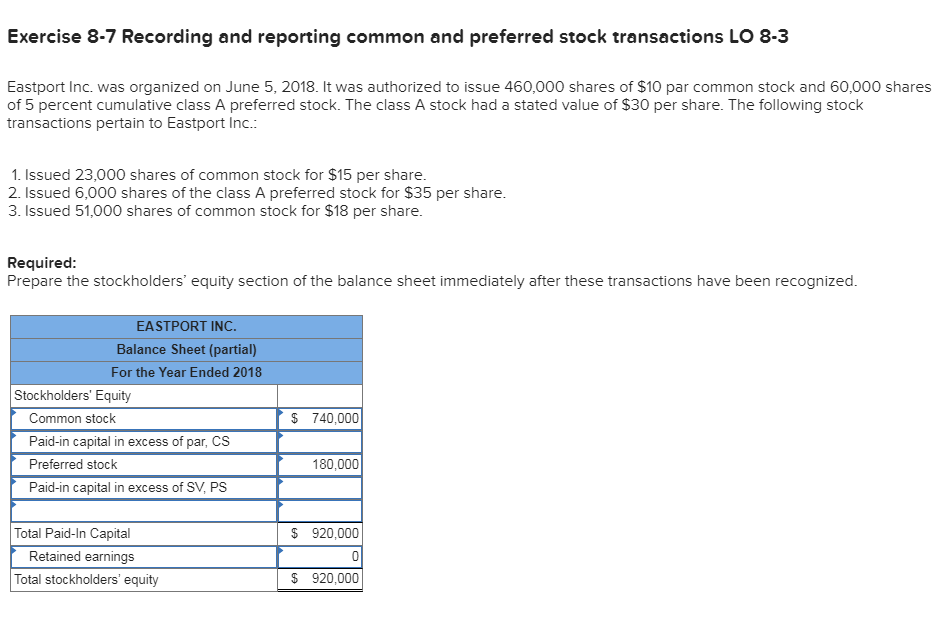

Capital Paid In Excess Of Par

Breaking: Mammoth Corp shares plummeted 15% today following the revelation of a significant discrepancy in their reported "Capital Paid in Excess of Par," raising alarms about potential financial misrepresentation.

The discrepancy, amounting to $50 million, has triggered an immediate internal investigation and prompted the Securities and Exchange Commission (SEC) to launch a formal inquiry, casting a shadow over the company's financial stability and leadership.

