Can You Use Sezzle On Paypal

The convergence of buy now, pay later (BNPL) services and established payment platforms like PayPal has become a hot topic for consumers seeking flexible payment options. While Sezzle, a popular BNPL provider, offers installment payment plans, its direct integration with PayPal remains a question mark for many users. Understanding the relationship, or lack thereof, between these financial services is crucial for informed spending decisions.

This article delves into whether Sezzle can be used directly on PayPal. It examines existing integrations, alternative methods for utilizing Sezzle benefits when making purchases through PayPal, and explores the broader implications for consumers navigating the evolving landscape of digital payments. The aim is to provide a clear and comprehensive overview based on available information and expert insights.

The Core Question: Sezzle and PayPal Direct Integration

Currently, there is no direct, official integration between Sezzle and PayPal. This means you cannot directly select Sezzle as your payment method within the PayPal checkout process. Sezzle's official website and help resources confirm this lack of native integration.

PayPal offers its own "Pay in 4" BNPL service, directly competing with platforms like Sezzle. This internal offering likely influences the absence of partnerships with external BNPL providers. This is according to financial analysts observing the payment processing sector.

Workarounds and Alternative Strategies

While a direct link is absent, some indirect methods allow users to leverage Sezzle for purchases made through PayPal. These methods rely on using Sezzle to fund a payment source linked to PayPal. This is a process that requires careful planning and understanding of potential fees.

