Capital In Excess Of Par Value

Imagine a bustling marketplace where eager investors line up, not just to buy shares of a promising company, but to pay a premium, an extra bit of value above the listed price. This isn't some fictional scene from a Wall Street movie; it's the reality behind the concept of capital in excess of par value, a financial term that signifies more than just numbers on a balance sheet.

At its heart, capital in excess of par value, also known as additional paid-in capital (APIC), represents the amount investors pay for a company's stock above its stated par value.

This excess indicates strong investor confidence and reflects the market's perception of the company's potential worth, going beyond the nominal value assigned to each share.

Understanding Par Value: The Foundation

To fully grasp the significance of capital in excess of par value, we must first understand the concept of par value itself. Par value is a nominal value assigned to a share of stock in a company's charter.

Historically, par value served as a minimum subscription price for shares, meant to protect creditors by ensuring that shareholders contributed at least a certain amount of capital to the company.

However, in modern practice, par value is often set at a very low amount (e.g., $0.01 or even $0.0001) or is even avoided altogether through the use of "no-par" stock.

Why Such Low Par Values?

The shift towards low or no-par stock reflects a more nuanced understanding of corporate finance. Low par values offer companies greater flexibility in issuing shares.

It prevents the company from being unintentionally burdened by legal implications associated with issuing stock below par value, which could potentially expose directors to liability.

Modern investors focus more on factors like earnings, growth prospects, and market conditions than the arbitrary par value.

The Significance of Capital in Excess of Par Value

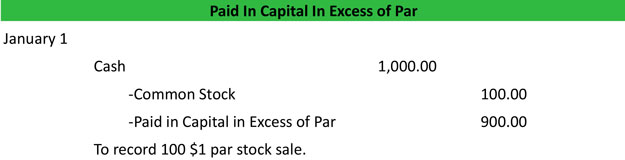

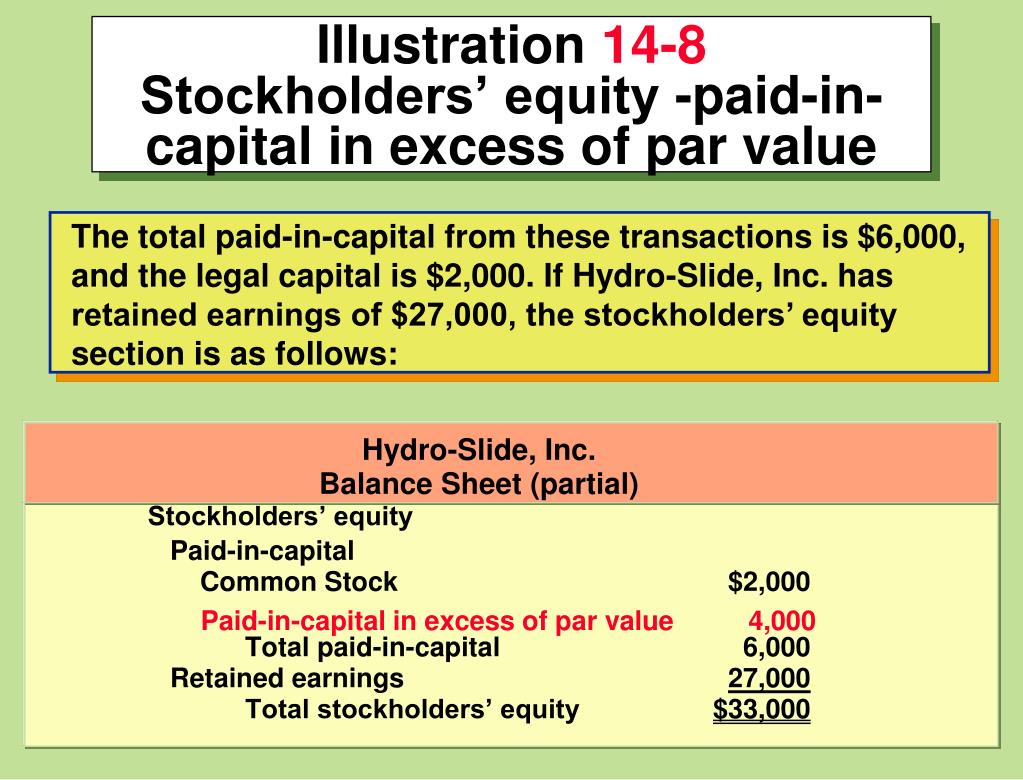

So, what happens when investors are willing to pay more than the par value for a company's shares? This difference is recorded as capital in excess of par value.

It's a direct reflection of the market's belief that the company's intrinsic value exceeds the face value of its shares.

Consider Apple, for example. If Apple stock has a par value of $0.0001 and is issued to investors at $170 per share, the $169.9999 difference is recorded as capital in excess of par value.

What Does It Tell Investors?

Capital in excess of par value offers valuable insights to investors. A large APIC balance suggests strong investor confidence in the company's future prospects.

It indicates that investors are willing to pay a premium based on expectations of future growth, profitability, and market dominance.

Conversely, a small or non-existent APIC might signal investor skepticism or indicate that the company is issuing shares at or near par value due to weak demand.

