Capital Accumulation And Income Distribution Pdf

Debates surrounding wealth inequality and its drivers continue to dominate economic discourse. A frequently cited document in these discussions is the research often referred to as "Capital Accumulation and Income Distribution," exploring the complex interplay between these two economic forces.

Understanding the nuances of how capital concentrates and its impact on income distribution is crucial for policymakers and individuals alike.

The core question revolves around the processes by which wealth accumulates in the hands of a few and how that accumulation affects the income earned by the broader population.

The Central Argument

At the heart of the debate is the idea that returns on capital, such as profits, dividends, and rents, tend to grow faster than overall economic growth, including wages. This concept, popularized by economist Thomas Piketty, suggests an inherent tendency towards increasing inequality in capitalist economies.

Data from various sources, including national income accounts and wealth surveys, are used to support or refute this claim.

Researchers analyze historical trends to determine if the rate of return on capital consistently outpaces the rate of economic growth.

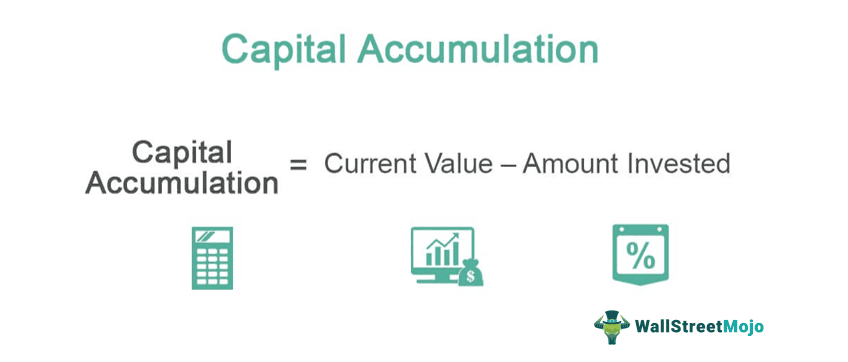

Key Factors Influencing Capital Accumulation

Several factors contribute to the accumulation of capital. Technological advancements, policy decisions, and market dynamics play significant roles.

Tax policies, for example, can influence the accumulation of wealth by affecting the returns on investments and the transfer of wealth across generations.

Deregulation and financial innovation can also contribute to faster capital accumulation, but may come with increased risks.

Impact on Income Distribution

The concentration of capital has direct implications for income distribution. If capital income grows faster than labor income, the share of income going to capital owners increases, while the share going to workers decreases.

This shift can lead to wider income gaps and a sense of economic inequality among different segments of the population.

Furthermore, unequal access to capital accumulation opportunities can exacerbate existing inequalities, creating a cycle of wealth concentration.

Criticisms and Alternative Perspectives

The idea of ever-increasing inequality is not without its critics. Some argue that technological progress creates new opportunities for income mobility and reduces the importance of inherited wealth.

Others point to the role of education and human capital in driving income growth, suggesting that investments in these areas can help offset the effects of capital concentration.

Changes in demographics, such as the aging population, can also affect both capital accumulation and income distribution.

The Role of Policy

Understanding the dynamics of capital accumulation and income distribution is critical for informing policy decisions. Governments can implement various policies to address inequality, such as progressive taxation, investments in education and infrastructure, and regulations aimed at curbing excessive financial risk-taking.

Progressive taxation, for example, can redistribute wealth and generate revenue for public services.

Investments in education and infrastructure can create opportunities for upward mobility and promote more equitable distribution of income.

Global Implications

The issues surrounding capital accumulation and income distribution are not confined to individual countries. Globalization and international capital flows have created new challenges and opportunities for addressing inequality on a global scale.

Tax havens and cross-border tax avoidance can exacerbate wealth concentration and undermine the ability of governments to collect revenue for public services.

International cooperation is essential for addressing these global challenges and promoting a more equitable distribution of wealth and income.

A Human Perspective

The abstract concepts of capital accumulation and income distribution have real-world consequences for individuals and communities. Access to education, healthcare, and housing are all affected by the distribution of wealth and income.

Families struggling to make ends meet may face limited opportunities for upward mobility, perpetuating cycles of poverty and inequality.

Understanding the human impact of these economic forces is essential for creating a more just and equitable society.

Looking Ahead

The debate surrounding capital accumulation and income distribution is likely to continue for years to come. New research and data will continue to shed light on the complex interplay between these economic forces.

Policymakers and individuals alike must engage in informed discussions about how to create a more equitable and sustainable economy.

The choices we make today will shape the distribution of wealth and income for generations to come.