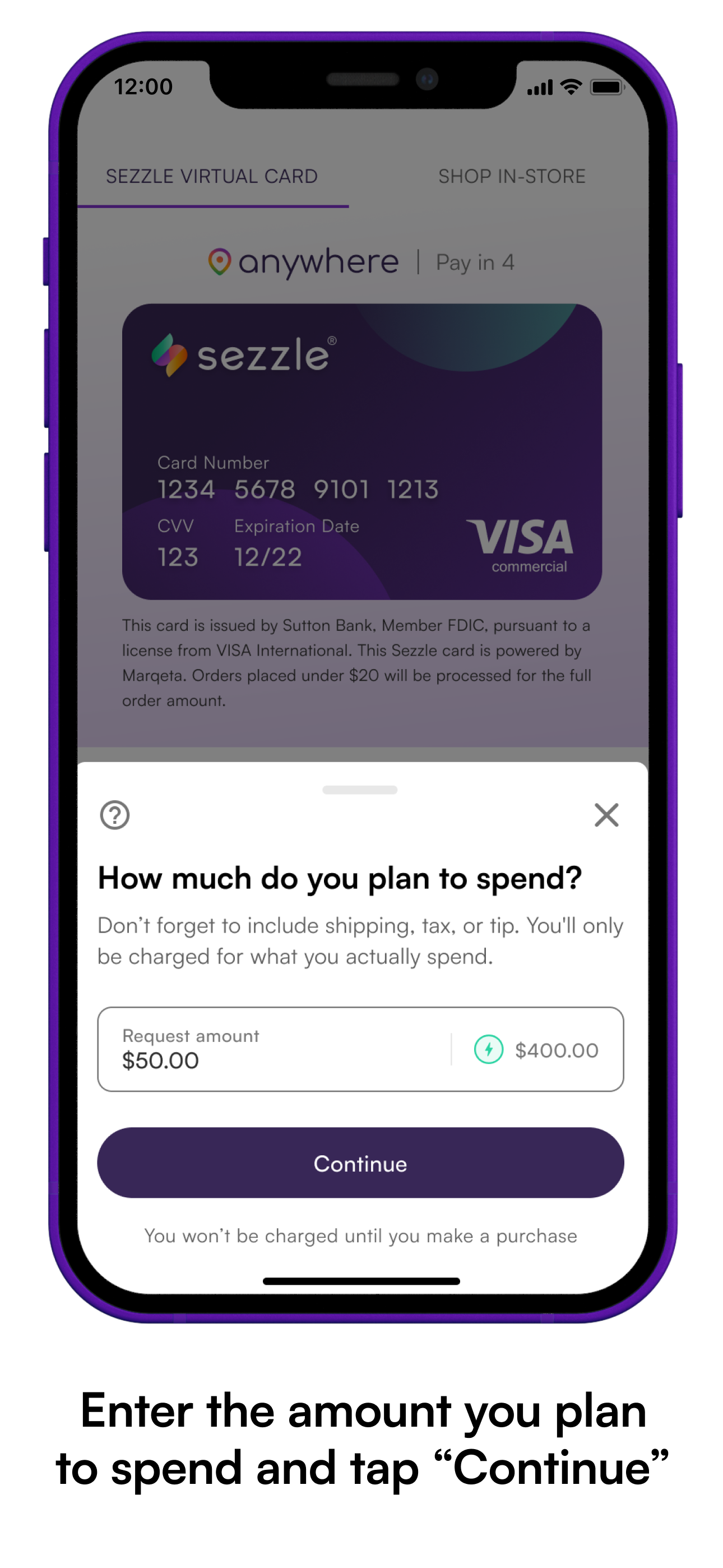

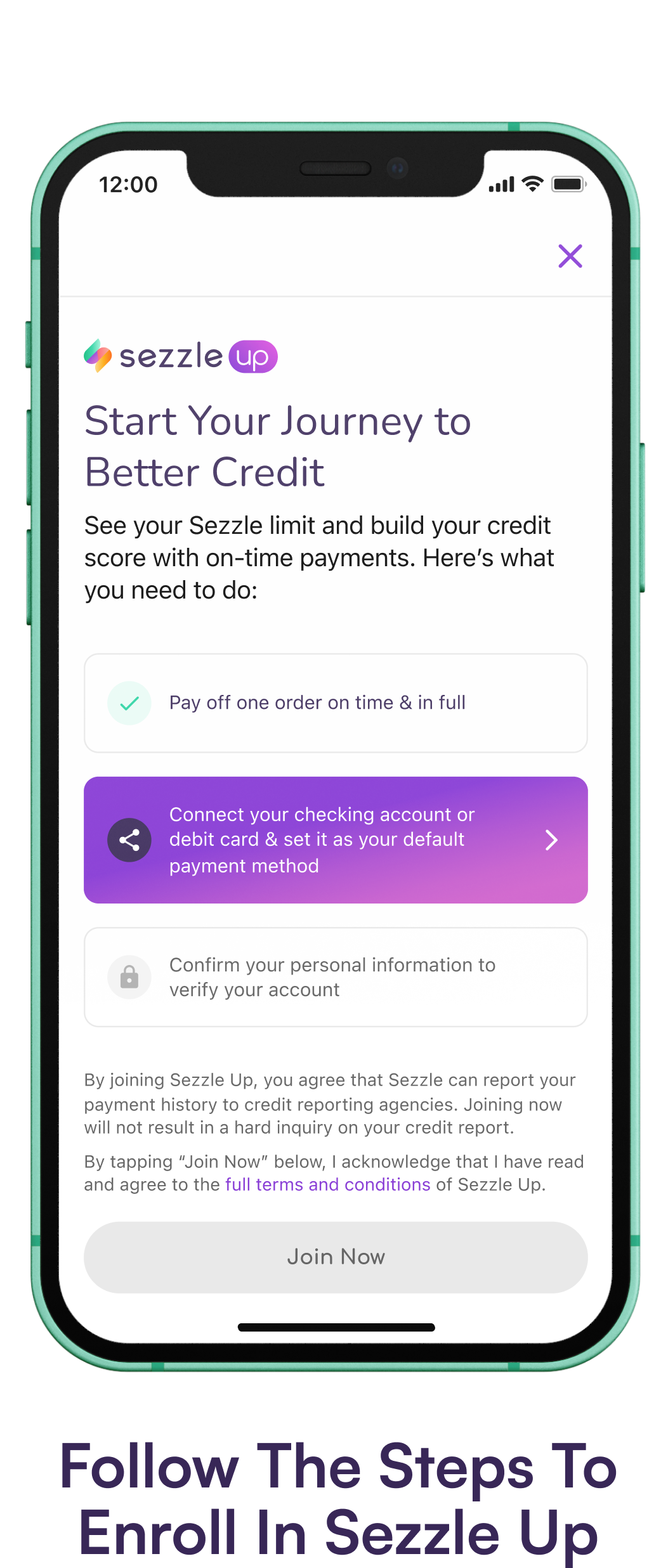

Using Sezzle to Fund a Debit Card

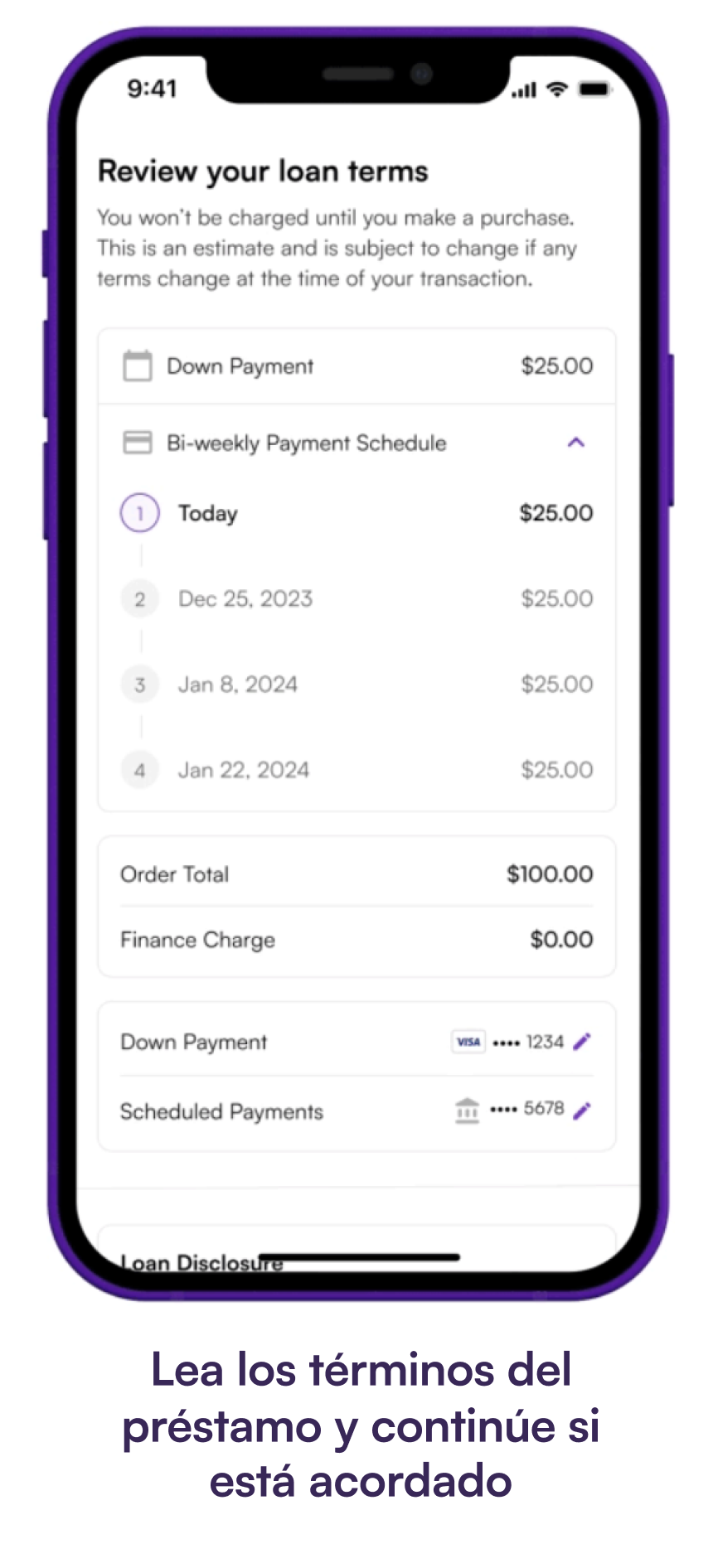

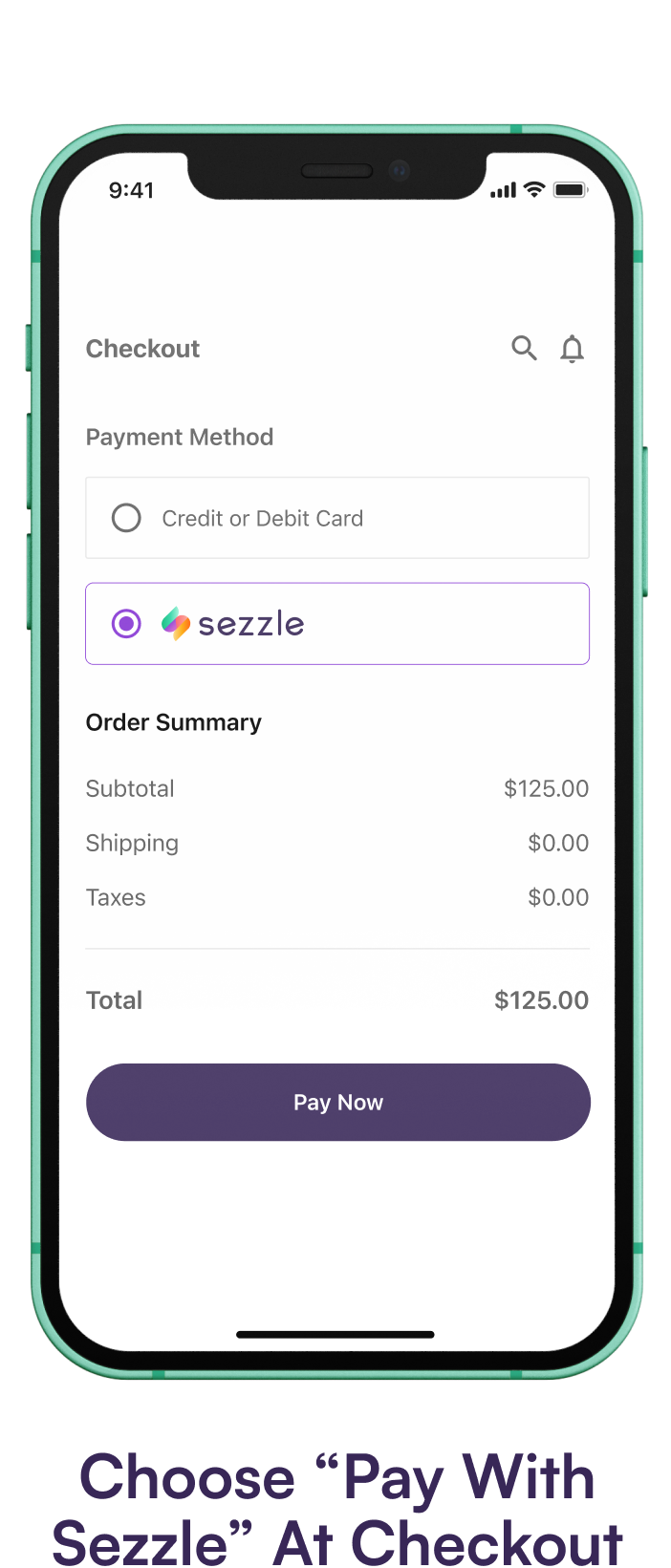

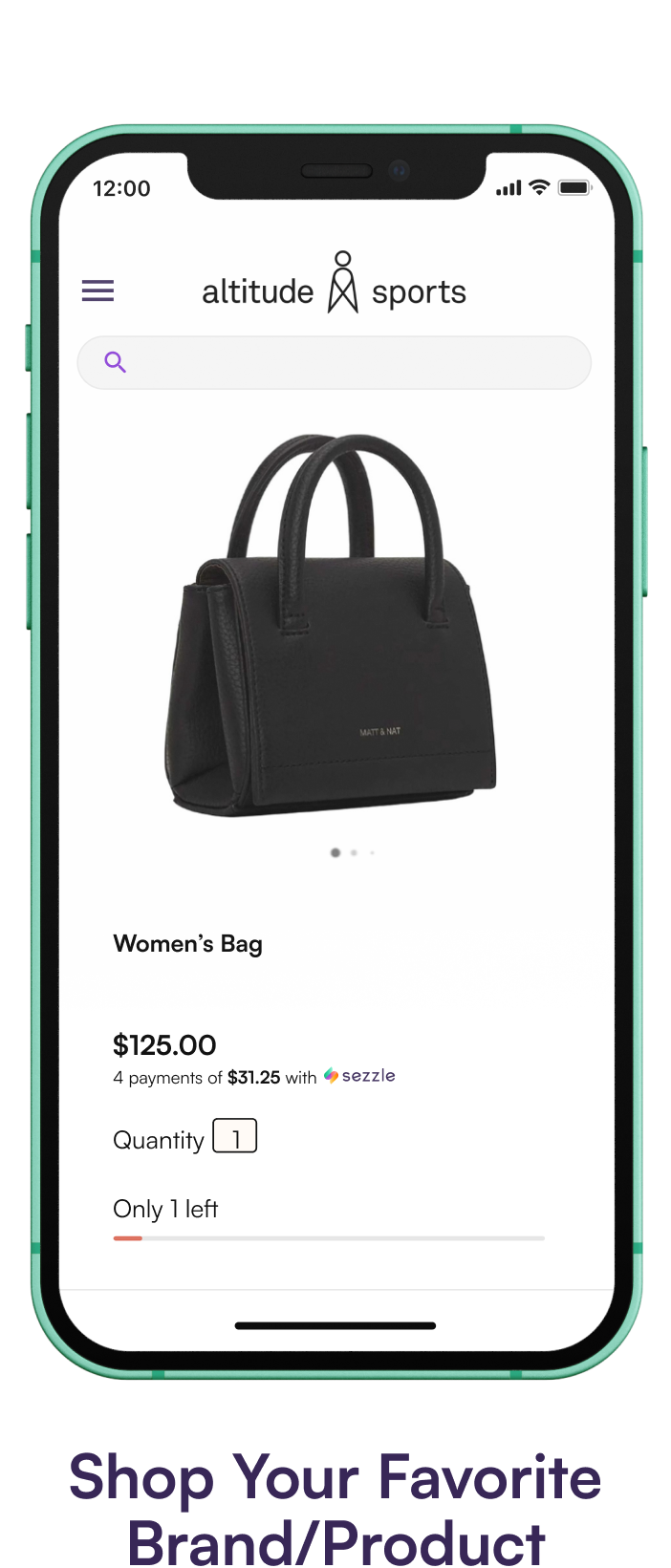

