Can You Use Sezzle On Venmo

In the rapidly evolving landscape of digital finance, consumers are constantly seeking seamless and flexible payment options. The intersection of buy now, pay later (BNPL) services like Sezzle and established payment platforms like Venmo has become a point of increasing curiosity and, for many, a source of potential convenience. The question on many users' minds is: Can you use Sezzle on Venmo?

This article delves into the compatibility – or lack thereof – between Sezzle and Venmo. It explores the current limitations, investigates potential workarounds, and examines the broader implications for users looking to leverage both platforms for their financial transactions. Understanding the nuances of these platforms is crucial for making informed financial decisions in the digital age.

The Direct Answer: No Direct Integration

Currently, there is no direct integration between Sezzle and Venmo. This means you cannot directly use your Sezzle account to fund payments on Venmo or vice versa. Sezzle functions as a standalone BNPL service, offering installment payment plans for purchases made at participating retailers.

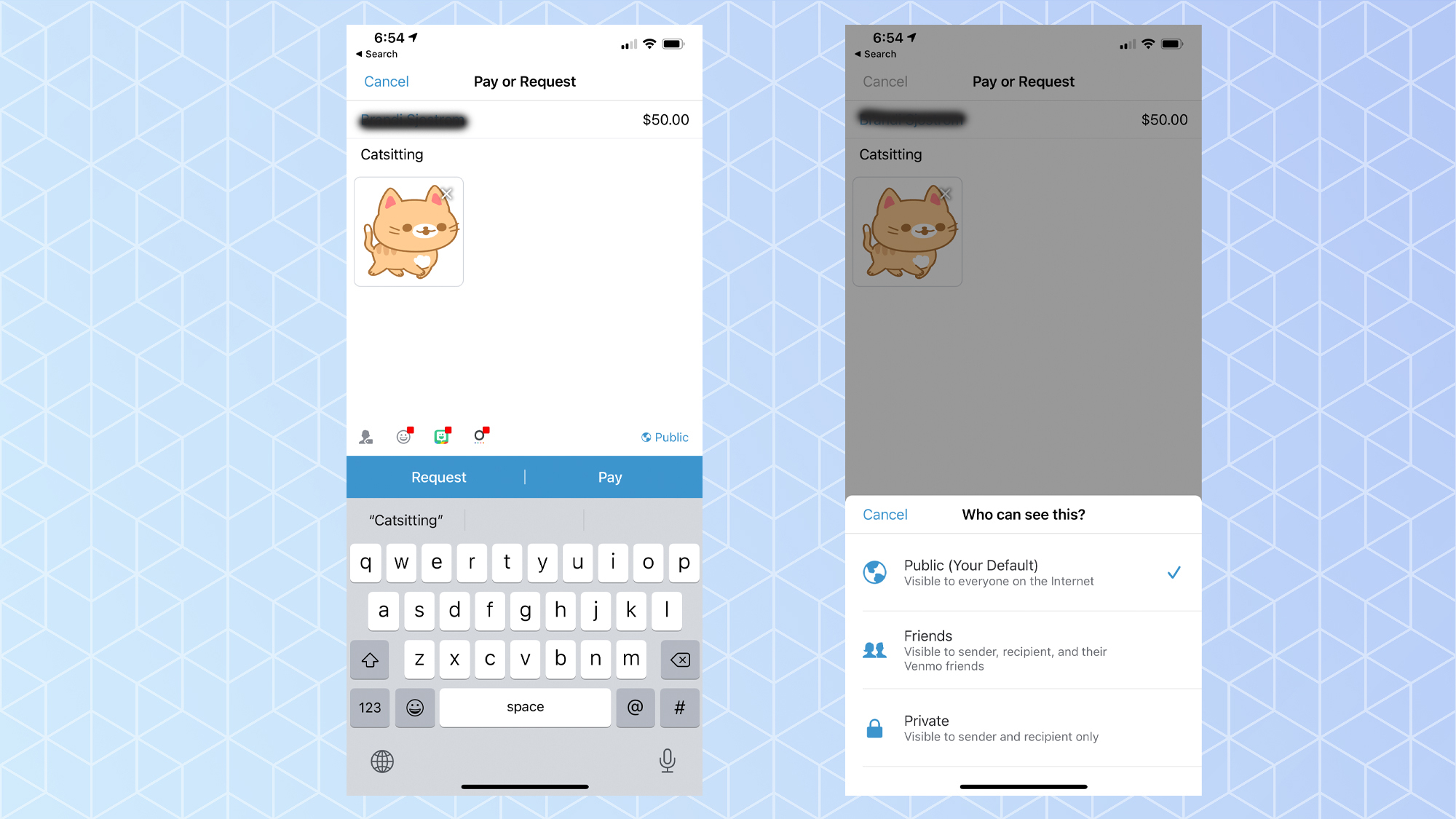

Venmo, on the other hand, operates primarily as a peer-to-peer payment platform and a digital wallet. Its functionalities revolve around sending and receiving money, making online purchases with participating merchants, and managing a balance.

Why the Disconnect? Technical and Business Considerations

Several factors contribute to the absence of direct integration. Technical infrastructure and business strategies of each platform are among them. Sezzle requires direct integration with merchants to offer its installment payment option at the point of sale.

Venmo's payment processing system is designed to work with debit cards, credit cards, and bank accounts. Integrating a third-party BNPL service would necessitate significant technical modifications and potentially alter the fundamental user experience.

Furthermore, from a business perspective, both companies may have strategic reasons for maintaining their distinct ecosystems. Venmo, owned by PayPal, already offers its own BNPL solutions, making a partnership with a competitor like Sezzle less appealing. Sezzle likely wants to keep the customer on their platform and drive traffic to their merchant partners.

