Capital Budgeting Decisions Generally Have The Most Effect On

Urgent warnings are surfacing across multiple sectors: flawed capital budgeting decisions are poised to trigger widespread economic instability. Companies and public entities must immediately reassess investment strategies to mitigate potentially catastrophic long-term consequences.

This article examines the growing concern that inadequate capital budgeting processes are shaping investment decisions. This affects economic stability and future growth.

Widespread Impact of Capital Budgeting Shortfalls

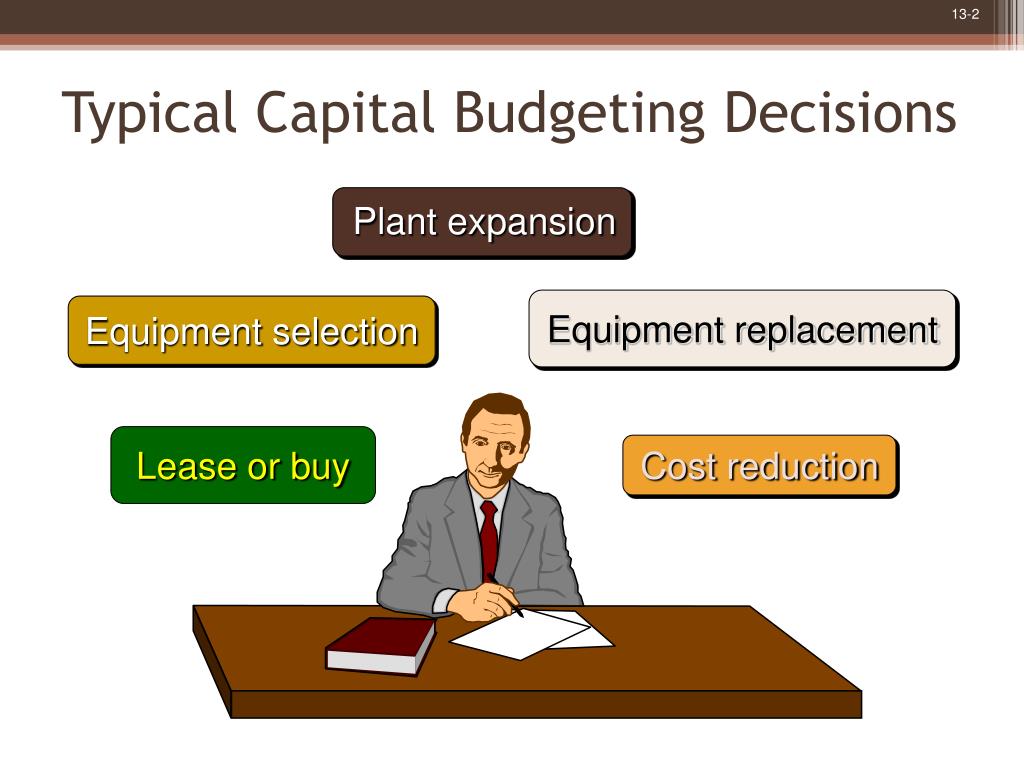

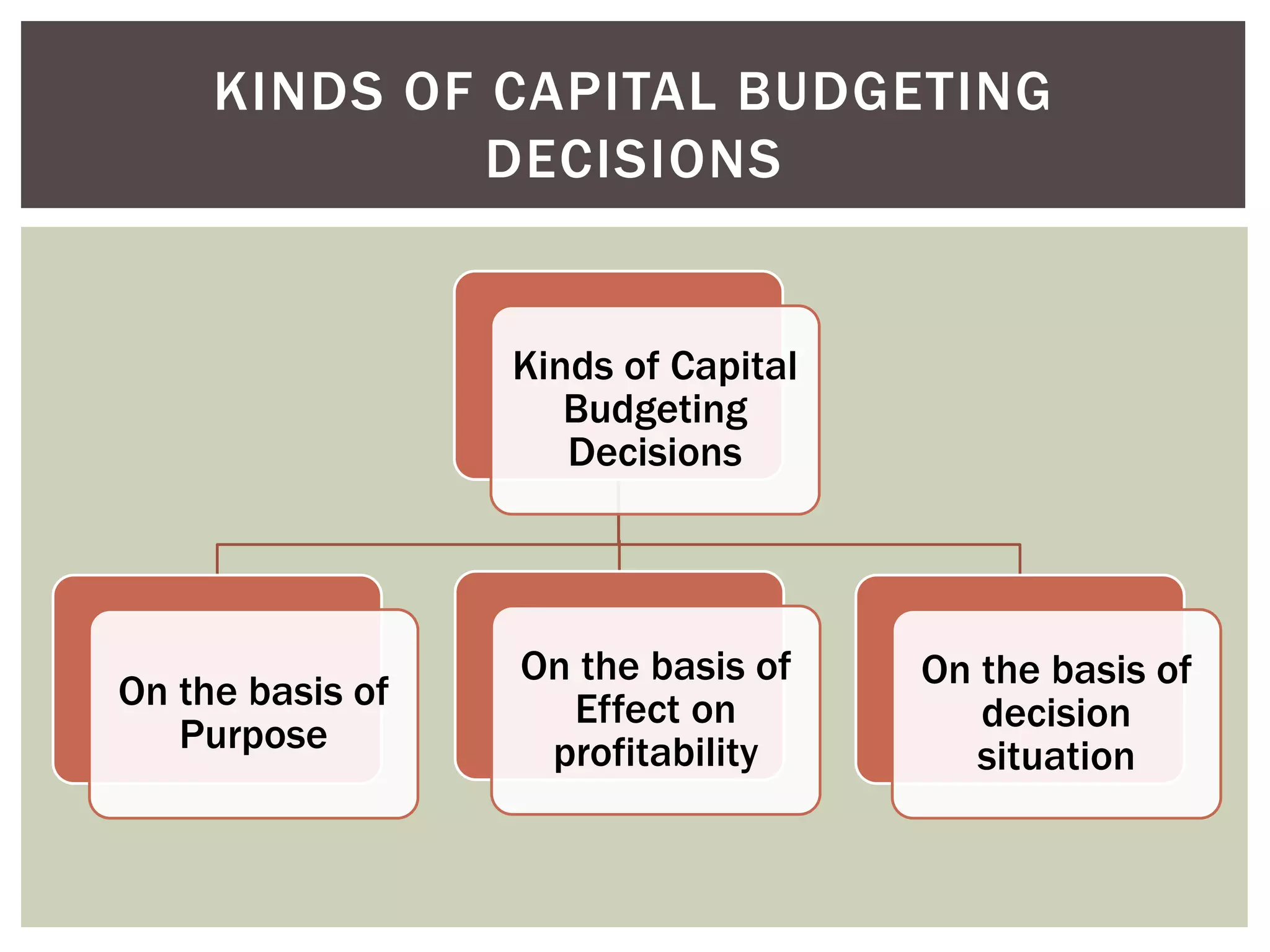

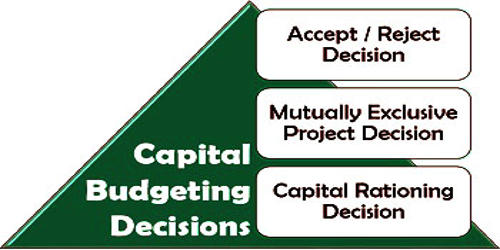

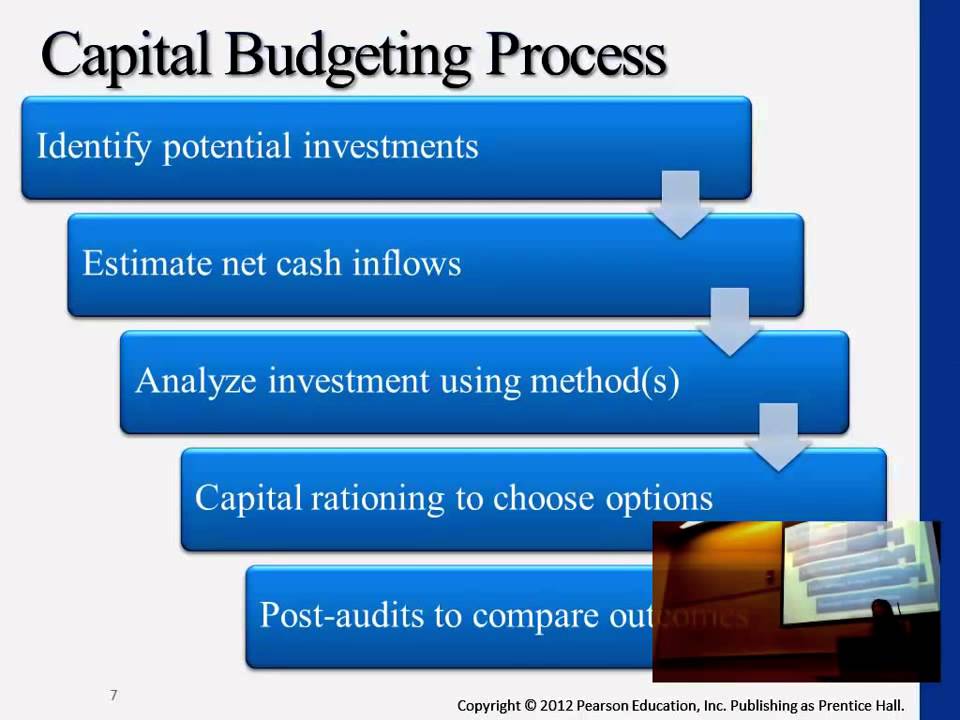

Capital budgeting decisions, which are processes companies use to evaluate potential investments, are under scrutiny for their far-reaching consequences. These decisions dictate the allocation of resources to projects with long-term implications, making their importance extremely vital.