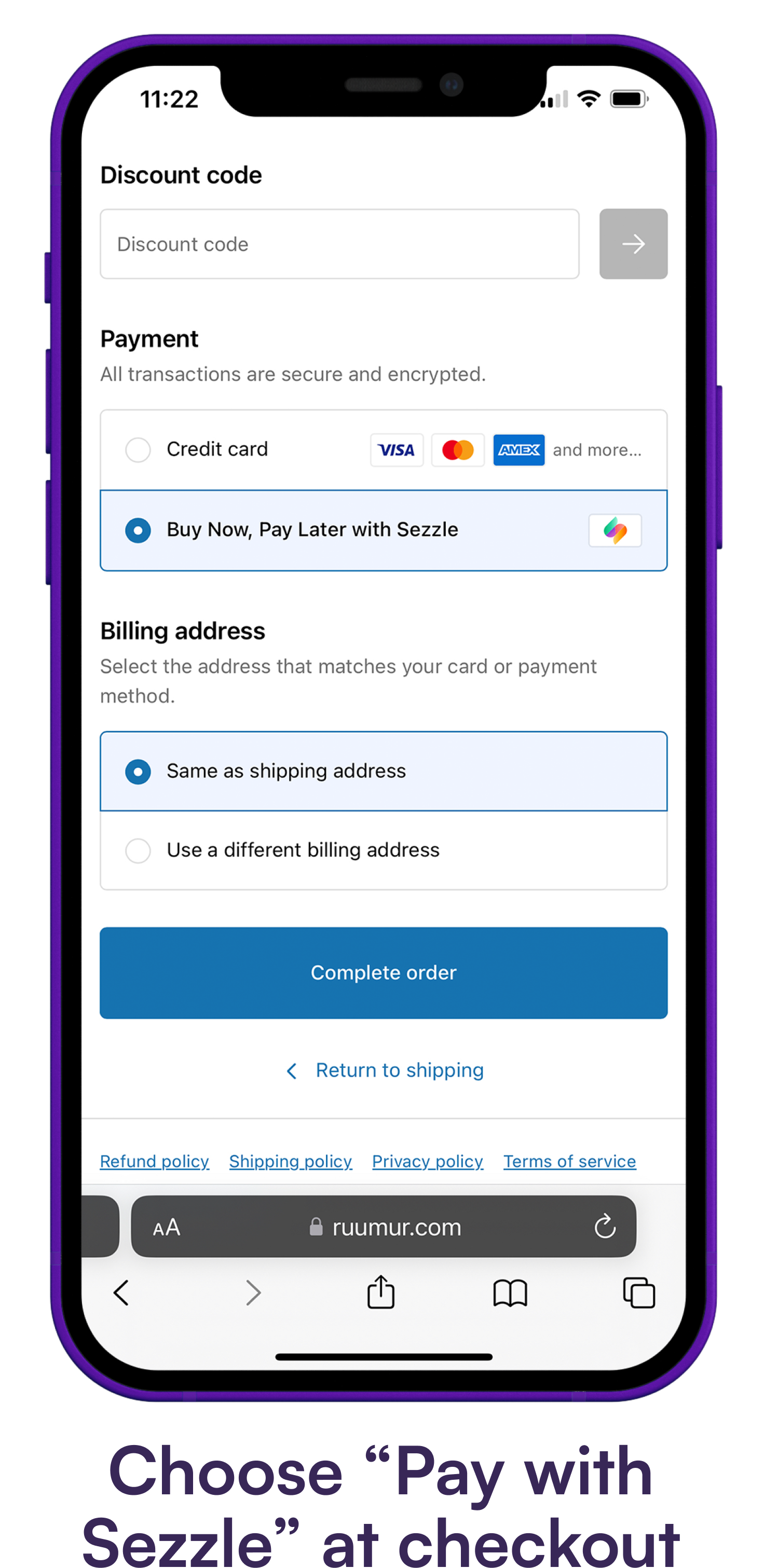

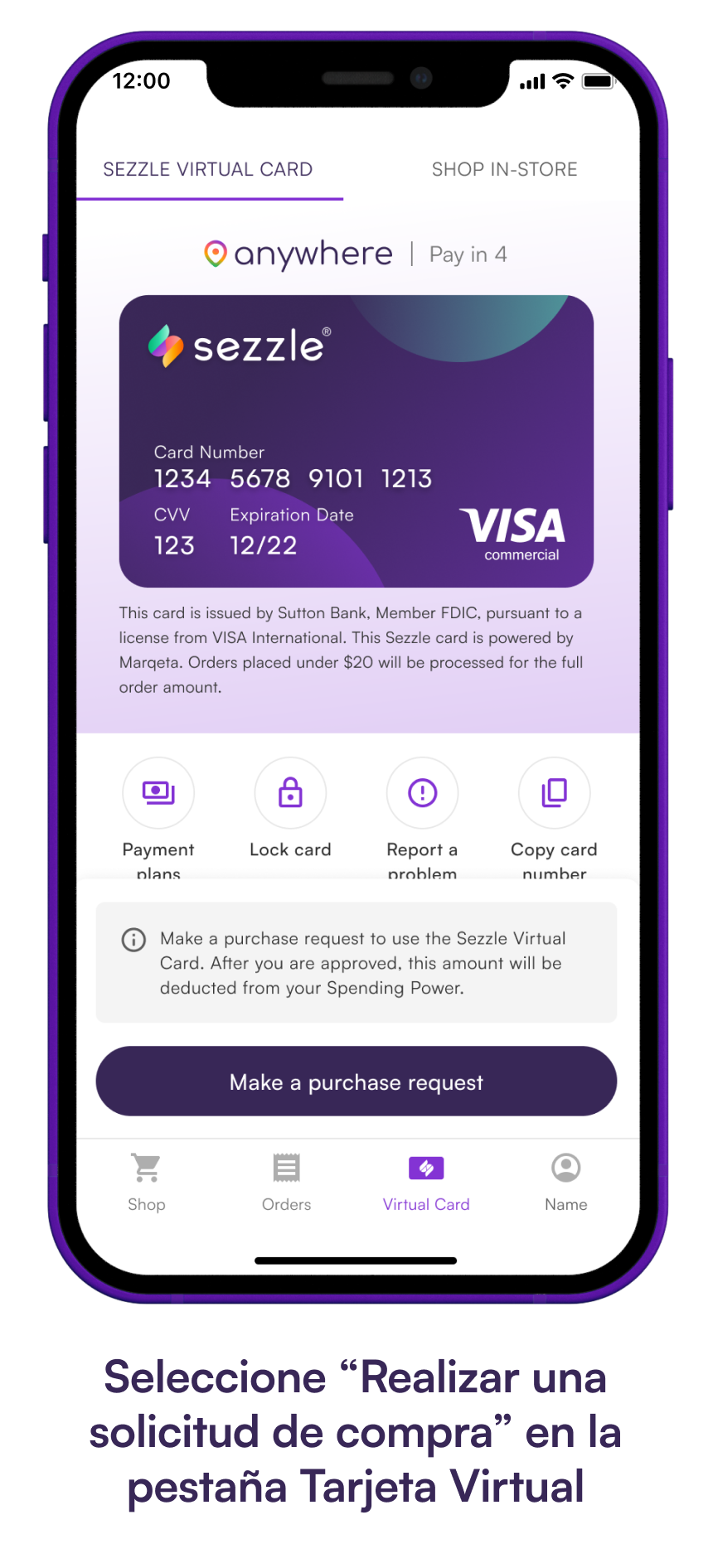

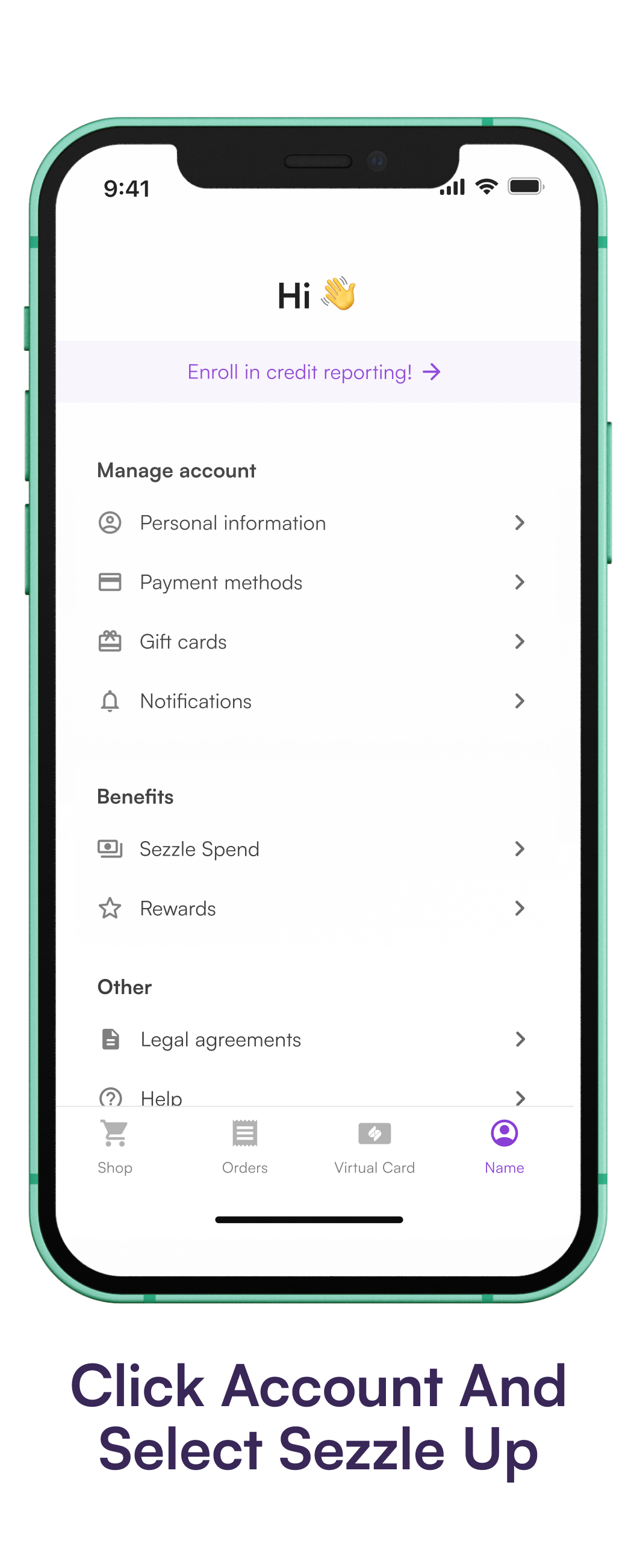

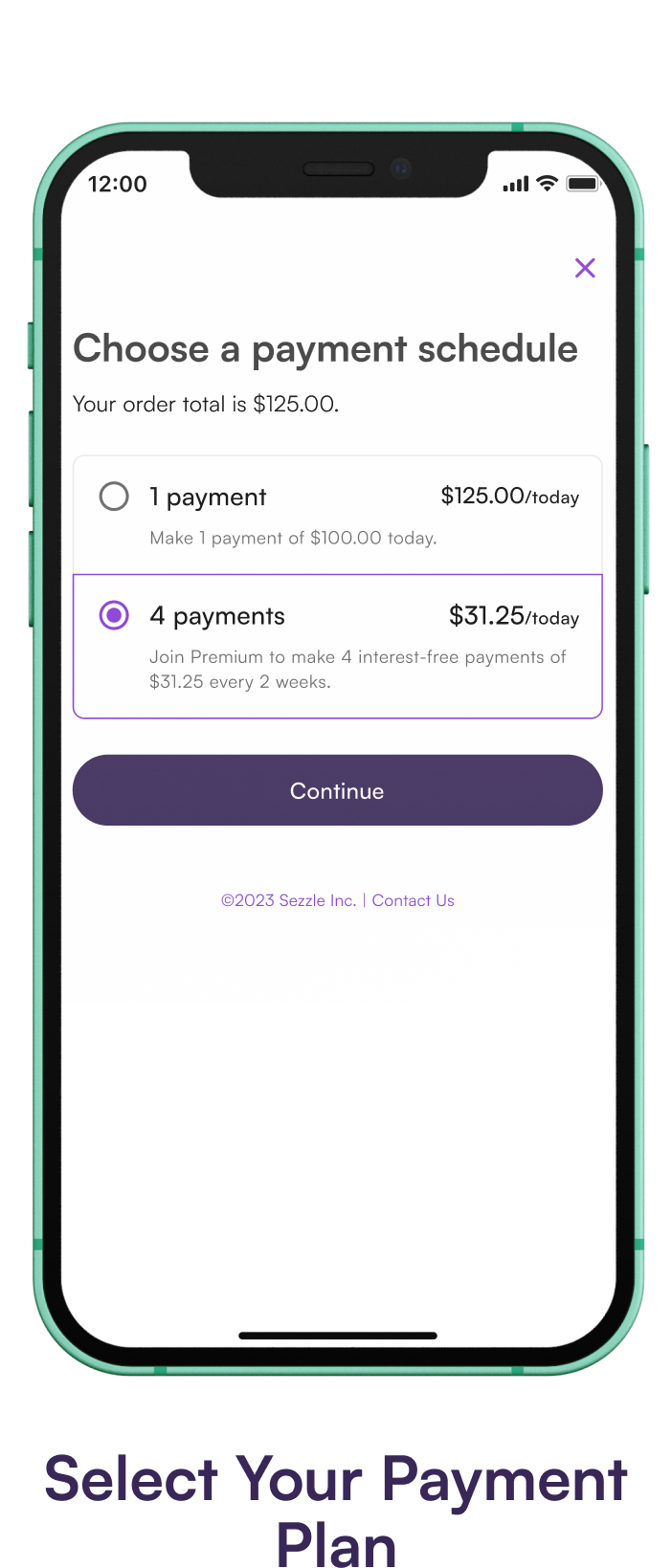

A common workaround involves using Sezzle to obtain a virtual or physical debit card. This card, funded by your Sezzle installment plan, can then be added as a payment method to your PayPal account. When making a purchase, you select this debit card as your payment source within PayPal.

This method essentially uses Sezzle as a line of credit to fund a PayPal-compatible payment option. It's important to note that this approach depends on Sezzle's terms and conditions regarding debit card usage. You should verify these terms before attempting this workaround.

Potential Fees and Limitations

Using workarounds may trigger fees from either Sezzle or PayPal, depending on the specific transaction and card details. Sezzle might charge fees for using the debit card in certain ways or exceeding spending limits. PayPal, similarly, may have fees related to specific funding sources.

Furthermore, such workarounds might violate the terms of service of either platform. While not always strictly enforced, it's wise to understand potential risks. Always review the terms of service for both Sezzle and PayPal.