Potential Workarounds: Limited Options

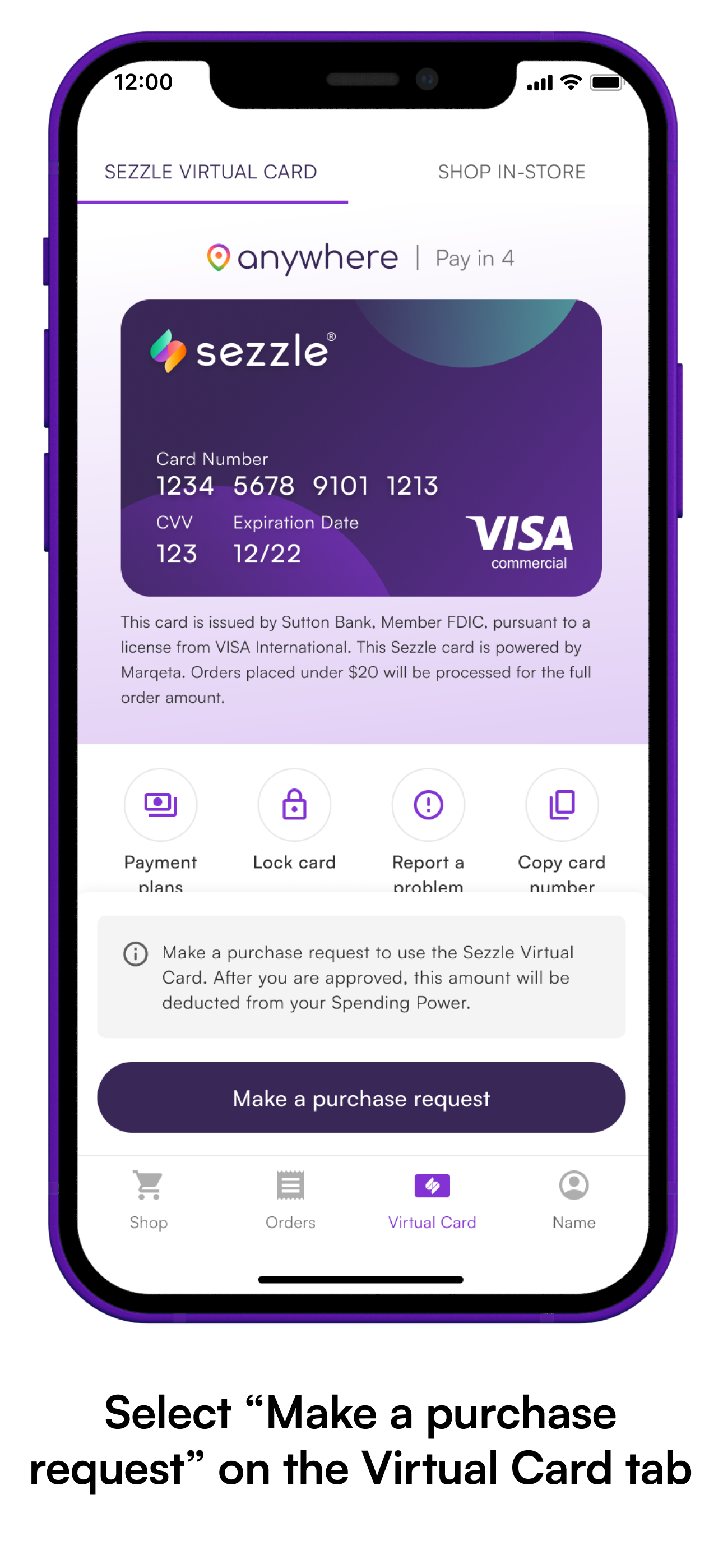

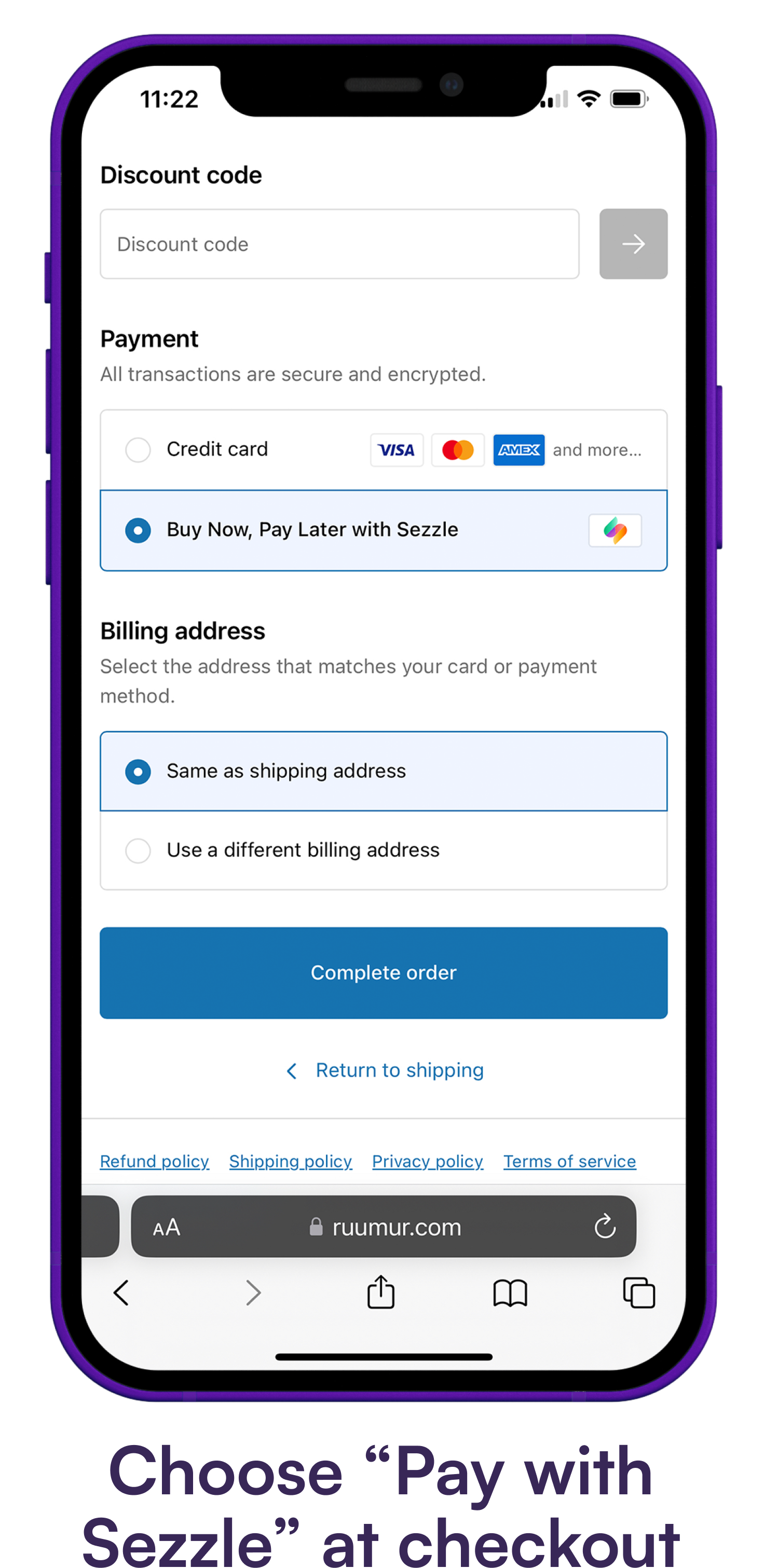

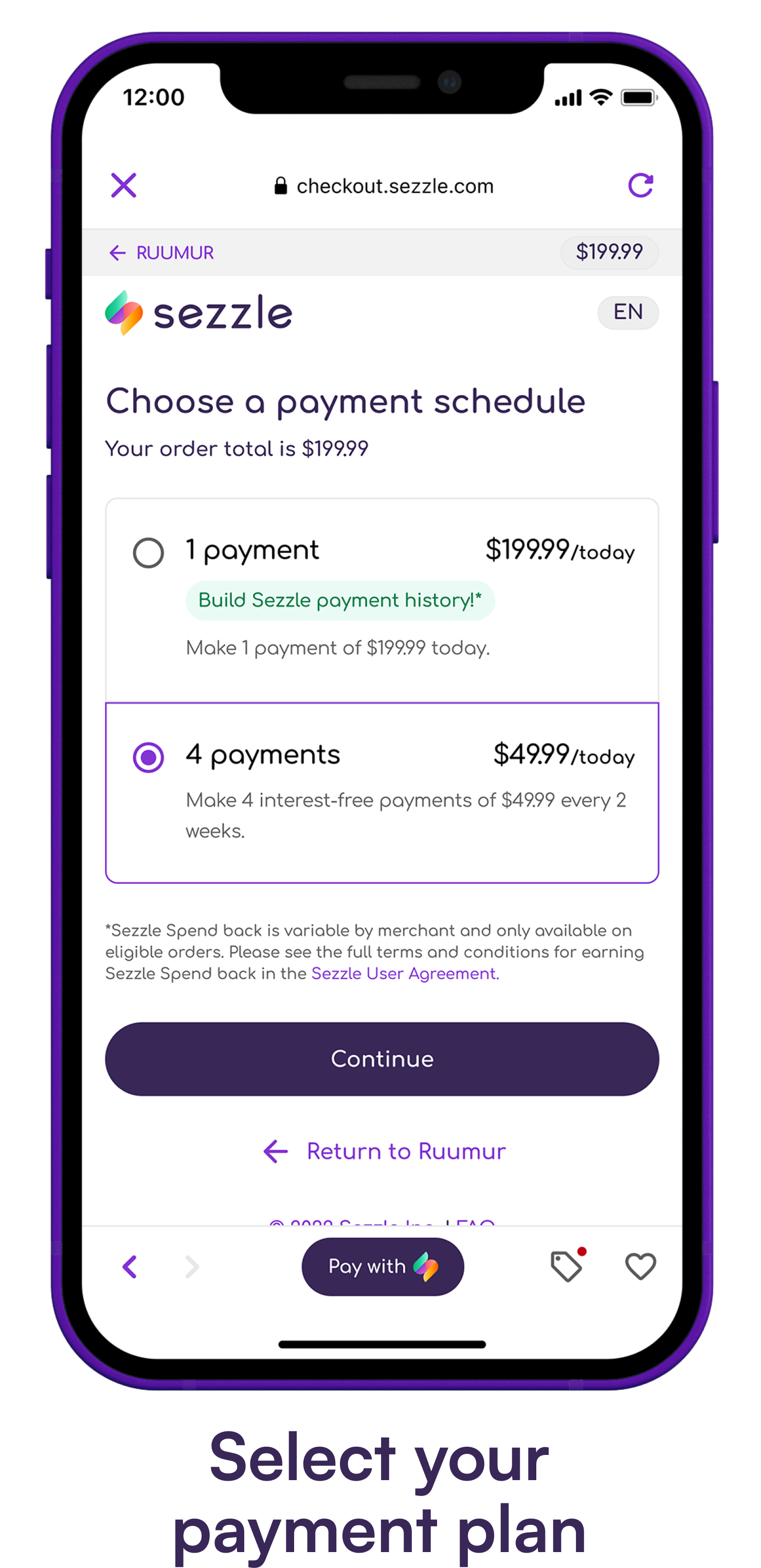

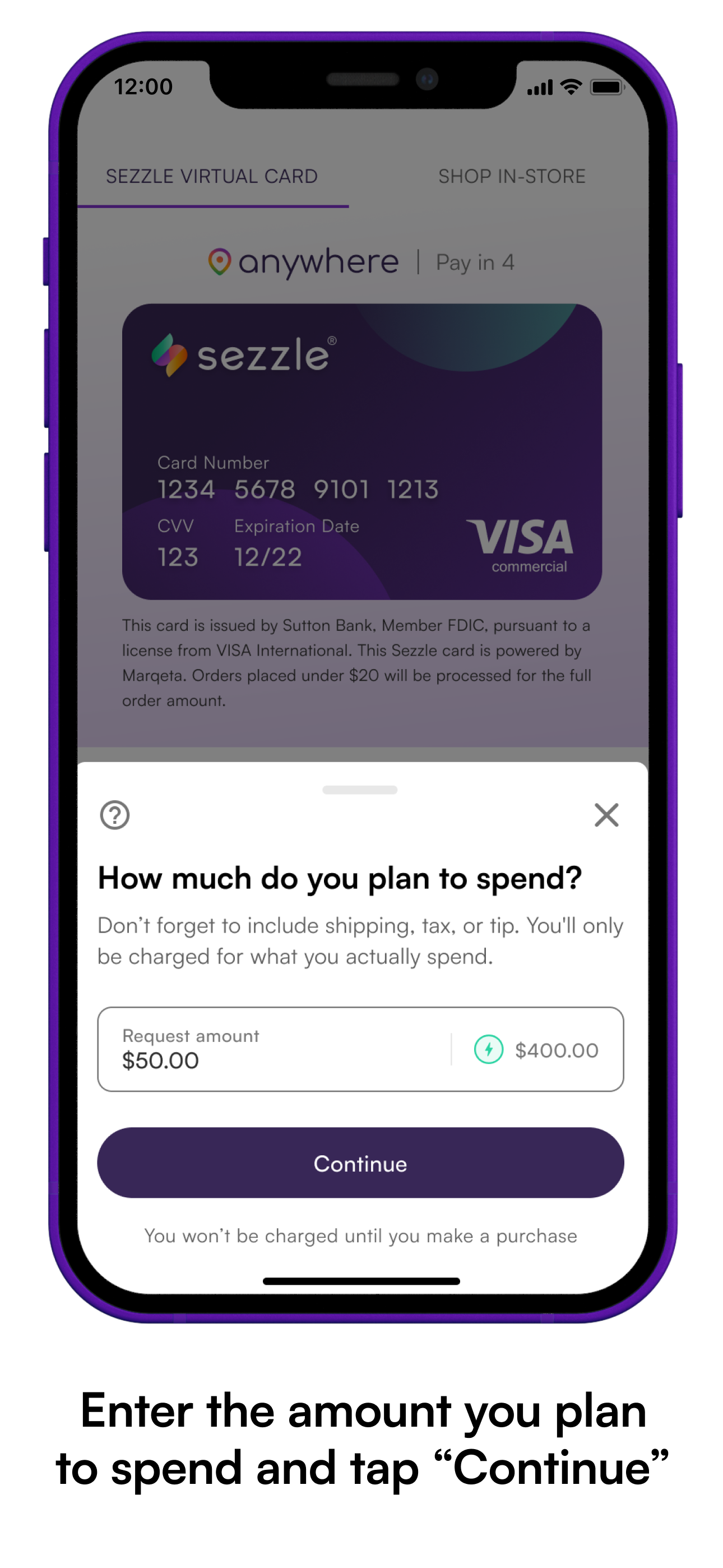

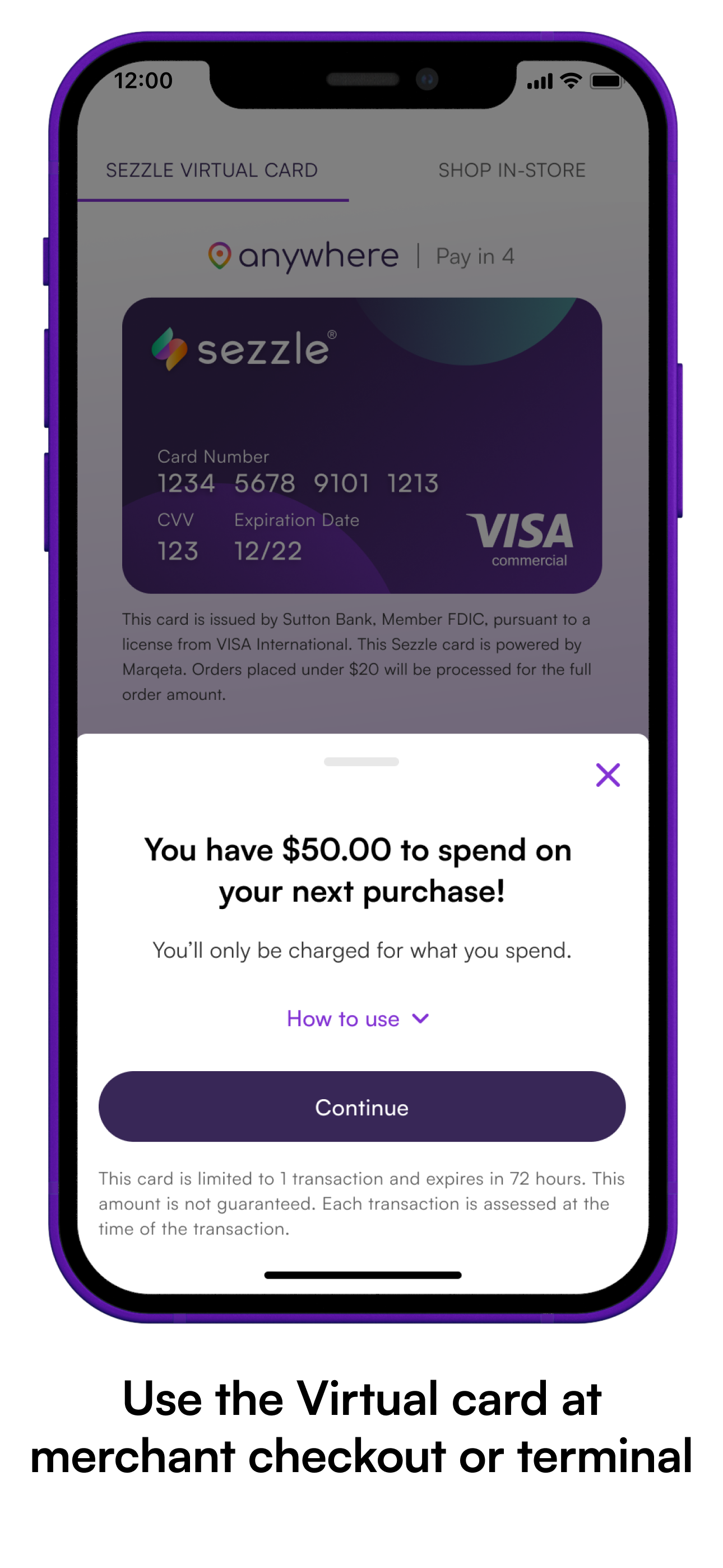

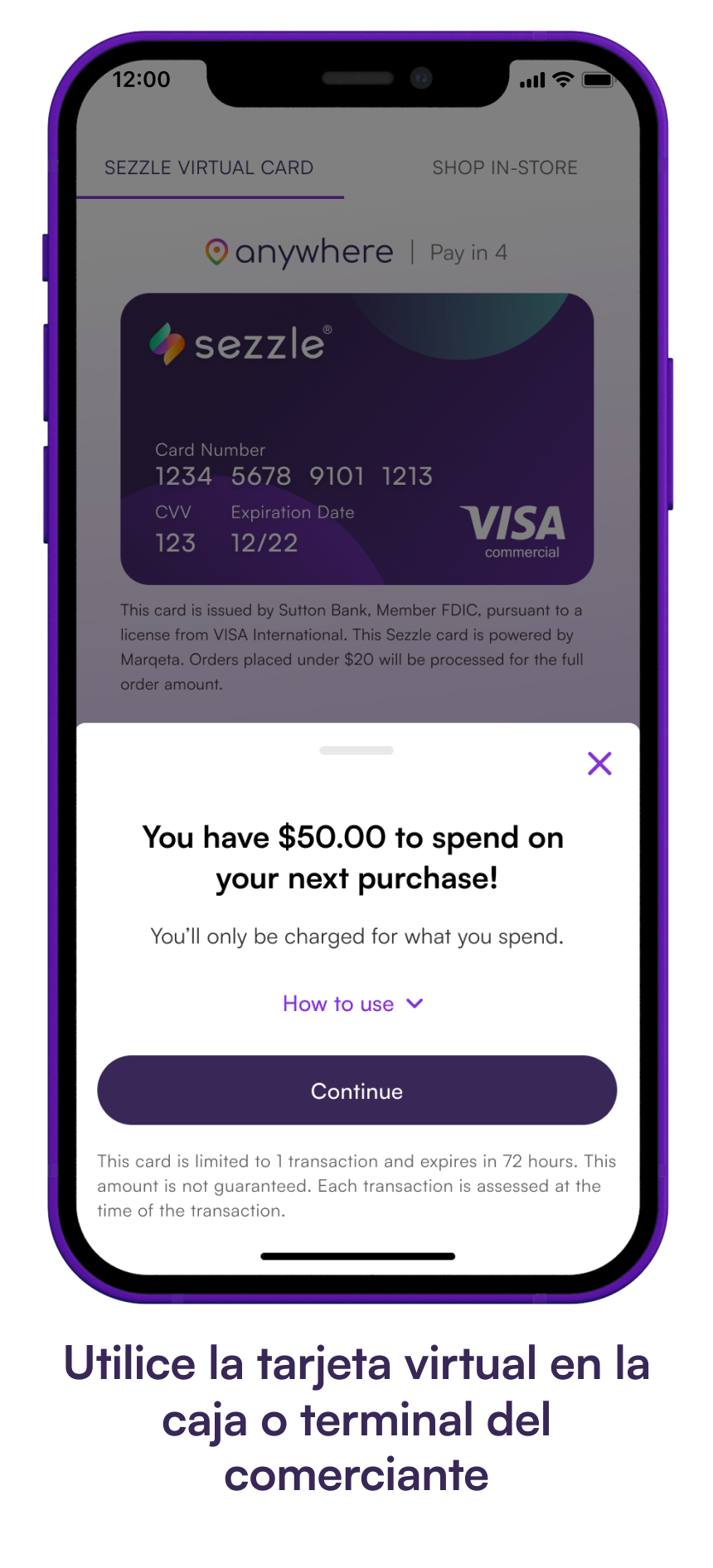

While direct integration is absent, some limited workarounds might exist. These are often indirect and may not offer the seamless experience users ideally seek. One possible workaround involves using a debit card funded by a Sezzle virtual card (if available) on Venmo.

