Capital One Secured Credit Card Refund

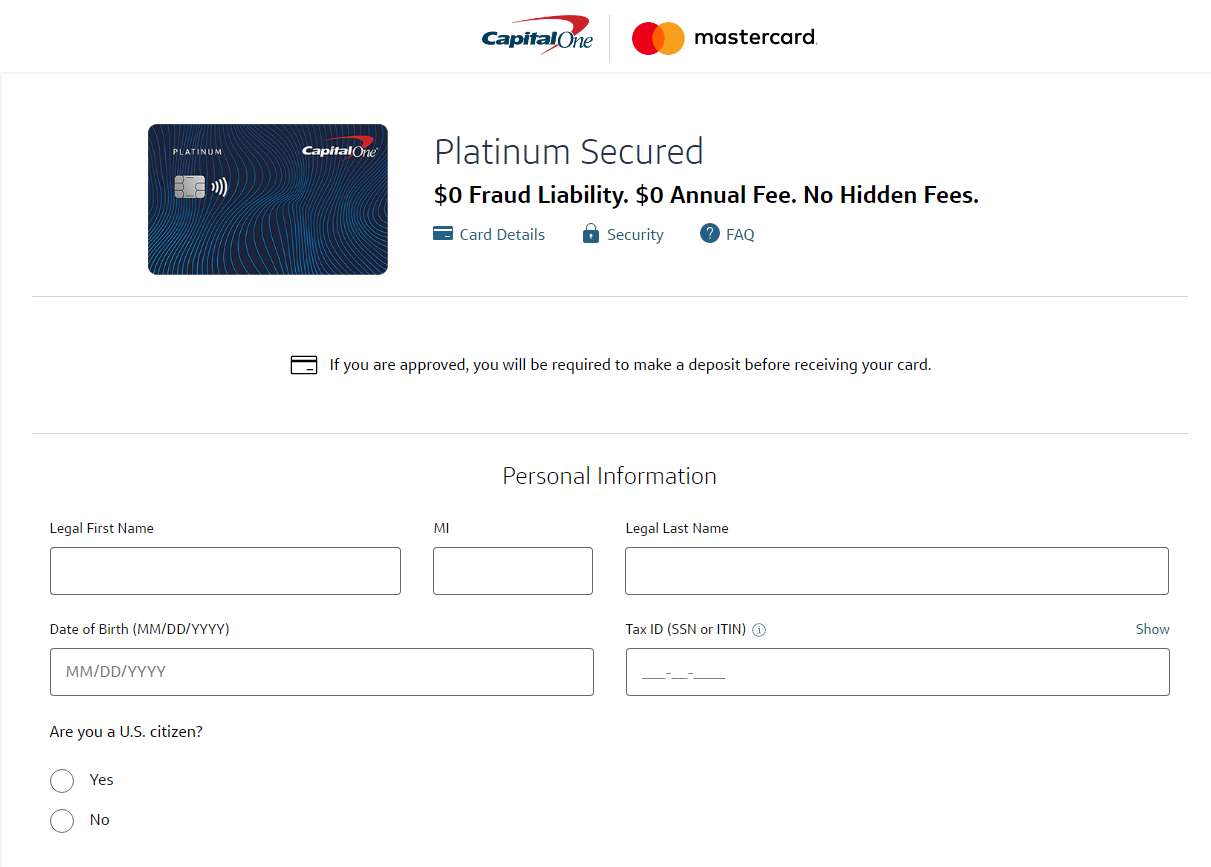

Capital One is issuing refunds to some secured credit card customers after identifying errors in how their accounts were handled upon closure. The issue primarily affects customers who paid their balances in full and were due a refund of their security deposit.

The Issue: Improper Security Deposit Returns

The refunds stem from a failure to properly and timely return security deposits to customers after they closed their secured credit card accounts. This oversight impacted a specific segment of Capital One's secured cardholders.

Capital One identified the errors internally and initiated a review of affected accounts.

The exact cause of the error has not been publicly disclosed, but sources suggest it may be related to a system or procedural issue in the account closing process.

Who is Affected?

The refunds are directed toward customers who held a Capital One Secured Credit Card, paid their balance in full, and closed their account. The timeframe of affected closures is still under review by Capital One.

Customers who received their security deposits promptly are not affected by this issue.

Capital One is contacting affected customers directly.

The Refund Process

Capital One is proactively reaching out to affected customers to inform them of the refund. The refund will include the original security deposit amount, plus interest where applicable.

Customers do not need to take any action to receive their refund if they are contacted by Capital One. The refunds are being issued automatically.

However, customers who believe they may be affected and have not been contacted can reach out to Capital One's customer service department to inquire about their account status.

Significance and Impact

The refund highlights the importance of accurate and transparent financial practices by credit card issuers. Failure to return security deposits promptly can negatively impact customers' financial well-being.

This incident serves as a reminder for consumers to carefully review their account statements and ensure they receive all funds due to them upon account closure.

It also underscores the role of internal audits and compliance programs in identifying and correcting errors within financial institutions.

Customer Perspective

One affected customer, speaking on the condition of anonymity, stated, "I closed my secured card several months ago and hadn't received my deposit back. I just assumed it was part of the process."

"I'm glad Capital One is addressing this issue and returning the funds."

This sentiment reflects the experience of many affected cardholders who were unaware of the delayed refund.

Capital One's Response

In a statement, Capital One acknowledged the error and apologized to affected customers. The company emphasized its commitment to rectifying the situation quickly and efficiently.

"We are taking full responsibility for this error and are committed to making it right for our customers," said a Capital One spokesperson.

Capital One is also reviewing its internal processes to prevent similar errors from occurring in the future.

The Capital One Secured Credit Card refund serves as a reminder of the importance of diligent account management and the need for financial institutions to uphold their obligations to customers. While the specific error has been identified and is being addressed, consumers should remain vigilant in monitoring their accounts and ensuring they receive all funds owed to them.