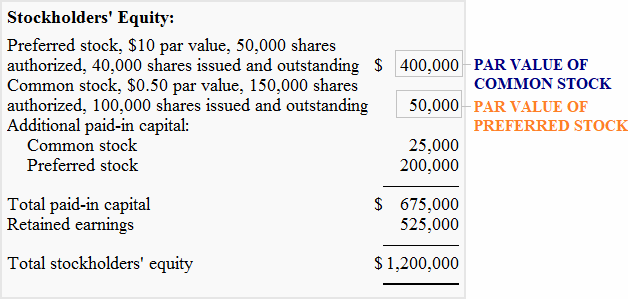

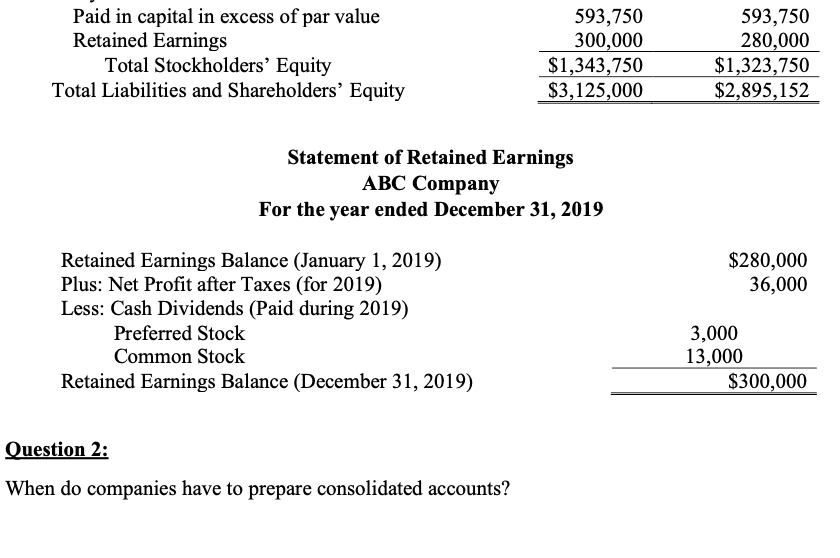

Accounting Treatment and Reporting

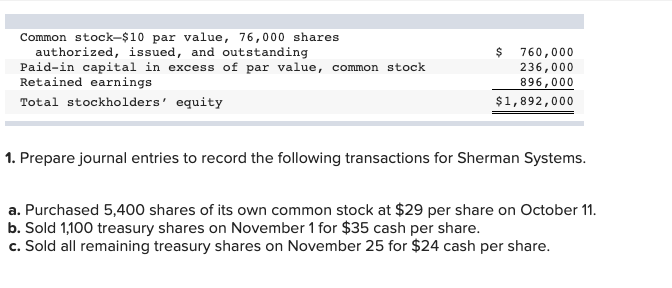

From an accounting perspective, capital in excess of par value is treated as part of shareholders' equity on the balance sheet. It is not considered revenue or profit.

Instead, it represents a contribution from shareholders above the nominal par value of the stock. This distinction is crucial for understanding a company's financial health.

The capital in excess of par value is reported separately from the common stock account, which reflects the aggregate par value of all issued shares.

How Companies Utilize APIC

While capital in excess of par value cannot be used for dividend distributions in some jurisdictions, it can be used for various other purposes.

Companies can use it to offset deficits, repurchase outstanding shares (treasury stock), or for other corporate purposes as permitted by law.

For instance, Microsoft, with its substantial cash reserves and APIC, might use these funds to acquire smaller companies or invest in research and development.

Real-World Examples and Implications

Consider a tech startup that gains significant traction and investor interest. When it issues shares in a Series A funding round at a price far exceeding the par value, the resulting capital in excess of par value is a clear signal of its perceived potential.

This influx of capital allows the startup to scale operations, hire talent, and invest in product development, fueling its growth trajectory.

Conversely, a mature company with declining performance may find it challenging to attract investors willing to pay a premium for its shares, resulting in a smaller APIC balance.

Analyzing APIC Across Industries

The amount of capital in excess of par value can vary significantly across industries. High-growth sectors like technology and biotechnology often exhibit substantial APIC balances.

This is because investors are willing to pay a premium for the potential of these companies to disrupt markets and generate significant returns.

In contrast, more mature or regulated industries like utilities or traditional manufacturing may have lower APIC balances, reflecting more stable but less explosive growth prospects.

The Future of Capital Markets and APIC

As capital markets continue to evolve, the significance of capital in excess of par value remains undiminished. It's a testament to the market's collective judgment of a company's worth.

With the rise of new investment vehicles, such as SPACs (Special Purpose Acquisition Companies), and the increasing democratization of investing, understanding APIC becomes even more critical for both seasoned investors and newcomers.

APIC provides an essential layer of insight into a company's financial health and market sentiment.

Conclusion: More Than Just a Number

In the intricate world of finance, capital in excess of par value stands as a reminder that numbers tell stories. It reflects the collective belief of investors, the perceived potential of a company, and the dynamism of the market itself.

By understanding this seemingly technical term, investors can gain a deeper appreciation for the forces that shape corporate valuations and drive economic growth.

So, the next time you see capital in excess of par value on a balance sheet, remember that it's more than just a number; it's a story of ambition, innovation, and the enduring pursuit of value.

:max_bytes(150000):strip_icc()/additionalpaidincapital-final-6c076433118e4b9bb699fa576696fb0e.png)