Some BNPL services provide a virtual card that can be used for online transactions. If Sezzle offers such a feature, a user could potentially add this virtual card to their Venmo account. However, this approach depends on Sezzle's specific offerings and Venmo's acceptance of the virtual card as a valid funding source.

Another potential, though less practical, workaround involves using a cashback credit card to pay off your Sezzle balances, then using the cashback to fund your Venmo account. This is a very indirect solution and is more about managing payments than true integration. This would require careful budgeting and timely payments to avoid interest charges.

The Broader BNPL Landscape and Future Possibilities

The BNPL sector is experiencing rapid growth and consolidation. As the industry matures, partnerships and integrations between different platforms become increasingly likely. It is not inconceivable that Sezzle and Venmo, or similar companies, might explore collaborative ventures in the future.

Regulatory pressures and evolving consumer demands will also shape the future of BNPL services. Increased scrutiny from regulatory bodies may push BNPL providers to adopt more transparent and standardized practices, potentially facilitating integration with other financial platforms. Consumer preferences for integrated and streamlined payment experiences may push companies towards partnerships.

However, any future integration would likely be subject to careful consideration of regulatory compliance, data security, and user privacy. The complexities involved in integrating financial platforms require meticulous planning and adherence to stringent security protocols.

Expert Opinions and Consumer Perspectives