The Discrepancy Unveiled

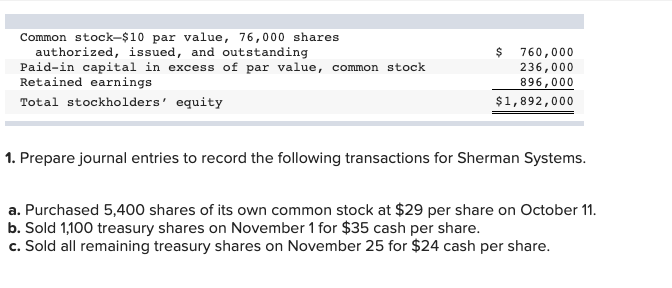

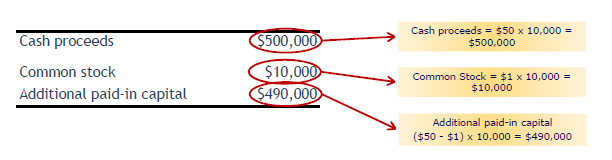

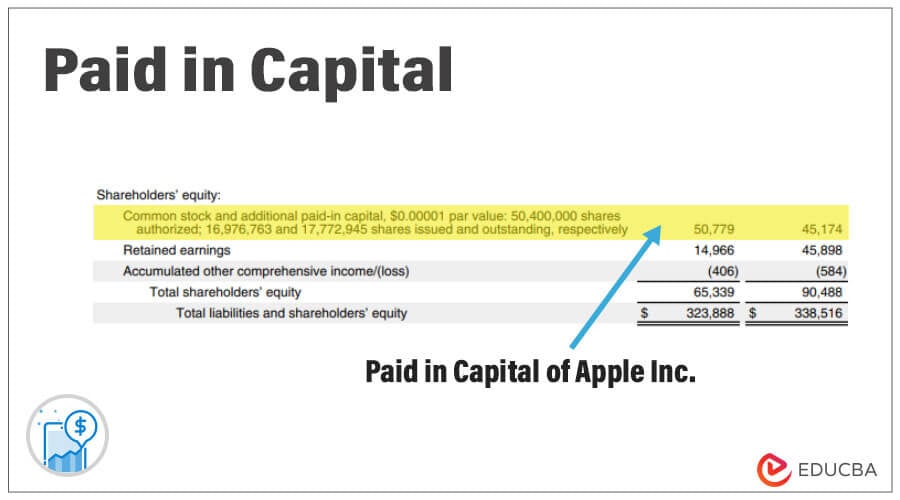

The issue came to light during an internal audit prompted by whistle-blower allegations received last week. Preliminary findings indicate that the "Capital Paid in Excess of Par", representing funds received from shareholders above the stock's nominal value, was overstated in recent quarterly reports.

Specifically, the audit suggests that a portion of funds recorded under this category may have been improperly classified, potentially masking underlying financial strains.

Who is Involved?

While the full scope of responsibility remains under investigation, initial scrutiny focuses on the Chief Financial Officer (CFO), Jane Doe, who has been placed on administrative leave pending the outcome of the internal probe. Several members of the accounting department are also being questioned.

CEO, John Smith, issued a statement expressing "deep concern" and pledging full cooperation with the SEC investigation. He emphasized the company's commitment to transparency and accountability.

What Happened?

The overstatement centers around a series of stock offerings conducted over the past year. Sources suggest that the classification of certain revenues generated from these offerings is under dispute.

Specifically, the core concern relates to whether these funds should have been booked as "Capital Paid in Excess of Par" or classified under a different, potentially less favorable, accounting treatment. The precise accounting method is in contention.

Where and When?

The discrepancy appears to have originated within Mammoth Corp's headquarters in New York City, impacting financial reports from Q1 2023 to the present. The overstated figures were included in official SEC filings during this period.

The alleged misclassification started in the early of 2023 and continues until to the internal investigation begin last week.

How Was it Discovered?

The issue was raised by an internal compliance officer who reported a potential anomaly after reviewing recent financial statements. This report triggered the internal audit and eventually, the SEC investigation.

The individual is a Senior Auditor, who has been working at the company since 2015.

Immediate Market Reaction

The revelation sent shockwaves through the market, leading to a rapid sell-off of Mammoth Corp shares. The stock price plunged 15% in morning trading, wiping out billions in market capitalization.

Trading was temporarily halted twice due to the volatility. Investors are urged to exercise caution.

Trading volume soared, and analysts downgraded the stock's rating, citing concerns about financial risk and uncertainty.

SEC Investigation and Potential Penalties

The SEC's investigation is expected to be thorough and potentially lengthy. If violations are confirmed, Mammoth Corp could face significant financial penalties, including fines and disgorgement of profits.

Individual executives could also face personal liability, including civil and criminal charges, depending on the extent of their involvement.

"We are committed to uncovering the truth and holding those responsible accountable," said an SEC spokesperson in a released statement.

The SEC has subpoenaed documents and testimony from key individuals within Mammoth Corp.

Next Steps and Ongoing Developments

Mammoth Corp has hired an independent accounting firm to conduct a forensic audit and provide a comprehensive assessment of its financial records. The internal investigation is ongoing.

The company plans to release updated financial statements correcting the discrepancies as soon as the audit is completed. A press conference is scheduled for next week to address investor concerns.

The situation remains fluid, and further developments are expected in the coming days and weeks.

:max_bytes(150000):strip_icc()/Paidincapital_sketch_final-99d3b0711bc2421aa14b0bf5ecb6eeaf.png)

:max_bytes(150000):strip_icc()/additionalpaidincapital-final-6c076433118e4b9bb699fa576696fb0e.png)