Consider the energy sector. Poor decisions here influence long-term energy availability and affordability. For instance, overinvesting in fossil fuel infrastructure amidst a growing shift towards renewables could leave investors with stranded assets worth billions, according to the International Energy Agency (IEA).

The transportation industry is seeing similar disruptions. Misjudging the demand for electric vehicles could lead to wasted investment in traditional vehicle manufacturing.

Real Estate and Infrastructure Face Parallel Issues

The real estate sector also suffers. Development projects predicated on inflated growth projections can result in ghost towns and unsustainable infrastructure burdens.

Public infrastructure investments, like roads and bridges, face similar risks. Neglecting long-term maintenance needs or failing to anticipate changing demographics can lead to infrastructure decay and financial strain.

Examples in the Tech Industry

Even in the technology sector, known for its rapid evolution, poor capital budgeting decisions can result in dramatic losses. Companies that overinvest in outdated technologies or fail to anticipate market shifts risk obsolescence.

Analysts at Gartner report that over 60% of digital transformation projects fail to deliver expected ROI due to flawed capital allocation.

This is because companies often chase short-term gains instead of evaluating long-term strategic value.

The Public Sector's Exposure to Risk

The public sector isn’t immune to these problems. Government investments in healthcare, education, and defense must carefully assess future needs.

Misallocation of resources can lead to underfunded vital services and increased national debt. According to a recent Government Accountability Office (GAO) report, billions of dollars are wasted each year due to inefficient project management and oversight.

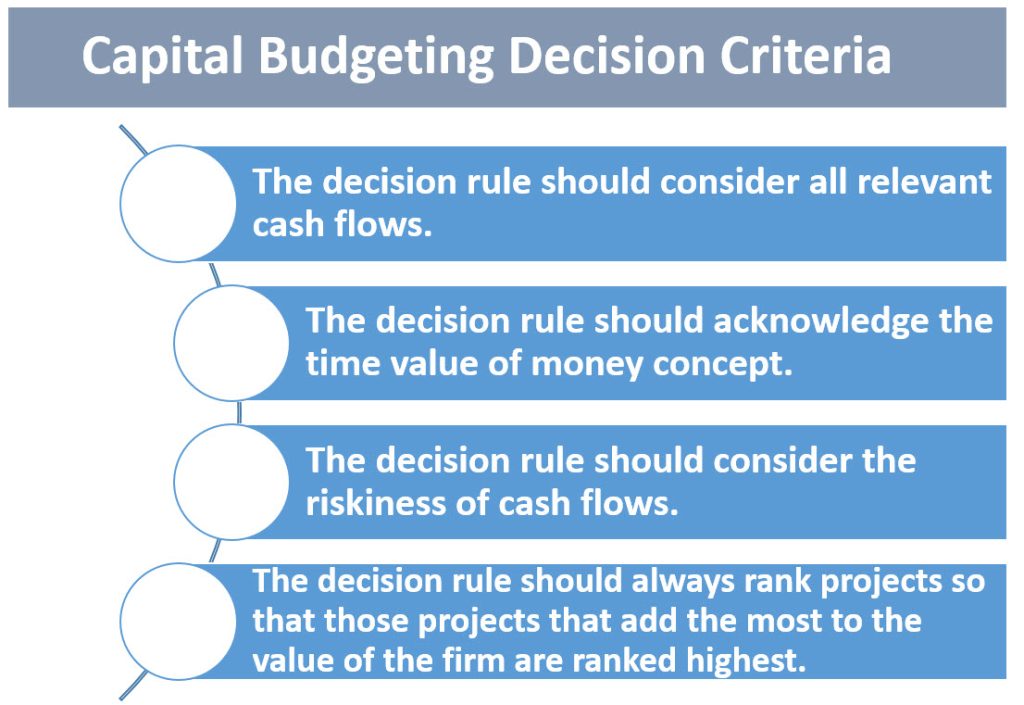

The report highlights that a strategic budgeting method that uses the net present value and takes account of the internal rate of return is more likely to succed.

Addressing the Core Issues

Experts emphasize the necessity of robust risk assessment. This includes sensitivity analysis and scenario planning.

Implementing rigorous review processes and independent oversight can prevent costly errors. Furthermore, promoting transparency in decision-making helps ensure accountability.

Dr. Anya Sharma, a professor of finance at Wharton, argues that "integrating environmental, social, and governance (ESG) factors into capital budgeting is no longer optional. It's essential for long-term sustainability and value creation."

Moving Forward: A Call for Action

Immediate corrective action is needed to mitigate the potential damage from flawed capital budgeting decisions. Businesses and governments need to adopt a more forward-thinking, data-driven approach.

This includes enhancing risk management practices, promoting transparency, and integrating ESG considerations into their investment strategies. Further research into the correlation between capital project allocation and overall productivity is needed.

The long-term economic stability and future prosperity are on the line. Corrective action is required now.