Financial analysts suggest that the lack of direct integration between BNPL services and platforms like Venmo stems from a combination of technical hurdles and strategic considerations. "The technical architecture of these platforms is designed for specific use cases," says Jane Doe, a fintech analyst at XYZ Research. "Integrating a BNPL service would require significant modifications to their existing systems."

Consumers express mixed reactions to the current limitations. Some appreciate the simplicity of using each platform independently. Others desire a more integrated experience that would allow them to leverage the benefits of both Sezzle and Venmo seamlessly.

"I wish I could use my Sezzle account to pay my friends back on Venmo," says John Smith, a frequent user of both platforms. "It would be so much more convenient than having to transfer money between different accounts."

Conclusion: Awaiting Future Developments

For now, using Sezzle directly on Venmo remains impossible. The lack of direct integration is due to technical constraints, business strategies, and the inherent differences in the functionalities of each platform.

While potential workarounds exist, they are often cumbersome and may not provide the desired level of convenience. The future of BNPL services and their integration with established payment platforms is uncertain but holds the promise of greater flexibility and user-friendliness.

As the digital finance landscape continues to evolve, consumers can expect to see more innovative solutions and potentially greater integration between different payment platforms. The possibility of using Sezzle on Venmo, or similar integrations, remains a topic to watch closely in the years to come.