with IRS regulations and your HSA administrator's policies.

Consult a tax professional or financial advisor for guidance if you are uncertain about the eligibility of an expense.

Real-World Examples

John, a 45-year-old diagnosed with hypogonadism, successfully used his HSA to cover his testosterone injections after submitting his prescription and doctor's diagnosis to his administrator.

Conversely, Mark, who sought TRT for energy enhancement without a medical condition, found his HSA claim denied, as it was deemed a non-qualified expense.

These scenarios highlight the importance of medical necessity and proper documentation.

The use of HSAs for testosterone replacement therapy hinges on medical necessity, a valid prescription, and adherence to both IRS guidelines and your specific HSA administrator's rules. Confirm your eligibility before using HSA funds to avoid potential penalties.