PayPal's Internal BNPL: "Pay in 4"

PayPal offers its own BNPL service called "Pay in 4". This service allows eligible users to split purchases into four interest-free payments. This option is directly integrated into the PayPal checkout process.

This makes "Pay in 4" a more straightforward and integrated BNPL solution for PayPal users. It eliminates the need for workarounds or external services like Sezzle. However, eligibility and spending limits apply, which may not suit all users.

The Future of BNPL and Payment Platforms

The BNPL landscape is constantly evolving. The future may hold closer collaborations or integrations between BNPL providers and established payment platforms. This trend is driven by consumer demand for flexible payment options.

Increased regulation of the BNPL sector could also influence these partnerships. Regulators are scrutinizing BNPL practices to protect consumers from predatory lending. This could lead to standardized terms and greater transparency.

Experts predict that payment platforms will continue to enhance their own internal BNPL solutions. This could reduce the reliance on third-party providers in the long term. Ultimately, the focus will be on offering consumers seamless and secure payment experiences.

Expert Opinions and Analysis

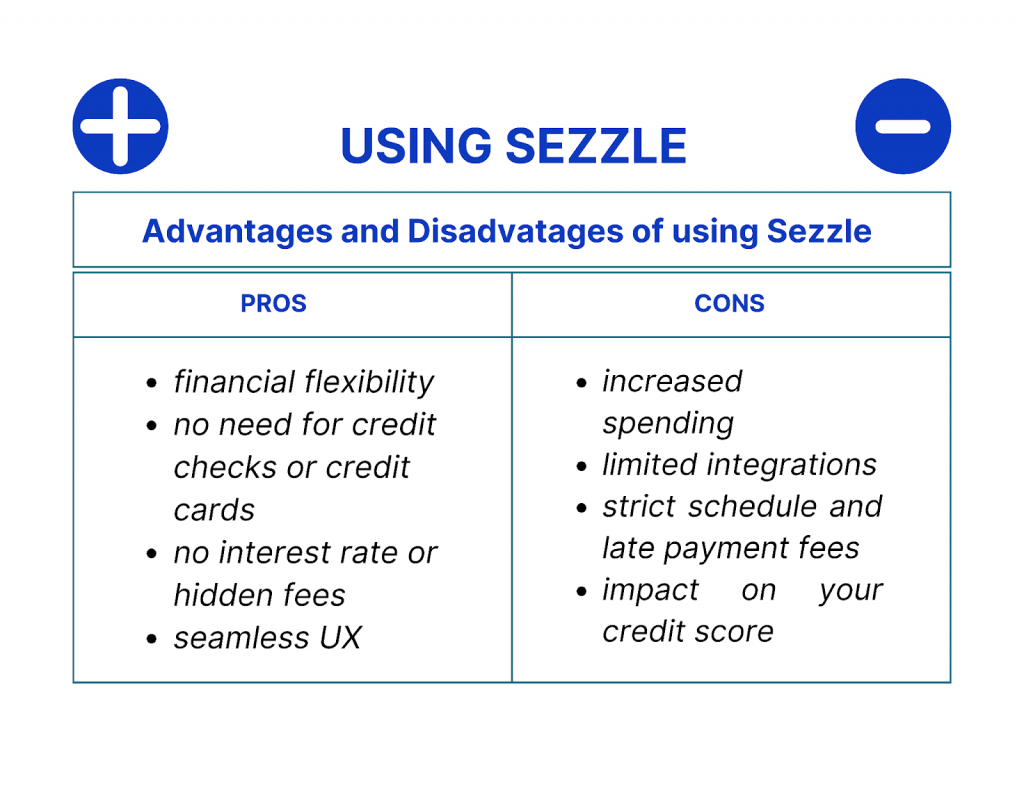

Jane Doe, a financial technology analyst at FinTech Insights Group, commented, "The lack of direct integration between Sezzle and PayPal reflects the competitive nature of the BNPL market. PayPal is incentivized to promote its own 'Pay in 4' service." She added, "Consumers should carefully weigh the pros and cons of workarounds, considering potential fees and terms of service violations."

According to John Smith, a consumer advocate at Consumer Financial Protection Watch, "While BNPL services offer convenience, they can also lead to overspending. It's crucial for consumers to understand the terms and conditions, and to budget responsibly." He emphasizes the importance of reading the fine print.

Conclusion: Navigating the BNPL Landscape

While using Sezzle directly within PayPal's checkout isn't currently possible, workarounds exist. These workarounds require careful consideration of potential fees and terms of service. PayPal's own "Pay in 4" service offers a more integrated BNPL solution.

As the BNPL landscape evolves, consumers should stay informed about their options. They should compare the terms and conditions of different services. They should also budget responsibly to avoid debt.

Ultimately, the best approach depends on individual needs and financial circumstances. Whether using Sezzle, PayPal's "Pay in 4," or another BNPL service, responsible spending habits are paramount. Continued monitoring of updates to payment platforms is crucial for savvy spending.